Syllabus - Brandeis Login

advertisement

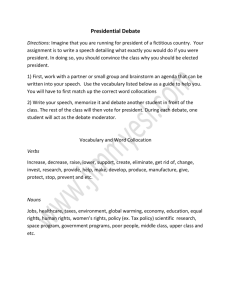

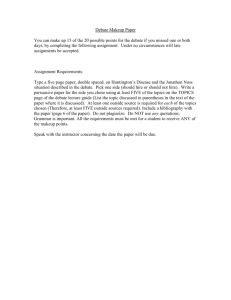

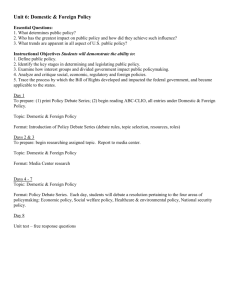

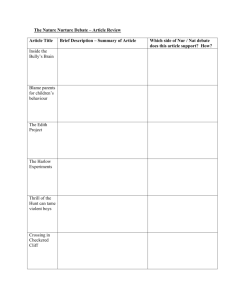

Brandeis University Graduate School International Business Final - Econ 201a, Global Economic Environment Fall 2014, Wednesday afternoons Dr. John W. Ballantine, Jr. 978 371-2652 (home, fax) e-mail: johnbal@brandeis.edu Class meetings: Office hours: I Global Economic Environment, Econ 201a limit to 50 +/- students (10 groups) Wednesday 2:00 - 4:50 p.m. after or before class or by appointment (please email me) Course description: Global Economic Environment (GEE) is about how business decision-makers, politicians, and policy-making institutions operate in our changing/conflicted global environment. The process of globalization -- the interconnection of financial and goods / real markets, and information -- brings together a series of disparate topics, cutting across many disciplines, particularly politics and economics. We will look how people approached these issues over time and today through case discussions, debates, readings, papers and problem sets. We begin the class, with basic macro-economic concepts (GDP, inflation, money, growth) and the theory of trade – why countries trade and the gains from trade. From here we will move to the reasons for foreign investment (FDI) and capital flows – how and why companies invest in other/foreign countries…and then back to financial crises. A review of these topics will let us examine productivity, growth, capital markets and foreign exchange rates. We will also look at the changing institutional arrangements governing the economy and the broader policy issues that are part of the political debate – distribution of income, labor practices, environmental impact, the role of the state, corruption, human rights, and, of course, our economic well-being / current state of our global recovery / political crises. These issues will form the core questions in our class debates. Student debates about current topics will take up much of our class time. This will give small groups of students the opportunity to present information and arguments clearly, respond to other perspectives / points of view, and persuade your fellow students of the strength of your debate position. The debates bring a lot of energy to our class discussions. In addition to debates about economics and politics, students will be actively involved in case discussions that contain confusing data. Students will learn to make recommendations with incomplete information. Each student will also work on drafting short memos – how to present recommendations and back up arguments with relevant data that are to the point. By the end of the class, you should have a good sense of economic principles, be familiar with economic data, be able to write strong memos, be ready to debate almost any topic with passion, logic and humor, and be comfortable with case discussions. GEE is FUN, challenging and exciting. Welcome Aboard! Brandeis International Business School Learning Goals: Through a combination of cases, readings, debates, discussion, and research, GEE students will gain a better understanding of the complexities of our global economy. Throughout the semester the course will focus on the following learning goals. 1. Understanding of economic concepts: - monetary policy, money supply, credit creation, money demand and inflation - fiscal policy, multipliers; aggregate supply and demand, and economic growth - National economic measures (GDP, etc); Balance of payments - Trade theory, comparative advantage, FDI, capital flows, - Financial markets, international financial flows, exchange rates, currency crises - regulation and controls of global markets - economic growth, productivity, and development 2. Appreciation of political economy - different political systems and the role of institutions - role of people, leaders and how various groups are represented in the state - different perspectives / backgrounds and history of the key players - rule of law and ways of “doing business” - government policy, decisions and economic consequences 3. Development of professional skills - case analysis and discussion - debate positions / presentations, questions & answers, - data analysis, graphs and presentation - memo writing and written communication / recommendations - team participation, leadership and group work - research and bibliographic resources 4. Grasp of the complexities of globalization - interaction of various forces / people / institutions - principles of economic, politics, sociology, history, and culture - complexity of change and the challenges facing our global economy 5. Be excited about learning Course Structure The schedule lays out the general structure of the course. We will cover four broad areas: Macroeconomics / economic principles Trade theory / foreign direct investment Capital markets, crises and foreign exchange Economic growth and development Final Draft - Econ 201a 2 Ballantine Brandeis International Business School These economic topics will be explored through a combination of readings, background material, data analysis, and case discussions. The first 80 minutes of class will be spent: first, discussing the economic theory / principles illustrated by the case. Our focus will be on the intuition of economics through a quick economic principles lecture with slides (10 minutes) with the online text providing a more structured review. Second the case discussion with involve understanding the DATA exhibits / issues: read the cases, think about the questions on the syllabus, and look at the data. Third, the class will break into separate role plays to understand the perspective of various players involved in the case. I will provide a description of the role play before our case discussion and an online student forum to discuss the roles. The role plays is a dynamic and somewhat confusing part of the class, however, it will engage everyone in the case discussion. Once the class is underway, we will Debate some of the key issues confronting decision makers throughout the world. We will discuss the debate issues and divide into small teams to debate the issue during the second half of the class (60 minutes). See details later in the syllabus. This is a reading, discussion, writing, and research intensive course with a good deal of prepared work that will be passed in on a regular basis. See the schedule: eight assignments during the semester, plus two debates OR, 9 assignments including the debate paper. TAs will be available for assistance with the material (not the answers, but how to approach). Course material: Required: Course packet, use