Vertical Coordination in The Malting Barley Industry

advertisement

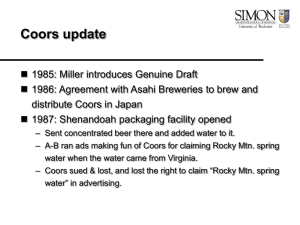

Vertical Coordination in The Malting Barley Industry: A ‘Silver Bullet’ for Coors Brian C. Briggeman Joshua D. Detre Case Study prepared for the 2004 American Agricultural Economics Association Denver, CO Background • Adolph Coors founded Coors Brewery in Golden, CO (1876) • Growth – 2002 acquisition of Bass Brewers (UK) – Increased net income by 8% • 2002 net income $161.8 million • 2003 net income $174.7 million – 9th largest brewer in the world – In discussions with Molson • Competitive Advantage – Rocky Mountain Fresh Production Contracts • Secure supply of high-quality barely • Strict Standards • Price premium to barley farmer – Idaho Barley Commission • 2002 Malt Barley: $5.67/cwt • 2002 Coors Production Contract: $6.75/cwt • How does this affect costs in the value chain? Agency Theory • Principal and agent – Farmer pursues goals that differ from Coors (moral hazard) • Shirking results – Asymmetric information (adverse selection) • Farmers may have hidden information-knowledge – Production history – Production costs – Risk sharing – Use financial incentives to motivate workers • Farmer must be willing to accept the contract • Farmer must take efficient actions Agency Theory • Why Agency Theory is not the whole story – Little difficulty of performance measurement in contracted barley • Occurs because Coors pay the farmers on the value they create • Residual returns to barley production go to the farmer therefore there are incentives to pursue efficient actions – Multiperiod relationships limit the existence of hidden information Transactions Costs • Firms are designed to minimize the total costs of transacting – Farmers may be able to exploit learning and scale economies • Farmers are specialists who make necessary investments to develop expertise and exploit scale economies – The market provides intangible benefits • Integration may give rise to additional costs – Agency – Influence Transactions Costs • Why Transactions Cost Are Not The Whole Story – Problems • Costs of transactions indistinguishable from other costs – Technical efficiency gains from contracting outweighs the agency efficiency (minimization of transactions costs) of vertical integration • Efficiency does not always imply cost minimization – Coors does not force the farmers to bear all risks • Repeated relationship between Coors and the farmers – Reduces uncertainty – Makes investments in assets more profitable Why Ownership and Property Rights Work for Coors • Incomplete contracts, bargaining costs, moral hazard, and influence costs are sources of inefficiency in business relationships – Assignment of ownership rights affects the magnitude of each of these problems and possibilities of creating value Why Ownership and Property Rights Work for Coors • Farmer ownership accompanied by secure property rights – Effective institution for providing incentives to maintain a supply of quality barely – Without them there are dulled incentives for farmers to make the investments necessary to ensure quality barley Coors Not Buying The Farm • Objective for the law of property rights is to assign them in a way that creates value – Important rights be assigned properly initially – Coase states if transaction costs are low and rights are assigned, secure, and transferable, there will be efficiency – Contract arrangements between Coors and the farmers have evolved towards an efficient arrangement that allow both parties capture mutually available gains Coors Not Buying The Farm • Difficulty of performance measurement in barley production • Coors wants the farmer to have possession of residual decision rights and residual returns. – Decisions regarding the use of the assets that are not explicitly covered in the contract – Will make efficient decisions because he will want to maximize returns Coors Not Buying The Farm • Coors has multiperiod relationships with key barley suppliers – Provides an incentive for fair treatment – Reputation is an effective control mechanisms of the contract • Arms length transactions are preferred to ownership – Consequences for performance when contracts are granted for the next year – Presence of a learning curve, which means long-term relationships are valuable • Very difficult to transfer knowledge and experience Value Chain affects on Property Rights • Supply Chain Management Activities – Contract standards ensure high quality barley • Creates a benefit position relative to competitors • Accomplished through property rights • Operations – Production processes for Coors are higher – Predictable costs (COGS per Sales ≈ 54%) – Affect on contract bidding Value Chain affects on Property Rights • Distribution – Economies of Scale • Minimum Efficient Size • Sales and Marketing – Building product image through • Branding, pull advertising, and product promotion • Breadth of product line • Service – Savings due to recycling can be passed onto the production contracts Value Chain affects on Property Rights • Profit Margin – BOTTOM LINE – Willingness to pay for Coors’ products – Why? Competitive advantage attributed to our differentiated barley 1999 Beer Industry Leaders Operating profit Operating margin Anheuser Busch Coors Miller $23.51 $6.73 $12.47 25% 7% 15% Source: Sanford C. Bernstein & Co., Inc. April 17, 2000 Beer Naturally • Production contracts via property rights are the most efficient form of organization for Coors – Source of Competitive Advantage in the “Value Chain” • Where to go from here… – Economies of scale in operating expenses • Continued selective acquisitions, mergers, and ventures – Product proliferation – Co-branding – Capture cost advantages while maintaining benefit advantages • Thank you for your time and attention • Please feel free to ask any questions you may have about our presentation Table 3. Income Statement Data for the Adolph Coors Company, 1998 to 2002 (millions of dollars) Gross Sales Beer Excise Taxes Net Sales Cost of Goods Sold Gross Profit Other Operating Expenses Marketing and Administration Special Charges Total Other Income Operating Income Interest Income Interest Expense Other Income, Net Net Income Before Taxes Income Tax Expense Net Income After Taxes Net Income Per Common Share 2002 4957 -1181 3776 -2415 1361 2001 2843 -413 2430 -1538 892 2000 2842 -427 2415 -1526 889 1999 2643 -406 2237 -1397 840 1998 2464 -392 2072 -1333 739 -1057 -6 -1063 298 21 -71 8 256 -95 161 4.47 -717 -23 -740 152 16 -2 32 198 -75 123 3.33 -723 -15 -738 151 21 -6 4 170 -60 110 2.98 -693 -6 -699 141 11 -4 3 151 -58 93 2.51 -616 -19 -635 104 12 -10 5 111 -43 68 1.87 Table 4. Other Performance Information, 1998 to 2002 2002 2001 2000 1999 1998 Barrels of Beer Sold, millions 31.8 22.7 23 22 21.2 Divdends Per Share of Common Stock 0.82 0.8 0.72 0.65 0.6 Depreciation, millions of dollars 230.3 121.1 129.3 123.8 115.8 Capital Expenditures, millions of dollars 246.8 244.5 154.3 134.4 104.5 Table 5. Scale Advantages Are Key In Beer Industry 1999 ($/Barrel) U.S. Revenues, net COGS Gross profit Gross profit Operating Expenses Operating profit Operating margin Share Anheuser Busch $93.37 55.88 37.49 40% 13.99 $23.51 25% 47% Source: Industry sources, Bernstein Coors $93.68 55.39 38.29 41% 31.57 $6.73 7% 11% Miller $82.39 53.99 28.41 34% 15.94 $12.47 15% 21% Table 7. Yahoo Beer Industry Statistics Description Beverages (Alcoholic) Adolph Coors Company Allied Domecq PLC (ADR) Anheuser-Busch Companies, Big Rock Brewery Income T Boston Beer Company Brown-Forman Corporation Chalone Wine Group, Ltd. Companhia de Bebidas das Constellation Brands, Inc Consumer Non-Cyclical Diageo plc (ADR) Heineken N.V. (ADR) Kirin Brewery Company, Lt Quilmes Industrial S.A. Robert Mondavi Corp. Todhunter International, Market Cap 143.65B 2.55B 9.18B 41.74B 54.86M 280.97M 5.64B 127.83M 7.59B 3.96B 1214.44B 39.15B 15.43B 9.53B 5.25B 559.21M 74.24M P/E ROE % Div. Yield % Debt to Equity Price to Book Rev Qtr vs Yr Ago EPS Qtr vs Yr Ago 19.95 64.10 1.69 2.33 12.88 7.44 15.06 14.64 14.30 1.19 NA NA 