part 1 - your adviser business - Institute of Financial Advisers

advertisement

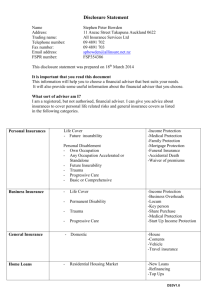

Your Guide to preparing your

Adviser Business Statement

This Guide has been prepared using guidance notes from the Securities Commission, our own research, and

other sources. It identifies the key areas, details the key requirements in each, and suggests some possible

responses for you to use in constructing your own ABS.

This Guide is in the form of a Word document that you can use to prepare your own ABS. It consists of:

Some Introductory Notes based on material from the Securities Commission

An ABS cover page

13 Key Areas, grouped into two Sections. In each Area we have provided some guidance notes, and

some possible text.

Everything that is in red is a guidance note that can be deleted as you work your way through the process.

How to prepare your ABS:

1. Review the latest requirements – visit SecCom’s AFA website (www.sec-com.govt.nz/far/afa/) to

review their latest ABS guide, and also ensure you are familiar with the current Code.

2. Save this document as your ABS

3. Read the Introductory Notes in red on the next few pages

4. Prepare your title page

5. Complete Key Area 1 (Role):

- read the Guidance Notes key requirements in red ( minimum requirements and best practice)

-look at some example text you could use, as the basis.

- delete the text you don’t want to use and add to the text you do want

- when you have finished, review the guidance notes again to check that you have provided all the

information required

- review any other “best practice” information you have listed

- delete the guidance notes

6. Repeat for the other 12 Key Areas

7. Delete this page and the Introductory Notes on the next few pages.

8. Review the entire document once more, then save

Page 1

Introductory Notes

(based on Securities Commission guidelines)

What is an ABS?

Behind every successful professional is a well-ordered business with good systems and procedures. As part

of the authorisation application process you must prepare an Adviser Business Statement - or ABS. Your ABS

is a snapshot of how you operate. It explains the systems and procedures you have to ensure you conduct

your business in a professional way.

The ABS is a short, written document that sets out what business you are in and what compliance

arrangements you've put in place. It will be a requirement of the terms and conditions of your authorisation

to have an ABS that is up to date.

The ABS is intended to be a helpful business tool. It's your primary evidence that you've thought about your

professional obligations and how your adviser business operates and that you have systems and procedures

that are relevant to its size and nature. Your ABS is an internal document - you don't need to make it public.

It's a living document that you are obliged to keep up to date so it reflects any changes in your business and

any changes in the requirements in the Act and the Code.

Your ABS will be a key source of information for the Commission. You don't need to attach your ABS to your

application, but it must be available for us to see on request - both before and after authorisation.

The Commission will be doing spot checks as part of our ongoing role of monitoring the financial advice

industry. This could involve a visit to your office so you need to keep your ABS current and have it ready for

inspection.

How do I prepare an ABS?

You need to develop an ABS before you go online to register and apply for authorisation. The ABS consists of

two parts:

Part 1 describes your adviser business. It helps you to think about your business in the context of the

standards in the Code and the Act. It helps the Commission understand your business. It also provides

context for Part 2.

Part 2 explains the systems and procedures you have in place to comply with the Financial Advisers Act and

its regulations; the Code of Professional Conduct for Authorised Financial Advisers; and the terms and

conditions of your authorisation. It should address the things you’ve mentioned in Part 1.

Both sections include:

minimum requirements

suggested information, to help you understand the sort of information which will help to show how

you meet the principle or requirements.

You can structure and write your ABS in a form that suits your own business needs so it will assist you with

operating professionally.

Page 2

The length and complexity of your ABS will depend on the scope and scale of your adviser services. For most

advisers the Commission expects that the ABS will be around 7 to 15 pages. Your ABS is intended to

summarise your approach, but should be comprehensive enough to explain how you oversee your business.

Part 1 may contain similar information to that included in your business planning process. For Part 2 the

Commission expects that you will be operating systems and procedures that already address some of the

new requirements. Any detailed guidance on using these procedures should remain in separate records or

manuals, which the ABS can cross-reference. The ABS can indicate the topics covered in your records or

manuals that are key to your compliance and consolidate topics from a number of sources into one place.

Your employer or QFE can help you write your ABS, or a group of advisers might help each other. An

employer or professional body might provide additional suggestions relevant to a particular business area.

Your employer or QFE cannot require you to adopt a particular ABS, but the systems and procedures

described in your ABS might be those your employer or QFE requires you to follow. The ABS is your

document to help demonstrate your professionalism so you are responsible for it. You are expected to be

able to explain it to the Commission or provide supporting documentation, if requested.

AFAs are responsible for meeting and maintaining the same professional standards, whether or not they

work with a QFE. A QFE sits between its advisers and the Commission and is responsible for their compliance

with the standards specified in the Code. Therefore, an AFA in a QFE can source some of the information

required for their ABS from their QFE, for example, by including QFE-produced material describing the QFE's

systems and procedures as an appendix to a shortened ABS.

Key points to remember:

The focus should be on you as the adviser, not on your business

Don’t just fill in the blanks. Think about your business and personalise your ABS. This will give it

more credibility.

Every word you write has to be deliverable.

Show the controls you have in place to deliver.

You do not need a lawyer to write your ABS. You must personally know the law, the Code and

MED’s disclosure requirements (due out October 2010)

Think about what consumers want to know

Part 1 can be more of a template approach, but Part 2 needs to show how you deliver in a way

that fosters consumer protection. It’s your opportunity to showcase what you do beyond the

minimum.

Your ABS will be a living document. You need to update it to reflect changes. You should keep a

copy of those changes.

Page 3

Table 1: Draft Code Standards

Draft

Code

standard

Overview of standard

ABS section

1

Placing client interests first and acting with integrity

Ethical behaviour

2

Obligation not to bring financial advisory industry into

disrepute

Ethical behaviour

3

Use of term "Independent"

Ethical behaviour

Marketing and branding

4

Borrowing from/lending to client

Ethical behaviour

Client money

5

Restrictions that apply where AFA is related person of

provider

Ethical behaviour

6

Obligation to behave professionally

Advice or service

Competence

7

Ensuring retail clients are able to make informed

decisions

Disclosure

8

Suitability of personalised financial advice

Advice or service

9

Explaining the basis of personalised servicews

Advice or service

10

Providing class services for retail clients

Advice or service

11

Complaints processes

Complaints

12

Recording information about personalised services

Record Keeping

13

Record retention

Record Keeping

14

Overarching competence requirement

Competence

15

Adequate knowledge of Code, Act and laws

Competence

16

National Certificate in Financial Services (Financial

Advice) (Level 5) requirement and alternative

qualifications and designations

Competence

17

Professional development plan

Competence

18

Obligation to undertake continuing professional training

Competence

Page 4

Table 2: Financial Advisers Act conduct and disclosure obligations

Act

section

Overview of Act requirements

ABS section

21 to 25

Disclosure obligations

Disclosure

27 to 29,

31

Disclosure obligations

Disclosure

30

Advertising must refer to disclosure document

Marketing and branding

33

Must exercise care, diligence and skill

Advice or service

34

Must not engage in misleading or deceptive conduct

Ethical behaviour

35

Advertisement must not be misleading, deceptive or

confusing

Marketing and branding

36

Restriction on use of term sharebroker

Marketing and branding

37

Must comply with Code

All sections

38

Must not recommend illegal securities

Advice or service

39 to 44

Conduct obligations in respect of client money

Client money, property and

information

45

Must comply with terms and conditions of authorisation

All sections

Page 5

[START YOUR ABS CREATION HERE]

AFA ADVISER

BUSINESS STATEMENT

XYZ Adviser

Address

Phone

Email

FSP Registration number:

ABS prepared [date]

Page 6

PART 1 - YOUR ADVISER BUSINESS

Part 1 of your ABS must describe your financial adviser business. It must include the requested information.