Harvard Business school web site, see HBS registration instructions on next page 4 with link. Background text online: Krugman and Wells, Economics (KW), or Feenstra and Taylor (FT) available through Aplia web site: www. Aplia.com (instruction later in syllabus). Hard copies are also on reserve Debate material will be posted on latte as background for your debates. The debate teams are expected to go beyond this material as they prepare the debates. Please read Financial Times or The Economist to keep current with our changing world. You are responsible for obtaining the materials prior to each class. Additional material will be made available on the course latte web site or passed out in class. Come to class PREPARED Prerequisites: There are no prerequisites for the course and ALL IBS students are expected to take a global political economy class at IBS. Many students have some familiarity with economics and the business press. We encourage you to look at the online text material in Aplia.com Final Draft - Econ 201a 3 Ballantine Brandeis International Business School GRADING: Course grades will be determined according to the following schedule: Case write-ups (3) 30% Problem sets (2-3 short online) 20% Debates, two (2) (groups of 4/5) 20% Final debate paper (groups of 2 or 3 students) 15% Class participation 15% DUE DATES Written assignments (9 including final debate paper and global essay): Case write-ups are due in class during the week marked on the syllabus (hard copy to me in class or IBS mail box, not emailed) on the following dates (see syllabus schedule): A. Class 2 (Sept 10 ) - Globalization CHALLENGES from YOUR perspective, 1-2 page with some supporting data / example, THEN country Data memos 1. Class 4 2. Class 8, 3. Class 11 (Sept 24) – small group case (Oct 22) – individual case (Nov 12) – individual case Problem set / online quizzes (3): During the semester there will be two-three (3) short take home (online) problem sets to make sure that you have an understanding of the economic concepts that are illustrated through the case discussions / readings. The problem sets will be drawn from the online economics text (aplia.com KW, FT) and cases. You will have one week to prepare (and practice problems too). The problem sets will be taken and scored online. B. Practice Problem set: monetary, fiscal policy DUE Sunday Sept 21 1. Class 5 2. Class 9 3. Class 12 online problem set 1, DUE Sunday, Oct 5 online problem set 2, DUE Sunday, Nov 2 online problem set 3, DUE Sunday, Nov 30 NAME cards: Students should keep name cards up Throughout the semester, and sit in the same seat! NO computers should be open in class, except for debates or case material. (No email, facebook, OR web cruising). Pay attention to class discussion and Participate! Final Draft - Econ 201a 4 Ballantine Brandeis International Business School Instructions to Access the Harvard Business Course Materials Online: Course link at HBS: GEE 2014 Ballantine Thank you. COURSE DETAILS For technical assistance, please contact the Harvard Business Publishing Tech Help line at 800 810-8858 (outside the U.S. and Canada, call 617 783-7700 ); or email techhelp@hbsp.harvard.edu. Our business hours are 8 am - 8 pm ET, Monday-Thursday, and 8 am - 7 pm ET on Friday. Additional instructions for accessing the Aplia online Krugman (KW) text and Feenstra (FT) problem sets will be emailed and posted on Latte. See Aplia.com Hard copies of text on Reserve Final Draft - Econ 201a 5 Ballantine Brandeis International Business School Academic Honesty: All students are expected to be familiar with and abide by the academic honesty policies of Brandeis. Academic Integrity: The University has request that course syllabi include the following passages: “Academic integrity is central to the mission of educational excellence at Brandeis University. Each student is expected to turn in work completed independently, except when assignments specifically authorize collaborative effort. It is not acceptable to use the words or ideas of another person – be it a world-class philosopher or your lab partner – without proper acknowledgement of the source. This means that you must use footnotes and quotation marks to indicate the source of any phrases, sentences, paragraphs or ideas found in published volumes, on the internet or created by another student. “Violations of University policies on academic integrity, described in Section Three of the Rights and Responsibilities, may result in failure in the course or on the assignment, or in suspension from the University. If you are in doubt about the instructions for any assignment in this course, it is your responsibility to ask for clarification. “If you are working in groups that I have authorized, I will expect your answers to resemble those of your partners; otherwise I expect you to do your work separately from your friends, classmates, family members, and so on. You are not permitted to have anyone other than your professors help you on written assignments outside of class. If you have questions on the type of help you may receive, please ask me before you seek help from someone.” 1 NOTE, I will ask you to sign an academic honesty form with your papers / memos that states that this is your work and that you followed the class instructions regarding group work and consultation with TAs. Disabilities: If you are a student with a documented disability on record at Brandeis University and wish to have a reasonable accommodation made for you in this class, please see me immediately. Shawn McGuirk, Kara Curcio, and Carrie Klugman, “Information for your Syllabi,” Memoradum to Faculty, Department of Student Development and Conduct, Brandeis University, August 1, 2004. 1 Final Draft - Econ 201a 6 Ballantine Brandeis II International Business School General Course explanation / guidelines: Class sessions will be devoted to a discussion short economics lecture, case discussion role play. It is expected that each student will come prepared to class ready to discuss the readings and the case. A. Lecture and readings: MOST of the classes/sections will start with a short conceptual economics lecture that should be explored in greater depth in the online economics texts. The purpose of the lectures and readings in the course is to give the students the concepts that are illustrated in the case. The text book readings are assigned for their relevance to the case and to re-emphasize the economic principles. B. Cases Discussions: We will usually start each case discussion by looking at the data, identifying the big issues/questions in the case and then getting into our role plays. Case discussion questions are on the syllabus. These questions are designed to stimulate your thinking rather than structure