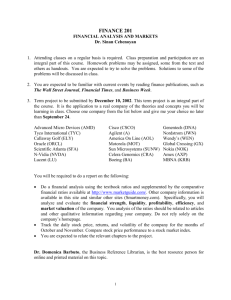

Equity Instruments & Markets - NYU Stern School of Business

advertisement

Equity Instruments & Markets: Part II

B40.3331

Relative Valuation and Private

Company Valuation

Aswath Damodaran

1

The Essence of relative valuation?

In relative valuation, the value of an asset is compared to the values

assessed by the market for similar or comparable assets.

To do relative valuation then,

– we need to identify comparable assets and obtain market values for these

assets

– convert these market values into standardized values, since the absolute

prices cannot be compared This process of standardizing creates price

multiples.

– compare the standardized value or multiple for the asset being analyzed to

the standardized values for comparable asset, controlling for any

differences between the firms that might affect the multiple, to judge

whether the asset is under or over valued

2

Relative valuation is pervasive…

Most valuations on Wall Street are relative valuations.

– Almost 85% of equity research reports are based upon a multiple and

comparables.

– More than 50% of all acquisition valuations are based upon multiples

– Rules of thumb based on multiples are not only common but are often the

basis for final valuation judgments.

While there are more discounted cashflow valuations in consulting and

corporate finance, they are often relative valuations masquerading as

discounted cash flow valuations.

– The objective in many discounted cashflow valuations is to back into a

number that has been obtained by using a multiple.

– The terminal value in a significant number of discounted cashflow

valuations is estimated using a multiple.

3

Why relative valuation?

“If you think I’m crazy, you should see the guy who lives across the hall”

Jerry Seinfeld talking about Kramer in a Seinfeld episode

“ A little inaccuracy sometimes saves tons of explanation”

H.H. Munro

“ If you are going to screw up, make sure that you have lots of company”

Ex-portfolio manager

4

So, you believe only in intrinsic value? Here’s

why you should still care about relative value

Even if you are a true believer in discounted cashflow valuation,

presenting your findings on a relative valuation basis will make it more

likely that your findings/recommendations will reach a receptive

audience.

In some cases, relative valuation can help find weak spots in

discounted cash flow valuations and fix them.

The problem with multiples is not in their use but in their abuse. If we

can find ways to frame multiples right, we should be able to use them

better.

5

Multiples are just standardized estimates of

price…

You can standardize either the equity value of an asset or the value of the asset

itself, which goes in the numerator.

You can standardize by dividing by the

– Earnings of the asset

Price/Earnings Ratio (PE) and variants (PEG and Relative PE)

Value/EBIT

Value/EBITDA

Value/Cash Flow

– Book value of the asset

Price/Book Value(of Equity) (PBV)

Value/ Book Value of Assets

Value/Replacement Cost (Tobin’s Q)

– Revenues generated by the asset

Price/Sales per Share (PS)

Value/Sales

– Asset or Industry Specific Variable (Price/kwh, Price per ton of steel ....)

6

The Four Steps to Understanding Multiples

Define the multiple

– In use, the same multiple can be defined in different ways by different users. When

comparing and using multiples, estimated by someone else, it is critical that we

understand how the multiples have been estimated

Describe the multiple

– Too many people who use a multiple have no idea what its cross sectional

distribution is. If you do not know what the cross sectional distribution of a

multiple is, it is difficult to look at a number and pass judgment on whether it is too

high or low.

Analyze the multiple

– It is critical that we understand the fundamentals that drive each multiple, and the

nature of the relationship between the multiple and each variable.

Apply the multiple

– Defining the comparable universe and controlling for differences is far more

difficult in practice than it is in theory.

7

Definitional Tests

Is the multiple consistently defined?

– Proposition 1: Both the value (the numerator) and the standardizing

variable ( the denominator) should be to the same claimholders in the

firm. In other words, the value of equity should be divided by equity

earnings or equity book value, and firm value should be divided by

firm earnings or book value.

Is the multiple uniformly estimated?

– The variables used in defining the multiple should be estimated uniformly

across assets in the “comparable firm” list.

– If earnings-based multiples are used, the accounting rules to measure

earnings should be applied consistently across assets. The same rule

applies with book-value based multiples.

8

Descriptive Tests

What is the average and standard deviation for this multiple, across the

universe (market)?

What is the median for this multiple?

– The median for this multiple is often a more reliable comparison point.

How large are the outliers to the distribution, and how do we deal with

the outliers?

– Throwing out the outliers may seem like an obvious solution, but if the

outliers all lie on one side of the distribution (they usually are large

positive numbers), this can lead to a biased estimate.

Are there cases where the multiple cannot be estimated? Will ignoring

these cases lead to a biased estimate of the multiple?

How has this multiple changed over time?

9

Analytical Tests

What are the fundamentals that determine and drive these multiples?

– Proposition 2: Embedded in every multiple are all of the variables that

drive every discounted cash flow valuation - growth, risk and cash flow

patterns.

– In fact, using a simple discounted cash flow model and basic algebra

should yield the fundamentals that drive a multiple

How do changes in these fundamentals change the multiple?

– The relationship between a fundamental (like growth) and a multiple (such

as PE) is seldom linear. For example, if firm A has twice the growth rate

of firm B, it will generally not trade at twice its PE ratio

– Proposition 3: It is impossible to properly compare firms on a

multiple, if we do not know the nature of the relationship between

fundamentals and the multiple.

10

Application Tests

Given the firm that we are valuing, what is a “comparable” firm?

– While traditional analysis is built on the premise that firms in the same

sector are comparable firms, valuation theory would suggest that a

comparable firm is one which is similar to the one being analyzed in terms

of fundamentals.

– Proposition 4: There is no reason why a firm cannot be compared

with another firm in a very different business, if the two firms have

the same risk, growth and cash flow characteristics.

Given the comparable firms, how do we adjust for differences across

firms on the fundamentals?

– Proposition 5: It is impossible to find an exactly identical firm to the

one you are valuing.

11

Price Earnings Ratio: Definition

PE = Market Price per Share / Earnings per Share

There are a number of variants on the basic PE ratio in use. They are based

upon how the price and the earnings are defined.

Price:

– is usually the current price (though some like to use average price over last 6

months or year)

EPS:

– Time variants: EPS in most recent financial year (current), EPS in most recent four

quarters (trailing), EPS expected in next fiscal year or next four quartes (both called

forward) or EPS in some future year

– Primary, diluted or partially diluted

– Before or after extraordinary items

– Measured using different accounting rules (options expensed or not, pension fund

income counted or not…)

12

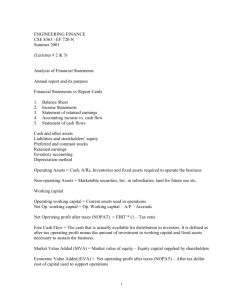

Looking at the distribution…

PE Ratio Distribution: US firms in January 2005

700

600

500

400

Current PE

Trailing PE

300

Forward PE

200

100

0

0-4

4-8

8-12

12-16

16-20

20-24

24-28 28 - 32

PE Ratio

32-36

36-40

40-50

50-75

75-100

>100

13

PE: Deciphering the Distribution

Mean

Standard Error

Median

Kurtosis

Skewness

Minimum

Maximum

Number of firms

Largest(500)

Smallest(500)

Current PE

48.12

3.69

23.21

1214.98

31.75

1.15

10081.26

4072

58.90

12.65

Trailing PE

42.86

3.39

20.65

1428.36

32.86

1.31

9713

3637

44.72

11.11

Forward PE

28.53

0.98

19.21

157.28

10.85

1.40

1017.00

2402.00

29.31

14.54

14

Comparing PE Ratios: US, Europe, Japan and

Emerging Markets

Median PE

Japan = 23.45

US = 23.21

Europe = 18.79

Em. Mkts = 16.18

PE Distributions: Comparison

18.00%

16.00%

14.00%

% of firms in market

12.00%

10.00%

US

Emerging Markets

8.00%

Europe

Japan

6.00%

4.00%

2.00%

0.00%

0-4

4-8

8-12

12-16

16-20

20-24

24-28 28 - 32

PE Ratio

32-36

36-40

40-50

50-75

75-100

>100

15

PE Ratio: Understanding the Fundamentals

To understand the fundamentals, start with a basic equity discounted

cash flow model.

With the dividend discount model,

P0

DPS1

r gn

Dividing both sides by the current earnings per share,

P0

Payout Ratio * (1 g n )

PE =

EPS0

r-gn

If this had been a FCFE Model,

P0

FCFE1

r gn

P0

(FCFE/Earnings) * (1 gn )

PE =

EPS 0

r-gn

16

PE Ratio and Fundamentals

Proposition: Other things held equal, higher growth firms will

have higher PE ratios than lower growth firms.