You may decide on the form and structure of your ABS, but complying with the following suggestions will

minimise Commission queries:

Use the suggested information as a guide to the sort of information which may be helpful. Don't

worry if you don't have all of the suggested information. Add other information if this better explains

your adviser business.

Write your ABS in a way that helps you to think about your business in the context of the standards

in the Code and the Act. It should also help the Commission understand your business and provide

context for Part 2.

Think about the Act's objectives: to promote sound financial advice and to encourage public

confidence in the professionalism and integrity of financial advisers.

Focus on the Code of Professional Conduct and the areas of your business most relevant to the

Code.

Where possible, keep information in the ABS at a high level.

Address all relevant financial adviser services that you provide.

Focus on the business that you personally do rather than the whole of your employer's or principal's

business.

Provide enough information to allow the Commission to assess your business.

Explain any changes to your business that are in progress or planned.

Provide supporting quantitative information to show the relative importance of various business

areas. Give the best information that you can and the latest available (include the date and the

period it covers). You may use forecast information, particularly if changes are expected.

Key question: Do you provide a “financial adviser service” or a “discretionary investment management”

service, as defined?

Page 7

PART 1 - YOUR ADVISER BUSINESS

1.1 Role

What’s

required

Describe your role, including an overview of the type of adviser business

that you undertake. Refer to your Scope of Service

check

Minimum

requirement

Suggested/

best practice

Key message:

whether you provide(a) opinions and recommendations, (b) an” investment

planning service” and/or (c) a “discretionary investment management service”

the method by which you provide services - face to face, internet, phone, postal

or other means

if you work for a QFE, as an employee or nominated representative, state the

name of your QFE and the nature of your relationship

if you are employed, state the organisation that you work for with a brief

overview of its business, including the size of the adviser business, approximate

number of advisers and the number in similar roles to yours.

the proportion of your time spent on your adviser business - outline any other

business you undertake or specific responsibilities you have

a description of the various services you provide, including whether you provide

personalised and non-personalised financial advice. State the relative proportion

of your business that these represent

whether your role involves home or workplace visits or seminars

whether you supervise other advisers or trainees and the proportion of your time

devoted to this.

State not just what you do, but where you are focused

EXAMPLE:

Type of service

I operate as a financial adviser, providing opinion and recommendation in the following financial services

business areas:

[Choose from this list]

Cash management

Debt management & Mortgage Broking

Taxation Planning

Personal Risk (insurance) Management

Fire & General Insurance

Retirement Planning

Investment Planning

Comprehensive Financial Planning

Specialist Business Insurance Planning.

Page 8

[I provide an investment planning service for consumers if required, within the guidelines of the agreed

Scope of Service with a client.

[AND/OR: I provide a discretionary investment management service for my clients if required, within the

guidelines of my Scope of Service.

A Disclosure Statement is provided to every client at the initial interview, and then updated Disclosure

Statements are provided as and when necessary at any time during the engagement or ongoing business

relationship. Additional Disclosure Statements are provided at any time, free of charge, upon request to

clients or prospective clients.

I am personally qualified to provide this type of advice on the basis of my qualifications and education,

supported by my ongoing professional development programme of a minimum 60 hours professional

learning every 2 years (Education Credits log available on request): My relevant designations, qualifications

and education are:

Certified Financial Planner (CFPCM)

Chartered Life Underwriter (CLU)

I have completed a Diploma in Business Studies (Personal Financial Planning) at Massey University,

and undertaken the following XX professional development courses through private education

providers or industry institutions:

XXX

XXX

XXX

How my services are provided

Initial engagement is usually undertaken with personal interview (face to face), although this can be done via

telephone, email or any other method of communication that allows a confidential exchange of information.

During the initial engagement our Terms of Engagement are provided in writing to prospective clients when

establishing the Scope of Service.

I may provide limited advice, or engage in transactional order placing for a client, if that is all the consumer

requires. Client records clearly reflect any express limitations on advice offered or taken.

New clients are generally sourced via referrals from existing satisfied clients, referrals from other business

specialists, [internet/website advertising],[ seminars for members of the public], [newspaper advertising]

[ADD MORE AS REQUIRED]

How my time is spent

In any given year the proportions of work undertaken within the different business lines can vary

significantly, depending on market conditions, product initiatives and choices, consumer demands or new

learning. Typically the breakdown of my work, by time spent advising clients (not by remuneration) is:

XX% Personal Risk Planning

XX% Retirement Planning

XX% Investment Planning Service

XX% whatever

Overview of my business

Page 9

I am self employed, and am the principal shareholder-employee of XYZ Advisers Ltd. XYZ Advisers Ltd has

been operating since XXXX and currently has:

XX Authorised Financial Advisers (and/or potential AFAs pending authorisation)

XX Registered Financial Advisers

XX support and administration staff

I have XX customers, of whom approximately xx% generally take full financial advice and the balance engage

in limited advice or transactional placements.

Each adviser is a current member of the Institute of Financial Advisers, and adheres to the Code of Ethics of

the IFA, including being bound by the professional development requirements and the complaints

provisions. I have had XX complaints recorded about me by customers with XYZ Advisers Ltd in the last XX

years, and XX complaints to the IFA in the last XX years by clients. XX have been upheld, or are still pending.

I maintain Professional Indemnity insurance through XXX, and have had XXX claims made against my policy.

This Adviser Business Statement relates to my personal position as an Authorised Financial Adviser (AFA)

only, not necessarily to other employees or advisers of XYZ Advisers Ltd. No material changes to the details

provided in this ABS are anticipated at this time.

Where I operate

My business is operated under the brand of XYZ Advisers Ltd from my professional premises at:

[physical location]

All meetings are held onsite at this location

OR

Most meetings with clients are held at those premises. About 5% of the time I may need to visit a client at

his/her residence or place of work.

What other advisers I supervise

I do not currently supervise or train any advisers.

OR

I am currently mentoring XX advisers.

OR

I am not currently supervising any advisers, but I have done so in the past and I may do so in the future.