or limit your analysis of each case. Additional case preparation emails / role plays will be sent to you before class Case role play instructions will be posted on our Latte Forums before each case discussion. We will break into separate groups to talk about the perspectives / roles of the different players in the case? The role play will help us understand the challenges of coming to a decision. Emails: I will usually send a follow-up email to everyone after each class. This helps summarize some of the material covered in our class discussion, clarify the confusing points and remind all of what we are supposed to do for the next class. C. Written memos cases: Students are also expected to turn in three (3 cases) three page case write-ups during the semester (with data exhibits). The write-ups should address the general issues and be specific (refer to relevant data). Students will work in small groups for one of the case write-ups, and submit two individual case write-ups. (1 small group case (2/3 people) and 2 individual case write-ups) The basic memo guidelines (structure) for case write-ups (we will review in class and I will post sample memos on latte): What are the issues (describe the situation); What is the problem / challenge? What is your analysis and your recommendations. How do you support your analysis and recommendation with relevant data, What are your caveats and issues / concerns? What don’t you know…what concerns you about your recommendations. Some additional case write-up tips (organization and structure matter!) Case write-ups should be 2-3 pages long, not more than 1000 words, with exhibits. Final Draft - Econ 201a 7 Ballantine Brandeis International Business School Use a bullet outline to organize your memo with descriptive headings for each section. 1. Introduce the case by identifying the issues. You don’t need to restate the details of the case (you should assume the person grading the cases has read them). Present the essence of the problem and causes. What is the problem? Your recommendation? 2. Analyze the problems and use evidence from the case and the exhibits. You may need to manipulate the data to come up with useful figures. Refer to the exhibits in the case. A summary table or graph that supports your analysis and position is important. 3. Think in terms of political and socioeconomic circumstances at both the country-level as well as the global perspective where appropriate. Use your knowledge of economic and other theoretical concepts. 4. Given your analysis of the situation, decide whether the strategy followed in the case was a good one or not. Defend your position and if you disagree, then put forward your recommendations. D. Debates: Discuss ISSUES…in 1st and 2nd class. Select NEW 2014 debate topics During the semester we will have ten debates. Students will divide into teams of four/five per team and be prepared to debate both sides of an issue. The actual position that you will take will not be decided until a day or two before the debate. Teams must prepare both sides of the debate. (You will debate twice during the semester) The debate topics will be decided during the first two weeks of the semester. The final list of topics and debate team schedule will be SET by third/fourth week of class. For example we might debate in week 5: “The Federal Reserve should taper QE#. The economy is growing” The general structure of the debate will be as follows: (You should have a brief handout or power point slides with (8-10) summary slides / data. - each side opens with a brief statement (5 minutes each) - a response is made by each side after the opening statement (4 minutes each) - two questions from the opposing team and response (2 minutes for each question) - audience and professor ask questions of each team (4) with 12 minutes of response - restatement from each team of their argument and other questions (3 minutes) - final summary statement (2 minutes) - Final class vote, position and feedback on the debate topic (3 minutes) Each debate should be quite interactive and take approximately 50-60 minutes with five minutes of preparation before we get started. The debates are a fun way to illustrate the challenges confronting our peoples in various parts of the political economy. Debate paper: At the end of the semester, the debate team will divide up into smaller groups (2 /3 each) and prepare a 6 page paper supporting one of their debate positions. Students will do the paper as a subset (two / three) of the debate team. The papers are due by Dec. 19th in hard copy. Final Draft - Econ 201a 8 Ballantine Brandeis International Business School Group work policy: One of the case write-ups and all of the debates are to be done in groups of 4/5 people. Groups will be formed at the beginning of the semester and stay constant throughout. If someone is not participating in the group discuss it with them and me (if necessary). We will form groups that have a good mix of talents, perspectives, nationalities …and those who can meet / communicate regularly. Convenience and capacity are also important to team makeup. At the end of semester, I will ask each group to evaluate the group and each member of the group. This means that those who do extra work in the group or are free riders are likely to be noted by other members of the group. Class participation: Regular preparation of assigned readings, class attendance, and participation in class discussions are required. Students who are unable to attend class for any reason are expected to call or notify me of their absence prior to the class…. Teaching Assistants: The TAs will read all the assignments and put initial grade on the written assignment that I will also read (two readings), they will also keep track of class participation and be available for additional out of class assistance. TAs are: Final note Finally, this course is a lot of work, but it should be a great deal of fun if you put the work in and discuss the fascinating issues / cases that we will review in during the semester. And remember to read the press because the world is our classroom! And ASK questions!! Final Draft - Econ 201a 9 Ballantine Brandeis International Business School APLIA Online text detailed readings (KW, FT) see schedule / login instructions on Latte. Note, specific topics / pages shown below: Week 2: Hyperinflation / Money KW chapter 30, The Meaning of Money, p 798-799 KW chapter 30, The Monetary Role of Banks, p 804-808 KW chapter 30, Determining the Money Supply p808-813 KW chapter 30, Open Market Operations p 814-815 KW chapter 24, Inflation and Deflation, p.630-635 Week 3: Obama case /Macro KW chapter 29, Fiscal Policy the Basics, p 768-774 KW chapter 29, Fiscal Policy and the Multiplier, p 774-779 