Boston Beer Co report

Ticker: SAM

Sector: Consumer Staples

Industry: Brewers

Recommendation: DON’T BUY

Pricing

Closing Price $57.40 (4/23/10)

Overview:

52-wk High $57.45 (4/23/10)

52-wk Low

Market Data

Market Cap

Total assets

$23.95 (4/23/10)

$804.69M

$263M

The Boston Beer Co Inc. (SAM), the largest craft brewer and currently the 6 th largest brewer overall in the U.S., offers a variety of products under the Samuel Adams brand name. Samuel Adams has remained the third largest better beer brand over the past five years, behind imports Corona and Heineken, which makes Samuel Adams the largest U.S. produced better beer brand. It is also the largest

American-owned independent brewery.

Valuation

EPS (ttm) $2.17

The company’s flagship, Samuel Adams Boston Lager, has been brewed for over 25 years using its original recipe that is over 150 years old. Samuel Adams offers a diverse range of flavors that come P/E (ttm) 26.48

Profitability & Effectiveness (ttm)

ROA 14.3% from its wide selection of seasonal beers and various beer types, including its limited editions and brewmaster’s collection. Boston

Beer also produces malt and cider beverages under the brands

Twisted Tea and HardCore Cider. Like all companies in this industry

ROE 19.9%

Profit Margin 7.5% are legally required to do, due to government regulation, Boston

Beer sells to distributors, who then sell to various types of retailers.

Oper. Margin 13.3%

Analyst:

Boston Beer’s distributors sell its products to pubs, restaurants, grocery chains, package stores, stadiums, etc. The company also distributes in Canada, Europe, Israel, the Caribbean, and the Pacific

Rim.

Jeff Griffith jmgxb6@mail.missouri.edu

Boston Beer is uniquely positioned in the U.S. beer market. There are three different categories in the brewery industry: Mass Produced,

Craft Beer, and Imports. When a brewer reaches the annual 2 million barrel production mark, it is then considered Mass Produced. 2009 was the first year that Boston Beer reached the 2 million barrel cutoff. The company’s products are positioned to compete with other Craft beers, but SAM is now technically considered to be Mass Produced. This puts SAM in a unique position in the U.S. beer market, which has its advantages and disadvantages.

Historically, SAM has used a combination of brewing at its own facilities and contacted facilities. In 2007-

2008, the company had many concerns about future availability and pricing. Management decided that better brewing control was the answer. SAM decided to do this by purchasing Diageo’s Pennsylvania

brewery for $55 million in June 2008. As a result, in 2008, volume at company-owned operations increased to about 52%, from 35% in 2007. In addition to an increase in company owned volume, this new brewery increased Boston Beer’s proximity to certain markets, which allowed the company to offer fresher products while lowering its transportation costs. The company’s other company-owned breweries are located in Boston, MA and Cincinnati, OH.

Recommendation: After spending a lot of time carefully analyzing this company, I recommend that the we DON’T BUY stock in SAM, at least right now. One should “keep an eye” on SAM because it may be a good buy sometime in the future, but it is not right now. Boston Beer is a great company, with a good position in the U.S. beer market, but the company is currently significanlty overvalued and is an intense, competitive industry.

While I recommend that SAM is not a good buy right now, there are many attractive aspects of Boston

Beer that one should consider. While the Craft brew sector of the brewers industry is very concentrated, with many small craft brewers, SAM has positioned itself well. This has allowed the company’s brand to become well established, and as a result, SAM now leads the Craft brewers sector accounting for about

21% of the craft beer market.

Despite all of the attractive aspects discussed above, we should not buy stock in SAM because it is significantly overvalued, does not pay a dividend, and is in a highly competitive industry. The unattractiveness of the U.S. brewers industry is one of the biggest reasons not to invest in SAM. Also, the craft brews sector of the U.S. beer industry is highly competitive due to the large number of craft brewers with similar pricing. Craft brewers also target a lot of the same customers, which further increases competition.

Using conservative growth rates for SAM, an intrinsic value per share of $14.32 was calculated using

Warren Buffet’s Discounted Cash Flow model. As of April 23, 2010, the stock currently trades at $57.40.

