The Great Depression PowerPoint

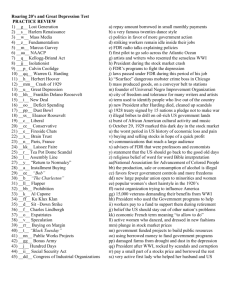

advertisement

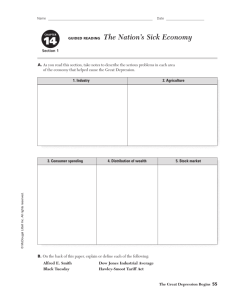

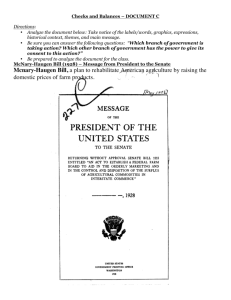

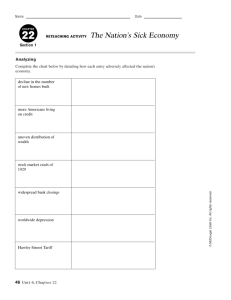

The Great Depression 1929-1941 1st CAUSE OF THE GREAT DEPRESSION •An old decaying industrial base •Outmoded equipment made some industries less competitive Industry in Trouble The miner says, “Uh Oh…” •Textiles •Steel •Railroads •Mining and Lumbering •Automobiles •Construction 2nd CAUSE OF THE GREAT DEPRESSION •A crisis in the farm sector •Farmers produced more than they were able to sell, especially with the demand of WWI and the disappearance of markets that the war had opened to them Farmers in Trouble •During WWI •International demand for food crops soared •Prices Rose •Farmers took out loans to buy more land and equipment Farmers in Trouble •Post WWI •Prices and demand fell •To compensate for lower prices farmers boosted production •Too much infiltrated the market •PRICES FELL McNary-Haugen Bill 1. The government would buy from farmers surplus crops at guaranteed prices that were higher than the market rate McNary-Haugen Bill 2. The government would then sell these crops on the world market for the lower prevailing prices McNary-Haugen Bill 3. To make up for losses caused by buying high and selling low, the government would place a tax on domestic food sales, thus passing the cost of the farm program along to consumers McNary-Haugen Bill •Congress passed 2x •Coolidge vetoed the bill 2x •“Farmers have never made money. I don’t believe we can do much about it.” 3rd CAUSE OF THE GREAT DEPRESSION •The availability of easy credit •Many people went into debt buying goods on the installment plan Living on Credit •Americans buying beyond their means •Purchased goods on CREDIT •An arrangement in which consumers agreed to buy now and pay later for purchases •Credit easily available •BUT Hard to pay off debts 4th CAUSE OF THE GREAT DEPRESSION •An unequal distribution of income •There was too little money in the hands of working people who were the vast majority of consumers Less Money to Spend •Everyone’s income fell •Americans buying less •Rising Prices •Stagnant Wages UNBALANCED DISTRIBUTION OF INCOME UNBALANCED DISTRIBUTION OF INCOME •½ the nation’s families earned less than $1500/year •1920-1929 •Income of the wealthiest 1% rose 75% •Poorest 40% of the population earned just over 1/10 of the national income And the Stock Market Came Tumbling Down Speculation: The engagement in risky business transactions (buying or selling stocks) on the chance of quick or considerable profit And the Stock Market Came Tumbling Down Buying on Margin: Paying a small percentage of a stock’s price as a down payment and borrowing the rest Going, going…gone… October 24, 1929 Stock market took a bad fall Panicked investors unloaded their shares October 29, 1929 People and corporations frantically tried to sell their stocks before prices plunged even lower Those who had purchased stocks on credit acquired huge debts when stock prices plunged BLACK TUESDAY October 29, 1929 Many who had invested entire savings in the market lost everything 16 million shares dumped This is a scene of the Toronto Stock Exchange the day of the crash. Immediately after this picture was taken, the income of almost every single Canadian family was cut by more than half. The disappearance of national resources meant a total economy collapse. The fisherman stopped going out to sea, workers connected with the fish market were laid off or had fewer working hours for less money. Dow Jones Industrial Average •Barometer of the Stock Market’s health •Measure based on stock prices of 30 representative large trading firms trading on the NYSE Alcoa 3M Altria (Philip Morris) American Express Boeing Caterpillar Citi Group Coca Cola E.I. DuPont de Nemours Exxon Mobil General Electric General Motors Hewlett-Packard Home Depot Honeywell Intel International Business Machines JP Morgan Chase Johnson & Johnson McDonalds Merck Microsoft Proctor and Gamble SBC Communications United Technologies Wal-Mart Stores Walt Disney Financial Collapse •Many Americans panicked (wouldn’t you?!!) and tried to withdraw all of their money from banks •Banks forced to close because they could not cover their customers’ withdrawals •Banks lost money in the crash, too Financial Collapse •Economy went into a tailspin •Unemployment rose dramatically •1929 •3% of workforce unemployed •1933 •25% of workforce unemployed Some Folks Did Ok… •Joe Kennedy made all of his money during the weeks just before the Crash •Some held onto their jobs •Endured pay cuts •Endured fewer work hours $$$$$$$$$$$$$$$$$$$$$$$$ Shockwaves Throughout the World •Europe still recovering from WWI •USA limited Europeans from exporting their goods •THEREFORE, IT BECAME MORE DIFFICULT TO SELL US GOODS ABROAD Hawley-Smoot Tariff The most ridiculous sounding name for a tariff ever •Highest protective tariff in history •Designed to help US farmers and manufacturers by protecting their products from foreign competition Hawley-Smoot Tariff BACKFIRED: •Reduced number of European goods into USA •Prevented other countries from earning US currency to purchase American exports •Countries reacted by raising their own tariffs •Reduced overall economic activity Gold Standard •Britain and other European countries went off the Gold standard •Paper money could no longer be exchanged for gold •Gold dropped in value •Europeans began to purchase US goods and repaying loans in cheaper currency Gold Standard Today, money is based on “full faith and credit” We accept dollars because: 1.They are legal tender 2.They are backed by the world’s confidence in the US government Unemployment Towns Poverty and Families Dust Bowl Migrants Shantytowns How the Other Half Lived… Virginia Mansion The Manor House (Long Island) Springwood Mansion (FDR’s Home) The Chimneys (Long Island) Vanderbilt Mansion