KW chapter 23, The National Accounts, p 590-599 KW chapter 23, Real GDP: A Measure of Aggregate Output, p 600-603 Week 4: China / FX and BOP FT chapter 18, Soaring Loonie… p 716 FT chapter 20, Central Bank Balance Sheet p 818-821 FT chapter 20, Too Much of a Good Thing? P. 844 FT chapter 16, Measuring Macroeconomic Activity: An overview p 598-608 FT chapter 16 Balance of Payments Accounts: International Transactions,p 624-635. Week 5: Corn Laws / Trade KW chapter 8, Absolute advantage, comparative advantage, and the pattern of trade, p. 195-205 KW chapter 8, Gains from trade, and distribution of gains/losses, p. 199-200 and p. 205-211 KW chapter 8, Effects of tariffs, p. 211-215 KW chapter 8, Politics of trade policy, p. 215-220 Week 6: Cambodia / trade agreements FT chapter 11, Trade agreements, p. 391-394 and p. 398-406 FT chapter 11, International agreements on labor issues, p. 406-411 FT chapter 8, The Multifibre Arrangement (MFA), p. 304-308 Week 7: South Africa / FX, trade, FDI, productivity KW chapter 25, Comparing Economies Across Time and Space, p 642-646. KW chapter 25, Sources of Growth, p 646-654 KW chapter 25, Role of Governments in Promoting Growth p 656-658. FT chapter 9, Infant industry argument, p. 325-339 Week 8: Ireland / FDI and growth FT chapter 5 Movement of Capital between Countries p 161-169 FT chapter 5, Myth of Asia’s Miracle p. 169 FT chapter 5 Conclusions, p. 179-180 Week 9: Banking crisis 1933 / financial crises KW chapter 30, The Monetary Role of Banks, p 804-807 KW Chapter 30 An Overview of 21st Centruy American Banking System p 818-821 Final Draft - Econ 201a 10 Ballantine Brandeis International Business School Week 10: Korea / IMF and FX crises FT chapter 16 BOP accounts: International transactions p 624-629 FT chapter 20 Facts about XR crises ; 812-817 FT chapter 20 How Pegs Work p 817-821 FT chapter 20 Central Bank Balance Sheet and Financial System p 839-844 FT chapter 20 Can we prevent Crises? P 863-865 Week 11: Greece / FX, default FT chapter 22 Debt and Default p 956-964 Week 12: Russia / growth and leadership Final Draft - Econ 201a 11 Ballantine Econ 201a, GEE Class dates Topic / concepts Tues, Fri Class 1 Introduction to GEE: Global Economic Sept 3 Environment ASSIGNMENTS Readings / Online assignments, see details Look at handouts inclass, and then, share Globalization, Trade In-class handouts What is your view of globalization and the International countries you know? Institutions background Case Video Bretton Woods Today!! G-8, EU Look at readings passed out in class Issues / questions What is globalization? Why free trade? WTO politics and issues. Political Economy? What is your definition of globalization … How does globalization affect you and your country? Explain the role of various international institutions, what works and does not work? Why / how were they formed? Our knowledge of economics and what we will learn. I Tools for Understanding Global Economic Policy Class 2 Sept 10 Class 3 Sept 17 Economic concepts: - monetary policy, - quantity theory, Ms, Md - banks, V, M multiplier - inflation, ir, FX - Note on Money and Global write-up: What is globalization Monetary Policy and the issues for you? (1-2 pages) - KW, Chpts 24, 30 Skills 1: Down load data on Brandeis Library Jason country Note, see detailed page Bernard, data workshop in instructions 10, 11 Economic concepts: - measuring economy - fiscal, monetary policy - multipliers, timing - macro, micro - aggregate S, D …other - balance of payments Skills 2: Writing short memo, data, bullets, structure, outline Fall 2014 Practice Problem set on fiscal and monetary policy Draft country data memo outline Krugman Wells, KW chapters 23, 29, German Hyper Inflation Monetary policy and money. Role of Central Bank, banks and credit…look at roles of different players National Income Accounting: past, present, future background - Note analyzing BGIE data Obama and Bush Tax cuts. Form debate teams 12 Why hyperinflation? And what were the consequences of the peace? Debt reparations, Ms and Interest rates. Impact on various players? Political turmoil? What should the German government have done in 1923? Political and economic consequences of the peace. Data and politics. . National income accounts and Economics in one session: Aggregate Demand, Supply, inflation and monetary policy. Numbers and how we measure our economy. How good are the numbers, where from, who collects? Review data: post war, Bretton Woods, Today…and post war institutions.. How do people collect and measure data. What is missing? Explain fiscal policy and how it works. Multipliers? Were the Bush tax cuts a good idea? Look at each set of tax cuts; how did they work? What fiscal policy should Obama pursue? Stimulus and financial crisis today? When do you expect to see the impact…what further consequences / challenges? Ballantine Econ 201a, GEE Class 4 Sept 24 Economic concepts: - fiscal, monetary policy - industrial policy - productivity and growth - budget deficits…BOP and FX Skills 3: Point points slides, presentations and debate techniques African case Small group case memo 1 (in class) - Reading Balance of Payments China Renminbi FT, chapters 16, 18, 20 Prepare power points (3-4 slides) with point of view Why is the world (US, EU) pressuring China to revalue its currency. What is the evidence and what are the trade and economic implications. Why is China resisting and what are the implications of a more open FX market? On the exchange rate, on the real economy, BOP. How should WTO, China and other approach the currency, and underlying trade issues? Are there broader issues that should be taken into account or should all move towards a free (floating) exchange rate as soon as possible? Debate topics / schedule II Trade, Foreign Direct Investment, Foreign Exchange and Global Issues What are the Gains from trade? Explain comparative advantage? Bhagwati – why free trade arguments hold today; how different from Britain in 19th century? Class 5 Oct 1 Economic concepts: - Gains Trade (Ricardo) - PPP, interest rate parity, - Tariffs and trade policy - FX rates - BOP flows, FDI - Economic Gains from Trade: Comparative online problem set 1 Advantage Corn Laws Should the prime minister repeal the Corn Laws in 1845? Why or why not? What are the positions of various parties? Why the explosion of free trade radicalism in Britain, is the campaign purely an economic movement? What are the long and short-term implications for prime minister Peel? Political realignment? Longer term implications for growth and trade? Worker Rights: Cambodia Textiles Describe Cambodia’s economic position and options. Why accept labor standards as part of the trade agreement? What are your concerns about gains from trade and the limitations