Balances - Treasury Management Association of New York

advertisement

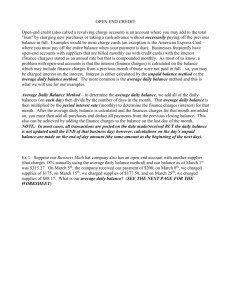

Bank Fee Analysis and Billing Everything is Changing TMANY June, 2011 OPEN SOLUTIONS WEILAND FINANCIAL GROUP TODAY’S PRESENTERS STEVE WEILAND Founder & VP Strategic Development The Weiland Financial Group A Division of Open Solutions Inc Principal contributor • ANSI X12 822 • TWIST BSB Principal author • AFP Guide to Account Analysis: Statement Standards and Transaction Set 822 Implementation Guide • BSB Requirements Document Contact Information • Stephen.Weiland@OpenSolutons.com • +1 847-810-6120 1 of 55 www.opensolutions.com www.weiland-wfg.com TODAY’S PRESENTERS BRIDGET MEYER Independent Bank Account Relationship Management Consultant Technical Consultant and Author • 2008 version of the AFP Service Codes • New Global Services Codes Product Manager of the AFP Accredited Services Provider Program Former Financial Program Specialist with the US Treasury Dept, FMS Contact Information • Bridgetmeyer@embarqmail.com • 281-802-1139 2 of 55 www.opensolutions.com www.weiland-wfg.com BANK FEE ANALYSIS AND BILLING EVERYTHING IS CHANGING First Things First Change: Balance Considerations Change: Service Considerations Growing: Electronic Statement Usage New: eBAM, Get Ready 3 of 55 www.opensolutions.com www.weiland-wfg.com BANK FEE ANALYSIS AND BILLING EVERYTHING IS CHANGING First Things First • Account Analysis – Why examine it, who cares? • Account Analysis – What is it? • Elements of Account Analysis • The Change Drivers Change: Balance Considerations Change: Service Considerations Growing: Electronic Statement Usage New: eBAM, Get Ready 4 of 55 www.opensolutions.com www.weiland-wfg.com WHY EXAMINE IT, WHO CARES? REASONS TO EXAMINE BANK CHARGES & BALANCES Cost Control • Reduce bank fees, optimize balances • Eliminate pricing errors, invalid services, bad volumes, closed accounts, redundant services • Allocate costs to departments • Compare prices by bank and benchmarks Investments • Maximize return on investable balances • Track balances, offset fees, & invest the rest or fund other activities Compliance • Bank fees and balances merit oversight and transparency • SOX argues for bank fee and balance control and reporting Metrics • Your bank statements provide tremendous insight into your treasury operation • What divisions/departments are using what services and at what cost? • Is our service usage (volume) increasing or decreasing? Why? • What should we budget for the coming year? • Which bank offers the best prices? 5 of 55 www.opensolutions.com www.weiland-wfg.com ACCOUNT ANALYSIS – WHAT IS IT? A WAY TO SAVE MONEY & SO MUCH MORE A bill for services rendered A marvelous record of balances and services A weighing process For some…a flat out mystery 6 of 55 www.opensolutions.com www.weiland-wfg.com ACCOUNT ANALYSIS – WHAT IS IT? A WEIGHING PROCESS - Traditionally Balances Services 7 of 55 www.opensolutions.com www.weiland-wfg.com ACCOUNT ANALYSIS – WHAT IS IT? A WEIGHING PROCESS -> Profit To The Bank Services $7,000 Balances $10,000 EC 8 of 55 www.opensolutions.com www.weiland-wfg.com ACCOUNT ANALYSIS – WHAT IS IT? A WEIGHING PROCESS -> You pay $3,000 Balances $7,000 EC Services $10,000 9 of 55 www.opensolutions.com www.weiland-wfg.com ACCOUNT ANALYSIS – WHAT IS IT? A WEIGHING PROCESS -> Break Even Balances $7,000 EC Services $7,000 10 of 55 www.opensolutions.com www.weiland-wfg.com ELEMENTS OF ACCOUNT ANALYSIS CALCULATE THE BALANCE ON WHICH THE EC IS BASED Balances Average Daily Ledger Balance $250,000 Less Float 50,000 Average Daily Collected Balance 200,000 Less Reserve Requirement (10%) 20,000 Balance to Support Services 180,000 11 of 55 ???? ???? ???? www.opensolutions.com www.weiland-wfg.com ELEMENTS OF ACCOUNT ANALYSIS LIST AND TOTAL ALL PERIOD SERVICE CHARGES Services SERVICES RENDERED.... VOLUME Collected Balance OD 8,000 FDIC Premium/Thou 250 Monthly Maintenance 1 Deposit Items 1,000 PRICE CHARGE 6.00% 40.77H .06 15,00H 30.00 30.00 .10 100.00 ----Total Charges Before Credit 185.77 Compensable Subtotal 130.00 Hard Charge Subtotal (H) 55.77 12 of 55 BALANCE ???? ???? 