This indicates that the company is signifcantly overvalued because its stock currently trades at more than four times that value. The S&P analysts calculated a fair value of $48.50 per share, also indicating it is overvalued. Even using a 2009 free cash flow value equal to the 2009 Net Income, results in a value of

$53.01, which also indicates it is overvalued. I think that while Boston Beer appears to be a good company, at this time it would not be a good addition to our portfolio.

Major Characteristics:

Boston Beer is the largest craft brewer with 21% market share in 2008

Boston Beer is also the 6 th largest brewer overall in the U.S.

Boston Beer is also the largest U.S. produced better beer brand, and third largest overall behind Corona and Heineken.

Forces

Threat of New Entry

5 Forces for the U.S. Brewers Industry

Industry Boston Beer

MODERATE LOW to MOD

Supplier Power

Buyer Power

Threat of Substitutes

Rivalry (Competition)

STRONG

STRONG

HIGH

HIGH

STRONG

STRONG

HIGH

LOW to MOD

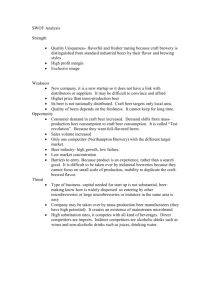

SWOT Analysis

Strengths: Boston Beer Co (SAM) is the largest Craft Brewer and the largest U.S. produced brand in the better beer category. SAM uses a lot of innovation to keep that position. It develops and creates many other malt beverages, so that the Samuel Adams consumer can have the opportunity to try numerous different styles of beverages. The company uses very little debt to finance its operations. In the past few years, the highest SAM’s debt-to-assets ratio has been is about 31%. Also, the company does not use any long-term debt. The company also offers a relatively broad portfolio of products. SAM is well-positioned in the U.S. beer market and is currently competing in the craft beer category, as well as in the mass produced beer category.

Weakness: SAM is located in a highly competitive industry, and within that, SAM competes in the craft beer segment, which is the most highly concentrated part of this industry. Many of the companies in this segment offer similar products with similar pricing to the same customer groups as Boston Beer. This makes these companies even more competitive with one another and the main factor they use to compete is price. Also, from an investor standpoint, SAM may not as attractive of an investment because it does not ever pay a dividend.

Opportunities: There is an increasing trend of consumers moving to better beer products, such as craft beers. If this continues, SAM should continue to see increasing sales.

Threats: SAM’s financial performance is somewhat dependent on the market conditions. If we are to see a second dip in the market, the company may be greatly affected by it. Also, if SAM is to meet increased competition or to see pricing measures intensify, this would have a great affect on its performance as well. Also, if the largest beer producers, Anheuser-Busch InBev and

MillerCoors, “craft beer” products become even more successful with their craft beers, this would result in those companies stealing market share from SAM. There is also a trend of consumers switching to wines and spirits from the premium domestic brewers. As this continues, SAM market share will likely continue to decrease.

Competitors:

As previously stated, SAM is currently straddling the border of craft beer and mass produced beer. Therefore, competitors of SAM are in both categories. In the mass produced beer category, although there is a large difference in company size, SAM is now technically competing with companies such as Anheuser-Bush InBev, Molson Coors, among other large producers. In the craft beer category, SAM competes with hundreds of other craft brewers. It is difficult to accurately compare SAM to these companies because most craft beer brewers are privately held. One of the only public craft brewers is Craft Brewers Alliance (HOOK). Boston Beer Company (SAM) does not have any public competitors that closely mirror its operations, so we will look at look at all three of these companies, as well as the industry, and compare them to SAM.

DIRECT COMPETITOR COMPARISON

Market Cap:

Employees:

Qtrly Rev Growth (yoy):

Revenue (ttm):

Gross Margin (ttm):

EBITDA (ttm):

Oper Margins (ttm):

Net Income (ttm):

EPS (ttm):

P/E (ttm):

PEG (5 yr expected):

P/S (ttm):

BUD = Anheuser-Busch InBev

TAP = Molson Coors Brewing Co.

HOOK = Craft Brewers Alliance, Inc.