of bi-lateral agreements? What are the trends in global textile markets? What is the US perspective on textile competition, trends and practices? Does this approach work? Your concerns and questions, what is the role of China, US, world Due Sunday, Oct 5 KW 8, Debate 1 No Classes Oct 9 Class 6 Oct 8 Fall 2014 Economic concepts: - Trade, BOP, - Fair trade, labor and other regulations - FDI, capital investment - trade barriers, protection - In-class textile and trade handouts Debate 2 FT 8, 11 13 Ballantine Econ 201a, GEE Class 7 Oct 15 Economic concepts: - FX rates, prices, - Monetary policy, Fx - BOP and flows, reserves - trade & development - Background FDI Agreements FDI in South Africa A, later look at B. Debate 3 FT 9, KW 25 FDI the key to South African growth. How to attract? What invest in South Africa before and after apartheid? How important is FDI to growth, unemployment and BOP, FX issues? The role of ANC and democracy in the New South Africa, and other new players? How has the South African economy changed and where is it going? Debate 3 Class 8 Oct 22 Economic concepts: - FDI and growth policy - development models - linkages - growth and subsidies Individual case memo 2 - Accounting for Productivity Growth Due in class FT 5 Ireland and FDI Explain the importance of FDI and some of the concerns that investors might have. Review the capital flow data, how is it different from FDI; do they mirror each other? Why or why not? Why the success in Ireland? And where did it come from…what were its attributes / advantages/ What role did FDI play in Ireland and why invest? What policies and inducements were offered, is this a policy that other countries should replicate? An Irish success story or…? The future of Ireland today? Dual economies… Importance of productivity and growth. Labor surplus and economic development…. Financial crises. Debate 4 III Crises Financial and Currency Crises Class 9 Oct 29 Economic concepts: - Banks, safety/soundness - Money, credit, Md - cronyism and politics online problem set 2 The Great Depression: Due Sunday Nov 2 KW 30 Money and the role of banks in creating money? How banks work (Assets, Liabilities …confidence). Why the banking crisis… full faith, and the role of deposit insurance in 1933? Roosevelt’s changing position, Bank holidays, deposit runs and loan demand / economy. What are the links between the bank crisis, money and economic activity? Keynes…“animal spirits.” Investment / borrowing. What data was available? When, how good? The beginning of GDP accounting, depression and national and international institutions. Debate 5 Fall 2014 US Banking Crisis 1933 14 Ballantine Econ 201a, GEE Class 10 Nov 5 Economic concepts: - Fx rates and policies - Central bank, BOP - and capital account flows - Politics/institutions, IMF Debate 6 - Note on Currency - Crises Collapse in Asia Korea 1997 “On the 1997-8 back of a Tiger” FX crises - Background and Agreements on FDI FT 16, 20 Class 11 Nov 12 Economic concepts: - Fx, debt payments - Int’l capital flows - Institutions, national economy, and.. - WDC / IMF approach Individual case memo 3 Due in class Note on Currency crises FT 22 The Greek Crisis: Tragedy or Opportunity? Debate 7 What happened to the tiger of Asian economic growth? FDI, BOP and capital flow imbalances, explain? The role of government, leadership and private economy? What should IMF do, and how to stabilize Korea and other Asian economies. An overreaction, by whom? A regional flu or isolated incident? How to stabilize and grow? After its 2009-2010 fiscal crisis shook the euro, can the Greek government stabilize debt, avoid default, and remain part of the Euro? How did Greece get here: the social and political road to to the crisis;the economic and budget challenges? How will Greece pay back its debt what is the role EU and ECB? IMB, Germany, UK? What to do now and what about the Euro and EU growth? How are markets responding to these events? IV Economic development and Country Growth Class 12 Nov 19 BREAK Class 13 Dec 3 Dec 19 Fall 2014 Economic concepts: - economic development - institutions, rule of law - trade and investment - restructuring / change - ec dev’lmt projects and country growth Russia: Revolution and The collapse of the Soviet Union in 1991 ushered in a period of revolutionary transformations. Explain how the Reform leaders have tried to manage their economy and re- The Promise and Perils establish some government management. Contrast the roles of Russia’s Resurgent of Yeltsin, Putin and Medvedev. State What are the strengths of various institutions, sectors and capacity of government to build a new economy? How? To what extent can a statist and large business economy compete in global economy? online problem set 3 Due Sunday, Nov 30 - Note on Rules Debate 8 Thanksgiving Economic concepts: - resources, capacities - regional and state policy - strategy for growth Debate Papers Due Debate 9 & 10 Hard Copy Projections of global prospects, World Bank Brazil or Turkey May not get to discuss these cases Debate Papers Due Hard Copy 15 Ballantine Econ 201a III Class Discussion: Globalization and Political Economy EDIT/change ? What does Globalization mean to you? ?What is your experience? (Next class essay 1-2 pages with examples / data) The Economist briefing on economics “The Other Worldly Philosophers” (July 18, 2009): “Robert Lucas, one of the greatest macroeconomists of his generation, and his followers are making ancient and basic analytical errors “all over the place”. Harvard’s Robert Barro, another towering figure in the discipline is making truly “boneheaded arguments.” The past 30 years of macroeconomics training at American and British universities were a costly “waste of time.”… To the uninitiated, economics has always been a dismal science. But all these attacks come from within the guild….these internal critics argue that economists missed the origins of the crisis; failed to appreciate its worst symptoms; and cannot now agree about the cure. In other words, economists misread the economy on the way up, misread it on the way down and now mistake the right way out. On the way up, macroeconomist were not wholly complacent. Many of them thought the housing bubble would pop or the dollar would fall. But they did not expect the financial system to break. Even after seizure in the interbank markets in August 2007, macroeconomist misread the danger. Most were quite sanguine about the prospect of Lehman Brothers going bust in September, 2008. Nor can economists now agree on the best way to resolve the crisis. They mostly overestimated the power of routine monetary policy (i.e., Central Bank purchases of government bills) to restore prosperity. Some now dismiss the power of fiscal policy (i.e., government sales of its securities). Others advocate it with passionate intensity... The furious rows that divide them are a blow to their credibility, but prove to be a spur to creativity.” 