40,000 133,333 -----173,333 173,333 www.opensolutions.com www.weiland-wfg.com ELEMENTS OF ACCOUNT ANALYSIS ESTABLISH THE COMPENSATION POSITION ACCOUNT POSITION....... Earnings at 1.0% Less Compensable Charges Earnings Excess Hard Charges (H) Total Due ???? 13 of 55 ..FEES 150.00 130.00 20.00 BALANCES 180,000 173,333 6,667 55.77 55.77 www.opensolutions.com www.weiland-wfg.com THE CHANGE DRIVERS REGULATION, GLOBALIZATION, TECHNOLOGY Reg Q – Glass Steagall Act, 1933 Reg CC – Expedited Funds Availability Act, 1987 822 – The US Electronic Analysis Statement, 1991 Check 21 Act, 2004 Electronic Services – New, imaging vs paper BSB - The Global Electronic Billing Statement, Oct 2006 FSRR - Financial Services Regulatory Relief Act, Oct 2008 TAG – Transaction Account Guarantee, part of TLGP, Nov 2008 & Aug 2009 Dodd-Frank Wall Street Reform and Consumer Protection Act, July 2010 eBAM – Electronic Bank Account Management, Now 14 of 55 www.opensolutions.com www.weiland-wfg.com BANK FEE ANALYSIS AND BILLING EVERYTHING IS CHANGING First Things First Change: Balance Considerations • Some examples • Interest on reserves • Overdraft charge base balances • Dodd-Frank & hard interest • Tiered earnings credit rates Change: Service Considerations Growing: Electronic Statement Usage New: eBAM, Get Ready 15 of 55 www.opensolutions.com www.weiland-wfg.com BALANCE CONSIDERATIONS SOME EXAMPLES We’ll start with the classic analysis statement balance presentation and earnings credit calculation Net Collected Positive Average Ledger Balance $250,000 Less Float/Holds 50,000 Average Collected Balance 200,000 Less Reserves (10%) 20,000 Balance to Support Services 180,000 Earned Credit at 1.0% 150 Net Collected Reduce Float Net Collected Reduce Float No Reserves $250,000 20,000 230,000 23,000 207,000 $250,000 $250,000 20,000 20,000 240,000 230,000 0 0 240,000 230,000 173 192 Pos Collected Reduce Float No Reserves 200 A net increase in Earned Credit of $50, or 33% 16 of 55 www.opensolutions.com www.weiland-wfg.com BALANCE CONSIDERATIONS INTEREST ON RESERVES, THE FSRR ACT OF 2006 Effective date moved from Oct 1, 2011, to Oct 1, 2008 Authorizes interest payments on funds maintained at the Fed • On Required Reserves: average targeted Fed funds rate less 10 points • On Excess Reserves: lowest targeted Fed funds rate less 75 points • On Clearing Balances: implicit earnings credit against Fed services Depository institutions not required to pass along interest to their customers Reg Q will no longer prevent explicit interest payments to DDA accounts How (and will) corporate checking accounts benefit? 17 of 55 www.opensolutions.com www.weiland-wfg.com BALANCE CONSIDERATIONS INTEREST ON RESERVES: BANK RESPONSES Average Daily Ledger Balance Less Float Average Daily Collected Balance Less Reserve Requirement (10%) Balance to Support Services NIF Earnings at 1.0% = 150.00 $250,000 50,000 200,000 20,000 180,000 180,000 Average Daily Ledger Balance Less Float Average Daily Collected Balance NIF Earnings at 1.0% = 166.67 $250,000 50,000 200,000 200,000 Eliminate reserves with same rate of 1.0% 200,000 Eliminate reserves with reduced rate of 0.9% $250,000 50,000 200,000 20,000 180,000 180,000 20,000 Reserve reduction with ECR of 1.0% and earnings on reserves at 10 points less than the Fed Funds rate of 2.0% NIF Earnings at 0.9% = 150.00 Average Daily Ledger Balance Less Float Average Daily Collected Balance Less Reserve Requirement (10%) Balance to Support Services NIF Earnings at 1.0% = 150.00 Reserves Earnings at 1.9% = 31.67 181.67 18 of 55 Classic Approach Reserve reduction with ECR of 1.0% New Approaches www.opensolutions.com www.weiland-wfg.com BALANCE CONSIDERATIONS OVERDRAFT CHARGE BASE BALANCES Example Assumptions: 30 day month Ending OD balance on day one: (300,000) Ending balance on each of the other 29 days: 248,275.86 Aggregate Balance Results: Average Balance Results: Positive: 29 * 248,275.86 = 7,200,000 Positive: 7,200,000 / 30 = 240,000 Negative: 1 * (300,000) = (300,000) Negative: (300,000) / 30 = (10,000) Net: = 6,900,000 