Page 10

1.2 Remuneration and reward

What’s

required

Minimum

requirement

Explain the way that you are remunerated or rewarded and explain

any potential conflicts of interest arising from this.

Suggested/

best practice

check

a breakdown of how you are remunerated or rewarded, including any base

salary, bonuses, commission and fees. You should include percentages, based

on figures available for the last quarter or year, for example X% salary and Y%

commission

the factors affecting how your remuneration may vary.

the proportion of your overall remuneration and reward received from various

sources, for example, from each product provider

how your fees are calculated, noting any circumstances where these fees can

vary

an overview of any additional rewards that you may receive depending on

performance, and the factors which determine whether you qualify for these

any preferential commission terms that you have in place with various

providers, particularly any variations in commission rates based on volume

the proportion of clients who might be affected by each potential conflict of

interest.

How I am remunerated or rewarded

EXAMPLE/s: (This is an area where it may be more suitable to blend elements of the different types of

remuneration structures used in the examples)

EXAMPLE 1:

I am remunerated entirely by commission from product providers in all business lines. This commission is

potentially payable in a number of forms, primarily:

1. Introductory commission – a gross commission amount payable by a product provider for successful

placement of new business with them. This is generally a fixed proportion of the premium, loan or

investment amount placed with that product provider, and typically accounts for XX% of my annual gross

revenue

2. Renewal (or Service or Trail) commission – a fixed percentage amount payable of the ongoing (or in-force)

premium, loan or investment amount held with a product provider for ongoing management of that

business. This type of gross commission typically accounts for XX% of my annual gross revenue.

3. Production Bonus Commission – a fixed percentage gross commission over-rider payable on volume of

new business (or commission) generated through a particular product provider.

Page 11

4. Persistency Bonus – a fixed percentage gross commission over-rider determined by the overall business

quality, or persistency, held with a particular product provider.

The Gross Commission Remuneration paid by product providers to me annually is approximately:

Provider A

XX%

Provider B

XX%

Provider C

XX%

Provider D

XX%

OR

EXAMPLE 2:

I have an agreement with Provider XX that we will place XX% of the new business generated with them, and

be governed by their branding requirements. They do/do not audit my production to ensure that this

requirement is essentially met.

The gross remuneration generated may vary for many reasons, including overall new business levels & sales

achieved, market/consumer confidence or satisfaction, amendments to commission terms and structures by

product providers or other parties, impact of competition or economic conditions on existing

clients/business levels and so on.

Apart from the gross commission variances, there are the many common business factors potentially

impacting on the operational costs of providing an advisory service, such as unanticipated compliance costs

for example.

My remuneration is Gross Commission less Operating Costs. Generally this means that my personal

remuneration is about XX% of the Gross Commission received, although I may be responsible repayment of

the Gross Commission generated for up to 2 years in event of policy cancellation.

In addition to these types of commissions I will receive some non-cash additional rewards. I may receive

free or heavily discounted travel and/or corporate gifts from product providers I recommend, depending the

total volume of business done with those providers. Most providers over these type of incentives, and the

value can be substantial.

For example, a company may provide a trip for two to Rome if I place $120,000 of annual insurance

premium business with them, or I may receive a trip to Tahiti if I place $60,000 annual insurance

premium with another.

I do not generally do sufficient business with any particular product provider that generates this type of

additional reward. I do often receive benefits in the form of entertainment (e.g. occasional rugby tickets,

concerts, golf days, etc), or subsidised professional development (e.g. below actual cost conference

attendance, subsidised cost training courses, etc), or office supplies (e.g. notepads, pens, etc). The value of

these things are usually unknown to me, nor are they predictable or frequent. Subsidised stationery would

typically be under $XXX in value per annum, subsidised professional development typically under $XXX per

annum and entertainment typically in the $XXX-XXX per annum range though I believe.

OR

Page 12

I am remunerated by way of revenue sharing with the firm XYZ Advisers Ltd. The firm receives all

commissions payable by product providers, together with all fees paid directly by clients. For the clients I

manage the overall (firm) revenue breakdown is approximately:

XX% commissions

XX% client fee income

Apart from the gross commission variances, there are many (common) factors potentially affecting the

operational costs of providing an advisory service.

I receive XX% of the gross revenue/net revenue (??) generated by the clients I manage.

OR

I am remunerated as a shareholder-employee by salary (on a PAYE) basis primarily. In addition to this salary

I may receive a profit share/bonus/company dividend, which is determined as follows:

XXXXXX

XYZ Advisers Ltd receives all commissions and client fees. Fees are calculated on the basis of the time and

expertise required to complete the clients requirements. The current hourly rate is $XXX plus GST. This rate

may change at any time, and from project to project, or client to client. Factors considered in establishing

the fee per client or project include:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

The time and labour expended

The skill, specialized knowledge, and responsibility required to perform the services properly

The importance of the matter to you and the results to be achieved

The urgency and circumstances in which the matter is undertaken and any time limitations imposed,

including any imposed by you

The degree of risk assumed by us in undertaking the services

The complexity of the matter, and degree of difficulty

The experience, reputation and ability of the adviser providing services to you

The possibility that the acceptance of the particular work will preclude engagement of our firm by

other clients

Whether the fee is fixed or conditional

Any quote or estimate of fees given by us

The reasonable costs of running a practice

The fee typically charged for similar services by other professionals

How my remuneration may vary

My remuneration will depend only on the total annual premium income I place OR the total funds invested

OR

My gross remuneration may vary for many reasons, including overall new business levels generated,

market/consumer confidence or satisfaction, amendments to commission terms and structures by product

Page 13

providers or other parties, impact of competition or economic conditions on existing clients/business levels

and so on.

OR

My remuneration levels will vary depending on my achievement of certain production levels for particular

product providers.

Additional rewards or preferential commission terms

I have no preferential terms (other than those readily offered to other market participants) or production

performance agreements with any particular provider.

OR

I am eligible for production bonuses on insurance business place with product providers that is greater than

an agreed minimum. This production bonus will vary from provider to provider. I am also eligible for noncommission incentives such as discounted or free conferences [overseas trips] [etc] with [list providers]

Conflicts of Interest that may arise

Any single client engagement may present a potential conflict of interest.

[NOTE: a brief detail of if and how your remuneration & reward policy could create a conflict of interest]

[ I receive commissions from product providers which vary from provider to provider. I may also be eligible

for additional non-commission benefits]

I mitigate the potential for this to arise by:

1. providing & discussing full Disclosure Statement before client engagement

2. having a formal agenda at the outset of a client engagement, ensuring the client also receives or

understands: Privacy Act consent, engages in a discussion of the obligations of the full advice

process, a personal fee agreement, general Terms of Engagement, and establishing a personal

Scope of Service.

3. disclosing any preferential relationships that might present a conflict of interest to each individual

client engagement when identified, and ensuring engagement does not proceed without client

acknowledgement and consent.