1. Robert Gilpin in Global Political Economy (2001 Princeton Press) writes. ..“although globalization had become the defining feature of the international economy at the beginning of the twenty-first century, the extent and significance of economic globalization have been greatly exaggerated and misunderstood in both public and professional discussions: globalization in fact is not nearly as extensive nor as sweeping in its consequences (negative or positive) as many contemporary observers believe. This is still a world where national policies and domestic economies are the principal determinants of economic affairs. Globalization and increasing economic interdependence among economies are indeed very important; yet the major economic achievement of the post-World War II has been to restore the level of international integration that existed prior to World War I…. As national economies have become more and more integrated, the significance of the fundamental differences among national economies has greatly increased… ..States set the rules that individual entrepreneurs and multinational firms must follow. Yet economic and technological forces shape the policies and interest of individual states and the political relation among states. The market is indeed a potent force in the determination of economic and political affairs. For this reason, both political and economic analyses are required to understand the actual functioning and evolution of the global economy.” Fall 2012 16 Ballantine Econ 201a, GEE 2. Or Tina Rosenberg writes in a NY Times magazine article in 2002. “Globalization is meant to signify integration and unity – yet it has proved, in its way, to be no less polarizing than the cold war divisions it has supplanted. The lines between the globalization supporters and its critics run not only between countries, but also through them, as people struggle to comes to terms with the defining economic forces shaping the planet today. The two sides in the discussion describe what seem to be two completely different forces. Is the world being knit together by the Nikes and MicroSofts and Citigroups in a dynamic new system that will eventually lift the have-nots of the world up from medieval misery. Or are ordinary people now victims of ruthless corporate domination, as the Nikes and Microsofts and Citigroups roll over the poor in nation after nation in search of profits?“ 3. Joseph Stiglitz Globalization and its Discontents 2002, Nobel Prize Economics 2001 “I have written this book because while I was at the World Bank, I saw firsthand the devastating effect that globalization can have on developing countries and especially the poor within those countries. I believe that globalization – the removal of barriers to free trade and the closer integration of national economies – can be a force for good and that it has the potential to enrich everyone in the world, particularly the poor. But I also believe that if this is to be the case, the way globalization has been managed, including international trade agreements that have played such a large role in removing those barriers and the policies that have been imposed on developing countries in the process of globalization, need to be radically rethought. Or later in Price of Inequality (2112) “There are moments in history when people all over the world seem to rise up, to say that something is wrong….” Time, however, may be running out. Four years ago there was a moment (2008 election) where most Americans had the audacity to hope. Trends more than a quarter of century in the making might have been reversed. Instead they have worsened. …rules of the game that weaken the bargaining power of workers vis-à-vis capital…the dearth of jobs and the asymmetries in globalization have created competition for jobs in which workers have lost and owners of capital have won. 4. John Micklethwait and Adrian Woolbridge, WSJ about The Economist (2004) “In the 19th century, the cause of globalization only won because politicians were willing to sacrifice their own personal interests for the sake of principles. The great example was the Conservative prime minister Robert Peel, a landowner who was willing to throw away his own career and split his party for a generation by getting rid of the Corn Laws for no better reason than he thought they were unjust. Today such leadership is rare. Business leaders are forever asking people like coal miners and steel workers to bear the burdens of globalization while conveniently forgetting professionals, like accountants or lawyers (both of whom hide behind non-tariff barriers). Economists celebrate competition from the luxury of tenured jobs. Politicians support trade in the form of good exports, not wicked imports. This is not only economically illiterate, it also encourages the myth, repeated on the banners in Washington this week, that trade is zero-sum game, where somebody has to lose for others to win. 5. Paul Krugman in the New York Times (2005) “But is has been a generation since most American Workers could count on sharing in the nation’s economic growth. America is much richer country than it was 30 years ago, but since the early 1970s the hourly wage of the typical worker has barely kept up with inflation. Fall 2014 17 Ballantine Econ 201a, GEE The contrast between rising national wealth and stagnant wages has become extreme lately. In 2004, which was touted both by the Bush administration and by Wall Street as a year in which the economy boomed, the median real income of full time, year round male workers fell by more than 2 percent… During the 1990s optimists argued that better education and worker training could restore the economies ability to create good jobs. Mr. Miller of Delphi picked up that argument as part of his public relations campaign for wage cuts. “ The world pays knowledge workers far more than it pays manual industrial workers,” he said, “ and that’s what’s sweeping over here. What if neither education nor health care reform is enough to end the wage squeeze? That’s the possibility that make free-trade liberal like me very nervous, because at that point protectionism enters the picture. When corporate executives say that they have to cut wages to meet foreign competition, workers have every right to ask why don’t we cut foreign competition instead….I hope we don’t have to go there. But denial is not an option. American working middle class has been eroding for a generation, and it may be about to wash away completely. Something must be done. Or later…NYTimes 2008 So far, the international