Net: 6,900,000 / 30 = 19 of 55 230,000 Charge No Charge www.opensolutions.com www.weiland-wfg.com BALANCE CONSIDERATIONS DODD-FRANK & HARD INTEREST: July 2011,Bank Responses Option 1: No change. “Soft” earnings credit only • Earnings credit rates usually lower than hard interest rates • Reserve requirement might reduce effective rate • Credit not taxable • Charges offset by soft credit cannot be expensed Option 2: “Hard” interest only, pay with dollars • Hard interest rates usually higher than earnings credits rates • Credit is taxable • Charges can be expensed Option 3: Hybrid combination of “Soft” credit and “Hard” interest • Soft credits offset fees, hard interest earned on excess balances • Earnings credit not taxable while hard interest is • Reserve requirement rate may be a factor • Charges offset by soft credit cannot be expensed 20 of 55 www.opensolutions.com www.weiland-wfg.com BALANCE CONSIDERATIONS TIERED EARNINGS CREDIT RATES No tiering. Any and all balances at the same ECR. ACCOUNT POSITION....... Earnings at 1.0% Less Compensable Charges Compensable Charges due Total Due ..FEES .BALANCES 150.00 180,000 173.77 231,693 (23.77) (51,693) 23.77 21 of 55 www.opensolutions.com www.weiland-wfg.com BALANCE CONSIDERATIONS TIERED EARNINGS CREDIT RATES Tiering in effect. Balances over 100K earn at a higher rate. ACCOUNT POSITION....... ..FEES Earnings at 1.5% 225.00 Less Compensable Charges 173.77 Earnings Excess 51.23 Excess .BALANCES 180,000 154,461 32,739 51.23 There were charges due. Now there is an excess. Note: Tiering (on what balance?) can also be used to establish the hard credit interest rate. 22 of 55 www.opensolutions.com www.weiland-wfg.com BANK FEE ANALYSIS AND BILLING EVERYTHING IS CHANGING First Things First Change: Balance Considerations Change: Service Considerations • DODD-FRANK & FDIC fees • Hard Charged vs Balance Compensable • Bargaining: volume discounts Growing: Electronic Statement Usage New: eBAM, Get Ready 23 of 55 www.opensolutions.com www.weiland-wfg.com SERVICE CONSIDERATIONS DODD-FRANK & FDIC FEES Prelude: Transaction Account Guarantee Program (TAGP) • Part of Temporary Liquidity Guarantee Program approved 11/21/08 (12 CFR 370) • Guarantees non-interest bearing deposit accounts over $250,000 without limit • Bank’s TAG fee based on risk category and non-interest balances exceeding $250,000 • Termination Date: December 31, 2010 (third extension) • Dec 2009 one-time payment of 13 quarters’ fees & FDIC credit swaps Dodd-Frank Wall Street Reform & Consumer Protection Act • Singed into law July 21, 2010 (Public Law 111-203) • Unlimited coverage for non-interest accounts extended to December 31, 2012 – Unlike TAGP, participation is mandatory for all banks – Unlike TAGP, prohibits charging a separate premium for this increased coverage – Unlike TAGP, does not cover NOW accounts • Reserve ratio increased from 1.15 to 1.35 – 9/30/20 target – DIF is $20 Billion in the red as of June 2010 – Offset required for institutions with total consolidated assets of less than $20 billion – 1.5 cap lifted • Changes assessment base calculation from deposits to assets • Insurance coverage permanently raised from $100,000 to $250,000 for all accounts 24 of 55 www.opensolutions.com www.weiland-wfg.com SERVICE CONSIDERATIONS DODD-FRANK & FDIC FEES Experience shows a major increase in FDIC fees The FDIC is silent on how or if their fees are to be passed on to bank customers – are you paying a premium or receiving a discount? Impossible to tell if you are being penalized for your bank’s risky behavior Impossible to determine if you are paying your “fair share” Dodd-Frank makes assessing the price of extended coverage impossible Must compare the price of coverage per insured dollar across your banks 25 of 55 www.opensolutions.com www.weiland-wfg.com SERVICE CONSIDERATIONS HARD CHARGED VS BALANCE COMPENSABLE Two services are Hard Charged. No balance offset. What you see is what you pay SERVICES RENDERED.... VOLUME Collected Balance OD 10,000 FDIC Premium/Thou 250 Monthly Maintenance 1 Deposit Items 1,000 PRICE CHARGE 6.00% 50.00H .06 