Coors - Faculty Directory | Berkeley-Haas

advertisement

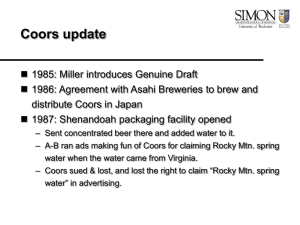

Adolph Coors in the Brewing Industry Take-aways Internal Fit A strategy should fit internally Activities of the firm should link in a complementary way with one another This requires a cross-functional perspective An activity map is an important tool to assess the internal fit of a company’s strategy An Activity Map Procurement Backward Integration Manufacturing Marketing Plant Scale One Product One Location Intermediate Price High Capacity Utilization Limited Advertising Distribution Regional Distribution Distribution Controls Cans Other inputs Other Unique Process • Asset-Intensive • Long • Unpasteurized Product • Attributes • Rocky Mount. Image AllEquity Finance Family Control Confrontational Manag. External Fit A strategy must also fit externally A company’s strategy needs to make sense in the “terrain” in which they are operating Comparative financial statement analysis is a key tool for this type of assessment Identify the key drivers of change in making comparisons Coors’ Strategy 1970s: Product Advantage vs Competitive Advantage Scale and Centralization Missed opportunities Static view of rivals and opportunities 1980s: Constrained by Earlier Choices Reactive strategy Little adaptation Coors Update 1985 — Miller introduces Genuine Draft August 1 1986 — Agreement with Asahi Breweries in Tokyo—to brew and distribute Coors in Japan 1987 — Shenandoah packaging facility opened 1987 — Agreement with AFL-CIO ends 10-year boycott against Coors 1988 — Record volume moves Coors from #5 in the industry to #4 1989 — Introduced Keystone (a popular beer that cannibalized Coors’ premium sales) Coors Update 1990 — Coors rises to #3 among US brewers 1991 — Entered 50th state (Indiana) and began exporting to Puerto Rico, Guam and Cayman Islands 1992 — Spun off nonbrewing assets including diversified technology business 1993 — New president and COO hires from Frito-Lay; first non-Coors family member to be president 1994 — Purchased brewery in Spain 1996 — Anheuser Busch has captured 48% of US beer sales Week Ending 1/ 2/ 04 1/ 2/ 03 1/ 2/ 02 1/ 2/ 01 1/ 2/ 00 1/ 2/ 99 1/ 2/ 98 1/ 2/ 97 1/ 2/ 96 1/ 2/ 95 1/ 2/ 94 1/ 2/ 93 1/ 2/ 92 1/ 2/ 91 1/ 2/ 90 1/ 2/ 89 1/ 2/ 88 1/ 2/ 87 1/ 2/ 86 1/ 2/ 85 Indexed Adjusted Closing Price (1/1/1985 = 100) Coors Performance Post 1985 Relative Performance of Coors and the S&P 500 (1985-Present) 1000 S&P 500 + 581% Coors + 334% (end 2003) 100 Coors + 52% (end 1995) 10 10 Week Ending 1/2/04 7/2/03 1/2/03 7/2/02 1/2/02 7/2/01 1/2/01 7/2/00 1/2/00 7/2/99 1/2/99 7/2/98 1/2/98 7/2/97 1/2/97 7/2/96 1/2/96 7/2/95 1/2/95 7/2/94 1/2/94 7/2/93 1/2/93 7/2/92 1/2/92 7/2/91 1/2/91 7/2/90 1/2/90 7/2/89 1/2/89 7/2/88 1/2/88 7/2/87 1/2/87 7/2/86 1/2/86 7/2/85 1/2/85 Indexed Adjusted Closing Price (1/1/1985 = 100) Coors Performance Post 1985 relative to Anheuser Busch Relative Performance of Coors, Anheuser Busch, and the S&P 500 (1985-Present) 100000 10000 1000 100