Itemized Deductions

advertisement

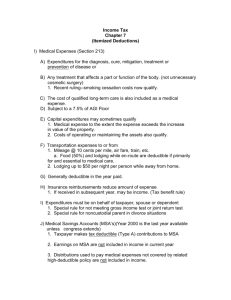

Standard Deduction vs Itemized Deduction After figuring the adjusted gross income (AGI), either the standard deduction or itemized deductions may reduce the AGI. In most cases, the taxpayer can choose which deduction to take and usually takes the largest deduction, which results in the lowest tax. The standard deduction is a fixed amount that is based upon the taxpayer’s filing status and age, and whether or not the taxpayer is blind. It can also be reduced for taxpayers who can be claimed as an exemption by another taxpayer. The standard deduction is usually adjusted for inflation from year to year. It is advantageous to take the standard deduction if it is larger than the taxpayer’s total allowable itemized deductions. Standard Deduction Amounts 2015 Standard Deduction Amounts (for taxpayers under age 65 and who are NOT blind) Single Married Filing Jointly Head of Household Married Filing Separately Qualifying Widow(er) $6,300 $12,600 $9,250 $6,300 $12,600 Taxpayers who are 65 years or old or who are blind receive larger standard deduction amounts. The age and vision if taxpayer (if filing jointly) is counted separately for each spouse. There are additional standard deduction amounts for taxpayers age 65 or older or are blind or both. After determining if the taxpayer is at least age 65 or blind, an additional amount can be added to the standard deduction amount for each occurrence (taxpayer and spouse). For unmarried taxpayers filing Single or Head of Household, the additional amount is $1,550. For taxpayers considered married and filing as Married Filing Jointly, Qualifying Widow(er), or Married Filing Separately; the additional amount added is $1,250 for each occurrence. The additional amount for blindness will be allowed if the taxpayer or spouse are totally or partly blind on the last day of the tax year. If partly blind, a certified statement from an optometrist or eye doctor must be obtained declaring no more than 20/200 vision in one eye (even with eye glasses or contact lenses), or that the field of vision is not more than 20 degrees. Itemized Deductions Even though most taxpayers are eligible to take the standard deduction, it is more advantageous for some taxpayers to take the total allowable itemized deductions. The allowable itemized deductions are specific and can be sometimes be limited. If a taxpayer itemized, Schedule A and Form 1040 must be filed (cannot file 1040EZ or 1040A). Once the amount of itemized deductions are determined, the amount is carried to Form 1040, line 40, and then subtracted from AGI. Medical and Dental Expenses A taxpayer may deduct certain medical and dental expenses paid that exceed 10% (7.5% if taxpayer or spouse is 65 or older) of AGI (Form 1040, line 38). IRS Publication 502 explains medical and dental expenses that can be claimed on Schedule A, and expenses that cannot be deducted. The deduction is allowed for expenses paid for the prevention and alleviation of a physical or mental defect or illness. Medical expenses include those related to diagnosis, cure, mitigation, treatment, or prevention of disease, or treatment affecting any function or structure of the body. Deduction guidelines Expenses must be for taxpayer, spouse, or dependent, or for anyone who would qualify as a dependent except for having a gross income of more than $4,000 Expenses must be paid during the current tax year, regardless of when incurred Expenses must not be compensated by insurance Expenses must not be paid out of a tax‐free medical savings or health savings account The taxpayer subtracts from the deduction total any reimbursement of medical expenses, whether they were paid to the taxpayer or directly to the doctor or hospital Deductible Taxes • • • Taxpayers who itemize might be able to deduct state, local, and foreign income taxes. State and local personal property taxes and state and local sales tax (in lieu of state income taxes) may also be deductible. Certain state, local and foreign real estate taxes are deductible as well. State and local income taxes withheld from wages are deductible in the year withheld. State and local income tax estimates or prior‐year payments are also deductible in the year paid. Foreign income taxes usually qualify as an itemized deduction or tax credit in the year paid. In 2014, taxpayers had the option of deducting state and local income tax or local sales tax, not both. The taxpayer could claim the actual amount paid in sales tax or a standard amount based on income level. The sales tax deduction expired December 31, 2014. It must be renewed by Congress in order to be claimed in 2015. Deductible Interest Some interest paid is deductible on Schedule A. In order for interest to be deductible the taxpayer must be liable for the debt and the interest must be paid in the current year. Home mortgage interest and investment interest (limited to net investment income) are both deductible. Personal interest cannot be deducted. Personal interest is interest paid on a loan to purchase personal property such as a car, credit card, or installment interest for personal expenses, and other non‐business‐related properties. Gifts to Charity Charitable contributions are donations made