15,00H 30.00 30.00 .10 100.00 -----Earnings at 1% 150.00 Less Compensable Charges 130.00 -----Excess Earnings 20.00 Plus Hard Charge Subtotal (H) 65.00 Total Due 65.00 26 of 55 BALANCE 40,000 133,333 ------173,333 www.opensolutions.com www.weiland-wfg.com SERVICE CONSIDERATIONS HARD CHARGED VS BALANCE COMPENSABLE Change the two services to compensable and the charge can be offset by balances. SERVICES RENDERED.... VOLUME Collected Balance OD 10,000 FDIC Premium/Thou 250 Monthly Maintenance 1 Deposit Items 1,000 PRICE CHARGE BALANCE 6.00% 50.00H .06 15,00H 30.00 30.00 36,000 .10 100.00 120,000 ------ ------Earnings at 1% 150.00 Less Compensable Charges 130.00 156,000 -----Deficit Earnings 20.00 Plus Hard Charge Subtotal (H) 65.00 Total Due 65.00 CHARGE 50.00 15.00 30.00 100.00 -----150.00 195.00 -----45.00 .00 45.00 BALANCE 60,000 18,000 36,000 120,000 ------180,000 You saved $20.00 27 of 55 www.opensolutions.com www.weiland-wfg.com SERVICE CONSIDERATIONS BARGAINING: VOLUME DISCOUNTS No volume discount on high volume services SERVICES RENDERED.... VOLUME Collected Balance OD 10,000 FDIC Premium/Thou 250 Monthly Maintenance 1 Deposit Items 1,000 PRICE CHARGE 6.00% 50.00 .06 15,00 30.00 30.00 .10 100.00 -----Total Charges Before Credit 195.00 28 of 55 BALANCE 60,000 18,000 36,000 120,000 -----240,000 www.opensolutions.com www.weiland-wfg.com SERVICE CONSIDERATIONS BARGAINING: VOLUME DISCOUNTS Tiered pricing discount on high volume service SERVICES RENDERED.... VOLUME Collected Balance OD 10,000 FDIC Premium/Thou 250 Monthly Maintenance 1 Deposit Items 400 300 300 PRICE CHARGE 6.00% 50.00 .06 15,00 30.00 30.00 .10 40.00 .08 24.00 .06 18.00 -----Total Charges Before Credit 177.00 BALANCE 60,000 18,000 36,000 48,000 28,800 21,600 -----212,400 You saved $18.00 29 of 55 www.opensolutions.com www.weiland-wfg.com Time Out ! Analysis Information Overload? What Shall We Talk About? • • • • Cloning? Politics? Ethics, Morality, Religion, Dying? Sex 30 of 55 www.opensolutions.com www.weiland-wfg.com BANK FEE ANALYSIS AND BILLING EVERYTHING IS CHANGING First Things First Change: Balance Considerations Change: Service Considerations Growing: Electronic Statement Usage • What are the Electronic Statements? • What’s the purpose? • Who’s producing them? • AFP Code use, globalization, and trends New: eBAM, Get Ready! 31 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS YOUR OPTIONS ARE CHANGING 1. EDI Transaction Set 822 - Domestic 2. BSB – Global 3. WEB 32 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS WHAT’S THE PURPOSE? TO AUTOMATE REVIEW Gain faster delivery, accelerate payment Eliminate the paper, reduce statement charge Satisfy SOX and EU directives by examining all prices & charges Check all bank calculations (find errors) Check expected balances, volumes, prices Allocate bank charges automatically Perform modeling and “what if” scenarios Compare divisions, departments, regions, etc... Export data to existing systems ( GL, Budgeting, Payables ) Perform bank-to-bank comparisons Examine each and every line item charge and tax Analyze global fees in one common currency Archive statements electronically 33 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS 822 & BSB ELECTRONIC STATEMENT STANDARDS 822 BSB ANSI ASC (US) TWIST (Global) Format X12 Looping Format XML Balances Important – earnings credits, reserves Not required but desirable (No Reg Q) Compensation Yes – single currency Yes – multiple currencies Very important – AFP codes, balance required Very important – AFP codes optional, no balance required Taxes & Currencies NA Very Important Relationship Structure Yes Yes Adjustments Yes Yes Absolutely! Absolutely! Standards Body Services A Tool for Treasury? 