hhw-ahkhan - KV AFS Memaura

advertisement

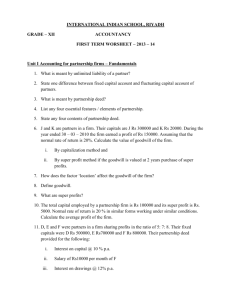

HOLIDAY HOMEWORK FORCLASS XII CCMMERCE SUBJECT- ACCOUNTANCY Q1. If partnership deed provides for payment of interest on partner’s loan, but does not specify the rate, what will be therate of interest on partner’s loan? Q.2.Under what circumstances the fixed capital of may changed? Q3.) P, Q and R are partners sharing profits and losses in the ratio of 5:3:2. From 1stJanuary, 2012, they decide to share profits and losses in equal proportion. The partnership deed provides that in the event of any changein profit sharing ratio, the goodwill should be valued at three years’ purchase of the average of five years’profits. The profits and losses of the preceding five years are: Profits :2007 - Rs. 60,000 2008 Rs. 1,50,000 2009 - Rs. 1,70,000 2010 - Rs. 1,90,000. Loss :2011 -Rs. 70,000. Give the necessary journal entry to record the above change. (3) Q4. X , Y & Z were partners in a firm sharing profits in the ratio of 3:2:1. After division of profits for the year ended 31.3.2011, their capitals were Rs.295000, Rs.330000 and Rs.335000.During the year they withdrewRs.40000 each for personal use. The profits of the year was Rs.180000.The partnership deed provided for interest on capital @10% p.a. ,interest on drawings to be charged @5%p.a. and salary to X Rs.6000 p.a. While preparing the final accounts, the above provisions were omitted to be recorded. Give the necessary adjustment 5.Y and Z are partners in a firm sharing profit and losses in the ratio of 5:3 with capitals of Rs.40000 and rs.30000 respectively. They withdrew from the firm the following amounts, for the personal use: Y Month May 31 , 2011 June 30, 2011 August 31st, 2011 November 1st, 2011 December 31st, 2011 January 31st, 2012 March 1st, 2012 At the beginning of each month st Z Rs. 1200 1000 2000 800 3000 600 1400 800 Calculate interest on drawings @ 6% p.a. for the year ended on March 31st, 2012. Q6. (a)Ajay, Vijay & Sanjay are partners in a firm sharing profits and losses in the ratio of 3:1:2. Vijay retires.After making all adjustments, the capital balances of Ajay, Vijay &Sanjay were Rs. 21,600, Rs. 17,800, & Rs. 5,600 respectively. Vijay was to be paid through cash, brought in by continuing partners in such a way as to make their capitals proportionate to their profit sharing ratio. Calculate theamount of cash brought in by continuing partners and givethe necessary entry for this. (b) M, N and O are partners in firm sharing profit and losses in the ratio of 3:2:5. N retires and on his retirement goodwill was estimated at Rs. 80000. Pass necessary journal entry. (2) Q7. Anil & Sunil were partners. The partnership deed provided for profits to be divided as Anil 1/2, Sunil 1/3 and 1/6 to be transferred to reserves; the accounts are closed on March 31 each year. In the event of death of a partner, the executors will be entitled to the following I) capital to the credit on the date of death II) interest on capital @ 12% p.a III) proportion of profit to the date of death based on the average profits of the preceding 3 years IV) share of goodwill based on 3 years purchase of average profits of the preceding 3 years. The following information is provided to you : Anil’s capital Rs. 80,000 ; Sunil’s capital Rs. 50,000 ; Reserves Rs. 30,000 ; cash Rs. 10,000 ; Investments Rs. 140,000; JLP(Policy amount Rs.80,000)-Rs.10,000 Sunil died on 30th September, 2010. The profits for the 3 preceding years wereRs. 48,000, Rs. 42,000 and Rs. 45,000. Pass necessary journal entries and calculate the balance due to Sunil’s executor. Metallic Ltd invited applications for issuing 18,000 shares of Rs.20 each at a premium of 10%. Rs.14 per share were payable on application (including premium) and the balance on allotment. Applications for 20,000 shares were received.Shares were allotted proportionately to all applicants.An applicant who was allotted 1,800 shares failed to pay the allotment money. His Q8.A and B share profits in the proportions of ¾ and ¼ .Their Balance Sheet on Dec.31,2010 was as follows: Balance Sheet (as on 31 Dec. 2010) LIABILITIES AMOUNT Sundry Creditors 41,500 Reserve Fund 4,000 Capitals Accounts A’s 30,000 B’s 16,000 46,000 ASSETS Cash at Bank Bills Receivable AMOUNT 26,500 3,000 Debtors 16,000 Stock 20,000 Fixtures 1,000 Land and Building 91,500 25,000 91,500 On Jan. 1,2011,C was admitted into partnership on the following terms : ( a)That C pays Rs.10,000 as his capital. (b)That C pays Rs.5,000 for goodwill. Half of this sum is to be withdrawn by A and B. (c)That Stock and Fixtures be reduced by 10% and a 5% provision for doubtful debt be created on Sundry Debtors and Bills Receivable. (d)That the value of land and building be appreciated by 20%. (e)There being a claim against the firm for damages, a liability to the extent of Rs.1,000 should be created. (f)An item of Rs. 650 included in sundry creditors is not likely to be claimed and hence should be writtenback. Prepare Revaluation Account, Partner’s Capital Account and the new Balance Sheet. 9.Sonu and Ashu sharing profits as 3:1 and they agree upon dissolution.The Balance Sheetas on March 31st,2010 is as under : Balance Sheet as on 31 March 2010 LIABILITIES AMOUNT(Rs.) ASSETS AMOUNT(Rs.) Loan 12,000 Cash at Bank 25,000 Creditors 18,000 Stock 45,000 Furniture 16,000 Debtors 70,000 Capitals: Sonu 1,10,000 Ashu 68,000 1,78,000 2,08,000 Plant and Machinery 52,000 2,08,000 Sonu took over plant and machinery at an agreed value of Rs.60,000.Stock and furniture were sold for Rs.42,000 and Rs. 12,000 respectively. Debtors were took over by Ashu at Rs.69,000. Creditors were paid subject to discount of Rs.900. Sonu agrees to pay the loans. Realisation expenses were Rs.1,600. Prepare Realisation Account, Bank account and Capital accounts of all the partners.