Work on Acquisition Team Project

advertisement

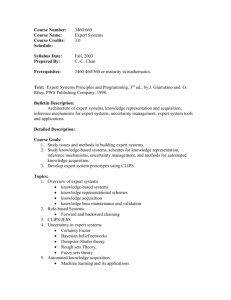

Mergers, Acquisitions, and Other Corporate Restructuring Activities MBAF 624 Course (40962) Syllabus-Fall 2005 Monday: 7:15 to 10:00 P.M., Hilton 023 Instructor: Name: Don DePamphilis, Ph.D. Office: Hilton 210 Phone: 310-338-7415 E-mail: dondepam@pacbell.net (easiest way to contact) or ddepamph@lmu.edu Office Hours: Mondays 4:00-7:00 P.M.; Wednesdays 1:00-4:00 P.M.; or by appointment. Course Overview: Learning Objectives: Students will 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. Investigate what corporate restructuring is and why it occurs; Evaluate the impact of the regulatory environment on M&A activity; Analyze how value is created (or destroyed) as a result of corporate mergers, acquisitions, divestitures, spinoffs, etc., through in-depth analysis of how to “do a deal.”; Assess how risks associated with the various approaches to creating value can be identified and managed; Evaluate commonly used takeover tactics and defenses; Apply a process for selecting appropriate takeover tactics depending upon the types of anti-takeover defenses in place at a target company; Deduce how and when to apply valuation techniques under special circumstances; Assess the practical limitations of the various valuation techniques; Investigate the importance of understanding assumptions underlying business valuations; Apply a highly practical “planning based approach” to managing the acquisition process; Evaluate challenges associated with each phase of the M&A process from developing acquisition plans through post-closing integration; Investigate the advantages and disadvantages of alternative deal structures; Investigate how the various components of the deal structuring process interact to determine price; Analyze how to manage the deal structuring process to minimize the risk that a business combination will not meet expectations; Evaluate advantages and disadvantages of alternative ways to exit businesses; Apply financial modeling tools to evaluating mergers and acquisitions; Apply the many tools and skills that have been learned in this and other courses in an integrated manner in completing an acquisition; and Investigate alliances/joint ventures as alternatives to mergers and acquisitions. Description: The course is divided into two discrete sections: (1) developing an in-depth understanding of how and when to apply the appropriate tools and skills to successfully complete a transaction and (2) the application of what has been learned to solving “real” world business problems. All major elements of the acquisition process will be discussed in the context of a logical process. The course will involve the application of what the student may have learned in such courses as finance, accounting, business law, micro and macroeconomics, management, negotiation, new ventures, entrepreneurship, strategic planning, and business policy/organization. As part of pre-class preparation and in-class discussion, students will be asked to solve both quantitative and qualitative problems and to analyze both publicly traded and privately owned companies involving valuing synergy, control premiums, and leveraged buy-outs. Illustrations will include practical ways to evaluate IPOs, new ventures, and internet-related companies. Students will be asked to form acquisition teams to develop highly realistic business and acquisition plans that could be used to convince top management of an acquiring corporation, a venture capital firm, or a lender to fund their proposal. The focus will be on how to effectively manage the process. As a key part of the learning experience, the course will require primary research to obtain the necessary data to develop the acquisition plan, working within teams, and the development of project management skills. The professor will illustrate how the process works in practice by drawing upon his personal experience in managing more than 30 acquisitions, divestitures, alliances, joint ventures, equity partnerships, minority investments, and licensing arrangements from the planning through implementation stages. The professor will frequently relate concepts discussed in class to transactions currently in the news to illustrate their application and limitations. Who should take this course?: Those who are seeking to become entrepreneurs, financial analysts, chief financial officers, operating managers, investment bankers, business brokers, portfolio managers, investors, corporate development managers, strategic planning managers, bank lending officers, auditors, venture capitalists, business appraisers, actuaries, corporate attorneys, or who simply have an interest in the subject. Prerequisites: The course presumes that students have knowledge of basic accounting, economics, and financial management concepts and tools. Students should have had at least one course in accounting, finance, and economics within the last two years or relevant work experience. Required Text: Mergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and Solutions, 3rd edition, Donald M. DePamphilis, Elsevier/Academic Press, San Diego, Ca., 2005. The text will be referred to as DePamphilis throughout this syllabus. Other Required and Optional Reading: Unless otherwise noted, the textbook contains all case studies required for this course, except for the following, which are available on Blackboard: BigCo Acquires Upstart Corporation