34 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS WHAT SOFTWARE OPTIONS DO I HAVE? 822 BSB Over 800 corporations receive 822s using one of the four options: Approximately 30 corporations have begun receiving the BSB. Licensed Software Hosted Software Outsourced Analysis Proprietary Software Licensed Software Hosted Software Outsourced Analysis Spreadsheet analysis 35 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS BSB TWIST UPDATE TWIST and SWIFT have agreed to maintain the BSB standard jointly under the ISO 20022 umbrella. They are working together to: • Possibly extend BSB standard to enable electronic invoicing. • Complement BSB and eBAM standards to provide one comprehensive set of bank-customer administrative standards. • Publish a new global set of standard service codes through the AFP for use specifically with the BSB. 36 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS BSB DEVELOPMENT CHANGES Banks Offering BSB Countries Available Deutsche Bank 10 countries in Europe HSBC Canada Standard Chartered Middle East Bank of America Adding Europe, Asia, Canada, and Latin America in Q1 2011. Barclays Bank, BNP Paribas, Danske Bank, Citibank, and JP Morgan rolling out to additional regions *ISB/TWIST BSB –Fall 2010 Newsletter 37 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS AFP CODE USE AND GLOBALIZATION Since 1986, AFP Services Codes© have been recognized as the standard for identifying balances and charges that appear on account analysis statements and in responding to RFPs. Updated in 1997, 2004, 2008 CALL FOR VOLUNTEERS! Assigned by bank product managers Used to compare “apples to apples” across all bank relationships Global service code book in development 38 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS AFP CODE INFORMATION – HOW TO GET IT My bank sends me AFP codes but I don’t know what they mean. HOW DO I GAIN ACCESS TO THE AFP CODE DESCRIPTIONS AND SEARCH ENGINE? ASK YOUR BANK ASK YOUR SOFTWARE PROVIDER PURCHASE A YEARLY LICENSE FOR ONLINE ACCESS FROM AFP 39 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS AFP SERVICE CODE© STRUCTURE AFP codes are always a 6 character alphanumeric code. 00 Product Family 00 Product Group 0 Service Line 0 Service Detail 40 of 55 www.opensolutions.com 40 www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS AFP SERVICE CODE EXAMPLES Return Item Notification - Internet 10 Depository Services + 04 Return Items + 1 Return Item Notification – Automated+ 6 Internet = 100416 Wire Transfer Out Phone Repetitive 35 Wire and Other Funds Transfer Services + 02 Outgoing Fedwire Transfer – Manual + 00 Repetitive = 350200 41 of 55 www.opensolutions.com 41 www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS GLOBAL SERVICE CODES Coming Fall 2011 Domestic Codes Global Codes Length 6 digit alphanumeric 8 digit alphanumeric Level of detail High Moderate Compatibility 822, Web/Excel Only BSB Balance Codes Yes No Service Codes Yes Yes Accessible/Searchable online Yes Coming Accreditation/Mapping Services Yes Coming AFP will provide a mapping that links the Global to the Domestic codes for corporations who may use both. 42 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC BANK FEE ANALYSIS AFP CODE STANDARDIZATION TRENDS Global Interest Domestic Bank Analysis RFP Usage 43 of 55 www.opensolutions.com www.weiland-wfg.com ELECTRONIC STATEMENT USAGE AFP SERVICE CODES © ACCREDITED PROVIDER PROGRAM Increase standardization in reporting bank compensation by recognizing banks that are using the AFP Service Codes© consistently with the standard. •40% Accuracy Rate in assigning AFP codes – Why? •Banks continue to merge •Code mapped is a code frozen •Not properly trained •Fluid industry •What you can do. •Pay attention to your AFP codes •Not getting them? Ask for them •Ask your bank to become Accredited 44 of 55 44 www.opensolutions.com www.weiland-wfg.com BANK FEE ANALYSIS AND BILLING EVERYTHING IS CHANGING First Things First Change: Balance Considerations Change: Service Considerations Growing: Electronic Statement Usage New: eBAM, Get Ready! • What is BAM? • eBAM, Hanging the “e” on BAM • Combine eBAM with Electronic Statements for a completely e-relationship! 