Proposition: Other things held equal, higher risk firms will have

lower PE ratios than lower risk firms

Proposition: Other things held equal, firms with lower

reinvestment needs will have higher PE ratios than firms with

higher reinvestment rates.

Of course, other things are difficult to hold equal since high growth

firms, tend to have risk and high reinvestment rats.

17

Using the Fundamental Model to Estimate PE

For a High Growth Firm

The price-earnings ratio for a high growth firm can also be related to

fundamentals. In the special case of the two-stage dividend discount

model, this relationship can be made explicit fairly simply:

P0 =

(1+ g) n

EPS 0 * Payout Ratio *(1+ g) * 1

(1+ r) n

r-g

+

EPS 0 * Payout Ratio

n

*(1+ g) n *(1+ g n )

(r -g n )(1 + r)n

– For a firm that does not pay what it can afford to in dividends, substitute

FCFE/Earnings for the payout ratio.

Dividing both sides by the earnings per share:

(1 + g)n

Payout Ratio * (1 + g) * 1

(1+ r) n Payout Ratio n *(1+ g) n * (1 + gn )

P0

=

+

EPS 0

r -g

(r - g n )(1+ r) n

18

Expanding the Model

In this model, the PE ratio for a high growth firm is a function of

growth, risk and payout, exactly the same variables that it was a

function of for the stable growth firm.

The only difference is that these inputs have to be estimated for two

phases - the high growth phase and the stable growth phase.

Expanding to more than two phases, say the three stage model, will

mean that risk, growth and cash flow patterns in each stage.

19

A Simple Example

Assume that you have been asked to estimate the PE ratio for a firm

which has the following characteristics:

Variable

High Growth Phase

Stable Growth Phase

Expected Growth Rate

25%

8%

Payout Ratio

20%

50%

Beta

1.00

1.00

Number of years

5 years

Forever after year 5

Riskfree rate = T.Bond Rate = 6%

Required rate of return = 6% + 1(5.5%)= 11.5%

(1.25) 5

0.2 * (1.25) * 1

5

5

(1.115) 0.5 * (1.25) * (1.08)

PE =

+

= 28.75

(.115 - .25)

(.115 - .08) (1.115) 5

20

PE and Growth: Firm grows at x% for 5 years,

8% thereafter

PE Ratios and Expected Growth: Interest Rate Scenarios

180

160

140

PE Ratio

120

r=4%

r=6%

r=8%

r=10%

100

80

60

40

20

0

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Expected Grow th Rate

21

PE Ratios and Length of High Growth: 25%

growth for n years; 8% thereafter

22

PE and Risk: Effects of Changing Betas on PE

Ratio:

Firm with x% growth for 5 years; 8% thereafter

PE Ratios and Beta: Growth Scenarios

50

45

40

35

PE Ratio

30

g=25%

g=20%

g=15%

g=8%

25

20

15

10

5

0

0.75

1.00

1.25

1.50

1.75

2.00

Beta

23

PE and Payout

24

I. Assessing Emerging Market PE Ratios Early 2000

PE: Emerging Markets

35

30

25

20

15

10

5

0

Mexico

Malaysia

Singapore

Taiwan

Hong Kong

Venezuela

Brazil

Argentina

Chile

25

Comparisons across countries

In July 2000, a market strategist is making the argument that Brazil

and Venezuela are cheap relative to Chile, because they have much

lower PE ratios. Would you agree?

Yes

No

What are some of the factors that may cause one market’s PE ratios to

be lower than another market’s PE?

26

II. A Comparison across countries: June 2000

Country

UK

Germany

France

Switzerland

Belgium

Italy

Sweden

Netherlands

Australia

Japan

US

Canada

PE

22.02

26.33

29.04

19.6

14.74

28.23

32.39

21.1

21.69

52.25

25.14

26.14

Dividend Yield

2.59%

1.88%

1.34%

1.42%

2.66%

1.76%

1.11%

2.07%

3.12%

0.71%

1.10%

0.99%

2-yr rate

5.93%

5.06%

5.11%

3.62%

5.15%

5.27%

4.67%

5.10%

6.29%

0.58%

6.05%

5.70%

10-yr rate

5.85%

5.32%

5.48%

3.83%

5.70%

5.70%

5.26%

5.47%

6.25%

1.85%

5.85%

5.77%

10yr - 2yr

-0.08%

0.26%

0.37%

0.21%

0.55%

0.43%

0.59%

0.37%

-0.04%

1.27%

-0.20%

0.07%

27

Correlations and Regression of PE Ratios

Correlations

– Correlation between PE ratio and long term interest rates = -0.733

– Correlation between PE ratio and yield spread = 0.706

Regression Results

PE Ratio = 42.62 - 3.61 (10’yr rate) + 8.47 (10-yr - 2 yr rate)

R2 = 59%

Input the interest rates as percent. For instance, the predicted PE ratio for

Japan with this regression would be:

PE: Japan = 42.62 - 3.61 (1.85) + 8.47 (1.27) = 46.70

At an actual PE ratio of 52.25, Japanese stocks are slightly overvalued.

28

Predicted PE Ratios

Country

UK

Germany

France

Switzerland

Belgium

Italy

Sweden

Netherlands

Australia

Japan

United States

Canada

Actual PE

Predicted PE Under or Over Valued

22.02

20.83

5.71%

26.33

25.62

2.76%

29.04

25.98

11.80%

19.6

30.58

-35.90%

14.74

26.71

-44.81%

28.23

25.69

9.89%

32.39

28.63

13.12%

21.1

26.01

-18.88%

21.69

19.73

9.96%

52.25

46.70

11.89%

25.14

19.81

26.88%

26.14

22.39

16.75%

29

III. An Example with Emerging Markets: June

2000

Country

PE Ratio

Argentina

Brazil

Chile

Hong Kong

India

Indonesia

Malaysia

Mexico

Pakistan

Peru

Phillipines

Singapore

South Korea

Thailand

Turkey

Venezuela

14

21

25

20

17

15

14

19

14

15

15

24

21

21

12

20

Interest

Rates

18.00%

14.00%

9.50%

8.00%

11.48%

21.00%

5.67%

11.50%

19.00%

18.00%

17.00%

6.50%

10.00%

12.75%

25.00%

15.00%

GDP Real

Growth

2.50%

4.80%

5.50%

6.00%

4.20%

4.00%

3.00%

5.50%

3.00%

4.90%

3.80%

5.20%

4.80%

5.50%

2.00%

3.50%

Country

Risk

45

35

15

15

25

50

40

30

45

50

45

5

25

25

35

45

30

Regression Results

The regression of PE ratios on these variables provides the following –

PE = 16.16

- 7.94 Interest Rates

+ 154.40 Growth in GDP

- 0.1116 Country Risk

R Squared = 73%

31

Predicted PE Ratios

Country

PE Ratio

Argentina

Brazil

Chile

Hong Kong

India

Indonesia

Malaysia

Mexico

Pakistan

Peru

Phillipines

Singapore

South Korea

Thailand

Turkey

Venezuela

14

21

25

20

17

15

14

19

14

15

15

24

21

21

12

20

Interest

Rates

18.00%

14.00%

9.50%

8.00%

11.48%

21.00%

5.67%

11.50%

19.00%

18.00%

17.00%

6.50%

10.00%

12.75%

25.00%

15.00%

GDP Real

Growth

2.50%

4.80%

5.50%

6.00%

4.20%

4.00%

3.00%

5.50%

3.00%

4.90%

3.80%

5.20%

4.80%

5.50%

2.00%

3.50%

Country

Risk

45

35

15

15

25

50

40

30

45

50

45

5

25

25

35

45

Predicted PE

13.57

18.55

22.22

23.11

18.94

15.09

15.87

20.39

14.26

16.71

15.65

23.11

19.98

20.85

13.35

15.35

32

IV. Comparisons of PE across time: PE Ratio

for the S&P 500

PE Ratio for S&P 500: 1960-2004

35

30

25

PE Ratio

20

Average over period = 16.82

15

10

5

2004

2002

2000

1998

1996

1994

1992

1990

1988

1986

1984

1982

1980

1978

1976

1974

1972

1970

1968

1966

1964

1962

1960

0

33

Is low (high) PE cheap (expensive)?

A market strategist argues that stocks are over priced because the PE

ratio today is too high relative to the average PE ratio across time. Do

you agree?

Yes

No

If you do not agree, what factors might explain the higher PE ratio

today?

34

E/P Ratios , T.Bond Rates and Term Structure

EP Ratios and Interest Rates: S&P 500

16.00%

14.00%

12.00%

10.00%

8.00%

Earnings Yield

T.Bond Rate

Bond-Bill

6.00%

4.00%

2.00%

2004

2002

2000

1998

1996

1994

1992

1990

1988

1986

1984

1982

1980

1978

1976

1974

1972

1970

1968

1966

1964

1962

1960

0.00%

-2.00%

Year

35

Regression Results

There is a strong positive relationship between E/P ratios and T.Bond

rates, as evidenced by the correlation of 0.70 between the two

variables.,

In addition, there is evidence that the term structure also affects the PE

ratio.