Financing LBOs: The SunGard Transaction Forecasting Business Performance Illustrating the Free Market Process of Creative Destruction: Consolidation in the Telecommunications Industry News Corp Acquires Stake in Hughe’s DirecTV P&G Buys Gillette Valuation Methods Employed in Investment Banking Fairness Opinions (Optional) Computer skill requirements: Students will need to know how to use spreadsheet software (e.g., Microsoft Excel) no later than the fourth class meeting. Grading: Students will be evaluated in five different ways: Grade Points: Examination (2 exams—100 points each) Acquisition Team Project (see discussion below)1 Peer Review (see discussion below) Problem Set Class participation (see discussion below) 200 points 250 points 25 points 50 points 75 points 600 points 1 Team project leaders have the potential to earn an additional 20 points based on an anonymous review of their performance by other team members. Final letter grades will be assigned according to the following point scale: A 576 - 600 A- 555 - 575 B+ 540 - 554 B 500 - 539 B- 490 - 499 C 450 - 489 D 425 - 449 F < 425 At the end of the year, the professor reserves the right to lower the scale in the student’s favor. 2 Assignments will not be accepted after their due date, which is defined as the end of the class on the day on which they are due. If the student is unable to attend a class, the student is expected to send the instructor the assignment via e-mail no later than the due date. Make-up examinations will be given only in cases of verified illness or death in the immediate family. The best way to contact me is through e-mail (see first page for address). Students are encouraged to ask the professor at any time for an “informal” evaluation of how they are doing in the class. Class Participation. Learning to speak clearly and succinctly on an impromptu or informal basis in large groups is an essential skill that needs to be developed in whatever career the student pursues. In the workplace environment, we are often judged as much by what we don’t say as by what we do. Under no circumstances will a student have to feel concerned about being embarrassed in front of their classmates. In-class discussion will always be treated in a professional, non-threatening manner. In the absence of active participation, the professor will call on students. Active participation is defined to include both questions and comments. To receive the maximum number of points in this category, the student will be expected to participate during every class by asking questions or by making thoughtful comments. The quality of both questions and comments will receive greater weight than frequency in determining the final participation point score. Obviously, the student must attend most of the classes in order to get the maximum number of points. Acquisition Team Project: Early in the term students will divide into “teams” of four-to-six students each to share the research, analysis, and field work required to design a viable corporate acquisition proposal. The purpose of the Acquisition Project is to give students the opportunity to apply the tools they have learned in an increasingly common situation, i.e., mergers and acquisitions. Each team will be asked to represent an acquiring company or investment group whose business strategy involves an acquisition or merger. The acquiring and target firms must be in the same industry. The acquisition can involve a recent transaction (i.e., last 12 to 18 months), a current transaction, or a hypothetical transaction involving two publicly traded firms, private companies, or some combination. The use of publicly traded companies will facilitate data collection, and the selection of companies in the same industry will simplify the analysis by eliminating the need to analyze two different industries. Selecting Companies to Study: The success of the Project will be greatly dependent on the Team’s ability to understand the company’s operations, products, and the competitive dynamics of the industry in which it competes and to obtain financial, technical and market-related information on the company. Teams are encouraged (but not required) to select a publicly traded company, because both internal financial and operating data, as well as market/industry data, is likely to be more readily available (e.g., through Disclosure, Value Line, Standard & Poors Corporate Register, Thomas Register, etc.) than for a privately owned firm. It is helpful, although not essential, that the acquiring companies, target companies, or corporate divisions you evaluate be located in Southern California. This would enable teams to interview key corporate personnel to obtain additional information. Keep in mind that detailed financial information on publicly traded companies is likely to be available only on a consolidated basis. Consequently, efforts to obtain detailed financial information on a specific operating division of a diversified publicly traded company are likely to be very frustrating. While there are no restrictions on the size and type of company you select, I suggest that teams select relatively small, uncomplicated businesses such as single product, independent companies or operating units within larger companies. For those teams that choose to select privately owned companies here in Southern California, small companies, particularly those that are considering “going public” or attempting to obtain additional