Exercise 2 - WordPress.com

advertisement

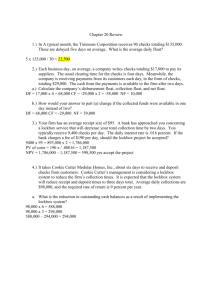

Exercise: 2 Managing cash Inflows And Outflows Computation of Float Q.1: Clearwater Glass Company (CGC) examined its cash management policy and found that it takes an average of five days for checks that the company writes to reach its bank and thus be deducted from its checking account balance-that is, disbursement delay, or float, is five days. On the other hand, it is an average of four days from the time CGC receives payments from its customers until the funds are available for use at the bank-that is, collection delay, or float, is four days. On an average, CGC writes checks that total Taka 70,000, and it receives checks from customers that total Taka 80,000. Required: (a) Compute the disbursement float, collection float, and net float in Taka. (b) If the CGC has an opportunity cost equal to 10%, how much would it be willing to spend each year to reduce collection delay (float) by two days? (Hint: Assume any funds that are freed up will be invested at 10% annually). Answers: a. Disbursement float = 5 days x $70,000 = $350,000 Collection float = 4 days x $80,000 = $320,000 Net float = Disbursement float - Collection float = $350,000 - $320,000 = $30,000 b. Two days of collection float = 2 days x $80,000 = $160,000 Opportunity savings = $160,000(0.10) = $16,000, which is the amount Clearwater would be willing to spend to reduce collection float by two days. Cash Management Q.2: INTEGRATIVE PROBLEMS RAY SMITH, A RETIRED LIBRARIAN, RECENTLY OPENED A SPORTSMAN’S SHOP CALLED SMITTY’S SPORTS PARADISE (SSP). SMITH DECIDED AT AGE 62 THAT HE WASN’T QUITE READY TO STAY AT HOME, LIVING THE LIFE OF LEISURE. IT HAD ALWAYS BEEN HIS DREAM TO OPEN AN OUTDOOR SPORTSMAN’S SHOP, SO HIS FRIENDS CONVINCED HIM TO GO AHEAD. BECAUSE SMITH’S EDUCATIONAL BACKGROUND WAS IN LITERATURE AND NOT IN BUSINESS, HE HIRED YOU, A FINANCE EXPERT, TO HELP HIM WITH THE STORE’S CASH MANAGEMENT. SMITH IS VERY EAGER TO LEARN, SO HE ASKED YOU TO DEVELOP A SET OF QUESTIONS TO HELP HIM UNDERSTAND CASH MANAGEMENT. NOW ANSWER THE FOLLOWING QUESTIONS: A. WHAT IS THE GOAL OF CASH MANAGEMENT? ANSWER: Because cash is a nonearning asset, the goal of cash management is to reduce the amount of cash held to the minimum necessary to conduct business. B. FOR WHAT REASONS DO FIRMS HOLD CASH? ANSWER: Firms hold cash for routine payments and collections. These cash balances are known as transactions balances. Firms also hold cash for compensation to banks for providing loans and services. These cash balances are known as compensating balances. C. WHAT IS MEANT BY THE TERMS PRECAUTIONARY AND SPECULATIVE BALANCES? ANSWER: A precautionary balance is cash held in reserve for random, unforeseen fluctuations in inflows and outflows. It is a safety stock, and the less predictable the firm's cash flows, the larger the balance should be. Speculative balances are held to enable a firm to take advantage of any bargain purchases that might arise. D. WHAT ARE SOME SPECIFIC ADVANTAGES FOR A FIRM HOLDING ADEQUATE CASH BALANCES? ANSWER: Sound working capital management requires an ample supply of cash so: (1) A firm has sufficient cash to take trade discounts, discounts that suppliers offer customers for paying their bills promptly. (2) A firm can maintain its credit rating. (3) A firm can take advantage of favorable business opportunities. (4) A firm can meet emergencies. E. HOW CAN A FIRM SYNCHRONIZE ITS CASH FLOWS, AND WHAT GOOD WOULD THIS DO? ANSWER: A firm can synchronize its cash flows by arranging to bill customers and to pay their own bills on regular “billing cycles” throughout the month. Synchronized cash flows reduce the cash balances, decrease required bank loans, lower interest expenses, and boost profits. F. YOU HAVE BEEN GOING THROUGH THE STORE’S CHECKBOOK AND BANK BALANCES. IN THE PROCESS, YOU DISCOVERED THAT SSP, ON AVERAGE, WRITES CHECKS IN THE AMOUNT OF $10,000 EACH DAY AND THAT IT TAKES ABOUT FIVE DAYS FOR THESE CHECKS TO CLEAR. ALSO, THE FIRM RECEIVES CHECKS IN THE AMOUNT OF $10,000 DAILY, BUT LOSES FOUR DAYS WHILE THEY ARE BEING DEPOSITED AND CLEARED. WHAT IS THE FIRM’S DISBURSEMENT FLOAT, COLLECTIONS FLOAT, AND NET FLOAT? ANSWER: SSP’s disbursement float is the amount of funds tied up in checks that have been written but are still in process and have not yet been deducted from the store's checking account balance by the bank. SSP’s