to qualified charitable organizations. The contributions can be monetary or physical property. Qualified charitable contributions are deductible as an itemized deductions. Taxpayers must also meet such record‐keeping requirements as retaining receipts, bank statements, cancelled checks, etc. IRS Publication 526 outlines the requirements for each donation type. Taxtime staff will provide additional counseling on all products and/or tax laws during your personalized session. Please call for an appointment. Qualified organizations can be public or private foundations, including religious organizations, fraternal orders, non‐profit hospitals and schools, foundations for the prevention of cruelty to children, and organizations of war veterans. Payments to individuals are never deductible. Limits also apply on deductible amounts in addition to the general limits on itemized deductions. Specific record‐keeping requirements must be met in order to deduct charitable contributions and vary depending on the value and type of contribution. For non‐ cash contributions of more than $500, Form 8283 may be required. For more information, see Publication 526, Charitable Contributions. Casualty, Theft, and Losses Casualty, theft, and losses are the unexpected loss of property and are deductible as an itemized deduction. A casualty occurs when property is damaged as the result of an identifiable event that is sudden, unexpected, and unusual. A theft occurs when property is taken or removed with the intent to deprive the owner of it. A theft is not mislaid or lost property. A loss on deposits occurs when a financial institution becomes insolvent or bankrupt. The amount the taxpayer can deduct as casualty or theft is the amount not reimbursable by insurance. Casualty and theft losses are reported on Form 4684 and are carried to Schedule A. Job Expenses and Certain Miscellaneous Deductions Certain expenses can be deducted as miscellaneous itemized deductions on Schedule A, but are allowed only to the extent they exceed 2% of AGI. Deductions subject to the 2% limit fall into the three categories: • Unreimbursed employee expenses • Tax return preparation fees • Other expenses Unreimbursed Employee Expenses Unreimbursed employee expenses can be deducted only if paid or incurred during the tax year for carrying on the trade or business of being an employee. The expenses must be ordinary and necessary. Some examples of unreimbursed employee expenses include: • Dues to professional societies • Legal fees related to job • Occupational taxes • Licenses and regulatory fees • Passports for a business trip • Union dues and expenses • Work‐related education • Tools and supplies used in job • Certain educational expenses Certain Miscellaneous Deductions Tax Preparation Fees Taxtime staff will provide additional counseling on all products and/or tax laws during your personalized session. Please call for an appointment. Taxpayers can usually deduct fees paid to have their tax return prepared in the year they were paid. Fees paid to a tax professional, cost of tax preparation software programs and tax publications, and fees paid for electronically filing a tax return can be deducted (subject to limits). Enter the expenses paid on Schedule A, line 22. Other Expenses Other expenses that are limited to the amounts that exceed 2% of AGI are reported on Schedule A, line 23, and include: Certain legal and accounting fees Clerical help and office rent Custodial (for example, trust account) fees The taxpayer’s share of the investment expenses of a regulated investment company Certain losses on non‐federally insured deposits in an insolvent or bankrupt financial institution. Casualty and theft losses of property used in performing services as an employee from Form 4684, lines 32 and 38b, or Form 4797, line 18a. Deduction for repayment of amounts under a claim of right if $3,000 or less Convenience fee charged by the card processor for paying the taxpayer’s income tax (including estimated tax payments) by credit or debit card. The deduction is claimed for the year in which the fee was charged to the card. Other Miscellaneous Deductions Only the expenses listed next can be deducted on line 28 of Schedule A. List the type and amount of each expense on the dotted lines next to line 28. If more space is necessary, attach a statement showing the type and amount of each expense. Enter one total on line 28. These deductions are not limited. Gambling losses (gambling losses include, but are not limited to, the cost of non‐winning bingo, lottery, and raffle tickets), but only to the extent of gambling winnings reported on Form 1040, line 21. Casualty and theft losses of income‐producing property from Form 4684, lines 32 and 38b, or Form 4797, line 18a. Loss from other activities from Schedule K‐1 (Form 1065‐B), box 2. Federal estate tax on income in respect of a decedent. Amortizable bond premium on bonds acquired before October 23, 1986. Deduction for repayment of amounts under a claim of right if more than $3,000 Certain unrecovered investment in a pension. Impairment‐related work expenses of a disabled person. Taxtime staff will provide additional counseling on all products and/or tax laws during your personalized session. Please call for an appointment.