In the following regression, using 1960-2004 data, we regress E/P

ratios against the level of T.Bond rates and a term structure variable

(T.Bond - T.Bill rate)

E/P = 2.07% + 0.746 T.Bond Rate - 0.323 (T.Bond Rate-T.Bill Rate)

(2.31)

(6.51)

(-1.28)

R squared = 51.11%

36

Estimate the E/P Ratio Today

T. Bond Rate =

T.Bond Rate - T.Bill Rate =

Expected E/P Ratio =

Expected PE Ratio =

37

V. Comparing PE ratios across firms

Company Name

Coca-Cola Bottling

Molson Inc. Ltd. 'A'

Anheuser-Busch

Corby Distilleries Ltd.

Chalone Wine Group Ltd.

Andres Wines Ltd. 'A'

Todhunter Int'l

Brown-Forman 'B'

Coors (Adolph) 'B'

PepsiCo, Inc.

Coca-Cola

Boston Beer 'A'

Whitman Corp.

Mondavi (Robert) 'A'

Coca-Cola Enterprises

Trailing PE

29.18

43.65

24.31

16.24

21.76

8.96

8.94

10.07

23.02

33.00

44.33

10.59

25.19

16.47

37.14

Expected Growth

9.50%

15.50%

11.00%

7.50%

14.00%

3.50%

3.00%

11.50%

10.00%

10.50%

19.00%

17.13%

11.50%

14.00%

27.00%

Standard Dev

20.58%

21.88%

22.92%

23.66%

24.08%

24.70%

25.74%

29.43%

29.52%

31.35%

35.51%

39.58%

44.26%

45.84%

51.34%

Hansen Natural Corp

9.70

17.00%

62.45%

38

A Question

You are reading an equity research report on this sector, and the analyst

claims that Andres Wine and Hansen Natural are under valued because

they have low PE ratios. Would you agree?

Yes

No

Why or why not?

39

VI. Comparing PE Ratios across a Sector

Comp any Name

PT Indosat ADR

Te lebras ADR

Te lecom Corporati on o f New Zeala nd ADR

Te lecom Argenti na Stet - France Telecom SA ADR B

Hell enic Te lecommu nicatio n Organ ization SA ADR

Te lecomun ica cio nes de Ch ile ADR

Swisscom AG ADR

Asia Sa tell ite Telecom Holdi ngs ADR

Portugal Tel eco m SA ADR

Te lefo nos de Me xico ADR L

Mata v RT ADR

Te lstra ADR

Gila t Comm unicati ons

Deutsche Telek om AG ADR

British Tel eco mmun ica tions PL C ADR

Te le Dan mark AS ADR

Te leko muni kasi Ind onesia ADR

Cab le & Wi reless PLC ADR

APT Satel lite Holdi ngs ADR

Te lefo nica SA ADR

Royal KPN NV ADR

Te lecom Italia SPA ADR

Nippon Teleg raph & Tel epho ne ADR

Fra nce Tel eco m SA ADR

Kore a Te lecom ADR

PE

7.8

8.9

11 .2

12 .5

12 .8

16 .6

18 .3

19 .6

20 .8

21 .1

21 .5

21 .7

22 .7

24 .6

25 .7

27

28 .4

29 .8

31

32 .5

35 .7

42 .2

44 .3

45 .2

71 .3

Growth

0.06

0.075

0.11

0.08

0.12

0.08

0.11

0.16

0.13

0.14

0.22

0.12

0.31

0.11

0.07

0.09

0.32

0.14

0.33

0.18

0.13

0.14

0.2

0.19

0.44

40

PE, Growth and Risk

Dependent variable is:

R squared = 66.2%

PE

R squared (adjusted) = 63.1%

Variable

Coefficient SE

t-ratio

Constant

13.1151

3.471

3.78

Growth rate

1.21223

19.27

6.29

Emerging Market

-13.8531

3.606

-3.84

Emerging Market is a dummy: 1 if emerging market

0 if not

prob

0.0010

≤ 0.0001

0.0009

41

Is Telebras under valued?

Predicted PE = 13.12 + 1.2122 (7.5) - 13.85 (1) = 8.35

At an actual price to earnings ratio of 8.9, Telebras is slightly

overvalued.

42

Using comparable firms- Pros and Cons

The most common approach to estimating the PE ratio for a firm is

– to choose a group of comparable firms,

– to calculate the average PE ratio for this group and

– to subjectively adjust this average for differences between the firm being

valued and the comparable firms.

Problems with this approach.

– The definition of a 'comparable' firm is essentially a subjective one.

– The use of other firms in the industry as the control group is often not a

solution because firms within the same industry can have very different

business mixes and risk and growth profiles.

– There is also plenty of potential for bias.

– Even when a legitimate group of comparable firms can be constructed,

differences will continue to persist in fundamentals between the firm

being valued and this group.

43

Using the entire crosssection: A regression

approach

In contrast to the 'comparable firm' approach, the information in the

entire cross-section of firms can be used to predict PE ratios.

The simplest way of summarizing this information is with a multiple

regression, with the PE ratio as the dependent variable, and proxies for

risk, growth and payout forming the independent variables.

44

PE versus Growth

300

200

100

Current PE

0

-100

Rsq = 0.1500

-20

0

20

40

60

80

100

Expected Growth in EPS: next 5 years

45

PE Ratio: Standard Regression for US stocks January 2005

Mod el Su mm a ry

Mo de l

1

R

R Sq ua re

.2 3 8

.48 7 a

Adju s te d R

Sq u ar e

.2 3 6

Std . Er ror of t he Es tim ate

14 9 8.8 25 10 65 0 57 86 00 0

a. Pr e d icto r s: ( Co nst a nt ), Pa yo ut Ra tio , 3 - yr Re g re s sion Be t a, Exp e ct ed Gr o wth in EPS:

n e xt 5 ye a rs

Co ef ficien t sa ,b

Un st a nd ard iz ed

Co ef ficie nt s

Mo de l

1

B

1 4. 78 1

Std . Er r or

.97 9

.91 4

.04 0

.22 0

.64 1

- 4 .8 9 2 E- 0 2

.01 5

(Con st ant )

Ex pe c t ed Gro wt h in

EPS: n ext 5 yea r s

3- yr Re g re ss io n Bet a

Payo ut Ra tio

St and a r dize d

C oe ffic ien ts

Be t a

9 5% Co n fide n ce Int e rva l f or

B

Lo wer

Upp er

Bo u n d

Bou n d

1 2. 86 1

1 6. 70 1

t

1 5. 09 9

Sig .

. 00 0

.47 0

2 3. 11 7

. 00 0

. 83 7

.99 2

.00 7

.34 3

. 73 2

- 1. 03 8

1.4 7 7

- .06 2

- 3 .16 5

. 00 2

- . 07 9

- .01 9

a . Dep en d e nt Va riable: Cur r ent PE

b . Weig ht ed Le a s t Squ a re s Regr ess io n - We ig hte d by Mar ke t Ca p

46

Problems with the regression methodology

The basic regression assumes a linear relationship between PE ratios

and the financial proxies, and that might not be appropriate.

The basic relationship between PE ratios and financial variables itself

might not be stable, and if it shifts from year to year, the predictions

from the model may not be reliable.

The independent variables are correlated with each other. For example,

high growth firms tend to have high risk. This multi-collinearity makes

the coefficients of the regressions unreliable and may explain the large

changes in these coefficients from period to period.

47

The Multicollinearity Problem

Co rre lat io ns

Ex pe c te d Gr owt h in

EPS: n e xt 5 ye a r s

3 - yr Re g r es sio n Be t a

Pa you t Ra tio

Pe a rs on Cor re la tion

Exp e c te d

Gr o wth in

EPS: n e x t 5

ye a r s

1

Sig . (2 - ta iled )

3- yr

Reg re s sion

Be ta

Pa yo ut Ra tio

.2 3 8**

- .19 1 **

.

.0 0 0

.00 0

N

25 0 9

25 0 9

2 08 7

Pe a rs on Cor re la tion

.2 3 8**

Sig . (2 - ta iled )

N

Pe a rs on Cor re la tion

1

- .08 4 **

.0 0 0

.

.00 0

25 0 9

70 2 4

3 97 9

- .1 91 **

- .0 84 **

1

Sig . (2 - ta iled )

.0 0 0

.0 0 0

.

N

20 8 7

39 7 9

3 97 9

**. Cor r e lat ion is s ig n ifica nt a t the 0 .0 1 leve l (2 - t a ile d ).

48

Using the PE ratio regression

Assume that you were given the following information for Dell. The

firm has an expected growth rate of 10%, a beta of 1.20 and pays no

dividends. Based upon the regression, estimate the predicted PE ratio

for Dell.