4. [rebating all front-end and trail commissions on investment products and charging clients a fee that

is independent of the product providers used]

[NOTE: Cross-reference this to section2.1 Ethical behaviour]

Page 14

OR

I identify potential conflicts of interest and

- mitigate or eliminate them by changing my remuneration structures

-

Pass on any business that might create such conflicts to another adviser

Page 15

1.3 Business relationships

What’s

required

Explain how your business is structured and your key internal and

external relationships and explain any potential conflicts of interest

arising from this.

check

By a business relationship the Commission means any person or entity that is

key to your business. This might include your employer, employees, product

providers and persons or entities you refer clients to or receive referrals from.

Minimum

requirement

Suggested/

best practice

the nature of any exclusive or preferential terms that you have with any

product or service provider

an overview of persons or entities whose services you employ who are key to

your adviser business.

the proportion of new clients who are introduced and the proportion of your

business that each key source accounts for

the proportion of clients who might be affected by each potential conflict of

interest

an overview of any contractual arrangements you have in place which could

give rise to a conflict of interest. The Commission may request additional

information on contractual arrangements, if necessary

the roles, responsibilities and relevance of persons or entities who are key to

your adviser business.

EXAMPLE:

Structure

XYZ Advisers Ltd is XX% owned by myself (ADVISER), and XX% owned by …………

It is a limited liability company (trading entity) that holds the agency and contractual agreements with

product providers, owns any assets and ongoing rights to contractual income streams, enters into

commercial agreements for the provision/receipt of professional business services, and employs the

administrative and support staff.

The following AFAs (either existing or pending approval) are employed as salaried staff:

XXX

XXX

The following AFAs (either existing or pending approval) are independent contractors to XYZ Advisers Ltd.

XXX

Page 16

XXX

The following RFAs are employed as salaried staff:

XXX

XXX

The following RFAs are independent contractors to XYZ Advisers Ltd:

XXX

XXX

People or organisations that are key to my business

Internal:

In addition to the financial advisers listed, the following key positions exist in XYZ Advisers Ltd:

Managing Director:

Director:

Director:

Auditor:

Compliance manager:

Office Manager:

[NOTE: one or more of these roles could be conducted by the same person]

Key Compliance and Best Practice responsibilities within the firm are managed as follows:

Client Complaints – directed to Office Manager in first instance for recording and initial attempt at

satisfactory resolution. If unsuccessful, referred to Compliance manager, who then attempts to resolve or

refer externally to (DISPUTES RESOLUTION SCHEME of choice)

Internal Audit of Practice Standards – responsibility of Compliance Manager, who reports results of regular

audit to Board of Directors.

Registration/Authorisation of Financial Advisers – responsibility of financial advisers themselves primarily,

but regulatory status of each adviser also checked and recorded internally by Compliance Manager

Statutory and Legal Obligations – operational management vests with Compliance manager, checked and

monitored by Managing Director, but overall responsibility for compliance remains the Board responsibility

External

Page 17

Outside my organisation, there are no people or organisations key to my business.

OR

Outside my organisation, I rely on the XYZ wrap platform to provide a range of services to my clients. These

include portfolio administration, tax calculation and reporting, and quarterly reporting.

Many of my clients also require estate planning work and I am reliant primarily on XYZ Lawyers for that

work.

OR etc

Exclusive or preferential arrangements

Neither I nor XYZ Advisers Ltd have any preferential terms (other than those readily offered to other market

participants) or production performance agreements with any particular product provider. Neither I nor XYZ

Advisers Ltd have any commercial relationships or contractual arrangements that present any particular

conflicts of interest to consumers generally.

OR

I have an agreement with Provider XX that we will place XX% of the new business generated with them, and

be governed by their branding requirements. They do/do not audit my production to ensure that this

requirement is essentially met.

Either myself or XYZ Advisers Ltd have entered into the following commercial or contractual arrangements

that may give rise to conflicts of interest with consumers:

Contractual/Agency Arrangements:

Myself and/or XYZ Advisers Ltd hold representative agencies with the following financial services providers:

Page 18

1.4 Products and services

What’s

required

Minimum

requirement

Outline the products that you provide advice or guidance on and the

services you provide. Focus primarily on retail products or services with

the greatest consumer risk.

Suggested/

best practice

an analysis of your business by high-level product types or classes, noting

category 1 and 2 products separately

in what instances you handle client money or property, if any, the context in

which this occurs and the extent of your involvement.

check

any variation in the service provided by products or product groups, for

example, provision of personalised or non-personalised financial advice

any complex or unusual products or services, terms or arrangements that you

advise on

whether you are tied to a particular provider, choose from a panel, or whether

you are free to select openly from the market place. If you are tied or use a

panel, whether you select the providers

the proportion of business that is given to particular preferred providers

whether you provide an ongoing or one-off transaction service.

EXAMPLE:

Analysis of business by type

I provide advice in both Category 1 & Category 2 products. The proportion varies significantly from client to

client (depending on their individual requirements), but in general terms the breakdown on an annul basis

would be approximately:

Category 1 products – XX% of client engagements

Category 2 products – XX% of client engagements

There are no particularly complex or unusual products or services provided by me.

OR The following particularly complex products and services are provided by me:

*

*

I offer full financial advice in the following areas:

Page 19

Cash Management, Debt Management, Lending/Mortgage Broking, Personal Risk Management, Taxation

Planning, Retirement Planning, Investment Planning, Comprehensive Financial Planning, Fire & General

Insurance, Business Insurance Planning, Estate Planning, Sharebroking, Accountancy services…..

In addition I will engage in limited advice, or providing transactional services, for clients when requested to

do so, with appropriate documentation reflecting the express limitations.

If and when we handle client money or property

Neither myself nor XYZ Advisers Ltd handle any client money directly, with all funds being payable directly to

product providers. The only client funds received are invoiced fees directly payable to myself/XYZ Advisers

Ltd for agreed services.

OR

(If you handle clients funds directly document your trust account processes and internal requirements)

Restrictions on who we can use

Neither I nor XYZ Advisers Ltd have any contractual arrangements restricting the product choices we may

recommend, and every client engagement begins with consideration of all products we are aware of.

OR

Neither I nor XYZ Advisers Ltd have any contractual arrangements restricting the product choices we may

recommend, however XYZ Advisers Ltd have determined that the overwhelming majority of our clients

needs and product solutions can be sourced from the following wrap account/product provider/s:

*

*

OR

I have a contractual arrangement with XYZ Advisers Ltd to recommend only the products approved by XYZ

Advisers Ltd. XYZ Advisers Ltd determine a suitable suite of products to meet clients requirements in key

areas, and I determine which of that suite of products is required at any time by any particular client.

Page 20

1.5 Clients

What’s

required

Outline the types of clients that you deal with, distinguishing between

retail and wholesale clients.

Minimum

requirement

the proportion of your business that each client group represents

how you recruit new clients and the key sources of your clients.

Suggested/

best practice

the business split between retail and wholesale clients giving the total number

of retail clients in each product or service group

any specific client segments which might have a greater need for financial

advice or be more vulnerable to poor advice, for example, older clients

if you are employed, please state the nature of the relationship you have with

your clients, that is, whether their primary relationship is with you or with

your employer or principal

the types of marketing and promotional activities for each client group and

your involvement in these activities.