funding from venture capitalists, may be more receptive to cooperating with your team. Contacting the president, general manager, or chief financial officer of the company or division is a good place to start. Commercial and industrial parks (e.g., the Irvine Spectrum in Irvine, California) offer dozens of potential candidates for your analysis. For those that choose a private company, assure management that they will be provided with a final report and presentation in order to more readily obtain the necessary information. Emphasize to senior management that 3 the report will contain a recommendation(s) of how to increase the “going concern” value of their business and a valuation of the business. Also emphasize that the results of the study and any information that they provide to your team will be kept confidential. Students should not consider financial services companies such as banks, insurance, or leasing companies as we will not be discussing how to deal with these types of firms. Furthermore, it is recommended that students not select airlines due to the extensive use of equipment leasing, which create challenges not adequately addressed in the course. If students choose to evaluate a recent transaction, they must address the key elements of the acquisition as outlined below as if the transaction had not taken place. However, based on their analysis, they must be able to answer the question of whether the acquiring firm overpaid, underpaid, or paid “fair market value” for the target firm and why. This may require that the Team undertake several activities or evaluate options that may not have actually been undertaken by the acquiring company. In this instance, the Team must determine and justify what it considers to be appropriate terms and conditions for the transaction. Alternatively, the Team must vigorously justify the actual terms and conditions of the transaction. Students are encouraged to consult with the Professor about selecting a “Target” company early in the selection process if there are questions about the appropriateness of a potential Target. The Professor will have final approval of the companies to be used in the Acquisition Project. In the past, students have developed business plans for their own companies (both public and private) and for a business they were planning to start. The latter option represents an excellent opportunity to get input from both the Professor and other students. Each acquisition team is encouraged to develop mission statements, strategies and action plans that are different from what the selected company may be saying publicly if the team feels that this is appropriate. The Acquisition Team Project will be completed by each team submitting both the Word documents and Excel spreadsheets to the Professor in both hard copy form and on a CD ROM. The cover page should indicate the team members and the section(s) each member was responsible for completing, e.g., Julie Chang completed the financial statements for the acquiring and target companies, David Martino and Leslie Van Houton were responsible for developing the business strategy, etc. Acquisition Team Project Business and Acquisition Plans: Each team will submit a business plan, which includes an acquisition plan, not to exceed 50 pages including supporting financial tables. The acquirer’s business plan should include the following elements: Introduction 1. Executive Summary: In 1-2 pages, describe key objectives, why an acquisition is preferable to alternative options such as a “go it alone” venture or alliance, why the recommended target is more attractive than other potential target firms, the amount and composition of the initial offer price, how it will be financed, and key risks associated with the transaction. Business Plan (for acquiring firm) 1. Industry/market definition: Define the industry/market in which the target firm competes in terms of size, growth rate, product offering, and other pertinent characteristics. 2. External analysis: Describe how the interaction and relative bargaining power of customers, competitors, potential entrants, product/service substitutes, and suppliers determine industry cash flow and profitability. Profile the industry/market using the “modified Porter framework” discussed in Chapter 4 (Figure 4-3) in DePamphilis (pp. 130-145). 3. Internal analysis: Describe the acquiring company’s strengths and weaknesses and how they compare to the competition. 4. Opportunities/threats: Discuss major opportunities and threats that exist because of the industry’s competitive dynamics. Be sure that you can show how these threats or opportunities are a consequence of the factors described in (2). 4 5. 6. 7. 8. 