here

advertisement

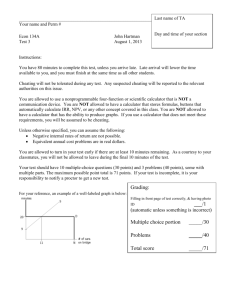

Last name of TA ________________________________________________________________ Your name and Perm # Econ 134A Test 3 John Hartman August 1, 2013 Day and time of your section Instructions: You have 80 minutes to complete this test, unless you arrive late. Late arrival will lower the time available to you, and you must finish at the same time as all other students. Cheating will not be tolerated during any test. Any suspected cheating will be reported to the relevant authorities on this issue. You are allowed to use a nonprogrammable four-function or scientific calculator that is NOT a communication device. You are NOT allowed to have a calculator that stores formulas, buttons that automatically calculate IRR, NPV, or any other concept covered in this class. You are NOT allowed to have a calculator that has the ability to produce graphs. If you use a calculator that does not meet these requirements, you will be assumed to be cheating. Unless otherwise specified, you can assume the following: Negative internal rates of return are not possible. Equivalent annual cost problems are in real dollars. You are allowed to turn in your test early if there are at least 10 minutes remaining. As a courtesy to your classmates, you will not be allowed to leave during the final 10 minutes of the test. Your test should have 10 multiple-choice questions (30 points) and 3 problems (40 points), some with multiple parts. The maximum possible point total is 71 points. If your test is incomplete, it is your responsibility to notify a proctor to get a new test. Grading: For your reference, an example of a well-labeled graph is below: Filling in front page of test correctly, & having photo ID ___/1 (automatic unless something is incorrect) Multiple choice portion _____/30 Problems _____/40 Total score _____/71 MULTIPLE CHOICE: Answer the following questions on your scantron. Each correct answer is worth 3 points. All incorrect or blank answers are worth 0 points. If there is an answer that does not exactly match the correct answer, choose the closest answer. 1. If the annual inflation rate is 5%, what is the exact nominal interest rate if the real interest rate is r? A. 5% + r B. 5% + r + r2 C. 5% + r + 0.5r2 D. 5% + r + 0.05r E. 5% + r + 0.5r Nominal = R and inflation = i: 1 + R = (1 + r)(1 + i) = (1 + r)(1.05) = 1.05 + 1.05r => 1 + R = 1.05 + r + 0.05r => R = 0.05 + r + 0.05r = 5% + r + 0.05r 2. The expected return on a security is 9%. The risk-free rate is assumed to be 4%. The expected return on the market is 6%. Use the capital asset pricing model (CAPM) to determine the beta of this security. A. 0.75 B. 1 C. 1.5 D. 2.5 E. 4.5 0.09 = 0.04 + beta*(0.06 – 0.04) => beta = 2.5 3. A stock is currently valued at $60, which is the correct current value. Today, news is revealed in which the new correct value of the stock should be 10% higher. However, the price of the stock increases to $70 today, and the value slowly decreases over the next few days until the new correct value is reached. This is an example of… A. Efficient market response to new information B. Overreaction and reversion C. Slow response D. A random walk similar to the Halloween night example shown in class E. None of the above Overreaction and Reversion. See Fig 14.1, p. 438 (10th edition of Ross, Westerfield and Jaffe). 4. A stock pays $9 every six months, starting nine months from today. If the stated annual interest rate is 12%, compounded every three months, what is the present value of the stock’s payments? A. $143 B. $146 C. $148 D. $150 E. $152 Interest rate for 3 months = 0.12/4 = 3 % Interest rate for 6 months = (1.03)^2 – 1 = 6.09 % Present value of payments = (9/0.0609) / 1.03 = 143.48 5. Lucky Seventy Jeans needs to buy a new production machine due to increased sales. The machine costs $60,000 (which must be paid today) and lasts for 10 years. Two maintenance expenses must be paid. The first will be in 5 years, at a cost of $6,000. The second will be paid in 8 years, at a cost of $15,000. What is the equivalent annual cost of this machine if the effective annual interest rate is 9%? A. $8,000 B. $9,000 C. $10,000 D. $11,000 E. $12,000 PV of cost = 60,000 + 6,000/(1.09^5) + 15,000/(1.09^8) = 71,427.58 EAC: 71,427.58 = (C/0.09) * (1 – 1/1.09^10) C = 11,129.85 6. Arianne currently is set to receive 24 payments of $10,000, starting one year from today. Given