study shows many minority mortgages involve very high costs

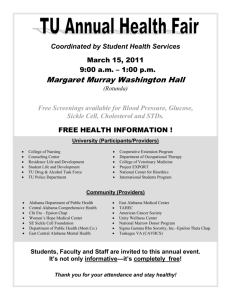

advertisement