Predicted PE =

Dell is actually trading at 22 times earnings. What does the predicted

PE tell you?

49

The value of growth

Time Period

Value of extra 1% of growth

January 2005

0.914

January 2004

0.812

July 2003

1.228

January 2003

2.621

July 2002

0.859

January 2002

1.003

July 2001

1.251

January 2001

1.457

July 2000

1.761

January 2000

2.105

The value of growth is in terms of additional PE…

Equity Risk Premium

3.65%

3.69%

3.88%

4.10%

4.35%

3.62%

3.05%

2.75%

2.20%

2.05%

50

Fundamentals hold in every market: PE ratio

regression for Japan

Mod e l Su m m ary

Mo de l

1

R

R Sq u a re

.57 5

a

.33 0

Adjus t e d R

Sq ua r e

.32 5

Std . Er ro r o f th e

Es t im a te

1 91 9 8.6 0 01 5 6 50 85

a . Pr e d ict or s: ( Con st an t), Est im a te d Gr owt h in e a r nin gs pe r sh a r e,

BETA, Pa yo ut Ra tio

Co e f fic ie n t s a,b

Un s ta n da rd iz e d

Co e ffic ie n ts

Mo de l

1

B

(C on st a nt )

Pa yo ut Ra tio

BETA

Es t im a te d Gr o wth in

ea r n ing s p e r s ha r e

Sta n da r d iz e d

Coe f fic ie nt s

Std . Er r or

- 8.1 10

Be ta

t

4.2 0 7

Sig.

- 1.9 28

.0 5 5

.5 2 8

.0 6 4

.3 4 5

8.2 2 7

.0 0 0

14 .6 05

3.4 1 7

.1 7 7

4.2 7 4

.0 0 0

.7 9 9

.0 8 3

.3 9 9

9.6 5 8

.0 0 0

a . De p en d e nt Va ria ble : PE

b . Weig ht ed Le a s t Squ a re s Re gr e ss io n - We ig hte d by Ma r ke t Ca p ita liz a t io n

51

Investment Strategies that compare PE to the

expected growth rate

If we assume that all firms within a sector have similar growth rates

and risk, a strategy of picking the lowest PE ratio stock in each sector

will yield undervalued stocks.

Portfolio managers and analysts sometimes compare PE ratios to the

expected growth rate to identify under and overvalued stocks.

– In the simplest form of this approach, firms with PE ratios less than their

expected growth rate are viewed as undervalued.

– In its more general form, the ratio of PE ratio to growth is used as a

measure of relative value.

52

Problems with comparing PE ratios to

expected growth

In its simple form, there is no basis for believing that a firm is

undervalued just because it has a PE ratio less than expected growth.

This relationship may be consistent with a fairly valued or even an

overvalued firm, if interest rates are high, or if a firm is high risk.

As interest rate decrease (increase), fewer (more) stocks will emerge as

undervalued using this approach.

53

PE Ratio versus Growth - The Effect of Interest

rates:

Average Risk firm with 25% growth for 5 years; 8% thereafter

54

PE Ratios Less Than The Expected Growth

Rate

In January 2005,

– 32% of firms had PE ratios lower than the expected 5-year growth rate

– 68% of firms had PE ratios higher than the expected 5-year growth rate

In comparison,

– 38.1% of firms had PE ratios less than the expected 5-year growth rate in

September 1991

– 65.3% of firm had PE ratios less than the expected 5-year growth rate in

1981.

55

PEG Ratio: Definition

The PEG ratio is the ratio of price earnings to expected growth in

earnings per share.

PEG = PE / Expected Growth Rate in Earnings

Definitional tests:

– Is the growth rate used to compute the PEG ratio

on the same base? (base year EPS)

over the same period?(2 years, 5 years)

from the same source? (analyst projections, consensus estimates..)

– Is the earnings used to compute the PE ratio consistent with the growth

rate estimate?

No double counting: If the estimate of growth in earnings per share is from the

current year, it would be a mistake to use forward EPS in computing PE

If looking at foreign stocks or ADRs, is the earnings used for the PE ratio

consistent with the growth rate estimate? (US analysts use the ADR EPS)

56

PEG Ratio: Distribution

PEG Ratio: US Companies in January 2005

300

250

200

150

100

50

0

<0.5

0.50.75

0.75-1

1-1.25

1.251.5

1.51.75

1.75-2

2-2.25

2.252.5

2.52.75

2.75-3

3-3.35

3.5-4

4-4.5

4.5-5

5-10

>10

57

PEG Ratios: The Beverage Sector

Company Name

Coca-Cola Bottling

Molson Inc. Ltd. 'A'

Anheuser-Busch

Corby Distilleries Ltd.

Chalone Wine Group Ltd.

Andres Wines Ltd. 'A'

Todhunter Int'l

Brown-Forman 'B'

Coors (Adolph) 'B'

PepsiCo, Inc.

Coca-Cola

Boston Beer 'A'

Whitman Corp.

Mondavi (Robert) 'A'

Coca-Cola Enterprises

Hansen Natural Corp

Average

Trailing PE

29.18

43.65

24.31

16.24

21.76

8.96

8.94

10.07

23.02

33.00

44.33

10.59

25.19

16.47

37.14

9.70

22.66

Growth

9.50%

15.50%

11.00%

7.50%

14.00%

3.50%

3.00%

11.50%

10.00%

10.50%

19.00%

17.13%

11.50%

14.00%

27.00%

17.00%

Std Dev

20.58%

21.88%

22.92%

23.66%

24.08%

24.70%

25.74%

29.43%

29.52%

31.35%

35.51%

39.58%

44.26%

45.84%

51.34%

62.45%

PEG

3.07

2.82

2.21

2.16

1.55

2.56

2.98

0.88

2.30

3.14

2.33

0.62

2.19

1.18

1.38

0.57

0.13

0.33

2.00

58

PEG Ratio: Reading the Numbers

The average PEG ratio for the beverage sector is 2.00. The lowest PEG

ratio in the group belongs to Hansen Natural, which has a PEG ratio of

0.57. Using this measure of value, Hansen Natural is

the most under valued stock in the group

the most over valued stock in the group

What other explanation could there be for Hansen’s low PEG ratio?

59

PEG Ratio: Analysis

To understand the fundamentals that determine PEG ratios, let us

return again to a 2-stage equity discounted cash flow model

P0 =

(1+ g) n

EPS 0 * Payout Ratio *(1+ g) * 1

(1+ r) n

r-g

+

EPS 0 * Payout Ratio

n

*(1+ g) n *(1+ g n )

(r -g n )(1 + r)n

Dividing both sides of the equation by the earnings gives us the

equation for the PE ratio. Dividing it again by the expected growth ‘g’

PEG =

(1+ g) n

Payout Ratio *(1 + g) * 1

(1 + r) n

g(r - g)

+

Payout Ratio n * (1+ g) n * (1+ g n )

g(r - gn )(1 + r)n

60

PEG Ratios and Fundamentals

Risk and payout, which affect PE ratios, continue to affect PEG ratios

as well.

– Implication: When comparing PEG ratios across companies, we are

making implicit or explicit assumptions about these variables.

Dividing PE by expected growth does not neutralize the effects of

expected growth, since the relationship between growth and value is

not linear and fairly complex (even in a 2-stage model)

61

A Simple Example

Assume that you have been asked to estimate the PEG ratio for a firm

which has the following characteristics:

Variable

High Growth Phase

Stable Growth Phase

Expected Growth Rate 25%

8%

Payout Ratio

20%

50%

Beta

1.00

1.00

Riskfree rate = T.Bond Rate = 6%

Required rate of return = 6% + 1(5.5%)= 11.5%

The PEG ratio for this firm can be estimated as follows:

(1.25) 5

0.2 * (1.25) * 1

5

0.5 * (1.25) 5 * (1.08)

(1.115)

PEG =

+

= 115 or 1.15

.25(.115 - .25)

.25(.115 - .08) (1.115) 5

62

PEG Ratios and Risk

63

PEG Ratios and Quality of Growth

64

PE Ratios and Expected Growth

65

PEG Ratios and Fundamentals: Propositions

Proposition 1: High risk companies will trade at much lower PEG

ratios than low risk companies with the same expected growth rate.

– Corollary 1: The company that looks most under valued on a PEG ratio

basis in a sector may be the riskiest firm in the sector

Proposition 2: Companies that can attain growth more efficiently by

investing less in better return projects will have higher PEG ratios than

companies that grow at the same rate less efficiently.

– Corollary 2: Companies that look cheap on a PEG ratio basis may be

companies with high reinvestment rates and poor project returns.

Proposition 3: Companies with very low or very high growth rates will

tend to have higher PEG ratios than firms with average growth rates.

This bias is worse for low growth stocks.

– Corollary 3: PEG ratios do not neutralize the growth effect.

