dt_ch40 - University of North Florida

advertisement

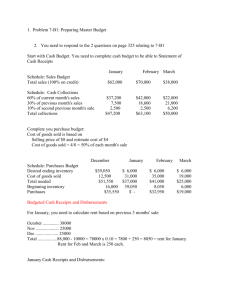

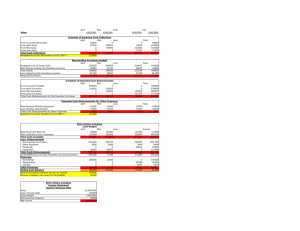

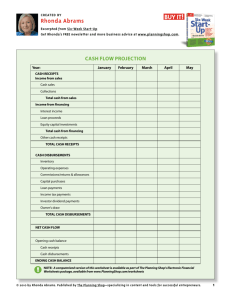

Chapter 40 Managerial Accounting Cash Budgets Prepared by Diane Tanner University of North Florida Cash Budget A VERY important budget Involves the planning and timing of cash flows A necessary supplement to the budgeted income statement Why? Cash inflows and outflows 2 = Revenues and expenses I.e., accrual-based income statement 2 3 Sources of Cash Inflows/Outflows All cash inflows are cash receipts Payments from customers Interest income received All cash outflows are cash disbursements Payments for inventory purchases Payments for operating expenses Payments for capital expenditures Payments for dividends 4 Cash Budget Formats Cash receipts budget Includes only cash inflows Cash disbursements budget Includes only cash outflows Complete cash budget Detailed format Lists cash inflows, cash outflows, and beginning and ending cash balances Summary format A single total for cash receipts and a single total for cash disbursements Shows beginning balance plus cash receipts less cash disbursements and often financing required to achieve a minimum cash balance 4 5 Cash Receipts Budget Example Cynedyne estimates it will collect 24% of its sales during the month of sale, 56% in the month after the sale, and 19% in the second month following the sale. 1% is estimated to be uncollectible. Projected sales are: Projected sales revenue April $230,000 May $220,000 June $287,000 July $261,000 August $255,000 Prepare a cash receipts budget in good form for June. $287,000 x 24% Cash to be received during June from: June sales $68,880 $220,000 x 56% May sales 123,200 $230,000 x 19% April sales 43,700 Budgeted cash receipts 5 $235,780 Cash Disbursements Budget Example 6 Cynedyne, Inc. provided the following budget information for the next five months: April May June July August Projected purchases $79,000 $95,000 $89,000 $78,000 $82,000 Budgeted income tax expense 28,000 24,000 26,000 25,000 24,000 • Inventory purchases: Paid 30% in the month purchased; 70% in the following month. • Operating expenses are budgeted at $91,000 in May, with an increase by $1,500 per month. Included in the monthly amount is depreciation of $4,200. • Operating expenses are paid 40% in the month incurred and 60% in the next month. • The company make a monthly note payment for $2,850, of which $150 is interest. • Cynedyne pays income taxes during the month after accrual. Prepare a cash disbursements budget in good form for June. Cash to be paid for June purchases (30% x $89,000) Cash to be paid for May purchases (70% x $95,000) Cash to be paid for June operating ($92,500 - $4,200) x 40% Cash to be paid for May operating ($91,000 - $4,200) x 60% Cash to be paid for note and interest Cash to be paid for income taxes Budgeted cash disbursements $26,700 66,500 35,320 52,080 2,850 24,000 $207,450 7 Summary Cash Budget Example Ceredyne has a budgeted June 1 cash balance of $16,000. Total budgeted cash receipts are $235,780. Total budgeted cash disbursements are $207,450. Prepare a summary cash budget for June. Budgeted beginning cash balance Add budgeted cash receipts Less budgeted cash disbursements Budgeted ending cash balance 7 $ 16,000 235,780 (207,450) $ 44,330 The End 8