disbursement float is $50,000 and is calculated as 5 days x $10,000. Collections float is the time it takes to deposit checks that have been received by the firm, and for the bank to process them and credit the firm's account with “good” funds. SSP’s collections float is $40,000 and is calculated as 4 days x $10,000. Net float is the difference between disbursement float and collections float. SSP’s net float is $10,000 and is calculated as $50,000 ─ $40,000; thus, SSP has positive net float. This means the store is able to collect checks written to pay for products, and get the use of money, relatively rapidly. G. HOW CAN A FIRM DISBURSEMENTS? SPEED UP COLLECTIONS AND SLOW DOWN ANSWER: To speed up collections, a lockbox plan can be used. A firm arranges to have its customers send payments to post office boxes in local areas. A local bank picks up the checks, has them cleared in the local area, and then transfers the funds by wire to the company’s concentration bank. This is not a practical solution for Smith because he only has one shop. To speed up his collections, he needs to concentrate on recording them as soon as they come in each day and making a bank deposit daily. To slow down disbursements, many firms write checks on banks located in distant cities. Another method would be to use drafts. A draft must be transmitted to the issuer, who approves it and deposits funds to cover it, and then it can be collected. Again, neither of these methods is effective for Smith; however, he can wait until the due date to pay his bills. H. WHY WOULD A FIRM HOLD MARKETABLE SECURITIES? ANSWER: Marketable securities can be held as a substitute for cash balances and as a temporary investment. Temporary investments in marketable securities occur because: (1) the firm must finance seasonal or cyclical operations, (2) the firm must meet some known financial requirements, and (3) the firm has just sold long-term securities. I. WHAT FACTORS SHOULD A FIRM CONSIDER IN BUILDING ITS MARKETABLE SECURITIES PORTFOLIO? WHAT ARE SOME SECURITIES THAT SHOULD AND SHOULD NOT BE HELD? ANSWER: When selecting marketable securities for a portfolio one must consider default risk, interest rate risk, purchasing power risk, liquidity, or marketability, risk, and returns on securities. Some securities that are suitable to hold as near-cash reserves are: U.S. Treasury bills, commercial paper, negotiable certificates of deposit (CDs) of U.S. banks, money market mutual funds, floating rate preferred stock mutual funds, and eurodollar market time deposits. Some securities that are not suitable to hold as near-cash reserves are: U.S. Treasury notes and bonds, corporate bonds, state and local government bonds, preferred stocks, common stocks of other corporations, and the firm’s own common stock. Lockbox System Q.3: Durst Corporation began operations five years ago as a small firm serving customers in the Area ABC. However, its reputation and market area grew quickly so that today Durst has customers throughout the country. Despite its board customer base, Durst has maintained its headquarters in Dhaka and keeps its central billing system there. Durst’s management is considering an alternative collection procedure to reduce its mail time and processing float. On average, it takes five days from the time customers mail payments until Durst is able to receive, process, and deposit them. Durst would like to set up a lockbox collection system, which it estimates would reduce the time lag from customer mailing to deposit by three days-bringing it down two days. Durst receives an average of Taka 1,400,000 in payment per day. Required (a) How many days of collection float now exist (Durt’s customers’ disbursement float) and what would it be under the lockbox system? What reduction in cash balance could Durst achieve by initiating the lockbox system? (b) If Durst has an opportunity cost of 10%, how much is the lockbox system worth on an annual basis? (c) What is the maximum monthly charge Durst should pay for the lockbox system? a. Presently, Durst has five days of collection float; under the lockbox system, this would drop to two days. $1,400,000 x 5 days = $7,000,000 $1,400,000 x 2 days = 2,800,000 $4,200,000 = amount freed up by reducing float b. 0.10($4,200,000) = $420,000 = the value of the lockbox system on an annual basis. c. $420,000/12 = $35,000 = maximum monthly charge Durst can pay for the lockbox system