Key message:

check

“This is how I deal with...”

Showcase where you go beyond the minimum requirement

EXAMPLE:

Client types

I advise retail clients only, and they represent 100% of my business.

OR

I advise predominantly retail clients, who account for approximately XX% of my business. The types of

wholesale clients I advise, and the proportion of business they generally represent are:

Habitual Investors:

XX%

Business Entities (as defined in statute):

XX%

Local Authorities and/or Crown Entities:

XX%

Eligible Investors:

XX%

OR

(if predominantly wholesale clients amend the previous statement in regards to retail investors)

Page 21

How I gain clients

New clients are attained by the following marketing methods, in descending order of importance:

*

*

*

Nature of relationship with my clients

I am an employee of XYZ Planning. All clients are clients of XYZ and the primary relationship is between the

client and XYZ.

OR

My clients’ primary relationship is with me.

Clients with greater needs

There are no particular clients or client segments that I deal with who would have higher vulnerability than

any other.

OR (Example only:) The following regular client types may have higher vulnerability to poor advice than

usual:

New immigrants of XXXXX nationality whom I am frequently referred to, who have a generally poor

understanding of English.

I deal primarily with retirees, and there is a proportion of elderly clients amongst them who sometimes

have difficulty understanding modern investment concepts and choices.

Marketing and promotional activities for each client group

All my marketing activities are targeted at my retail clients. This consists of:

Referrals from existing clients

Referrals from my accountant

Leads from articles I write for my local paper

All marketing activity is carried out by me.

Page 22

PART 2: COMPLIANCE ARRANGEMENTS

Overview of Part 2

Part 2 should explain how you take personal responsibility for complying with the Financial Advisers Act (the

Act), its regulations and the Code of Professional Conduct for Authorised Financial Advisers (the Code).

It must explain your systems and procedures for ensuring that you meet:

the minimum standards set out in the Code

the obligations in the Act and its regulations

the terms and conditions of your authorisation.

Part 2 must include the expected information set out in this section.

You may decide on the form and structure of your ABS, but complying with the following suggestions will

minimise Commission queries:

Provide an overview of your relevant systems and procedures in each section, and describe any

reliance on third parties for these.

Describe the compliance arrangements for your business and the checks that ensure that you are

operating to the required standards. (Advisers will implement processes and controls in different

ways, depending on the nature, scale and complexity of their services.)

Focus on how you ensure that professionalism is embedded in your daily role and activities.

If you employ staff or external parties within your business explain how professionalism is

embedded in their roles and activities.

Explain any changes to your systems and procedures that are in progress or planned. Point out

where these are new.

Use the suggested information as a guide to the sort of information which it may be helpful to provide. Don't

worry if you don't cover all of the things in the suggested information. Add other information if this better

explains your compliance arrangements or is more relevant.

You can provide information on how you exceed the requirements. The Commission can consider this in

determining the level of regulatory monitoring appropriate to you.

Key messages: Focus on you as a person rather than on your business.

How will you deliver what you say you will?

Page 23

PART 2: COMPLIANCE ARRANGEMENTS

2.1 Ethical behaviour

What’s

required

Requirements of the Code and the Act:

Draft Code Standard 1, Section 34 of the Act

Minimum

requirement

the safeguards you have in place to identify, avoid or manage any potential

conflict of interest.

Suggested/

best practice

any relevant mission statement or client charter you publicise

any additional code of ethics or conduct that you abide by, for example, from

your employer or professional body, stating the relevance to the requirements

any systems or procedures, or support, that help you maintain positive

professional behaviour to assist the achievement of suitable client outcomes,

for example, any mentoring arrangements

any ethical training you have undertaken.

check

EXAMPLE:

Managing potential conflicts of interest

Ass noted in section 1.2 Remuneration & Reward, I have a number of potential conflicts of interest.

[DESCRIBE briefly, eg “I am remunerated entirely by commission from product providers”]

I avoid or manage these by:

Avoiding any production requirements for any one company

Having access to a range of product providers for each of my insurance and investment advisory

businesses

Using ratings from independent research houses to guide me in my decisions – using only the top

three rated products regardless of fees or commissions.

Regularly reviewing my relationship with my key suppliers

Being transparent in my dealings with suppliers

Etc etc

Note: Cross-reference this to section 1.2 Remuneration & reward, in describing potential conflicts of interest

and how you avoid them]

Page 24

My mission statement/client charter

(IF you or your company have a Mission Statement or articulated client-care principles or values, then insert

them in this section)

My code of ethics

I am a member of the Institute of Financial Advisers, and as such subscribe to the IFA Code of Ethics,

together with the IFA continuing professional education requirements to ensure ongoing compliance with

these principles. As an IFA member I voluntarily subscribe to the core principles of:

* Placing the clients’ interests first

* being truthful and trustworthy

* Always acting in the clients best interests

* maintaining the necessary skills, knowledge and business expertise

* respecting others

* protecting private information and confidentiality

* maintaining an ethical reputation and professionalism

I am also bound by the IFA’s independent complaints process that is tasked with upholding these values.

Mentoring arrangements

I am undergoing peer-mentoring through the IFA as part of my professional assessment.

OR I have completed 2 years peer-mentoring through the IFA as part of my professional assessment.

OR I have completed 2 years peer-mentoring through the IFA as part of my professional assessment, and am

now an IFA Mentor myself.

Systems and procedures

I have a detailed business process manual that sets out how I manage each aspect of my relationship

with my client

This manual covers XXXXX.

Ethical training

I have completed a minimum of 30 hours continuing education (professional development) each year that I

have been an IFA member, which has included specific requirements in the past for “ethics” training. The

current requirements do not specifically require separate “ethics” training, however most ongoing

professional development contains ethical elements that are sufficient to maintain ongoing knowledge of

standards and expectations.

OR

I completed the Institute’s 2-hour Business ethics education programme in 2011.

OR

Page 25

2.2 Marketing and branding

What’s

required

Requirements of the Code and the Act:

Draft Code Standard 3, Sections 30, 35 and 36 of the Act

Minimum

requirement

any approval process that you have in place for marketing activities and

promotional and client-facing materials to ensure compliance.

Suggested/

best practice

an overview of the records you keep in relation to marketing and promotional

activity and approvals

where you rely on third parties for your marketing, an overview of your

involvement in ensuring that the marketing is compliant

any examples of how you have remedied issues in the past where your

marketing, branding or promotional activities have led to confusion.

Key messages

check

State what your role is and what you do in terms of marketing. Don’t say that you

do not do marketing, or that it is not personal to you. In particular, ensure you

meet the definition of “independence”.

EXAMPLE:

What I do

I do a limited level of marketing to attract new clients and to keep existing clients happy. This is in the form

of:

A quarterly newsletter.

A regular email to current clients

An occasional email to centres of influence including my accountant

A quarterly advertorial in my local newspaper

I write the material in conjunction with my PA.

