Adolph Coors Team Pirates Spring 2008

advertisement

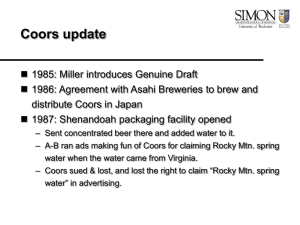

Adolph Coors Team Pirates Spring 2008 Major U.S. Company Market Shares: 1977-2008 (% of total domestic volume) 60.0% 50.0% 40.0% A&B MILLER 30.0% COORS 20.0% 10.0% 0.0% 1977 1981 1985 1992 2001 2003 2008 Competitive Advantage in 1970s High entry barriers - Economies of scale - Differentiation and Customer relations Suppliers and buyers have weak positions - Good wholesalers and retailers relations - Vertical integration Few threats from substitute products Moderate rivalry - Competitors - Few categories - Differentiation - High growing industry Five Forces of Competition What went wrong ? I. Operating Performance II. Slow growth Major Brewers’ Operating Income (per Barrel) Barrels Sold For 1977 Revenue COGS Advertising Other SG&A Total Operating Cost Operating Income For 1985 in $’s of 1977 Barrel Sold Revenue COGS Advertising Other SG&A Total Operating Cost Operating Income I. II. Low Revenue Operating Cost too high • • • Production Cost Transportation Cost Advertizing Cost A&B 36.6 Millions Miller 24.2 Millions $46.01 $36.61 $1.99 $2.79 $41.39 $45.87 N/A $2.48 N/A N/A $34.84 $24.52 $2.10 $4.35 $30.97 $41.56 $28.98 $1.09 $2.97 $33.04 $4.62 $4.38 $4.03 $8.52 A&B 68 Millions Miller 37.1 Millions Heilman 6.2 Millions Heilman 16.2 Millions Coors 12.8 Millions Coors 14.7 Millions $43.32 $29.02 $3.88 $4.04 $36.95 $39.11 N/A $4.53 N/A N/A $29.73 $21.33 $3.56 $2.56 $27.45 $41.10 $27.70 $6.28 $3.58 $37.56 $6.37 $2.06 $2.28 $3.55 Slow growth compare to Competitor Major U.S. Brewers' Sales 1977-1986 (millions of barrels) 70 Sales Growth 70.00% 60.00% 60 50.00% 50 40 A&B 30 MILLER COORS 20 40.00% A&B 30.00% MILLER 20.00% COORS 10.00% 10 0 1977 I. 0.00% 1981 1983 1985 Method of production • Only one facility • Not able to produce in advance II. Exposition on U.S Territory III. Diversity of products available -10.00% 1981 1983 1985 Factors to Coors Stagnation Unfocused strategy From one brand to the fall The “cult” of Coors The Water Mystique Coors’ image problem AFL-CIO Strike and boycott Coors’ and the minorities Coors’ family views Coors Banquet One brewery Only distributed in the West (11 states) Product Differentiation Strategy Only in draft Uniqueness of ingredients “Rocky Mountain Springwater” Coors’ Mystique Burt Reynolds in the movie “Smokey and the Bandit” Gerald Ford and Henry Kissinger The In n’ Out effect Coors’ Expansion Geographic Expansion Roll out in the fifty states Product Expansion Killian, Greystone, and Shulers Line Expansion Light beer, ice beer, dry beer, red beer, … Production Expansion Opening of a new packaging plant in Virginia The Water Mystique The original Coors’ can Expanding nationally actually hurt Coors’ image. Cross-brewing Too much availability led to Coors’ commonness AFL-CIO Boycott Lasted from 1977 to 1987 Market share dropped in California from 40% to 10%. AFL-CIO represents 13 million workers Union representative reached out to minorities organizations, universities, stadiums, and entertainment parks. Wanted to show that Adolph Coors is “antilabor, therefore antipeople” and N.E.A and N.O.W joined the boycott with more than 5 million people. Unfounded accusations Anti gay, anti minorities, anti woman employment practices Not eco-friendly Comments taken out of context viewed as racists Coors’ family contribution to conservative political group Boycott Coors Recommendations Diversification Multipoint competition Synergy •Create a new market •More value •Miller & Coors vs. Anheuser Busch •Risk reduction •Create a stronger brand Focus Strategy Focus more on consumer needs Wholesalers Buyers • Change production method • More accessible • “Freshness Policy” • On-premise • Off-premise Focus Strategy • Create new advertising campaigns • Focus on other segments of beer • Regionalize in terms of marketing and activities • Create a low cost strategy • Create more facilities sales Coors Current strategy Engaged in a 3-part strategy in 2004 (1) "Drive growth on Coors Light and Coors Original via a full line of support, including over 20 television spots, promotions, radio, out of home and print.” (2) "Support Keystone Light, Killian's, Zima, Blue Moon and Mexicali with local programming.” (3) "Respond aggressively to low-carb opportunities." Merged with Molson in 2005 Merged with SABMiller in 2007 Coors’ Current strategy Direct competitor to Anheuser-Busch after the merger with SABMiller. Expansion in developing market, such as Asia and Africa Goes up against the heavy marketing strategy of Anheuser-Busch, which spends twice the advertising expense of Coors, $2.5 billion and 50.6% of the market share. Thank you!