66

PE, PEG Ratios and Risk

45

2.5

40

2

35

30

1.5

25

PE

PEG Ratio

20

1

15

10

0.5

5

0

0

Lowest

2

3

4

Highest

67

PEG Ratio: Returning to the Beverage Sector

Company Name

Coca-Cola Bottling

Molson Inc. Ltd. 'A'

Anheuser-Busch

Corby Distilleries Ltd.

Chalone Wine Group Ltd.

Andres Wines Ltd. 'A'

Todhunter Int'l

Brown-Forman 'B'

Coors (Adolph) 'B'

PepsiCo, Inc.

Coca-Cola

Boston Beer 'A'

Whitman Corp.

Mondavi (Robert) 'A'

Coca-Cola Enterprises

Hansen Natural Corp

Trailing PE

29.18

43.65

24.31

16.24

21.76

8.96

8.94

10.07

23.02

33.00

44.33

10.59

25.19

16.47

37.14

9.70

Growth

9.50%

15.50%

11.00%

7.50%

14.00%

3.50%

3.00%

11.50%

10.00%

10.50%

19.00%

17.13%

11.50%

14.00%

27.00%

17.00%

Std Dev

20.58%

21.88%

22.92%

23.66%

24.08%

24.70%

25.74%

29.43%

29.52%

31.35%

35.51%

39.58%

44.26%

45.84%

51.34%

62.45%

PEG

3.07

2.82

2.21

2.16

1.55

2.56

2.98

0.88

2.30

3.14

2.33

0.62

2.19

1.18

1.38

0.57

Average

22.66

0.13

0.33

2.00

68

Analyzing PE/Growth

Given that the PEG ratio is still determined by the expected growth

rates, risk and cash flow patterns, it is necessary that we control for

differences in these variables.

Regressing PEG against risk and a measure of the growth dispersion,

we get:

PEG = 3.61 -.0286 (Expected Growth) - .0375 (Std Deviation in Prices)

R Squared = 44.75%

In other words,

– PEG ratios will be lower for high growth companies

– PEG ratios will be lower for high risk companies

We also ran the regression using the deviation of the actual growth rate

from the industry-average growth rate as the independent variable,

with mixed results.

69

Estimating the PEG Ratio for Hansen

Applying this regression to Hansen, the predicted PEG ratio for the

firm can be estimated using Hansen’s measures for the independent

variables:

– Expected Growth Rate = 17.00%

– Standard Deviation in Stock Prices = 62.45%

Plugging in,

Expected PEG Ratio for Hansen = 3.61 - .0286 (17) - .0375 (62.45)

= 0.78

With its actual PEG ratio of 0.57, Hansen looks undervalued,

notwithstanding its high risk.

70

Extending the Comparables

This analysis, which is restricted to firms in the software sector, can be

expanded to include all firms in the firm, as long as we control for

differences in risk, growth and payout.

To look at the cross sectional relationship, we first plotted PEG ratios

against expected growth rates.

71

PEG versus Growth

100

80

60

40

PEG Ratio

20

0

-20

-20

0

20

40

60

80

100

Expected Growth in EPS: next 5 years

72

Analyzing the Relationship

The relationship in not linear. In fact, the smallest firms seem to have

the highest PEG ratios and PEG ratios become relatively stable at

higher growth rates.

To make the relationship more linear, we converted the expected

growth rates in ln(expected growth rate). The relationship between

PEG ratios and ln(expected growth rate) was then plotted.

73

PEG versus ln(Expected Growth)

100

80

60

40

PEG Ratio

20

0

-20

-1

0

1

2

3

4

5

LNGROWTH

74

PEG Ratio Regression - US stocks

Mod e l Summ a ry

Mo de l

1

R

Ad jus te d R

Squ a r e

R Sq u a re

.55 7

a

.31 1

.31 0

Std . Err or o f t he

Est im a te

2 13 .1 59 6 8 22 4 16 6

a . Pr e d ict or s: ( Con sta n t), ln (Ex pe c te d Growt h), 3 - yr R e gre s s io n Be t a,

Pa you t Ra tio

Co ef ficien t sa ,b

Un st a nd ard iz ed

Co ef ficie nt s

Mo de l

1

B

(Con st ant )

Std . Er r or

Be t a

t

8.5 3 0

.26 0

.73 0

.09 0

.15 4

- 8 .3 3 8 E- 0 4

.00 2

- 2.72 7

.09 2

3- yr Re g re ss io n Bet a

Payo ut Ra tio

St and a r dize d

C oe ffic ien ts

ln (Ex pec t ed Gro wth )

Sig .

9 5% Co n fide n ce Int e rva l f or

B

Lo wer

Upp er

Bo u n d

Bou n d

3 2. 86 4

. 00 0

8. 0 2 1

8 .1 5 4

. 00 0

. 55 4

9.0 3 9

- .00 7

- .36 6

. 71 4

- . 00 5

.00 4

- .57 6

- 29 .57 1

. 00 0

- 2. 90 8

- 2.54 6

.90 6

a . Dep en d e nt Va riable: PEG Ra t io

b . Weig ht ed Le a s t Squ a re s Regr ess io n - We ig hte d by Mar ke t Ca p

75

Applying the PEG ratio regression

Consider Dell again. The stock has an expected growth rate of 10%, a

beta of 1.20 and pays out no dividends. What should its PEG ratio be?

If the stock’s actual PE ratio is 22, what does this analysis tell you

about the stock?

76

A Variant on PEG Ratio: The PEGY ratio

The PEG ratio is biased against low growth firms because the

relationship between value and growth is non-linear. One variant that

has been devised to consolidate the growth rate and the expected

dividend yield:

PEGY = PE / (Expected Growth Rate + Dividend Yield)

As an example, Con Ed has a PE ratio of 16, an expected growth rate

of 5% in earnings and a dividend yield of 4.5%.

– PEG = 16/ 5 = 3.2

– PEGY = 16/(5+4.5) = 1.7

77

Relative PE: Definition

The relative PE ratio of a firm is the ratio of the PE of the firm to the

PE of the market.

Relative PE = PE of Firm / PE of Market

While the PE can be defined in terms of current earnings, trailing

earnings or forward earnings, consistency requires that it be estimated

using the same measure of earnings for both the firm and the market.

Relative PE ratios are usually compared over time. Thus, a firm or

sector which has historically traded at half the market PE (Relative PE

= 0.5) is considered over valued if it is trading at a relative PE of 0.7.

Relative PE ratios are also used when comparing companies across

markets with different PE ratios (Japanese versus US stocks, for

example).

78

Relative PE: Determinants

To analyze the determinants of the relative PE ratios, let us revisit the

discounted cash flow model we developed for the PE ratio. Using the 2-stage

DDM model as our basis (replacing the payout ratio with the FCFE/Earnings

Ratio, if necessary), we get

(1+ g j )n

Payout Ratio j *(1 + g j ) * 1

n

(1+ rj )

Relative PE j =

rj - g j

(1+ g m ) n

Payout Ratio m * (1+ g m )* 1

n

(1+ rm )

rm - gm

where

+

+

Payout Ratio

n

j,n

*(1 + g j ) *(1 + g j,n )

n

(rj - g j,n )(1 + rj )

Payout Ratio

m, n

* (1+ g m )n *(1 + gm, n )

n

(rm - gm, n )(1 + rm )

Payoutj, gj, rj = Payout, growth and risk of the firm

Payoutm, gm, rm = Payout, growth and risk of the market

79

Relative PE: A Simple Example

Consider the following example of a firm growing at twice the rate as

the market, while having the same growth and risk characteristics of

the market:

Firm

Market

Expected growth rate

20%

10%

Length of Growth Period 5 years

5 years

Payout Ratio: first 5 yrs 30%

30%

Growth Rate after yr 5

6%

6%

Payout Ratio after yr 5

50%

50%

Beta

1.00

1.00

Riskfree Rate = 6%

80

Estimating Relative PE

The relative PE ratio for this firm can be estimated in two steps. First,

we compute the PE ratio for the firm and the market separately:

PE fi rm

PE market

(1.20) 5

0.3 * (1.20) * 1

(1.115) 5 0.5 * (1.20)5 * (1.06)

=

+

= 15.79

(.115 - .20)

(.115 -.06) (1.115) 5

(1.10)5

0.3 * (1.10) * 1

(1.115)5 0.5 * (1.10) 5 *(1.06)

=

+

= 10.45

(.115 - .10)

(.115-.06) (1.115) 5

Relative PE Ratio = 15.79/10.45 = 1.51

81

Relative PE and Relative Growth

82

Relative PE: Another Example

In this example, consider a firm with twice the risk as the market,

while having the same growth and payout characteristics as the firm:

Firm

Market

Expected growth rate

10%

10%

Length of Growth Period

5 years

5 years

Payout Ratio: first 5 yrs

30%

30%

Growth Rate after yr 5

6%

6%

Payout Ratio after yr 5

50%

50%

Beta in first 5 years

2.00

1.00

Beta after year 5

1.00

1.00

Riskfree Rate = 6%

83

Estimating Relative PE

The relative PE ratio for this firm can be estimated in two steps. First,

we compute the PE ratio for the firm and the market separately:

PE fi rm

PE market

(1.10) 5

0.3 * (1.10) * 1

(1.17) 5 0.5 * (1.10)5 * (1.06)

=

+

= 8.33

(.17 - .10)

(.115- .06) (1.17) 5

(1.10)5

0.3 * (1.10) * 1

(1.115)5 0.5 * (1.10) 5 *(1.06)

=

+

= 10.45

(.115 - .10)

(.115-.06) (1.115) 5

Relative PE Ratio = 8.33/10.45 = 0.80

84

Relative PE and Relative Risk

Relative PE and Relative Risk: Stable Beta Scenarios

4.5

4

3.5

3

2.5

Beta stays at current level

Beta drops to 1 in stable phase

2

1.5

1

0.5

0

0.25

0.5

0.75

1

1.25

1.5

1.75

2

85

Relative PE: Summary of Determinants

The relative PE ratio of a firm is determined by two variables. In

particular, it will

– increase as the firm’s growth rate relative to the market increases. The rate

of change in the relative PE will itself be a function of the market growth

rate, with much greater changes when the market growth rate is higher. In

other words, a firm or sector with a growth rate twice that of the market

will have a much higher relative PE when the market growth rate is 10%

than when it is 5%.

– decrease as the firm’s risk relative to the market increases. The extent of

the decrease depends upon how long the firm is expected to stay at this

level of relative risk. If the different is permanent, the effect is much

greater.

Relative PE ratios seem to be unaffected by the level of rates, which

might give them a decided advantage over PE ratios.

86

Relative PE Ratios: The Auto Sector

Relative PE Ratios: Auto Stocks

1.20

1.00

0.80

Ford

Chrysler

GM

0.60

0.40

0.20

0.00

1993

1994

1995

1996

1997

1998

1999

2000

87

Using Relative PE ratios

On a relative PE basis, all of the automobile stocks looked cheap in

2000 because they were trading at their lowest relative PE ratios than

1993. Why might the relative PE ratio be lower in 2000 than in 1993?

88

Relative PE Ratios: US stocks

Mode l Su m m ary

Mo de l

1

R

R Sq u a re

.25 2

.50 2 a

Ad jus t ed R

Sq ua r e

.25 1

St d. Er ro r o f

th e Es t im at e

4 9. 22 83 8

a. Pr ed ict or s: ( Con st an t), 3 - yr Re gr e ss io n Be t a , Relative Gr o wt h

Co e f fici e n ts a,b

Uns t and ar d iz ed

Coef ficie nt s

Mo de l

1

B

. 39 2

Std . Er ro r

.02 5

. 52 2

.02 1

1 . 5 12 E- 0 2

.02 1

(Co n st ant )

Relat ive Gr o wth

3 - yr Reg res sio n Bet a

St a nd ar dize d

Co e fficien ts

Be t a

t

1 5. 84 5

Sig .

. 00 0

.49 7

2 4. 99 4

. 00 0

.01 4

.72 1

. 47 1

a . Depe n d e nt Va riable : Rela tive P E

b . Weig ht ed Le as t Squ a re s Re gre ss ion - We ig hte d by Mar ke t Cap

89

Value/Earnings and Value/Cashflow Ratios

While Price earnings ratios look at the market value of equity relative

to earnings to equity investors, Value earnings ratios look at the market

value of the operating assets of the firm (Enterprise value or EV)

relative to operating earnings or cash flows.

The form of value to cash flow ratios that has the closest parallels in

DCF valuation is the value to Free Cash Flow to the Firm, which is

defined as:

EV/FCFF =

(Market Value of Equity + Market Value of Debt-Cash)

EBIT (1-t) - (Cap Ex - Deprecn) - Chg in Working Cap

90

Value of Firm/FCFF: Determinants

V =

0

Reverting back to a two-stage FCFF DCF model, we get:

n

(1 + g)

FCFF (1 + g) 1

0

n

(1+ WACC)

–

–

–

–

–

FCFF (1+ g) n (1+ g )

0

n

+

WACC - g

(WACC - g )(1 + WACC)n

n

V0 = Value of the firm (today)

FCFF0 = Free Cashflow to the firm in current year

g = Expected growth rate in FCFF in extraordinary growth period (first

n years)

WACC = Weighted average cost of capital

gn = Expected growth rate in FCFF in stable growth period (after n

years)

91

Value Multiples

Dividing both sides by the FCFF yields,

n

(1

+

g)

(1 + g) 1n

(1 + WACC)

V0

(1+ g) n (1+ gn )

=

+

FCFF0

WACC - g

(WACC - gn )(1 + WACC)n

The value/FCFF multiples is a function of

– the cost of capital

– the expected growth

92

Alternatives to FCFF - EBIT and EBITDA

Most analysts find FCFF to complex or messy to use in multiples

(partly because capital expenditures and working capital have to be

estimated). They use modified versions of the multiple with the

following alternative denominator:

– after-tax operating income or EBIT(1-t)

– pre-tax operating income or EBIT

– net operating income (NOI), a slightly modified version of operating

income, where any non-operating expenses and income is removed from

the EBIT

– EBITDA, which is earnings before interest, taxes, depreciation and

amortization.

93

Value/FCFF Multiples and the Alternatives

Assume that you have computed the value of a firm, using discounted

cash flow models. Rank the following multiples in the order of

magnitude from lowest to highest?

Value/EBIT

Value/EBIT(1-t)

Value/FCFF

Value/EBITDA

What assumption(s) would you need to make for the Value/EBIT(1-t)

ratio to be equal to the Value/FCFF multiple?

94

Illustration: Using Value/FCFF Approaches to

value a firm: MCI Communications

MCI Communications had earnings before interest and taxes of $3356

million in 1994 (Its net income after taxes was $855 million).

It had capital expenditures of $2500 million in 1994 and depreciation

of $1100 million; Working capital increased by $250 million.

It expects free cashflows to the firm to grow 15% a year for the next

five years and 5% a year after that.

The cost of capital is 10.50% for the next five years and 10% after that.

The company faces a tax rate of 36%.

V0

=

FCFF0

5

(1.15)

(1.15) 1(1.105)5

.105 -.15

5

(1.15) (1.05)

= 31.28

+

5

(.10 - .05)(1.105)

95

Multiple Magic

In this case of MCI there is a big difference between the FCFF and

short cut measures. For instance the following table illustrates the

appropriate multiple using short cut measures, and the amount you

would overpay by if you used the FCFF multiple.

Free Cash Flow to the Firm

= EBIT (1-t) - Net Cap Ex - Change in Working Capital

= 3356 (1 - 0.36) + 1100 - 2500 - 250 = $ 498 million

$ Value

Correct Multiple

FCFF

$498

31.28382355

EBIT (1-t)

$2,148

7.251163362

EBIT

$ 3,356

4.640744552

EBITDA

$4,456

3.49513885

96

Reasons for Increased Use of Value/EBITDA

1. The multiple can be computed even for firms that are reporting net losses, since

earnings before interest, taxes and depreciation are usually positive.

2. For firms in certain industries, such as cellular, which require a substantial

investment in infrastructure and long gestation periods, this multiple seems to

be more appropriate than the price/earnings ratio.

3. In leveraged buyouts, where the key factor is cash generated by the firm prior to

all discretionary expenditures, the EBITDA is the measure of cash flows from

operations that can be used to support debt payment at least in the short term.

4. By looking at cashflows prior to capital expenditures, it may provide a better

estimate of “optimal value”, especially if the capital expenditures are unwise

or earn substandard returns.

5. By looking at the value of the firm and cashflows to the firm it allows for

comparisons across firms with different financial leverage.

