faculty of economi̇cs - Department of Management

advertisement

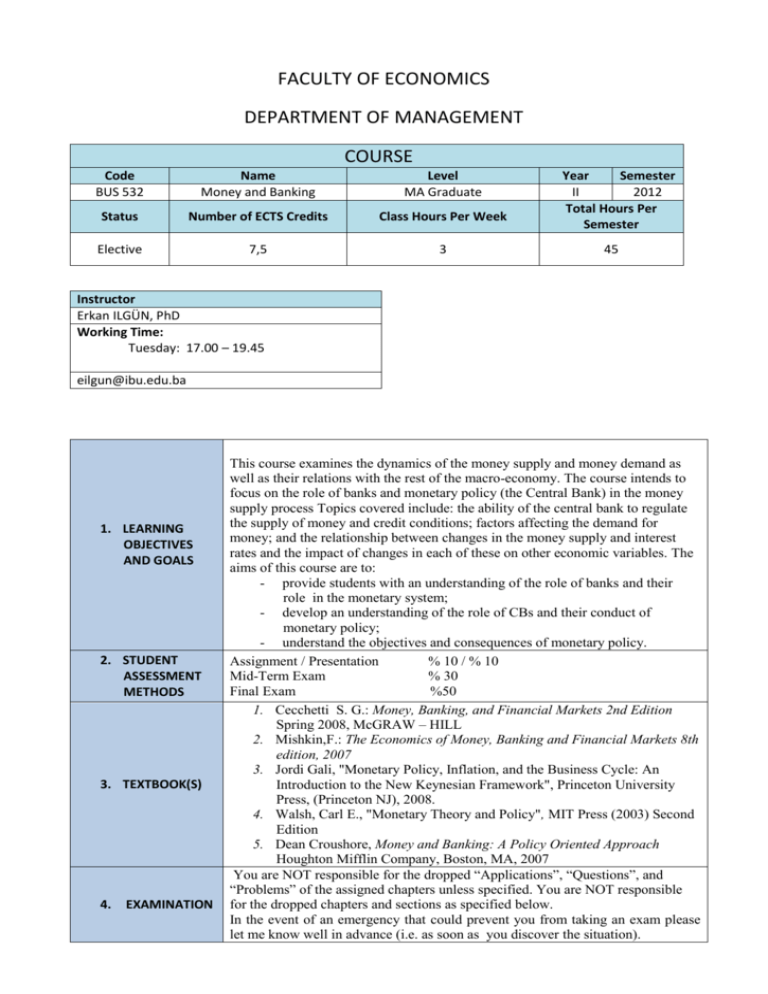

FACULTY OF ECONOMICS DEPARTMENT OF MANAGEMENT COURSE Code BUS 532 Name Money and Banking Level MA Graduate Status Number of ECTS Credits Class Hours Per Week Elective 7,5 3 Year Semester II 2012 Total Hours Per Semester 45 Instructor Erkan ILGÜN, PhD Working Time: Tuesday: 17.00 – 19.45 eilgun@ibu.edu.ba 1. LEARNING OBJECTIVES AND GOALS 2. STUDENT ASSESSMENT METHODS 3. TEXTBOOK(S) 4. EXAMINATION This course examines the dynamics of the money supply and money demand as well as their relations with the rest of the macro-economy. The course intends to focus on the role of banks and monetary policy (the Central Bank) in the money supply process Topics covered include: the ability of the central bank to regulate the supply of money and credit conditions; factors affecting the demand for money; and the relationship between changes in the money supply and interest rates and the impact of changes in each of these on other economic variables. The aims of this course are to: - provide students with an understanding of the role of banks and their role in the monetary system; - develop an understanding of the role of CBs and their conduct of monetary policy; - understand the objectives and consequences of monetary policy. Assignment / Presentation % 10 / % 10 Mid-Term Exam % 30 Final Exam %50 1. Cecchetti S. G.: Money, Banking, and Financial Markets 2nd Edition Spring 2008, McGRAW – HILL 2. Mishkin,F.: The Economics of Money, Banking and Financial Markets 8th edition, 2007 3. Jordi Gali, "Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework", Princeton University Press, (Princeton NJ), 2008. 4. Walsh, Carl E., "Monetary Theory and Policy", MIT Press (2003) Second Edition 5. Dean Croushore, Money and Banking: A Policy Oriented Approach Houghton Mifflin Company, Boston, MA, 2007 You are NOT responsible for the dropped “Applications”, “Questions”, and “Problems” of the assigned chapters unless specified. You are NOT responsible for the dropped chapters and sections as specified below. In the event of an emergency that could prevent you from taking an exam please let me know well in advance (i.e. as soon as you discover the situation). SCHEDULE OF LECTURES Date Class Hours Week 1 3 Week 2 3 Week 3 3 Week4 3 The risk and term structure of interest rates / The stock marke Week5 3 Economic analysis of financial structure / Banking and management of financial institutions Week 6 3 Week 7 Week 8 Topics Why study Money and Banking? An overview / What Is Money? Understanding Interest Rates Introduction Money and Interest Rates (Financial markets) The Behavior of Interest Rates Structure of interest rates and the stock market Financial Institutions Banking industry / Banking regulation MID – TERM EXAM 3 Multiple Deposit Generation and the Money Supply Process Week 10 3 Tools of Monetary Policy Week 11 3 Conduct of Monetary Policy: Targets and Goals Week 12 3 Week 13 3 Central banking (Money Supply) The Demand for Money The Keynesian Framework and the ISLM Model (SR, fixed prices transmission) Week 14 3 Monetary and Fiscal Policy in the ISLM Model Week 15 3 Aggregate Demand and Supply Analysis (SR to LR) Week 16 3 Transmission Mechanisms of Monetary Policy Week 17 3 Money and Inflation Week 18 Rational Expectations: Implications for Policy / Money Demand Monetary Policy 3 Monetary Policy Strategy: The Inte. Experience Week 19 3 The Foreign Exchange Market Week 20 3 The International Financial System Week 21 3 FINAL EXAM International Finance and Monetary Policy