I do not use the word “independent” as I receive various incentives from product providers, including

commissions.

OR

As all remuneration is received only from the client, I meet the definition of “independent” and use this in

my marketing literature.

What others do

In my newsletter I use information supplied by product providers. I do not check that their material is

compliant with all legal requirements – I rely on them to do that. To ensure that the material remains

compliant I do not edit their articles in any way.

Page 26

How I do it

I have a checking procedure for all marketing that I do.

All standard material is cross-checked by a colleague.

It is then reviewed by the Board of XYZ Advisers Ltd. The Board in turn is responsible for ensuring

legal and ethical compliance requirements are met

If we believe it appropriate, we will have the material vetted by ABC Lawyers & Solicitors.

Copies of all marketing initiatives, advertisements and promotional material are retained by myself

and XYZ Advisers Ltd

Any personalised marketing for individual clients (e.g. seminar invitations, product enhancement

letters, etc) are copied to the individual client file and stored electronically on our CRM database.

Past issues

There have been no issues brought to my/our attention previously regarding advertising and marketing, and

no suggestions of incorrect or misleading information being used by myself or XYZ Advisers Ltd.

Page 27

2.3 Disclosure

What’s

required

Minimum

requirement

Suggested/

best practice

Requirements of the Code and the Act

Draft Code Standard 7

Sections 21 to 25, 27 to 29 and 31 of the Act and the disclosure

regulations

how you design and approve your disclosure statement, and keep it up to date

your approach to providing disclosure to clients on a timely basis

the process that you follow for individual clients to calculate fees and any

commission.

the extent of your input to the design and content of your disclosure

documents or statement. For example, are these based on a template

provided by your principal?

if reliant on a third party for the development of disclosure documents or

statement, the extent of your involvement and the checks that you undertake

whether one standard disclosure statement is used, or whether this is tailored

to each client

whether initial disclosure is provided at the beginning of the relationship or

each time advice is given

if advice is given by telephone, whether no advice is given unless disclosure

has been made or disclosure documents or statement are sent immediately

afterwards

any periodic reviews you undertake

whether and how you test client understanding of the content of the

disclosure documents or statement

any amendments you have made to improve client understanding of your

disclosure documents or statement as a result of feedback.

check

EXAMPLE:

My current disclosure statement

I maintain a current Disclosure Statement that exceeds the requirements of the law and the requirements of

my professional association, the Institute of Financial Advisers. The starting point for the current version of

the Disclosure Statement was the template provided by the IFA, which I then personalised and checked for

initial compliance with legal requirements.

In addition to the Disclosure Statement, which is first provided to every single prospective client at the initial

meeting (if not beforehand), my advice process documentation (including, but not limited to, Letter of

Engagement, Terms & Conditions of Engagement, Scope of Service, Statement of Advice) reinforces the

initial disclosure, by further detailing forms and amounts of remuneration or fees, conflicts of interest,

commercial relationships and so on.

Page 28

I do not provide a tailored disclosure statement but give each client the same disclosure statement,. This is

because a number of my clients use more than one of my services.

Timely provision to clients

At my first meeting with a client I ensure I meet all minimum legal requirements for disclosure. I also provide

additional information within that statement that will assist a consumer in determining my areas of

competency, education, potential conflicts of interest and relevant business relationships. A current

Disclosure Statement is subsequently provided every time further advice is provided to the client.

Whenever a Disclosure Statement is provided to a client they are asked to review it and ask any questions –

whether those questions arise from information provided in the statement or not. On occasions if advice

has been provided over the telephone a disclosure statement is mailed to the client as soon as possible,

usually by the following day at the latest. The document is generic, and equally applicable for every single

client due to it disclosing well above the requirements.

I do not provide regular disclosure statements to clients. I do however tell them if there has been any

material change to the fees for existing services that they are using. I also disclose to them the current fees

and charges for any of my services that they have not used but are considering using.

Process for clients to calculate fees/commissions

In my Terms and Conditions of Engagement, I set out my approach to fees and/or commissions. This details:

The maximum commissions that I may be eligible to, for placement of risk or investment business

The actual level that I have chosen to receive, if this is less than the maximum

The nature and size of any other fees, such as planwriting, investment and estate planning fees

In general terms I charge on the following basis:

Financial planning:

- a planwriting fee (as a dollar amount) payable by the client in advance

- an annual review fee (as a dollar amount)

Investment business:

- an implementation fee, determined as a percentage of funds to be invested

- an annual management and monitoring fee, determined as a percentage of funds to be invested

Insurance business:

- I do not charge clients any fees. I am remunerated by the product provider in the form of commissions.

Ongoing reviews

My Disclosure Statement is reviewed and updated whenever there is any change in commercial

relationships, supplier terms and conditions, qualifications or education and so on. That is, any change in an

area of disclosure triggers a review of the entire Disclosure Statement. It is an ongoing process of revision,

and typically would be amended slightly twice a year. My Disclosure Statement is also subject to random

audit as a member of the IFA.

Page 29

In reviewing my disclosure documents, I take into account feedback from my clients and any suggestions or

comments I am aware of from the wider industry perspective such as from the IFA. I attempt to adopt a

‘best practice’ approach.

In the past year I amended my description of my annual fee for investment monitoring following questions

from two of my clients.

Page 30

2.4 Advice or service

What’s

required

Requirements of the Code and the Act:

Draft Code Standards 5 to 10

Sections 33 and 38 of the Act

Minimum

requirement

any systems and procedures to help you to ensure the quality and suitability

of your advice or service and related client communications.

Suggested/

best practice

the research methods you employ and any reliance on third parties for these

your approach to collecting enough information to understand a client's

requirements (within the scope of the service being provided), for example,

any parameters or guidance you use or any checklists, forms or templates

your approach to setting out your advice for the client, for example, any

templates you use

your approach when no suitable product or service is available

any differences in approach when dealing with different client types, products

or services

any differences in your approach when dealing with non-personalised advice

any "pre-check" of your advice or any periodic review of your work

any improvements you have made as a result of feedback from checks or from

customers.

check

EXAMPLE:

Collecting information

All client advice is tailored to suit the individual client, and as such the fact-finding (data gathering) can vary

substantially from case to case, depending on the Scope of Service and any express limitations. There is

always suitable fact-finding conducted for the scope of the engagement, and that may involve substantial

data gathering via a fact-finding booklet, or it may involve beginning with a blank sheet of paper and asking

gathering just the appropriate information required to complete the clients requirements for advice, or a

combination of both.

On completion of data gathering, consideration of the clients objectives and agreed scope of service, analysis

of data and formulation of a recommendation, the client receives written advice with the recommendation.

