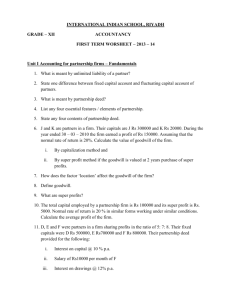

Different methods of calculating goodwill

advertisement

Different methods of calculating goodwill Goodwill refers to the reputation of a business enterprise which it acquires by it’s record of successful operations and cutomers’ satisfaction.It is an unidentifiable attribute or an intangible asset of a business. It enables the business to earn more than just sufficient profits which induces the entrepreneurs to remain in action all the times. Valuation of goodwill: Cost method It is the value which a rational buyer would pay for the business as a going concern less the value of net assets(assets-liabilities) taken over by the buyer. Cost of goodwill purchased=purchase price-net assets purchased Super profits method Super profits =Average profits –normal profits (1) No of years purchase method: Under this method , it is tacitly assumed that super profits will not continue indefinitely.tThe continuation of super profits depends a lot of complex factors such as technological factors, government policies etc . Hence without going into the weightage of all those complex factors, an appropriate number is generally suggested which is called “number of years of purchase”. Goodwill is calculated as follows: Goodwill=super profits*number of years purchase (2) Sliding scale method: This valuation is based on a more realistic assumption that super profits would decline over a period of time and after a certain period they would all together disappear. Amount of super profits number of years 1000 4 1500 3 2000 2 3000 1 Goodwill= 1000*4+1500*3+2000*2+3000*1 =15500 (3) Annuity method: This method takes into consideration the time value of money.It is based on the assumption that payment for goodwill is made on the basis of super profits which are to be earned in future.Hence to make it more consistent & comparable, present value of super profits is computed to calculate the goodwill.It requires that expected rate of interest should be used to discount the future super profits. Goodwill=super profits p.a* relevant annuity value (4)Capitalisation of super profit method Unlike the previous methods,it is based on the assumption that super profits will continue indefinitely. Goodwill=100/normal rate of return*super profits