4.57 -8.95 10.21 205.74 3.16 5.09 11.35 -2.01 124.32 20.13 79.19 1.70 2.77 15.35 5.99 17.54 12.61 23.22 7.40 0.19 2.77 26.52 152.63 21.49 22.70 NA 0.00 4.57 10.12 85.00 21.90 27.68 1.84 0.63 5.19 8.93 7.33 182.40 0.73 NA 0.80 1.32 -8.57 NA 19.79 27.92 4.68 1.43 5.34 19.41 -39.24 17.93 10.97 NA 0.90 1.71 19.99 8.78 20.60 33.57 2.43 1.14 8.29 12.79 19.07 15.02 32.49 3.06 2.16 7.08 -5.12 NA 32.08 27.57 0.83 1.72 8.07 12.89 -14.71 32.87 4.13 1.09 0.35 1.31 110.41 869.20 14.86 9.17 1.06 0.39 7.08 40.74 2675.00 25.16 4.82 NA 0.80 1.17 6.49 NA 13.71 7.75 NA 0.50 1.02 0.98 -23.14 Table 8. Dunn & Bradstreet Industry Quartiles Industry Quartiles 2003 2002 2001 Solvency Statement Sampling: 28 Upper Median Lower Statement Sampling: 139 Upper Median Lower Statement Sampling: 146 Upper Median Lower Quick Ratio (times) 1.5 0.9 0.3 1.5 0.8 0.3 1.7 0.8 0.4 Current Ratio (times) 3.1 1.9 1.3 3.2 2 1.2 3.3 2.1 1.1 Current Liabilities / Net Worth (%) 26.6 53.7 105.9 23.2 50.9 104.6 22.2 46.2 128.6 Current Liabilities / Inventory (%) 85.7 140.8 183.1 83.1 123.6 197 75.3 128.3 204.9 Total Liabilities / Net Worth (%) 40.1 104 270.7 35.2 91.5 228.1 30 109.3 244.2 Fixed Assets / Net Worth (%) 16.4 52.4 86.8 23.6 42.6 80.4 22 48.8 88.5 Table 8. Dunn & Bradstreet Industry Quartiles Industry Quartiles Statement Sampling: 28 Efficiency Upper Median Lower Collection Period (days) Sales / Inventory (times) Assets / Sales (%) Sales / Net Working Capital (times) Accounts Payable / Sales (%) 2002 2001 Statement Sampling: 139 Upper Median Lower Statement Sampling: 146 Upper Median Lower 2003 1.5 5.1 22.3 1.8 4.8 19.6 2.2 11.7 23 22.5 16.6 13.3 33 19.8 14 32.1 19.3 13.2 19.4 33.7 40.2 19.3 27.1 35.7 19.5 27.7 35.9 34.2 16.7 13.1 26.6 15.5 8.2 26 12.6 7.4 2.1 3.1 4 1.1 2.4 3.5 1.6 2.5 4 Table 8. Dunn & Bradstreet Industry Quartiles Industry Quartiles 2003 Statement Sampling: 28 Profitability Upper Median Lower Return on 1.8 0.6 Sales (%) 3.2 Return on 5.7 1.7 Assets (%) 8.4 Return on Net Worth (%) 18.9 11.9 5.4 2002 2001 Statement Sampling: 139 Upper Median Lower Statement Sampling: 146 Upper Median Lower 4.2 2.2 0.8 3.5 1.5 0.4 13.9 8.7 2.6 14 5.6 1.6 30.5 20.2 6.1 30 11.7 4.3 Table 8. Dunn & Bradstreet Industry Quartiles Median Variance Solvency Median 2003 2002 2001 2002 2001 Median 2003 2001 Median 2003 2002 Quick Ratio (times) 0.9 12.5 12.5 0.8 -12.5 0 0.8 -12.5 0 Current Ratio (times) 1.9 -5 -9.5 2 5 -4.8 2.1 9.5 4.8 Current Liabilities / Net Worth (%) 53.7 2.8 7.5 50.9 -2.8 4.7 46.2 -7.5 -4.7 Current Liabilities / Inventory (%) 140.8 17.2 12.5 123.6 -17.2 -4.7 128.3 -12.5 4.7 Total Liabilities / Net Worth (%) 104 12.5 -5.3 91.5 -12.5 -17.8 109.3 5.3 17.8 Fixed Assets / Net Worth (%) 52.4 9.8 3.6 42.6 -9.8 -6.2 48.8 -3.6 6.2 Table 8. Dunn & Bradstreet Industry Quartiles Median Variance Efficiency Median Collection Period (days) Sales / Inventory (times) Assets / Sales (%) Sales / Net Working Capital (times) Accounts Payable / Sales (%) 2003 2002 2001 2002 2001 Median 2003 2001 Median 2003 2002 5.1 -6.2 56.4 4.8 6.2 59 11.7 -56.4 -59 16.6 -16.2 -14 19.8 16.2 2.6 19.3 14 -2.6 33.7 6.6 6 27.1 -6.6 -0.6 27.7 -6 0.6 16.7 7.7 32.5 15.5 -7.7 23 12.6 -32.5 -23 3.1 0.7 0.6 2.4 -0.7 -0.1 2.5 -0.6 0.1 Table 8. Dunn & Bradstreet Industry Quartiles Median Variance Profitability Median Return on Sales (%) Return on Assets (%) Return on Net Worth (%) 2003 2002 2001 2002 2001 Median 2003 2001 Median 2003 2002 1.8 -0.4 0.3 2.2 0.4 0.7 1.5 -0.3 -0.7 5.7 -3 0.1 8.7 3 3.1 5.6 -0.1 -3.1 11.9 -8.3 0.2 20.2 8.3 8.5 11.7 -0.2 -8.5 Factors in Coors Organizational Structure • • • • • Specificity Frequency and Duration Complexity and Uncertainty Difficulty of Measuring Performance Connectedness Coors Not Buying The Farm • Difficulty of performance measurement in barley production – Since care is especially difficult and/or costly to measure for Coors, the solution would be allow the farmer to be the owner • He has residual control and is the residual claimant • The farmer will have the proper interest in maximizing the residual value of the asset