97

Enterprise Value/EBITDA Multiple

The Classic Definition

Value

Market Value of Equity + Market Value of Debt

EBITDA

Earnings before Interest, Taxes and Depreciation

The No-Cash Version

Enterprise Value

Market Value of Equity + Market Value of Debt - Cash

EBITDA

Earnings before Interest, Taxes and Depreciation

98

Enterprise Value/EBITDA Distribution - US

EV Multiples: US firms in January 2005

800

About 1500 firms trade at less

than 7 times EBITDA

700

600

Number of firms

500

400

EV/EBITDA

EV/EBIT

300

200

100

0

<2

2-4

4-6

6-8

8-10 10-12 12-16 16-20 20-25 25-30 30-35 35-40 40-45 45-50 50-75

75100

>100

EV Multiple

99

Value/EBITDA Multiple: Europe, Japan and

Emerging Markets in January 2005

EV/EBITDA: Market Comparison

25.00%

% of Firms in Market

20.00%

15.00%

US

Emerging Markets

Europe

10.00%

Japan

5.00%

0.00%

<2

2-4

4-6

6-8

8-10

1012

1216

1620- 25-30 30-35 35-40 40-45 45-50 50-75

20

25

EV/EBITDA

75100

>100

100

The Determinants of Value/EBITDA Multiples:

Linkage to DCF Valuation

The value of the operating assets of a firm can be written as:

FCFF1

V0 =

WACC - g

The numerator can be written as follows:

FCFF

= EBIT (1-t) - (Cex - Depr) - Working Capital

= (EBITDA - Depr) (1-t) - (Cex - Depr) - Working Capital

= EBITDA (1-t) + Depr (t) - Cex - Working Capital

101

From Firm Value to EBITDA Multiples

Now the Value of the firm can be rewritten as,

Value =

EBITDA (1 - t) + Depr (t) - Cex - Working Capital

WACC - g

Dividing both sides of the equation by EBITDA,

Value

(1- t)

Depr (t)/EBITDA

CEx/EBITDA

Working Capital/EBITDA

=

+

EBITDA

WACC- g

WACC -g

WACC - g

WACC - g

102

A Simple Example

Consider a firm with the following characteristics:

–

–

–

–

–

–

Tax Rate = 36%

Capital Expenditures/EBITDA = 30%

Depreciation/EBITDA = 20%

Cost of Capital = 10%

The firm has no working capital requirements

The firm is in stable growth and is expected to grow 5% a year forever.

103

Calculating Value/EBITDA Multiple

Value

EBITDA

In this case, the Value/EBITDA multiple for this firm can be estimated

as follows:

=

(1- .36)

.10 -.05

+

(0.2)(.36)

0.3

0

= 8.24

.10 -.05

.10 - .05

.10 - .05

104

Value/EBITDA Multiples and Taxes

105

Value/EBITDA and Net Cap Ex

106

Value/EBITDA Multiples and Return on Capital

107

Value/EBITDA Multiple: Trucking Companies

Company Name

KLLM Trans. Svcs.

Ryder System

Rollins Truck Leasing

Cannon Express Inc.

Hunt (J.B.)

Yellow Corp.

Roadway Express

Marten Transport Ltd.

Kenan Transport Co.

M.S. Carriers

Old Dominion Freight

Trimac Ltd

Matlack Systems

XTRA Corp.

Covenant Transport Inc

Builders Transport

Werner Enterprises

Landstar Sys.

AMERCO

USA Truck

Frozen Food Express

Arnold Inds.

Greyhound Lines Inc.

USFreightways

Golden Eagle Group Inc.

Arkansas Best

Airlease Ltd.

Celadon Group

Amer. Freightways

Transfinancial Holdings

Vitran Corp. 'A '

Interpool Inc.

Intrenet Inc.

Swift Transportation

Landair Services

CNF Transportation

Budget Group Inc

Caliber System

Knight Transportation Inc

Heartland Express

Greyhound CDA Transn Corp

Mark VII

Coach USA Inc

US 1 Inds Inc.

Average

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Value

114.32

5,158.04

1,368.35

83.57

982.67

931.47

554.96

116.93

67.66

344.93

170.42

661.18

112.42

1,708.57

259.16

221.09

844.39

422.79

1,632.30

141.77

164.17

472.27

437.71

983.86

12.50

578.78

73.64

182.30

716.15

56.92

140.68

1,002.20

70.23

835.58

212.95

2,700.69

1,247.30

2,514.99

269.01

727.50

83.25

160.45

678.38

5.60

EBITDA

$

48.81

$ 1,838.26

$ 447.67

$

27.05

$ 310.22

$ 292.82

$ 169.38

$

35.62

$

19.44

$

97.85

$

45.13

$ 174.28

$

28.94

$ 427.30

$

64.35

$

51.44

$ 196.15

$

95.20

$ 345.78

$

29.93

$

34.10

$

96.88

$

89.61

$ 198.91

$

2.33

$ 107.15

$

13.48

$

32.72

$ 120.94

$

8.79

$

21.51

$ 151.18

$

10.38

$ 121.34

$

30.38

$ 366.99

$ 166.71

$ 333.13

$

28.20

$

64.62

$

6.99

$

12.96

$

51.76

$

(0.17)

Value/EBITDA

2.34

2.81

3.06

3.09

3.17

3.18

3.28

3.28

3.48

3.53

3.78

3.79

3.88

4.00

4.03

4.30

4.30

4.44

4.72

4.74

4.81

4.87

4.88

4.95

5.37

5.40

5.46

5.57

5.92

6.47

6.54

6.63

6.77

6.89

7.01

7.36

7.48

7.55

9.54

11.26

11.91

12.38

13.11

NA

5.61

108

A Test on EBITDA

Ryder System looks very cheap on a Value/EBITDA multiple basis,

relative to the rest of the sector. What explanation (other than

misvaluation) might there be for this difference?

109

Analyzing the Value/EBITDA Multiple

While low value/EBITDA multiples may be a symptom of

undervaluation, a few questions need to be answered:

– Is the operating income next year expected to be significantly lower than

the EBITDA for the most recent period? (Price may have dropped)

– Does the firm have significant capital expenditures coming up? (In the

trucking business, the life of the trucking fleet would be a good indicator)

– Does the firm have a much higher cost of capital than other firms in the

sector?

– Does the firm face a much higher tax rate than other firms in the sector?

110

Value/EBITDA Multiples: Market

The multiple of value to EBITDA varies widely across firms in the

market, depending upon:

– how capital intensive the firm is (high capital intensity firms will tend to

have lower value/EBITDA ratios), and how much reinvestment is needed

to keep the business going and create growth

– how high or low the cost of capital is (higher costs of capital will lead to

lower Value/EBITDA multiples)

– how high or low expected growth is in the sector (high growth sectors will

tend to have higher Value/EBITDA multiples)

111

US Market: Cross Sectional Regression

January 2005

Mod el Su mm ary

Mo de l

1

R

Adjus t ed R

Sq ua re

R Sq u are

.61 8

a

.38 2

.38 0

St d. Erro r o f th e

Es t ima te

8 00 .0 39 5 02 10 11 83 0 00

a. Pr ed ict or s: (Con st an t), Ma rk e t De bt t o Ca p it al, Eff Ta x Rat e,

Re in ve st m e nt Ra te , Ex pect ed Gro wt h in Reve n ue s : n e xt 5 ye a rs

Co ef fici ents a,b

Un s tan da rd ize d

Co efficie n ts

Mo de l

1

Stan dar d iz e d

Coe f fic ie nt s

B

8.5 5 4

Std . Er r or

.8 4 3

1.0 1 6

.0 4 5

- .1 50

.0 2 0

Reinves tmen t Ra te

- 1.88 4 E- 02

.0 0 5

Mar ket Deb t t o Cap it al

- 6.64 2 E- 02

.0 1 5

(Co n st ant )

Ex pec t ed Gro wt h in

Reven ue s: ne xt 5 ye ar s

Ef f T ax Rat e

Be ta

9 5 % Con fid en ce In terval fo r

B

Lo wer

Upp er

Bou nd

Bou nd

6.9 0 1

10 .2 07

t

10 .1 52

Sig.

.0 0 0

.5 5 2

22 .6 99

.0 0 0

.9 2 8

1.1 0 4

- .1 64

- 7.5 03

.0 0 0

- .1 90

- .1 11

- .0 79

- 3.5 32

.0 0 0

- .0 29

- .0 08

- .1 08

- 4.4 14

.0 0 0

- .0 96

- .0 37

a . Dep en d e nt Va ria ble: EV/ EBITDA

b . Weig ht ed Le a s t Squ a re s Regr ess ion - We ig hte d by Mar ke t Ca p

112

Europe: Cross Sectional Regression

January 2005

Mod e l Su m m ary

Mo de l

1

R

Adju st e d R

Sq ua re

R Sq ua re

.55 1

a

.3 0 4

St d. Er ro r of th e Estim a t e

.3 0 3

16 1 8 .3 93 59 42 0 0 67 9 00 0

a. Pr e d ic to r s: (Co nst a nt ), Ma rk e t De bt to C ap ita l, Rein ve st m e nt Ra te ,

TAX_RATE

Co e f fic ie n t s a,b

Uns t a nd ar d iz e d

Coe f fic ie nt s

Mo de l

1

(C on st a nt )

TAX_RATE

Re inve s tme n t Ra te

St a nd a r diz e d

C oe ffic ie n ts

B

1 6. 79 7

Std . Er ro r

1.0 6 6

Be t a

t

1 5. 75 5

Sig .

