Coors in the 1970s - Faculty Directory | Berkeley-Haas

advertisement

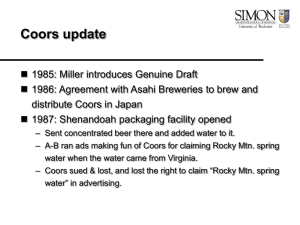

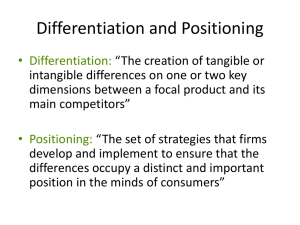

Coors Caselet Note: This case is loosely based on the competitive situation of Coors and other beer manufacturers at the end of the 1970s. The strategy part of the case is a “what-if” scenario analysis. By the late 1970s, Coors enjoyed superior margins and the largest market share of beer manufacturers for consumers located west of the Mississippi River. Still, there was considerable concern as to how sustainable this position was. Thanks to the acquisition by Philip Morris of the Miller Brewing Company, there was an advertising war occurring between Miller and its closest rival Anheuser-Busch for consumers in the east. The war was costing both companies dearly with little end in sight. In contrast, Coors mainly eschewed advertising in favor of a word of mouth strategy. When they did advertise, they emphasized the “Rocky Mountain Mystique” of their product. Despite this, Coors did not price its product as a “super premium” beer. Its price point was similar to, but slightly lower than Anheuser-Busch’s flagship beverage Budweiser and well below A-B’s super premium brand Michelob. Instead, Coors margin advantage derived from its superior cost structure. Owing to returns to scale from its massive Golden, Colorado plant, it was able to produce beer at considerably lower average cost than its rivals. Its dominance in the west also stemmed from a logistical advantage, its location in Golden was considerably closer to the large segment of consumers in California than the plant locations of its rivals, which were mainly in the east and the Midwest. The worry, of course, was that at some point in the future, these potential rivals would build plant in the west and directly vie with Coors for dominance. Plants took approximately two years to operate at full capacity from the time that they were first built; therefore, Coors felt that there was a window of opportunity for them to operate alone in the west in their present fashion. Based on the results from the marketing wars being fought by A-B and Miller, Coors observed that it was possible to create relatively sticky customers at existing price points through aggressive advertising. It was thought that, owing to their pre-existing customer base, such a campaign would enable Coors to retain significant market share even in the face of an incursion and a determined marketing campaign by rivals. The downside was that mounting a campaign on the scale of Miller and A-B was quite expensive. In considering whether to build plant in the west, A-B also needed to determine its potential market share gains in the west. It was thought that, if Coors continued on its present path of word-of-mouth advertising, building a single large plant in the west would allow A-B to leverage its already considerable marketing to gain share at Coors expense. The bottom line was that, under this scenario, such a plant build had positive ROI. On the other hand, a determined marketing campaign by Coors, either before or during the building of the plant, would significantly reduce A-B’s anticipated gain in market share. This would lead to a breakeven or possibly negative ROI situation for A-B. However, much of the expense in building a plant was spent up front, therefore, A-B concluded that if it began construction of the plant, it was only sensible to proceed to its completion. The management team at Coors determined that there were three main strategies it could follow. The first was a pre-emptive advertising campaign designed to deter entry by A-B. The second was a press release indicating that if any of the “big two” firms (A-B or Miller) were to build plant, then Coors would undertake a massive advertising campaign to reinforce in the minds of consumers the quality and value offered by the Coors brand. The third strategy was to stay the course with their previously successful word-of-mouth advertising campaign. Your Task: Analyze the three scenarios using game theory and then recommend an action to Coors management.