9. Business mission/vision statement: Describe what industry/market needs are to be satisfied, who the targeted customers are, and what resources or capabilities will be used to satisfy these targeted customer needs. Quantified strategic objectives (including completion dates): Indicate both financial (e.g., rates of return, sales, cash flow, share price, etc.) and non-financial (e.g., market share, being perceived by customers or investors as number one in the targeted market in terms of market share, product quality, price, innovation, etc.) goals. Business strategy: Identify how the mission and objectives will be achieved (e.g. become a cost leader, adopt a differentiation strategy, or focus on a specific market segment). Implementation strategy: From a range of reasonable options (“go it alone” strategy, partner via a joint venture or less formal business alliance, license, minority investment, and acquisition), indicate which option would enable the acquiring firm to best implement its chosen business strategy. Because of the nature of the course, you must indicate that an implementation strategy involving an acquisition is preferred to the other options and why. Acquirer’s business plan valuation: Provide projected five year “standalone” income, balance sheet, and cash flow statements for the acquiring company and estimate the firm’s value based on the acquirer’s projected cash flows. State key forecast assumptions underlying the projected financials and the valuation. Acquisition Plan (developed by acquiring firm) 1. Plan objectives: Identify the specific purpose of the acquisition. This should include what specific goals are to be achieved (e.g., cost reduction, access to new customers, distribution channels or proprietary technology, expanded production capacity, etc.) and how the achievement of these goals will better enable the acquiring firm to implement its business strategy (see (7) above). 2. Timetable: Establish a timetable for completing the acquisition including integration if the target firm is to be merged with the acquiring firm’s operations. Identify key activities that need to be accomplished and indicate the estimated time required to complete activities. Also, estimate resources (i.e., people, money, licenses, etc.) needed to complete each activity. 3. Resource/capability evaluation: Evaluate the acquirer’s financial and managerial capability to complete an acquisition. Identify affordability limits in terms of the maximum amount the acquirer should pay for an acquisition. Explain how this figure is determined by considering the impact on the acquirer’s EPS, cash position, or level of indebtedness relative to its industry average. 4. Management preferences: Indicate the acquirer’s preferences for a “friendly” acquisition, controlling interest, using stock, debt, cash, or some combination, etc. 5. Search plan: Develop screening criteria for identifying potential target firms and explain plans for conducting the search, why the target ultimately selected was chosen, and how you will make initial contact with the target firm. 6. Negotiation strategy: Identify key buyer/seller issues. Recommend a deal structure that addresses the primary needs of all parties involved. Comment on the major elements of the deal structure including the proposed acquisition vehicle, post-closing organization, form of payment, form of acquisition, and tax structure. Explain the justification for the approach your team adopted in dealing with each aspect of the deal structure (e.g., why was a particular tax strategy selected). Indicate how you might “close the gap” between the seller’s price expectations and the offer price. 7. Purchase (offer) price estimate: Provide projected five-year income, balance sheet, and cash flow statements for the target firm and for the consolidated acquirer and target firms. Develop a preliminary minimum and maximum purchase price range for the target. Specify potential sources of and destroyers of value. List key forecast assumptions. Identify an initial offer price, the composition (i.e., cash, stock, debt, or some combination) of the offer price, and why you believe this price is appropriate in terms of meeting the primary needs of both target and acquirer shareholders. The appropriateness of the offer price should reflect your preliminary thinking about the deal structure. 8. Financing plan: Using the combined/consolidated financial statements, determine if the proposed offer price can be financed without endangering the combined firm’s credit worthiness or seriously eroding near-term profitability and cash flow. 9. Integration plan: Identify potential integration challenges and possible solutions. (For those teams characterizing themselves as financial buyers, an integration plan may not apply. Instead, they should identify an “exit” strategy.) For an actual transaction, teams must assess whether the acquirer overpaid, underpaid, or paid fair value for the target firm. 5 Note that an Microsoft Excel-based spreadsheet model is available on the CDROM accompanying the textbook. Students may use the model for completing the acquisition project, modify it to reflect the unique characteristics of their situation, or develop their own model. Acquisition Team Project Assessment The total possible point score of 250 points for the project will be apportioned as follows: 33% for completeness: How well did the team address each point on the syllabus outline for the Acquisition Team Project? 33% for quality of application: Did the team apply correctly tools and concepts learned in this course? (Hint: Each team member should apply a number of different tools and concepts in each section for which they are responsible.) 