.00 0

- .35 6

.02 7

- .20 7

- 13 .14 7

.00 0

6 .0 93 E- 0 4

.00 1

.01 7

1 .1 06

.26 9

.51 8

.01 7

.49 0

3 1. 22 3

.00 0

Ma r ke t De b t t o Ca p it a l

a . De p en d e nt Va ria ble : EV/ EBITDA

b . Weig ht ed Le a s t Squ a re s Re gr e ss io n - We ig hte d by Mar ke t Ca p ita liz a t io n

113

Price-Book Value Ratio: Definition

The price/book value ratio is the ratio of the market value of equity to

the book value of equity, i.e., the measure of shareholders’ equity in the

balance sheet.

Price/Book Value =

Market Value of Equity

Book Value of Equity

Consistency Tests:

– If the market value of equity refers to the market value of equity of

common stock outstanding, the book value of common equity should be

used in the denominator.

– If there is more that one class of common stock outstanding, the market

values of all classes (even the non-traded classes) needs to be factored in.

114

Book Value Multiples: US stocks

Book Value Multiples: US companies in January 2005

800

700

600

500

Price/BV of Equity

400

Value/ BV of Capital

EV/Invested Capital

300

200

100

0

<0.25 0.25- 0.5- 0.75- 1- 1.25- 1.5- 1.75- 2- 2.25- 2.5- 2.75- 3- 3.5-4 4-4.5 4.5-5

0.5 0.75

1

1.25 1.5 1.75

2

2.25 2.5 2.75

3

3.35

5-10

>10

115

Price to Book: Europe, Japan and Emerging

Markets

Price to Book Equity: Market Comparison

18.00%

16.00%

14.00%

% of Firms in Market

12.00%

10.00%

US

Emerging Markets

8.00%

Europe

Japan

6.00%

4.00%

2.00%

0.00%

<0.25 0.25- 0.5- 0.75- 1- 1.25- 1.5- 1.75- 2- 2.25- 2.5- 2.75- 3- 3.5-4 4-4.5 4.5-5 5-10

0.5 0.75

1 1.25 1.5 1.75

2

2.25 2.5 2.75

3 3.35

P/BV

>10

116

Price Book Value Ratio: Stable Growth Firm

Going back to a simple dividend discount model,

P0

DPS1

r gn

Defining the return on equity (ROE) = EPS0 / Book Value of Equity, the value

of equity can be written as:

P0

BV0 * ROE * Payout Ratio * (1 gn )

r-gn

P0

ROE * Payout Ratio * (1 g n )

PBV =

BV 0

r-g

n

If the return on equity is based upon expected earnings in the next time period,

this can be simplified to,

P0

ROE * Payout Ratio

PBV =

BV 0

r-g

n

117

Price Book Value Ratio: Stable Growth Firm

Another Presentation

This formulation can be simplified even further by relating growth to

the return on equity:

g = (1 - Payout ratio) * ROE

Substituting back into the P/BV equation,

P0

ROE - gn

PBV =

BV0

r-gn

The price-book value ratio of a stable firm is determined by the

differential between

the return on equity and the required rate of return

on its projects.

118

Price Book Value Ratio for High Growth Firm

The Price-book ratio for a high-growth firm can be estimated

beginning with a 2-stage discounted cash flow model:

(1+ g)n

EPS 0 * Payout Ratio * (1 + g) * 1

(1+ r) n EPS 0 * Payout Ratio n * (1+ g)n *(1+ g n )

P0 =

+

r -g

(r - g n )(1+ r) n

Dividing both sides of the equation by the book value of equity:

n

(1+ g)

ROE * Payout Ratio *(1+ g) * 1

(1+ r) n

P0

ROE n * Payout Ratio n *(1+ g) n *(1+ g n )

=

+

BV0

r-g

(r - gn )(1 + r)n

where

ROE = Return on Equity in high-growth period

ROEn = Return on Equity in stable growth period

119

PBV Ratio for High Growth Firm: Example

Assume that you have been asked to estimate the PBV ratio for a firm

which has the following characteristics:

High Growth Phase Stable Growth Phase

Length of Period

5 years

Forever after year 5

Return on Equity

25%

15%

Payout Ratio

20%

60%

Growth Rate

.80*.25=.20

.4*.15=.06

Beta

1.25

1.00

Cost of Equity

12.875%

11.50%

The riskfree rate is 6% and the risk premium used is 5.5%.

120

Estimating Price/Book Value Ratio

The price/book value ratio for this firm is:

0.25 * 0.2 * (1.20) *

PBV =

(.12875

5

1 (1.20)

(1.12875) 5

.20)

5

0.15 * 0.6 * (1.20) * (1.06)

+

= 2.66

(.115 - .06) (1.12875) 5

121

PBV and ROE: The Key

PBV and ROE: Risk Scenarios

4

3.5

Price/Book Value Ratios

3

2.5

Beta=0.5

Beta=1

Beta=1.5

2

1.5

1

0.5

0

10%

15%

20%

25%

30%

ROE

122

PBV/ROE: European Banks

Bank

Banca di Roma SpA

Commerzbank AG

Bayerische Hypo und Vereinsbank AG

Intesa Bci SpA

Natexis Banques Populaires

Almanij NV Algemene Mij voor Nijver

Credit Industriel et Commercial

Credit Lyonnais SA

BNL Banca Nazionale del Lavoro SpA

Banca Monte dei Paschi di Siena SpA

Deutsche Bank AG

Skandinaviska Enskilda Banken

Nordea Bank AB

DNB Holding ASA

ForeningsSparbanken AB

Danske Bank AS

Credit Suisse Group

KBC Bankverzekeringsholding

Societe Generale

Santander Central Hispano SA

National Bank of Greece SA

San Paolo IMI SpA

BNP Paribas

Svenska Handelsbanken AB

UBS AG

Banco Bilbao Vizcaya Argentaria SA

ABN Amro Holding NV

UniCredito Italiano SpA

Rolo Banca 1473 SpA

Dexia

Average

Symbol

BAHQE

COHSO

BAXWW

BAEWF

NABQE

ALPK

CIECM

CREV

BAEXC

MOGG

DEMX

SKHS

NORDEA

DNHLD

FOLG

DANKAS

CRGAL

KBCBA

SODI

BAZAB

NAGT

SAOEL

BNPRB

SVKE

UBQH

BBFUG

ABTS

UNCZA

ROGMBA

DECCT

PBV

0.60

0.74

0.82

1.12

1.12

1.17

1.20

1.20

1.22

1.34

1.36

1.39

1.40

1.42

1.61

1.66

1.68

1.69

1.73

1.83

1.87

1.88

2.00

2.12

2.15

2.18

2.21

2.25

2.37

2.76

1.60

ROE

4.15%

5.49%

5.39%

7.81%

7.38%

8.78%

9.46%

6.86%

12.43%

10.86%

17.33%

16.33%

13.69%

16.78%

18.69%

19.09%

14.34%

30.85%

17.55%

11.01%

26.19%

16.57%

18.68%

21.82%

16.64%

22.94%

24.21%

15.90%

16.67%

14.99%

14.96%

123

PBV versus ROE regression

Regressing PBV ratios against ROE for banks yields the following

regression:

PBV = 0.81 + 5.32 (ROE) R2 = 46%

For every 1% increase in ROE, the PBV ratio should increase by

0.0532.

124

Under and Over Valued Banks?

Bank

Banca di Roma SpA

Commerzbank AG

Bayerische Hypo und Vereinsbank AG

Intesa Bci SpA

Natexis Banques Populaires

Almanij NV Algemene Mij voor Nijver

Credit Industriel et Commercial

Credit Lyonnais SA

BNL Banca Nazionale del Lavoro SpA

Banca Monte dei Paschi di Siena SpA

Deutsche Bank AG

Skandinaviska Enskilda Banken

Nordea Bank AB

DNB Holding ASA

ForeningsSparbanken AB

Danske Bank AS

Credit Suisse Group

KBC Bankverzekeringsholding

Societe Generale

Santander Central Hispano SA

National Bank of Greece SA

San Paolo IMI SpA

BNP Paribas

Svenska Handelsbanken AB

UBS AG

Banco Bilbao Vizcaya Argentaria SA

ABN Amro Holding NV

UniCredito Italiano SpA

Rolo Banca 1473 SpA

Dexia

Actual

0.60

0.74

0.82

1.12

1.12

1.17

1.20

1.20

1.22

1.34

1.36

1.39

1.40

1.42

1.61

1.66

1.68

1.69

1.73

1.83

1.87

1.88

2.00

2.12

2.15

2.18

2.21

2.25

2.37

2.76

Predicted

1.03

1.10

1.09

1.22

1.20

1.27

1.31

1.17

1.47

1.39

1.73

1.68

1.54

1.70

1.80

1.82

1.57

2.45

1.74

1.39

2.20

1.69

1.80

1.97

1.69

2.03

2.10

1.65

1.69

1.61

Under or Over

-41.33%

-32.86%

-24.92%

-8.51%

-6.30%

-7.82%

-8.30%

2.61%

-16.71%

-3.38%

-21.40%

-17.32%

-9.02%

-16.72%