Holiday Hw

advertisement

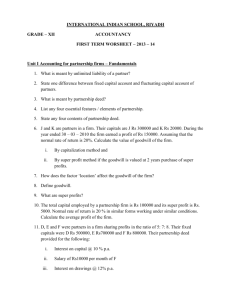

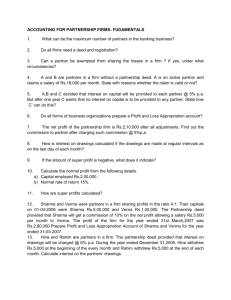

Holiday Home work – Business Studies 1. In order to be successful an organization must change its goals according to the needs of the environment. Which characteristic of management are highlighted in this statement? 2. To meet the objectives of the firm management of A Ltd offers employment to physically challenged persons. Identify the organizational objectives it is trying to achieve. 3. Bhavan is the manager of northern division of a large corporate house. At what level does he work in the organization? What are his basic functions? 4. Name that intangible force which creates productive relationshi among resources of an organization? 5. A petrol pump needs to be managed as much as a school or hospital. Which characteristic of management has been highlighted here? 6. Mr. Donalds, the fast food giant made major changes in its menu to be able to survive in the Indian market. Which characteristic of management has been highlighted here. 7. Your grandfather has retired as the director of a manufacturing Co. At what level of management was he working? What functions do you think he was performing at that level? State any four functions. 8. Ms. Anitha is associated with Fortune Ltd. She told you that her workers have good relations with her. At what level of management is she? 9. Name that intangible force which created productive relationship among resources of an organization. 10.There is no restriction in anyone being appointed or designated as a manager of any business enterprise. What aspect of management as a profession does this statement indicate? 11.Identifying and dividing the work is the first step in the process of one of the functions of management. Identify the function. 12.Grouping similar nature jobs into larger units called departments is the second step in the process of one of the functions of management. Identify the function. 13. Name the functions which reviews the operations in a business unit. 14. In an organization employees are happy and satisfied, there is no chaos and confusion and the effect of management is noticeable. Which characteristic of management is highlighted by this statement. 15.Name the process of designing and maintaining an environment in which individuals working together in groups efficiently accomplish selected aims. Holiday Home Work – Accountancy 1. A, B and C were partners in a firm having capitals of Rs.80,000,Rs. 80,000 and Rs.40,000 respectively. Their current account balances were A:Rs.10,000, B Rs.5000 and C Rs.2000(Dr). According to partnership deed the partners were entitled to interest on capital @ 5% p.a. C being the working partner also entitled to a salary of Rs.6000 p.a. The profits were to be divided as follows: (a) The first Rs.20,000 in proportion to their capitals (b) Next Rs.30,000 in the ration of 5:3:2 (c) Remaining profits to be shared equally. The firm made a profit of Rs.1,72,000 before charging any of the above Items. Prepare Profit & Loss Appropriation A/c. 2. R and S were partners in a firm sharing profits in 3:2 ratio. Their fixed capitals were Rs.10,00,000 and Rs.15,00,000. The partnership deed provides for the following: (a) Interest on capital @ 10% p.a (b) Interest on drawing @ 12% p.a During the year ended 31.3.2007, R’s drawing were Rs.1000 per month drawn at the end of every month and S’s drawings were Rs.2000 per month drawn in the beginning of every month. After the preparation of final accounts for the year ended 31.3.2007 it was discovered that interest on R’s drawings was not taken into consideration. Calculate interest on R’s drawing and give necessary entry for the same. 3. A, B and C are partners in a firm. They have omitted interest on capital @ 10% p.a for three years ended 31st March, 2007. Their fixed capitals on which interest was to be calculated throughout were: A - Rs.1,00,000 B - Rs. 80,000 C - Rs. 70,000 Give the necessary adjusting journal entry with working capital. 4. A and B are partners in a firm sharing profits equally. They had advanced to the firm a sum of Rs.30,000 as a loan in their profit sharing ratio on 1st July 1998. The partnership deed is silent on the question of interest on loan from partners. Compute the interest payable by the firm to the partners. Assuming the firm closes its books on December 31? 5. A and B are partners in a firm sharing profits and losses in the ratio of 3:2. According to the partnership deed both the partners are entitled to Rs.1000 per month as salary and 5 % interest on their capital. They are able to be charged on interest of 5% on their drawings, irrespective of the period which is Rs.12,000 for A and Rs.8000 for B. Prepare partners Accounts when capitals are fixed. 6. X, Y and Z were partners sharing profits in the ratio of 2:2:1. Z was guaranteed a minimum profit of Rs.20,000. The profits of the firm for the year ended 31.3.2000 were Rs.80,000. Prepare Profit & Loss Appropriation A/c. 7. A and B are partners in a firm. The partnership deed provided that interest on drawings will be charged @ 6% p.a. During the year ended December 31 2006. A withdraw Rs.5000 at the beginning of every month and B withdrew Rs.5000 at the end of each month. Calculate interest on partner’s drawings. 8. A,B and C were partners. Their capitals were A Rs.30,000, B –Rs.20,000 and C Rs.10,000 respectively. According to the partnership deed they were entitled to an interest on capital @ 5% p.a. In addition B was also entitled to draw a salary of Rs.500 per month. C was entitled to a commission of 5% on the profits after charging the interest on capitals but before charging the salary payable to B. The net profits for the year were Rs.30,000 distributed in the ratio of their capitals without providing for any of the above adjustments. The profits were to be shared in the ratio of 5:2:3. Pass the necessary adjustment entry showing the workings clearly.