45 of 55 www.opensolutions.com www.weiland-wfg.com NEW: eBAM, GET READY! WHAT IS BAM? BANK ACCOUNT MANAGEMENT A single, globally accessible, centralized way to manage and control bank account data • Banks • Accounts • Signers and limits (mandates) • Bank contacts • Corporate structures • Account hierarchies • Audit trail (openings, modifications, closings) • Related documents A single “source of truth” for all bank account related questions • How many accounts do we have? How many did subsidiary X open last month? • Who are all of our signers? Do they all still work here? What are their limits? • How are our accounts related? Is our account structure efficient? • What happens if we change banks, merge, acquire a new company? Important for control (trapped cash, fraud), compliance (SOX), and cost (fees) 46 of 55 www.opensolutions.com www.weiland-wfg.com NEW: eBAM, GET READY! HANGING THE “e” ON BAM eBAM streamlines communication between corporations and banks • eBAM is an electronic XML messaging standard composed of 15 message types • ISO 20022 approved, maintained by SWIFT • No more need for paper, PDFs, faxes, or emails between you and your bank With eBAM, you will be able to electronically… • Open accounts • Perform account maintenance (change mandates, account details, etc.) • Close accounts eBAM significantly cuts down the time and resources spent in account management But before you can use eBAM – you need BAM! • How can you change a signer if you don’t know the account number, the bank it’s held at, who the current signer is, the person with the authority to change it, etc. • Plus, you need a BAM system that fully integrates with the eBAM standard to fully realize its automation benefits – otherwise eBAM data must be manually entered 47 of 55 www.opensolutions.com www.weiland-wfg.com EVERY SIGNER AND ACCOUNT IS A POINT OF EXPOSURE THAT MUST BE CONTROLLED Get on the Wagon! 48 of 55 www.opensolutions.com www.weiland-wfg.com WE’VE REACHED THE FINISH LINE! ANY QUESTIONS? Please give us your card if you want more information or a follow up call. 49 of 55 www.opensolutions.com www.weiland-wfg.com APPENDIX: BANK ACCOUNT RELATIONSHIP CONSIDERATIONS 50 of 55 www.opensolutions.com www.weiland-wfg.com ORGANIZATIONAL CONSIDERATIONS Do I have a comprehensive bank account management policy? How many accounts do I have? Where are they domiciled? Do I know all my accounts and account numbers held at each bank? What types of accounts are they? Can I easily get a list of all my disbursement accounts, collection accounts, custodial accounts? Is the account a member of a hierarchy? Is the account a relationship parent, a detail account or some level in between? Who are my signers? Who can sign an account as an individual or as part of an identified group? Are digital signatures allowed and controlled? What happens when signing authority is removed? Who are my account contacts? Who are my primary and secondary account bank contacts for each of my accounts? What are my signers’ signing limits? Are dollar limits established for each signer? How often do we run a bank audit and is it accurate? Is the required information current, reliable and easily sampled? How easy is it to import/export data to existing systems (GL, Budgeting, Payables, HR)? Should I be receiving electronic statements? Can I and should I receive and analyze the 822 and BSB electronic statements? Can I format all bank statements into a common format for ease of use, cross-bank reporting and comparison? Can I archive account statements electronically for analysis and review? Are controls in place so that account openings, closings and critical maintenance are performed in the proper sequence by the proper people with the required authorizations? Am I ready for eBAM? 51 of 55 www.opensolutions.com www.weiland-wfg.com COST CONTROL CONSIDERATIONS Do I have any unnecessary accounts or services? Are there more cost effective services available? Am I managing my bank charges? Am I recognizing pricing errors, invalid services, bad volumes, closed accounts, redundant services, etc.? Are my earnings rates competitive? Do they reflect the bank’s earnings on my reserve balances? Should I be paying bank service charges with balance earnings or with hard dollars? Can I allocate account costs to the relevant departments? Do I have a reliable system to detect, track and resolve bank