Industry = Beverages - Brewers

SAM BUD

793.34M

77.95B

TAP HOOK Industry

9.16B 43.20M

8.19B

780

3.30%

415.05M

36.76B

51.52%

72.24M

116,489

11.50%

53.21%

14,350 N/A

3.20% 11.1%

3.03B 123.11M

43.05% 22.93%

14.35K

16.10%

3.03B

51.52%

12.72B

592.10M 10.36M

592.10M

13.33% 27.30%

31.12M

4.61B

13.35%

729.40M

2.47%

887.00K

15.20%

N/A

2.168

26.10

1.65

1.94

2.896

16.92

N/A

2.13

3.875

11.36

0.89

2.70

0.052

48.65

N/A

0.36

2.17

26.48

0.89

1.94

Below is a comparison of some key ratios for SAM over the last 4 years:

2009 2008 2007 2006

EPS

P/E

2.17

21.50

Price/Tangible Book 3.87

Price/EBITDA 9.06

ROE 19.9%

0.28 Debt/Assets

Current Ratio 1.5

0.56

50.34

2.88

8.00

5.9%

0.31

1.0

1.53

24.61

4.04

11.83

18.6%

0.30

2.3

1.27

28.43

4.78

15.79

18.7%

0.27

2.9

It is important to notice a few different things from the chart above. EPS overall is increasing, which is good for current shareholders. The overall decreasing trend in the Price-to-Tangible

Book Value ratio indicates the decreased risk of shareholders receiving a greater potential loss in the event of liquidation. The overall increasing ROE indicates that the shareholders are increasingly getting a little more of a return on their investment in SAM. The company has a good capital structure, especially with debt being used to finance less than 31% of total assets.

One thing to monitor is the company’s debt-to-assets ratio because it currently is low, but overall over the last several years, it has slowly been increasing. Another ratio to continue to monitor is SAM’s current ratio because its liquidity is has overall been decreasing over time, which indicates that it is increasingly less capable of paying off its short-term obligations.

Performance over the past 5 years compared to competitors : SBMRY (SABMiller), HOOK (Craft

Brewers Alliance), TAP (Molson Coors), and S&P500. Over the last 5 years, SAM appears to be the leader with SABMiller in second.

Stock price change over the past 2 years: Boston Beer Co, as well as most of its competitors, stock price begins to rise as the market turns around, but unlike the S&P 500, Boston Beer as well as its competitor SABMiller have reached their prices from before the market crashed.

Stock price change over the past year compared to competitors: Boston Beer, as well as

SABMiller, is seeing rising stock prices in the past year, but its competitors Molson Coors and Craft

Brewers Alliance cannot say the same.

Discounted Cash Flow

Some of the growth rates used in the DCF above were from Yahoo Finance. The only growth rates that did not come from Yahoo were the 5% for 2015-2019 and the 2.5% second stage growth rate. I used these growth rates because I felt that they were both conservative and reasonable.

The intrinsic value for SAM of $14.32 is much lower than the current stock price of about $57.40 (as of

4/23/10). When one checks the sensitivity of this analysis, one will find that even with a 2009 Free Cash

Flow of $31.1 billion (the same as 2009 Net Income), one will derive an intrinsic value for SAM of $53.01,

SAM is still significantly overvalued.

Wall Street Analysts’ Opinions:

Strong Buy

Buy

Hold

Underperform

Sell

Current Month

0

1

3

0

0

Last Month

0

1

3

0

0

Data provided by Thomson/First Call

Two Months

Ago

0

1

3

0

0

S&P Recommendation:

12 Month Target Price as of March 11, 2010 = $57.00

Qualitative Risk Assessment: HIGH

S&P Quality Ranking: B+ (Average)

S&P Fair Value Rank: 2+ (Stock is moderately overvalued)

Volatility: AVERAGE (CSCO had average price volatility over the past year)

Technical Evaluation: BULLISH (since Feb. 2010)

4 STARS = BUY

Three Months

Ago

0

1

3

0

0

Bigcharts.com netadvantage.standardandpoors.com google.com/finance/ yahoo.com/finance/

Sources