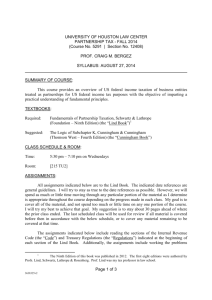

ACC 656-01

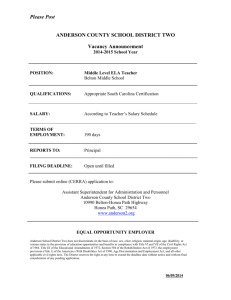

advertisement

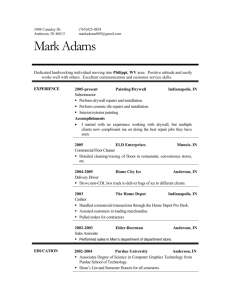

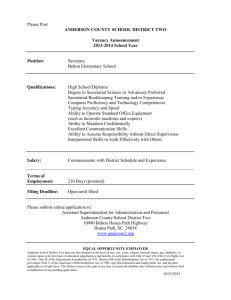

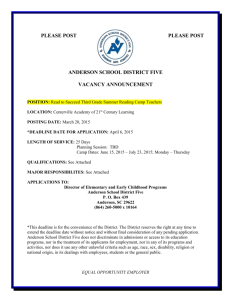

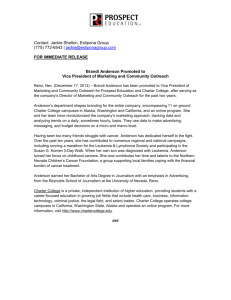

ACCOUNTING 656 Taxation of Flow-through Entities Bryan School of Business and Economics Spring, 2011 Dr. Bill Harden, CPA, ChFC Office Office Hours Phone E-mail Bryan 384 M, W 12:30 to 2:00 or by appointment 256-0188 jwharden@uncg.edu Texts: Lind, Stephen A., et. al., Fundamentals of Partnership Taxation, 8th Edition. Foundation Press. Prentice Hall’s Federal Taxation 2011 Comprehensive Pope, Anderson, Kramer Prentice Hall (2010 version okay if purchased last year, student is responsible for updating material) Federal Income Tax Code and Regulations Selected Sections 2010-2011 Martin Dickinson, Editor CCH (Earlier edition okay if purchased last year student is responsible for updating material) Objectives: After completing this course, students should possess an in-depth understanding of the tax law governing partnerships, limited liability companies, and S corporations. Learning Outcomes: Demonstrate the ability to analyze flow-through tax issues Develop an understanding of the importance of entity choice Demonstrate the ability to report flow-through transactions Improve analytical skills through problem solving Grading: Midterm Final Tax Return Projects Homework/Participation 40% 40% 10% 10% Final grades will be determined as follows: 100-93% A 92-90% A- 89-88 B+ 87-83% B 82-80% B- 79-70% C Below 70% F Policies: 1. This is a seminar class, therefore attendance is crucial. Late work will not be accepted. I reserve the right to drop students after two unexcused absences. Also, beginning with the second unexcused absence, any additional unexcused absences will result in your final average being reduced by 1 point for each unexcused absence. If you must miss a class, you may turn in the assignment early. 2. Students are expected to take the exams as scheduled. If you have an emergency, you must notify me before the exam, and only university excused absences will be accepted. You will be expected to provide verification of the emergency before a make-up will be scheduled. 3. Attendance will be taken at the beginning of each class and will count as part of your participation grade. 4. Homework will be taken up on an unannounced basis throughout the semester and will be graded for effort. 5. IF YOUR CELL PHONE GOES OFF DURING AN EXAM YOUR PAPER WILL BE COLLECTED AT THAT POINT AND YOU WILL NOT BE ALLOWED ADDITIONAL TIME TO COMPLETE YOUR EXAM. 6. Late work will not be accepted. 7. The complete Bryan School faculty and student guidelines can be references at: http://www.uncg.edu/bae/faculty_student_guidelines.pdf Course Outline: Class Meeting January 10 January 24 January 31 February 7 February 14 February 21 February 28 Topic Introduction; Choice of Entity; Overview of Partnership Taxation Partnership Formation Partnership Operations Partnership Operations (cont.) Partnership Allocations Partnership Allocations (cont.) Assignment* Read: Lind, Chapter 1; Anderson, C2-2 to C2-8, C9-2 to C9-5, C10-29 to C10-31, C11-2 to C11-6 Problems: Anderson, 11-29; Lind, Problem 1 page 16 Read: Lind, Chapter 2; Anderson, C9-5 to C9-12 Problems: Anderson, 9-25, 9-26, 9-28, 9-29; Lind, page 36, page 43, page 50, page 74 (#2) Read: Lind, Chapter 3; Anderson, C9-12 to C9-18, C9-21 to C9-27 Problems: Anderson 9-31, 9-32, 9-33, 9-39, 9-41, 942, 9-45; Lind, page 103, page 110, page 122 (#2) Read: Lind, Chapter 4; Anderson, C9-18 to C9-20 Read: Lind, Chapter 4; Anderson, C9-18 to C9-20 Transactions Between Partners and Partnership Problems: Anderson 9-36, 9-37, 9-38; Lind, page 161 (#1,3), page 195 (#1) page 214 (#1,3) Read: Lind, Chapter 5; Anderson, C9-27 to C9-29 Midterm Examination Problems: Anderson, 9-47, 9-48, 9-49, 9-51; Lind, page 234 (#1), page 250 (#1), page 257 (#1) Be Prepared March 14 March 21 March 28 April 4 Sales and Exchanges of Interests Operating Distributions Liquidating Distributions and Terminations Death or Retirement of a Partner and Anti-Abuse Regs. Read: Lind, Chapter 6; Anderson, C10-16 to C10-19, C10-20 to C10-22 Problems: Anderson, 10-38, 10-39, 10-40 10-46, 10-47, 10-48; (sale parts of 46 and 47) Lind, page 291 (#1) Read: Lind, Chapter 7; Anderson, C10-2 to C1011, C10-26 to C10-29 Problems: Anderson, 10-26, 10-27, 10-30, 10-31, 10-32; Lind, page 313, page 327 (#1) Read: Lind, Chapter 8; Anderson, C10-11 to C10-16, C10-22 to C10-26, C10-34 Problems: Anderson, 10-34, 10-35, 10-36, 10-49, 10-50; 10-46, 10-47 (liquidation parts of 46 and 47); Lind, page 349 (#1), page 390 (#1) Read: Lind, Chapters 9 and 10; Anderson, C10-19 to C10-20 Problems: Anderson, 10-41, 10-42, 10-44, 10-45; Lind, page 405, page 412 April 11 April 18, 25 May 2 S Corporation Operations and Taxation Read: Lind, 404-433, 436-455; Anderson, C11-4 to C11-27 Problems: Anderson 11-34, 11-35, 11-36, 11-37, 11-38, 11-39, 11-40, 11-42, 11-43, 11-48 S Corporation Distributions, Read: Lind, 432-436; Other S Corporation Issues Anderson, C11-27 to and Recap of Entity Choice C11-40 Final Examination Problems: Anderson 11-49, 11-51, 11-52, 11-53, 11-55, 11-57, 11-58 7:00 – 10:00 p.m. * Code and Regulation numbers to be read are given in the body of the Lind text for a given assignment and in the footnotes to the Anderson text, and are not repeated here. Students are expected to read the Code and Regulation sections listed in the text. Additional problems will be worked in class if time permits, but will not be collected as homework.