33% on creativity: Did the team specify clearly the acquirer’s and target’s objectives/needs? Deal the address common deal structuring questions? Were they successful in meeting the highest priority needs of both parties? Was the proposed deal structure realistic. Each team member will receive the project’s total score adjusted for the professor’s evaluation of the section(s) for which they are responsible. For example, while a paper may receive 250 points, individual team members may receive 105% (i.e., 210 points) or 95% (i.e., 190 points) of the project’s total score. Team Member Peer Review: Each team member will be asked to anonymously evaluate their team members by assigning a letter grade to their overall contribution to the team paper. The student’s overall grade will be calculated by a simple average of the grades assigned by their team members, with A=25, B=20, C=15, D=10, and F=0. Project Leader Peer Review: Each team member will also be asked to evaluate anonymously their project leader’s performance, with A = 20, B = 15, C = 10, and D = 5, and F = 0. The project leader should be evaluated in terms of their leadership in scheduling meetings, setting meeting agendas, facilitating meetings, motivating others to satisfy their commitments, and overall quality control. Quality control refers to effort expended to ensure that all portions of the final document have been completed and that the document reads as if it written by a single individual. Assignments: Answers to assignments, other than problem sets, should be typed. Answers to each question should be double-spaced and not exceed one page in length. Submissions that are not typed will automatically lose one-half of the total potential point score. Answers to problem sets should be legible. Class Schedule Week August 29 September 5 September 12 Subject 1. Defining expectations 2. Course overview 3. Introduction to M&A A. What is the success rate? B. Why do they occur? C. What are the key characteristics of mergers & acquisitions that meet expectations? D. Future of M&A Activity 4. Discuss P&G’s purchase of Gillette 5. Discuss forming teams Labor Day (University Holiday) 1. Common Takeover Tactics and Defenses Class Preparation Copies of the syllabus are available on Blackboard. PowerPoint presentations of the lecture notes for each class will be available on Blackboard. Students are encouraged to bring a copy of the appropriate lecture notes to each class and to utilize the Student Study Guide contained on the CDROM accompanying the textbook. Required Reading: Chapters 1 and 3 in DePamphilis and lecture notes entitled “Common Takeover Tactics and 6 2. 3. September 19 1. 2. Discuss Alcoa/Reynolds Case Study Class time will also be used to allow students to begin to form teams Acquisition Process: Developing Business and Acquisition Plans Discuss Case Study Illustrating the Free Market Process of Creative Destruction Defenses.” Read Case Study 3-1 in DePamphilis entitled “Alcoa Easily Overwhelms Reynold’s Takeover Defenses” (pp. 94-95) and be prepared to discuss in class. Note that there is no need to submit written answers to the case study questions. Individual students will be asked to lead discussion of specific questions in front of the class. Estimated time to complete reading: 4 hours. Required reading: Chapter 4 in DePamphilis and lecture notes entitled “Acquisition Process Phases 1 & 2. Be sure to read Case Study entitled “Illustrating the Free Market Process of Creative Destruction: Consolidation in the Telecommunications Industry found on Blackboard and be prepared to discuss questions 1-5 in class. Note that there is no need to submit written answers to the case study questions. Individual students will be asked to lead discussion of specific questions in front of the class. Estimated time to complete reading: 5 hours September 26 1. 2. October 3 1. 2. Acquisition Process: Search through Closing Discuss McKesson HBOC case study. Define valuation cash flow Discounted Cash Flow Valuation Methodologies a. Zero growth b. Constant growth c. Variable growth By this date, students are to have organized themselves into teams of four to five students each. Teams will submit a listing of all team members, including names and email addresses, to the professor. Teams will also be expected to appoint a project leader. The project leader’s responsibilities include scheduling team meetings and developing meeting agendas, motivating team members to meet their commitments, and for “quality control.” The project leader will have the potential to receive as many as 20 additional points based on a peer review by other team members. Required Reading: Chapters 5 and 6 in DePamphilis and lecture notes entitled “Acquisition Notes Phases 3-10.” Be sure to read Case Study 5-2 in DePamphilis entitled “McKesson HBOC Restates Revenue” (pp. 189-190) and be prepared to discuss in class. Note that there is no need to submit written answers to the case study questions. Individual students will be asked to discuss specific questions in front of the class. Estimated time to complete reading: 5 hours Required reading: Chapter 7 (pp. 255- 279) in DePamphilis as well as lecture notes entitled “Discounted Cash Flow Valuation.” Estimated time to complete reading: 4 hours Optional Reading: Case study entitled “Valuation Methods Employed in Investment Banking Fairness Opinion Letters” found on Blackboard Each Acquisition Team will provide the Professor with the name of their team’s acquiring company and acquisition target, LBO candidate, etc., and 2-3 page project plan. The project plan should include key objectives (i.e., why the acquiring company wants to 7 October 10 1. 2. 3. 4. 5. Relative Valuation Methodologies Valuing non-operating assets and liabilities Adjusting the firm’s equity value for non-operating assets and liabilities Discuss Problem Set Discuss expectations for first examination. October 17 First Examination October 24 1. 2. October 31 1. 