That form of written advice will either be in the form of a Statement of Advice (simple, or limited

engagement), or a full report or comprehensive financial plan (more complex or detailed engagement). Both

documents are templated within the business to ensure that the following aims are achieved: full and

necessary ongoing disclosure, restrictions or limitations on advice, statements as to why the advice is

appropriate and suitable, any risks and the rationale for the recommendations, and receiving client

acknowledgement of the advice, together with client authority to proceed to implementation. Client letters

and documentation are provided as swiftly as possible during the engagement process, with letters and

Page 31

Statements of Advice typically being sent within XX days of meeting, and a comprehensive report typically

being prepared and sent within XX days of meeting.

The advice process used by myself is fully documented for each stage of the engagement, with templates

and checklists used extensively within the business to ensure that all steps are met on each client

engagement. The process and standard of documentation is professional, clear, and meets or exceeds the

requirements expected by the Code of Professional Conduct and the Code of Ethics of the IFA. The advice

process and quality is continually improved incrementally from working with clients continually, and

incorporating client feedback into the documentation and templates. In addition there are additions and

improvements that arise from my ongoing professional development programme – new technical education

frequently provides enhancements to the process.

Use of research and external knowledge

I only provide advice on products and areas where I am competent to do so, and conduct my own analysis of

the suitability of product recommendations. In order to ensure my knowledge and understanding of the

products I work with is current and objective, XYZ Advisers Ltd, and myself by extension, subscribe to the

following research methods:

ABC Research house

DEF research

GHI Industry magazines and periodicals

JKL industry websites

MNO supplier accreditation and product training programmes

PQR Group conferences

Institute of Financial Advisers annual conference, and annual professional development roadshow

No-advice situations

On the occasions where I conduct transactional business for a client, with little or no advice sought or

tendered, then the Scope of Service and Letter of Engagement clearly reflect the nature of the nonpersonalised transaction, and a very clear statement to the effect that the transaction does NOT take into

account the clients personal situation and may or may not be appropriate for the client is made. The client

must also provide acknowledgement to that effect in their signed Authority to Proceed.

Inability to offer suitable product or service

In the event that I am unable to offer a suitable product solution, or provide further valuable advice the

client will be informed in writing. Neither I nor XYZ Advisers Ltd are related persons to any providers of

financial products, and as such are not in a position of conflict in that respect.

Differentiation of service

While each client has differing needs, the majority of my clients face similar situations. I have a standard

approach in dealing with clients in terms of the process I follow and the documentation I provide.

Page 32

Depending on the specific client needs, I will then tailor the process and the documentation to match the

particular requirements of the client. I follow this “top down” approach to ensure consistency and to ensure

I have covered off all a client’s particular needs. It also acts as a prompt for both the client and myself.

Process review

As an adviser with XYZ Advisers, we meet at least annually to discuss “best practice” plans. This will take into

account any feedback from clients, my colleagues, staff, and industry commentary. The outcome can include

modifying my process and the documentation that I use for clients.

[EXAMPLE] In the past year we have changed the way we handle clients’ needs for estate planning as a result

of a review, so that their needs for family trusts are identified earlier in the planning process.

Page 33

2.5 Complaints

What’s

required

Minimum

requirement

Requirements of the Code and the Act

Draft Code Standard 11

Suggested/

best practice

how you deal with any complaints, in particular your internal complaints

process

the number of complaints received about your advice or conduct in the last 12

months and the number upheld

the proportion that were referred to any external mediation, complaints body

or dispute resolution scheme or to any court in New Zealand or overseas.

check

your involvement in resolving complaints about your work and whether an

independent person is involved

your approach to the register of complaints, for example, whether your QFE or

employer keeps this record, or you keep your own

your procedures for complying with dispute resolution scheme requirements

for internal complaints handling

your procedures for assisting your dispute resolution scheme

the time taken to resolve complaints

any examples of how you have used complaint information to improve your

advice or service.

EXAMPLE:

How I deal with complaints internally

Within [one week] I

- acknowledge the complaint in writing

- provide the client with information about my internal complaints process

- advise the client how to complain to the Securities Commission

- provide details about the Disputes Resolution Scheme to which I belong

I note the complaint in a “complaints register” and update this with the actions taken to resolve the

complaint.

I call the client within [one week] [whatever] to discuss the complaint with them. I will attempt to resolve

the issue with the client over the phone. If this is successful I will document the outcome and send the client

confirmation by email or post.

If the complaint cannot be resolved by phone, I will meet with the client, if at all possible within one week.

At that meeting I will go through a process to (a) identify the exact issue, (b) identify why the client believes

it is an issue and the impact on the client, (c) identify what outcome(s) the client is seeking and (d) attempt

to find an outcome that is agreeable to both parties. If this is successful I will document the outcome and

send the client confirmation by email or post.

Page 34

If the complaint still cannot be resolved, I will advise the client again of the existence of the Disputes

Resolution Service of which I am a member and details of how to contact them. I will explain that it is free of

charge. I will contact our Disputes Resolution Service provider within three days of reaching deadlock with

my client, and provide my DRS provider with the details for them to commence their complaints handling

process. The process from that point will depend on the DRS’s own internal process.

OR

Within [one week] I

- acknowledge the complaint in writing

- provide the client with information about my internal complaints process

- advise the client how to complain to the securities Commission

- provide details about the Disputes Resolution Scheme to which I belong

All client complaints against any adviser of XYZ Advisers, including myself, are recorded. An officer of XYZ

Advisers Ltd is then tasked with handling the complaint directly, with a view to resolving it as swiftly as

possible with the maximum client satisfaction. The company publicises the complaints process to clients in

occasional newsletters and on the company website, and it is documented within the company’s Procedures

Manual, together with being included in each adviser’s Disclosure Statement including mine.

What I tell my clients

My Disclosure Statement includes the same client notification about complaints, which is printed in full

below:

“DISPUTE RESOLUTION

In the event of a complaint or dispute I recommend that in the first instance you bring it to my

attention. I will provide you with information about my internal complaints process, the Securities

Commission, and m y Disputes Resolution Scheme.

I will try in the first instance to resolve the complaint internally. Should I fail to handle any such

problem to your satisfaction within a reasonably short time frame, then my company has an internal

complaints handling process. In addition, if your complaint concerns one of our supplier companies

(e.g. fund manager, insurance company, etc) they will usually has an internal complaints logging and

handling system to which you should refer.

If I or our firm is unable to resolve your complaint to your satisfaction, then you may make the

complaint to the XYZ Disputes resolution Scheme of which we are a member. This has a three-step

process. We are bound by the outcome of that process. You can choose to be bound by the outcome

but you can also choose to be free to pursue other legal avenues.

In the event that the first two steps prove unsatisfactory then a complaints process exists within the

Institute of Financial Advisers (IFA), of which I am a member and by which I am bound. The IFA can be

contacted at P.O. Box 5513, Wellington, Ph: (04) 499 8062; Fax: (04) 499 8064.

Any complaints referred to the IFA are recorded, then investigated to determine likely degree of

seriousness, then depending on the level of severity handled by IFA National Office staff directly with

Page 35

the client concerned, or referred on to a Professional Complaints Committee consisting of a legally

qualified chair-person and two professionally credentialed advisers to resolve.