her discount rate, the current annuity factor of this annuity is 10.5288. If she were set to receive 25 payments, the annuity factor would increase to 10.6748. What is the present value of a $10,000 payment to Arianne paid 25 years from today? A. $21 B. $1,500 C. $2,000 D. $4,000 E. $6,000 The annuity factors will allow us to solve for the EAR. The PV of the 25th payment, which is made 25 years from now equals the difference of the two annuities, PV of 25th payment = 10,000 (10.6748 – 10.5288) = 1,460 [Note: We can use this PV to solve for the EAR if we needed to: 10,000/(1 + r)^25 = 1,460 r = 8.000%. Present value of a $ 10,000 payment made 25 years from now: 10,000/ (1.08000^25) = 1,460.] 7. A bond has a face value of $500. This bond has an unusual payout policy. The bond pays a 30% coupon each of the next 8 years, starting one year from today. Nine years from today, no coupon is paid but twice the face value is paid to the bondholder. How much is the bond currently worth if the effective annual discount rate is 5%? A. $2,500 B. $2,000 C. $1,800 D. $1,600 E. $1,500 Price of bond = 150/0.05 (1 – 1/1.05^8) + 1000/(1.05^9) = 1614.09 8. Joe Blockersfield has just purchased a house. The purchase price is $500,000, and Joe is taking out a loan for 80% of the house’s price. He is paying the loan back with 30 yearly payments, and the equal principal reduction each year. How much will the first payment be if the effective annual interest rate is 7%? A. $32,000 B. $34,000 C. $37,000 D. $39,000 E. $41,000 Loan size = 0.80 * 500,000 = 400,000 Principal payments each year = 400,000/30 = 13,333.33 First payment if EAR = 7% is: 13,333.33 + 400,000 * 0.07 = 41,333.33 9. Which statement is always true? A. Invest in any project that has a NPV > 0 B. Invest in any project with a PI > 1 C. Invest in any project with an effective annual discount rate less than the IRR D. Invest in any project which is most favorable using the undiscounted payback period method E. When faced with only two mutually exclusive projects to invest in, invest in the larger project if the incremental IRR is positive and enough money is available to invest in the larger project A and B are not true if there are monetary constraints C is not always true because NPV maybe negative when r < IRR (see project B in Fig 5.5, p. 146, 10th ed.) D is not always true because the payback period method does not typically maximize NPV E is always true because the NPV always increases 10. A bond has a par value of $5,000. It will pay a 5% coupon each of the next 14 years, starting one year from today. The bond will mature 14 years from today and pay back the par value. If the bond is currently selling for $5,000, what is the effective annual discount rate of the bond? A. 4% B. 5% C. 6% D. 7% E. 8% Must be 5 % because the bond sells at par For the following problems, you will need to write out the solution. You must show all work to receive credit. Each problem (or part of problem) shows the maximum point value. Provide at least four significant digits to each answer or you may not receive full credit for a correct solution. Show all work in order to receive credit. You will receive partial credit for incorrect solutions in some instances. Clearly circle your answer(s) or else you may not receive full credit for a complete and correct solution. 1. Negreanu’s Noodles stock currently sells for $80 per share. The effective annual discount rate for all parts of the problem below can be assumed to be 10%. (a) (6 points) For parts (a) and (b), also assume that the stock will change in value 6 months from today, 18 months from today, and 30 months from today. Each time the value changes, it goes up by $4 with 50% probability, and goes down by $2 with 50% probability. What is the present value of a European call option with an exercise price of $81 per share and an expiration date 36 months from today? The price is the expected discounted value of its payoffs. The call option’s payoff is zero in four out of the eight possible states; it is so because the stock price in these states is less than $81, the strike price of the option. If the state of the world is UUU, where U stands for the price going up by $4, then the price of the stock is $92 and the option’s payoff is $92 - $81 = $11. If the state of the world is UUD, DUU, UDU, then the price of the stock is $86 and the option’s payoff is $86 – $81 = $5. The probability of each of these