2. Review exam results. Introduction to M&A model building process a. Calculating EPS & post-merger share price for stock for stock, all cash, and cash for stock transactions. b. Model adjustment mechanisms Analyzing Privately Held Companies Discuss Gee Whiz Media Business Case acquire the target firm), key activities that must be completed to meet the project deadline, completion dates for each activity, and the individuals(s) responsible for completing each activity. Required Reading: Chapter 7 (pp. 279-299) in DePamphilis as well as lecture notes entitled “Relative Valuation Methodologies.” Problem Set: Answer practice problems 7.11, 7.12, 7.15, 7.16 – 7.19, 7.21, 7.24 and 7.25. Each student must show all work to receive full credit. Each student should bring two copies of their assignment, one to submit for credit and another for taking notes as we discuss solutions to the problems in class. Estimated time to complete reading: 3 hours Estimated time to complete Problem Set: 3 hours Review Chapters 1 and 3-7 in DePamphilis, as well as class notes, homework assignments, and Student Study Guide on CD ROM accompanying textbook. Calculators required. Required Reading: Chapters 8 DePamphilis and lecture notes entitled “Applying Financial Modeling Techniques to Mergers and Acquisitions.” Students should also review the Excel spreadsheet formulae contained on the CD ROM in the back of the textbook and read “Forecasting Business Performance” found on Blackboard. Estimated time to complete reading: 5 hours. Required Reading: Chapter 9 in DePamphilis and lecture notes entitled “Analyzing Private Companies.” Read Chapter 14 in DePamphilis (Gee Whiz Media Business Case). Be prepared to discuss questions 5, 13, 15, 21, and 29 in class. Individual students will be asked to lead discussion of selected questions in front of the class. There is no need to submit written answers to these questions to the professor. Estimated time to complete reading: 6 hours November 7 1. 2. Deal Structuring Process: Form of Payment, Acquisition Vehicle, and Post Acquisition Organization Discuss Case Study questions in class. Work on Acquisition Team Project. By this time, it is recommended that students should have completed Sections 1-5 of the Business Plan portion of the Acquisition Project. There is no need to submit these sections at this time. Required Reading: Chapter 10 (pp. 379-402) in DePamphilis and lecture notes entitled “Deal Structuring.” Also, read Case Study 10-1 in DePamphilis (pp. 385-386) entitled “ News Corp’s Power Play in Satellite Broadcasting“ and be prepared to answer all case study questions in class. Note that there is no need for students to submit written answers to the case study question. Estimated time to complete reading: 4 hours 8 November 14 1. 2. 3. November 21 1. 2. 3. November 28 December 5 1. 2. 3. 4. 2. 5. December 12 Final exam Deal Structuring Cont’d.: Tax and Accounting Treatment Discuss Case Study One-half hour of in-class time devoted to acquisition team meetings Work on Acquisition Team Project: By this time, teams should have completed Sections 6-9 of the Business Plan for the Acquisition Project. There is no need to submit these sections to the professor. Required Reading: Chapter 10 (pp. 402-415) in DePamphilis and lecture notes on tax and accounting treatment. Also read Case Study 10-3 (pp. 416-417) entitled “Vivendi and GE Combine Entertainment Assets” and be prepared to discuss questions 1-5 in class. Students will be selected to lead the discussion in class for individual questions. Analyzing and Structuring Leveraged Buyouts Discuss case study questions One-half hour of in-class time devoted to acquisition team meetings Estimated time to complete reading: 4 hours Work on Acquisition Team Project Required Reading: Chapter 11 (pp. 425 - 446) in DePamphilis. Also, read lecture notes entitled “Leveraged Buyouts” (pp. 1-11) and business case study entitled “Financing LBOs: The SunGard Transaction” found on Blackboard and be prepared to discuss questions 1-5 in class. Students will be selected to lead the discussion in class for individual questions. Valuing LBOs Discuss case study questions One-half hour of in-class time devoted to acquisition team meetings Time required to complete reading: 5 hours Work on Acquisition Team Project Required Reading: Chapter 11 (pp. 446 - 462) in DePamphilis and lecture notes on Blackboard entitled “Leveraged Buyouts” (pp. 12-29).” Also, read Case Study 11-2 in DePamphilis (pp. 441-442) entitled “Sony Buys MGM” and be prepared to discuss the case study questions in class. Students will be selected to lead the discussion in class for individual questions. Alternative Exit and Restructuring Strategies Discuss USX business case Peer review of team members and project manager Time Required to complete reading: 4 hours Work on Acquisition Team Project Required Reading: Chapter 13 in DePamphilis and lecture notes entitled “Alternative Restructuring Strategies.” Be sure to read Case Study 13-6 (pp. 524525) in DePamphilis entitled “USX Bows to Shareholder Pressure” and be prepared to discuss case study questions in class. Individual students will be selected to lead discussion of specific questions in front of the class. Final Exam Time required to complete reading: 4 hours. Acquisition Team Projects due. None will be accepted after this date. Review Chapters 8 – 11 and 13 in DePamphilis, Student Study Guide, and class notes since mid-term. Calculators are required. 9