economic consequences of the war in the Caucasus have been fairly minor, despite Georgia’s role as a major corridor for oil shipments. But as I was reading the latest bad news, I found myself wondering whether this war is an omen — a sign that the second great age of globalization may share the fate of the first. If you’re wondering what I’m talking about, here’s what you need to know: our grandfathers lived in a world of largely self-sufficient, inward-looking national economies — but our great-great grandfathers lived, as we do, in a world of large-scale international trade and investment, a world destroyed by nationalism. Writing in 1919, the great British economist John Maynard Keynes described the world economy as it was on the eve of World War I. “The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth ... he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world.” And Keynes’s Londoner “regarded this state of affairs as normal, certain, and permanent, except in the direction of further improvement ... The projects and politics of militarism and imperialism, of racial and cultural rivalries, of monopolies, restrictions, and exclusion ... appeared to exercise almost no influence at all on the ordinary course of social and economic life, the internationalization of which was nearly complete in practice.” But then came three decades of war, revolution, political instability, depression and more war. By the end of World War II, the world was fragmented economically as well as politically. And it took a couple of generations to put it back together. So, can things fall apart again? Yes, they can. Fall 2014 18 Ballantine Econ 201a, GEE Another Krugman OpEd 2011 This is the way the euro ends – not with a bang but with a bunga bunga. Not long ago European leaders were insisting that Greece could and should stay in the euro while paying its debts in full. Now, with Italy falling off the cliff, its hard to see how the euro can survive at all… First things first: the attempt to create a common European currency was one of those ideas that cut across ideological lines. It was cheered on by American right-wingers who saw it as the next best thing to a revived gold standard, and by Britain’s left, which saw it as a big step toward socialdemocratic Europe. But is was opposed by British conservatives, who also saw it as a step toward social democratic Europe. And it was questioned by American liberals, who worried – rightly I’d say – about what would happen if countries counldn’t use monetary and fiscal policy to fight recessions. So now that the euro project is on the rocks, what lessons should we draw?... What happened, it turns out, is that by going on the euro, Spain and Italy in effect reduced themselves to the status of third world countries that have to borrow in someone else’s currency, with all the loss of flexibility that implies… The other thing you need to know is that in the face of the current crisis, austerity has been a failure it has been tried: no country with significant debts has managed to slash its way back into the good graces of financial markets.. 6. Tom Friedman, NYTimes, August 2011 LONDON burns. The Arab Spring triggers popular rebellions against autocrats across the Arab world. The Israeli Summer brings 250,000 Israelis into the streets, protesting the lack of affordable housing and the way their country is now dominated by an oligopoly of crony capitalists. From Athens to Barcelona, European town squares are being taken over by young people railing against unemployment and the injustice of yawning income gaps, while the angry Tea Party emerges from nowhere and sets American politics on its head. What’s going on here? There are multiple and different reasons for these explosions, but to the extent they might have a common denominator I think it can be found in one of the slogans of Israel’s middle-class uprising: “We are fighting for an accessible future.” Across the world, a lot of middle- and lower-middleclass people now feel that the “future” is out of their grasp, and they are letting their leaders know it. Why now? It starts with the fact that globalization and the information technology revolution have gone to a whole new level. Thanks to cloud computing, robotics, 3G wireless connectivity, Skype, Facebook, Google, LinkedIn, Twitter, the iPad, and cheap Internet-enabled smartphones, the world has gone from connected to hyper-connected. 7. Dani Rodrik, One Economics, Many Recipes: Globalization, Institutions and Economic Growth On a visit to a small Latin American country a few years back, my colleagues and I paid a visit to the minister of finance. The minister had prepared a detailed powerpoint presentation on his economy’s progress, and as his aide projected one slide after another on the screen, he listed all the Fall 2014 19 Ballantine Econ 201a, GEE reforms that they had undertaken. Trade barriers had been removed, price controls had been lifted and all public enterprises had been privatized. Fiscal policy was tight, public debt levels low, and inflation non-existent. Labor markets were flexible as the come. There were no exchange rate or capital controls and the economy was open to foreign investments of all kinds…. And if there were justice in the world in matters of this kind, the country in question would have been handsomely rewarded with rapid growth and poverty reduction. Alas, not so. The economy was scarcely growing, private investment remained depressed, and largely as a consequence, poverty and inequality were on the rise. What had gone wrong? Meanwhile there were a number of other countries—mostly but not exclusively in Asia – that were undergoing more rapid economic development than could have been predicted by even the most optimistic economists….Clearly, globalization held huge rewards for those who knew how to reap them. What was it that these countries were doing right? 