pricing and charging errors? Do I have a way to score my satisfaction with the resolution of bank disputes to inform negotiations? Can I easily perform service price comparisons with other banks and benchmarks? Do I have enough historical account balance & charge information for informed and persuasive negotiations? Can I store statements electronically and eliminate paper statement fees and storage charges? Can I review the taxes levied on services & convert multiple currencies into a common currency for review? Can I reasonably forecast future account charges for budgeting purposes? Can I examine each and every line item charge on my analysis statements? Am I checking expected balances, expected volumes, and contracted prices? Have I established the most beneficial service charge calculations available from my banks? • Volume Discounts, Threshold Pricing, Tier Pricing • Balance-Based Tier Pricing (discounts based on collected balance tiers) • Fee-based (Hard Charged) versus Compensable • Base Charge plus Volume ($20 plus volume charge) • Min / Max Charge Limits (never less than and never more than) • Basket Pricing (chargeable volume equals sum of other volumes) • Waivers Based on Balance Levels • Percentage Discount on Charge Total 52 of 55 www.opensolutions.com www.weiland-wfg.com INVESTMENT CONSIDERATIONS Am I managing the investable balances in all my deposit accounts? Have I examined balance compensation versus fee compensation in order to free up balances? Am I tracking the average balances used to offset charges and then investing the remainder or using it to fund other activities? Am I in a short-term borrowing mode? If so, am I optimizing the use of my deposit account balances as the earnings “credit” earned from the bank will always be lower than the interest rate paid to the bank on borrowed funds? Will I be ready for the repeal of Reg Q and have the tools & data at my hands to decide which compensation approaches work best for my situation? 53 of 55 www.opensolutions.com www.weiland-wfg.com COMPLIANCE CONSIDERATIONS Am I properly overseeing my accounts, service charges, and balance usage? Am I able to report my service charges as an element of cost and demonstrate proper price management in compliance with SOX? Can I demonstrate proper account controls for • my banks, accounts, signers and related documents • all the processes involving them such as account openings, mandates and closings? Is my sensitive account data secure? SOX 302 Financial Statements • CEO and CFO certification required • Validation = complete inventory of accounts and balances (for cash, investments, etc.) SOX 404 Internal Control Framework • Auditors must certify that they have a framework • Auditors must certify that the framework will identify discrepancies and has been tested Are EU directives satisfied? 54 of 55 www.opensolutions.com www.weiland-wfg.com METRICS AND ANALYTICAL CONSIDERATIONS Do I have an easily accessible record of every service volume, price, and charge; every balance and earnings credit rate, for every account at all my banks going back months if not years? Am I analyzing the wealth of information contained in my bank account statements to gain transparency into my treasury operation, attain insights into my corporation’s business practices, and discover hidden saving opportunities? Do I compare division, department, or regional performance in terms of services used, service volumes, account costs, and balance usage? Do I perform modeling and “what if” scenarios to test different rate, balance level, volume, and pricing assumptions? Do I have confidence in my budgeting assumptions for the coming year? Are my service prices escalating? Are volumes increasing or decreasing? Are services not being used? Do I include bank pricing and charging mistakes/problems in my bank report cards? Do I document my conversations with my bankers and include these in my bank report cards? 55 of 55 60 www.opensolutions.com www.weiland-wfg.com Bank Fee Analysis and Billing Everything is Changing TMANY June, 2011 OPEN SOLUTIONS WEILAND FINANCIAL GROUP