This can be a lengthy and sometimes frustrating process for those involved, and is restricted to only

those complaints that breach the IFA’s own rules. It does not allow for civil litigation. I would urge any

dis-satisfied clients to resolve any issues personally and directly with me if at all possible.”

In addition to this internal disputes resolution methodology, I have joined XXXX Disputes Resolution Scheme

The client notice about complaints handling will be updated to reflect my membership of that DRS, and

directing clients to that scheme for resolution if I have been unable to satisfy the client myself.

Details about any complaints received

I have not received any complaints in the past 12 months

OR

I received one complaint in the past 12 months. This was referred to my disputes resolution provider (XXX

Ltd). The complaint was not upheld

OR

Within the last [12 months] I have received XX client complaints. XX of them were not able to be resolved by

myself and were referred to external mediation, which upheld XX of the client complaints. The average time

taken to resolve complaints internally is approximately XXXXX.

Page 36

2.6 Client money, property and information

What’s

required

Requirements of the Code and the Act

Draft Code Standards 4 & 12

Sections 39 to 44 of the Act

Minimum

requirement

how you handle any client money, property or information

any checks that are carried out on your handling of client money and

property, who carries them out and their relationship to you, if any.

Suggested/

best practice

the name of the entity whose client trust account you use and your

relationship to that entity

the name of the bank or entity that holds the trust account (and its location if

not in New Zealand)

the name of any custodian, platform or other third party that you use to hold

client property (and its location if not in New Zealand)

the results of any recent audit of the trust account that you use, the name of

any independent Chartered Accountant who conducted the audit and any

remedial action taken in response to it, where relevant

any other third party arrangements in place in relation to handling client

money and property.

check

EXAMPLE:

How I handle client money

Neither XYZ Advisers Ltd or myself handle or hold clients funds directly, or utilise any custodial accounts for

clients funds or property. All client funds are payable directly by clients to product providers. The only client

money received by myself or my firm is payment for agreed services. Neither XYZ Advisers Ltd nor myself

operate a trust account, and there is no intermingling of client and business funds or property.

(OR document your custodial and/or trust account procedures)

How I maintain client records

All client records are maintained in two forms, the first being primarily a paper-based individual client filing

system, the second being an electronic database. Each individual client paper-file contains copies of all

letters, reports, application forms, interview notes and older contact notes (information that pre-dates

implementation of database). Clients have access to the information contained within the file in accordance

with the requirements of the Privacy Act. The files are stored in the secured offices of XYZ Advisers Ltd, at:

[insert your physical address]

Page 37

All confidential and personal client information that is being disposed of is placed in a secure bin that is

removed from the premises as often as necessary, and all waste paper is shredded and burned. This service

is outsourced to ABC SHREDDING CONTRACTORS LTD.

Client information about my clients is also stored in an electronic client database operated by myself/XYZ

Advisers Ltd. [We are phasing out the use of paper records in favour of electronic storage and the majority of

client reports, policy and personal information and contact notes are recorded within that database.

The data is stored on a server in the secured offices of XYZ Advisers Ltd and is password-protected.

OR [insert your document security/access/backup provisions for electronic data]

Page 38

2.7 Record keeping

What’s

required

Minimum

requirement

Requirements of the Code and the Act

Draft Code Standards 12 and 13

check

the key documents you keep that demonstrate your compliance with the Code

and the conduct and disclosure obligations in the Act

explain your involvement in record keeping

if you rely on a third party for your record keeping, provide an overview of

their systems and procedures stating how these address your requirements

under the Code

the length of time that advice records are kept if in excess of seven years, and

any variations between products.

EXAMPLE:

What documents we keep

To demonstrate my compliance with the Code and the conduct and disclosure obligations of the Act, I keep a

copy of all key client documents on the electronic file of each client. The content and form of the client files

are referred to in detail elsewhere in this statement.

How I am involved in record-keeping

All client records, documentation and correspondence referred to in this Adviser Business Statement are my

responsibility. They are maintained primarily by me, with the assistance of my administrative support staff.

My use of third parties

I do not use any third parties for record-keeping.

OR

I maintain transaction and similar records for my investment clients on the XYZ Wrap Platform. XYZ is

responsible for ensuring the accuracy and security of these records.

How long I keep records for

All client records are retained in full for a period of at least 7 years after we cease to provide advice or

service to clients, continuing to be stored together with all other client files at the secured premises of XYZ

Advisers Ltd.

When we cease to act for a client any longer a notation is made on the electronic client database of the

future date when the file can be physically removed for secure destruction. Seven (7) years after

Page 39

termination of engagement, when the database reminder for disposal is received, the entire client paper file

is removed and disposed of in the secure bin for shredding. The electronic client records are retained and

archived on the server.

Page 40

2.8 Competence, knowledge and skills and continuing professional

training

What’s

required

Requirements of the Code and the Act

Draft Code Standards 6, 14 to 18

Minimum

requirement

Suggested/

best practice

Key message

how you are satisfied that you have the competence, knowledge and skills for

the specific services you provide

how you maintain and test your competence on an ongoing basis

the process you follow when you do not have the competence, knowledge or

skills to provide a professional level of service to a client.

check

any relevant qualifications which exceed the minimum Code requirements

how you develop your professional development plan, for example,

involvement of mentors, supervisors, client feedback or complaints

information. The role of any third party in delivering the plan

arrangements to maintain competence, knowledge and skills in the light of

product developments and changes

arrangements maintain competence, knowledge and skills in the light of

developments in professional practice.

Explain the systems aqnd procedures that you have in place to comply with the

Code, the Act and your terms and conditions. You must demonstrate you

understand and appreciate the Code’s obligations.

EXAMPLE:

My competence, knowledge and skills

(a) Qualifications and training

I have the following relevant qualifications:

Certified Financial Planner (CFP) – achieved in 1999, and maintain ongoing qualification.

Chartered Life Underwriter (CLU) – achieved in 1999, and maintain ongoing qualification

[other, including reliefs under the Code]

In the course of completing these professional designations I have completed the Diploma in Business

Studies (Personal Financial Planning) through Massey University, as well as additional university business

studies papers and a number of specific industry training organisations technical courses.

(b) Specific competence, knowledge and skills

Page 41

In addition to the qualification(s0 listed above, I have relevant competence and experience, and am hence

qualified and competent to provide financial advice, in the following areas:[DELETE the rows not relevant to

you]

Area

Comprehensive Financial

Planning

Cash management

Debt management

Mortgage broking

Taxation planning

Personal Risk (insurance)

Management

Specialist Business Insurance

Planning.

Fire & General Insurance

Estate planning

Retirement Planning

Investment Planning

Discretionary investment

management service

Specific competence, knowledge and skills

Have CFP designation. Prepare comprehensive financial plan for XX%

of clients, approx XX per month. Peer-reviewed by a colleague on

annual basis.

Basic principles covered in financial plan. Any detailed assessment

referred to accountant.

Referred to accountant

CLU designation, backed by regular training in specialist personal risk

areas. Attend regular seminars by main insurance providers.