four states of the world is 0.5^3. So price of the option = (0.5^3 * 11 + 3 * 0.5^3 * 5)/(1.10^3) = 2.44178, where the numerator is the expected value of the payoffs and the denominator discounts the payoff back 3 years using the EAR of 10%, which is given to us. (b) (6 points) What is the present value of a European put option with an exercise price of $83 and an expiration date 24 months from today? A put option pays when the price of the stock is less than the strike price of the option. Since the option expires 24 months from now, the stock only experience two out of the three price movements. So the stock price 24 months from now is $88, $82, or $76 with probability 0.5^2, 2 * 0.5^2, 0.5^2 respectively. Since the strike price of the put option is $83, its payoff is $1 when the stock price is $82 and $7 when the stock price is $76. So price of the option = (2 * 0.5^2 * 1 + 0.5^2 * 7)/(1.10^2) = 1.8595, where the numerator is the expected value of the payoffs and the denominator discounts the payoff back 2 years at 10 %. (c) (8 points) Suppose that Daniel buys one share of a stock at a price at $80 today, and one European put option with an exercise price of $120. The option expires twelve months from today. Draw a well-labeled graph that shows the present value of a combination of the share of stock and the put option as a function of the value of a single share of stock at the put option’s expiration date. The vertical intercept should have the value of the combination of the share of stock and the put option. The horizontal intercept should have the value of a single share of stock at the option’s expiration date. Make sure to label your intercepts and other relevant numbers on each axis, where relevant. (Hint: You may want to look at the front page of the test to see a well-labeled graph.) Please note that you need to justify the labels for the graph you provide. Please provide an explanation wherever necessary. Various explanations are acceptable. Some things to note: (1) If the value of the stock is less than $120 on the expiration date, then the value of the put and stock add up to exactly $120. Once it is discounted by 10%, you get $109.09. (2) For every dollar in value over $120 that the stock reaches, $1 in value is obtained from the stock with no change in the value of the put. Again, divide by 1.1 to get a slope of 0.9091. 2. (8 points) Destination Duffle Bags stock currently has an expected rate of return of 8%. Bonds that are issued by the same company have a 4% rate of return. Currently, the total value of stocks and bonds is $100,000, with 60% of the company’s value currently in stocks. If the company issues an additional $10,000 in bonds and uses this money to pay off stockholders, what is the new expected rate of return to stockholders after the stockholders are paid? Use MM Proposition II to answer this question, and you can assume that the rate of return on bonds does not change. You can also assume that the entire value of the company is through stocks and bonds. WACC = S/(B+S) * (Expected return on stock) + B/(B+S) * (Expected return on bonds) = 0.6 * 0.08 + 0.4 * 0.04 = 6.4 % Let R denote the new return on stocks. After the stock buyback, the ratio S/(B + S) changes to 0.5. The new required return on stock is 6.4 % = 0.5 * R + 0.5 * 0.04 => R = 8.8 % 3. (12 points) There are 3 known states of the world, high, medium, and low, each with one third probability. Conglomerates Anonymous has a rate of return of 2% during the low state, 10% during the medium state, and 12% during the high state. Special Spade Cards has a rate of return of 5% in the low state, 6% in the medium state, and 7% in the high state. What is the standard deviation of a portfolio consisting of 25% of Conglomerates Anonymous and 75% Special Spade Cards. (Note: This requires many steps. So please make sure it is clear to the grader each step of your work.) Expected return of CA = (0.02 + 0.10 + 0.12)/3 = 0.08 Expected return of SSC = (0.05 + 0.06 + 0.07)/3 = 0.06 Var(CA) = [(0.02 – 0.08)^2 + (0.10 – 0.08)^2 + (0.12 – 0.08)^2]/3 = 0.00186667 Var(SSC) = [(0.05 – 0.06)^2 + (0.06 – 0.06)^2 + (0.07 – 0.06)^2]/3 = 0.00006667 Covar = [(0.02 – 0.08) (0.05 – 0.06) + (0.10 – 0.08) (0.06 – 0.06) + (0.12 – 0.08) (0.07 – 0.06)]/3 = 0.00033333 Variance of portfolio = 0.25^2 * 0.00186667 + 0.75^2 * 0.00006667 + 2 * 0.25 * 0.75 * 0.00033333 = 0.0002791675 Standard deviation of portfolio = 1.67083 %