7. The Economist: quotes from recent editorials (20010 – 2012 and handouts) - July 5, 2010 “What a Way to Run the World” Clubs are too often full of people prattling on about things they no longer know about. On July 7th the leaders of the group that allegedly runs the world – the G7 democracies plus Russia – gather in Japan to preview the world economy. But what is the point of their discussing oil price without Saudi Arabia, the world’s largest producer? Or waffling about the dollar with China which holds so many American Treasury bills? Or slapping sanctions on Robert Mugabe, with no African present? Or talking about global warming, AIDS or inflation without anybody from the emerging world? Cigar make and ignorance are in the air. The G8 8s not the only global club that looks old and impotent. The UN security Council has told Iran to stop enriching uranium, without much effect. The nuclear non-proliferation regime is in tatters. The International Monetary Fund, the fireman in previous crises, has been a bystander during the credit crunch. The World Trade Organization’s Doha round is stuck. Of course, some bodies, such as the venerable Bank for International Settlements still do a fine job. But the global problems proliferate and information whips around the world ever faster, the organizational response looks every shabbier, slower and feebler. The world’s governing bodies need to change. - August 21st, 2010 Contest of the Century A hundred years ago it was perhaps already possible to discern the rising powers whose interaction and competition would shape the 20th century. The sun that shone on British Empire has passed midday. Vigorous new forces were flexing their muscles on the global stage, notably American, Japan and Germany. Their emergence brought undreamed of prosperity; but also carnage on a scale hitherto unimaginable. Now, digest the main historical event of this week: China has officially become the world’s secondbiggest economy, overtaking Japan…Countries as huge and complicated as China can underachieve or collapse under their own contradictions…How China and India manage their relationship will determine whether similar mistakes to those that scarred the 20th century will disfigure this one. - August 6th, 2011 Time for a Double Dip?” This ought to have been a good week for the American economy. The country’s at last ended a Fall 2014 20 Ballantine Econ 201a, GEE ludicrously irrelevant bout of fiscal brinkmanship, removing the threat of global financial Armageddon by agreeing to raise the federal debt ceiling. On August 2nd, the day the debt deal was signed, the S&P500 index saw its biggest one day fall in over a year and yields on Treasury bonds dropped to 2.6%, their lowest level in nine months, as investors sought safety. ..It is not all to do with America: the euro zone is a mess and manufacturing everywhere seems to be slowing. Once stalled, an economy can easily tip back into recession, particularly if it is hit by a new shock – as America is about to be, thanks to a hefty dose of fiscal tightening made worse by the debt deal… …The poisonous politics of the past few weeks have created a new uncertainty. Now that the teapartiers have used default successfully as a political weapon, it will be used again. The refusal to compromise, rapidly became a point of honour for both parties, is wreaking damage elsewhere…Does it have to be this way? Not necessarily. Barak Obama or one of his Republican challenges may yet discover the courage to tell the truth about the American economy in next year’s presidential election. But given the politicians current uselessness, the only institution with the power to avert danger is the Federal Reserve. Printing money is justifiable in the circumstances. Fiscal help would have been much better. - August 13, 2011 “Central Bankers to the Rescue” ..Flat on its back, feeble and growing weaker, the rich world’s economy is in a sorry state. In the past week the signs of alarm multiplied. In Europe yields on Italian and Spanish ten year notes rose above 6%. America fretted at seeing its credit downgraded by one of the big rating agencies. Around the world, stockmarkets tumbled, with some recording their biggest one-day falls since 2008….then the central banks stepped in. The European Central Bank (ECB) let it be known that it would support Spain and Italy by expanding its bond buying programme. Meanwhile America’s Federal Reserve said it was likely to keep interest rates close to zero until mid 2013 and hinted that it might take other steps to support the economy… The pessimism is obviously rooted in economic data, particularly in America, which suggests a sluggish recovery at best. But there is also a spectre of political risk. Having basically trusted politicians to sort things out for the past three years, investors have changed their mind. A lousy debt deal in Congress and the euro zone’s inability to confront its problems are not just bad in themselves; they also reveal politicians who are either failing to help or making matters worse….The despair is also affecting business confidence. - August 27, 2011 How to Avoid a Double Dip Anyone who managed to switch off during the summer holiday has faced a rude shock on his return. The world economy is in much worse shape than it was a few weeks ago. Growth has slowed sharply in both America and Europe. Even as the emerging world has lost some of its sizzle. Global share prices have dropped by around 15% since early July. Consumer confidence has slumped. All of this has led to a grim and sudden reassessment of growth prospects, especially in the rich world. Forecasts for 2012 have been slashed. The odds of a double-dip recession have risen sharply on both sides of the Atlantic. Fall 2014 21 Ballantine Econ 201a, GEE In 2008 the world economy was saved from depression by a bold and coordinated plan to shore up banks and counter the slump with fiscal and monetary stimulus. Today there is no such boldness (the Euro-zone crisis is the epitome of politicians doing too little too late). There is no coordination. And, to the extent that policies have a common theme, it is the wrong one: politicians across the rich world are taking too short-term a view of fiscal austerity – a bout of budget cutting which will only increase the risk of another recession. …A growth agenda won’t transform the rich world’s prospects. The recovery will still be fragile and sluggish. But it has a far better shot at avoiding both recession and stagnation than today’s policy mix. It is high time to change course - August 11, 2012 “Tempted, Angela?” For all you know, Angela Merkel is even now contemplating how to break up the euro. Surely Germany’s long-suffering chancellor must be tempted, given the endless euro-bickering over rescues that later turn out to inadequate. Howe she must tire of fighting her country’s corner, only to be branded weak by critics at home. How she must resent sacrificing German wealth, only to be portrayed as a Nazi in some of very countries she is trying to rescue… The euro could have been saved a long time ago, had politicians agreed on who should pay what or on how much sovereignty to surrender. Rather than push forward, Mrs. Merkel has waited, hoping that fiscal adjustment and structural reforms will lead to economic growth in southern Europe and that politicians could sort out their differences…the evidence, though, is not on her side. Southern Europe’s economic rot is deepening and spreading north. Politics is turning rancid…” OTHER class handouts on current economic / political issues Fall 2014 22 Ballantine