Document - Oman College of Management & Technology

advertisement

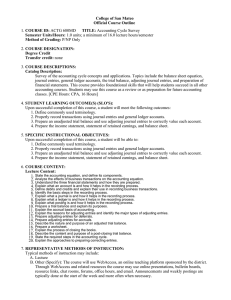

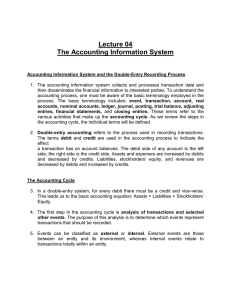

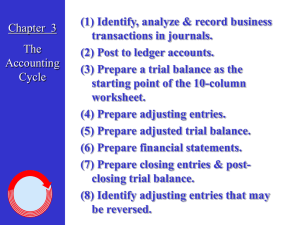

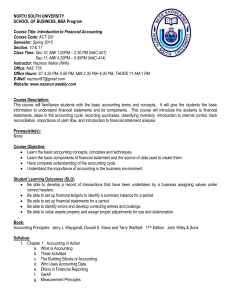

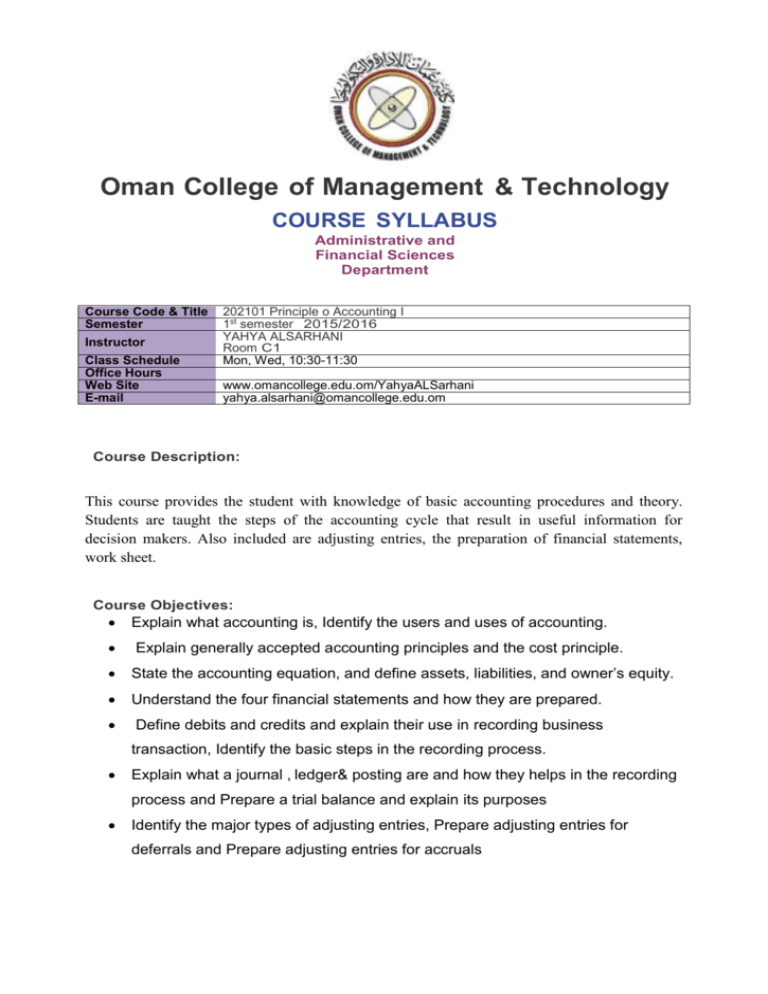

Oman College of Management & Technology COURSE SYLLABUS Administrative and Financial Sciences Department Course Code & Title Semester Instructor Class Schedule Office Hours Web Site E-mail 202101 Principle o Accounting I 1st semester 2015/2016 YAHYA ALSARHANI Room C1 Mon, Wed, 10:30-11:30 www.omancollege.edu.om/YahyaALSarhani yahya.alsarhani@omancollege.edu.om Course Description: This course provides the student with knowledge of basic accounting procedures and theory. Students are taught the steps of the accounting cycle that result in useful information for decision makers. Also included are adjusting entries, the preparation of financial statements, work sheet. Course Objectives: Explain what accounting is, Identify the users and uses of accounting. Explain generally accepted accounting principles and the cost principle. State the accounting equation, and define assets, liabilities, and owner’s equity. Understand the four financial statements and how they are prepared. Define debits and credits and explain their use in recording business transaction, Identify the basic steps in the recording process. Explain what a journal , ledger& posting are and how they helps in the recording process and Prepare a trial balance and explain its purposes Identify the major types of adjusting entries, Prepare adjusting entries for deferrals and Prepare adjusting entries for accruals Learning Outcomes: At the end of the course students would be able to Know and understand: Apply Generally Accepted Accounting Principles when recording business transactions; maintain a general ledger and prepare an unadjusted trial balance. Prepare the necessary period end adjusting entries, adjusted trial balance, and financial statements for unincorporated operations; and complete the accounting cycle. Identify all components of an income statement for a merchandising operation and prepare journal entries under the periodic and perpetual inventory systems. Discuss the basic concepts and design of a manual accounting information system, special journals, and subsidiary ledgers. Teaching Methods Class lectures and discussion covering all topics. Guided classroom exercises Seatwork/Board-work Review questions Course Time Table: Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Topics Chapter 1- Definition, nature, uses of Accounting. The building blocks of Accounting, Fundamental Business Concept Chapter 2 – the Recording Process Debits & Credit Steps in the recoding process: Journal Steps in the recoding process: Ledger First –Term Examination Financial Statements: income, owner equities and balance sheet. Chapter 3 –Adjusted the Accounting The basics of adjusted entries Preparing the adjusted: Trial balance. Preparing the adjusted : Financial statements Second-term Examination Chapter 4 – Completing of the Accounting Cycle Using a work sheet Closing the entries Post-closing Trial Balance Review Final Examination Textbook/References Accounting Principles,7th Edition by Kieso Financial Accounting, Second Edition, Jae K. Shim and Joel G. Siegel Performance Evaluation: The grade will be based upon the following: First Exam Class Participation & Activity Final Project (Exam) 20% 10% 50% Student Responsibility: • Mobile phones must be turned off during class time. • Students are expected to participate in class discussion and critiques. Failure to do so will result in grade reduction. • Students are expected to follow OCMT’s standardized attendance policy. Lecture attendance is mandatory. Students are allowed maximum of 15% absence of the total classroom hours. • Students are required to work on projects in and outside of class, and must Complete all assignments. • • Meet all deadlines and complete all assignments, (Late papers will not be accepted). Come on time and staying until class is over.