Accounting I – UNIT 6

advertisement

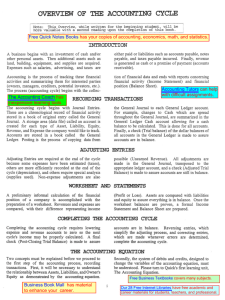

Chapter 4 Completing the Accounting Cycle – Part II Beginning on page 156 1 Objective 4 Describe the accounting cycle. 2 The accounting process that begins with analyzing and journalizing transactions and ends with preparing the accounting records for the next period’s transactions is called the accounting cycle. There are ten steps in the accounting cycle. 3 Accounting Cycle 1. Transactions are analyzed and recorded in the journal. 2. Transactions are posted to the ledger. 3. An unadjusted trial balance is prepared. 4. Adjustment data are assembled and analyzed. 5. An optional end-of-period spreadsheet (work sheet) is prepared. (continued) 4 Accounting Cycle (continued) 6. Adjusting entries are journalized and posted to the ledger. 7. An adjusted trial balance is prepared. 8. Financial statements are prepared. 9. Closing entries are journalized and posted to the ledger. 10. A post-closing trial balance is prepared. 5 Example Exercise 4-6 Accounting Cycle From the following list of steps in the accounting cycle, identify what two steps are missing. a. Transactions are analyzed and recorded in the journal. b. Transactions are posted to the ledger. c. Adjustment data are assembled and analyzed. d. An optional end-of-period spreadsheet (work sheet) is prepared. e. Adjusting entries are journalized and posted to the ledger. f. Financial statements are prepared. g. Closing entries are journalized and posted to the ledger. h. A post-closing trial balance is prepared. 6 Example Exercise 4-6 (continued) The following two steps are missing: (1) the preparation of an unadjusted trial balance and (2) the preparation of the adjusted trial balance. The unadjusted trial balance should be prepared after step (b). The adjusted trial balance should be prepared after step (e). 7 Problem 4-6A • Let’s take a look at your textbook exercises for this unit. We only have one – Problem 4-6A p 189 • Please be aware that it is a long one, so get started on it ASAP. Instruction 1 • Journalize each transaction in a two-column journal, referring to the following chart of accounts in selecting the accounts to be debited and credited. • Exhibit 9 on page 159-160 for an example of the journal and related journal entries. NOTE: THE AMOUNTS HERE ARE FOR THE DEMO ONLY!!! PLEASE USE THE INFORMATION IN THE TEXTBOOK TO COMPLETE YOUR WORK!!! First you complete the daily transactions for the company that are given to you in the instructions on page 189. NOTE: The Post Ref Column should be blank at this point. Instruction 2 • Post the journal to a ledger of four-column accounts. • Exhibit 17 page 166-168 for an example of a four-column ledger. After you have completed ALL of the journal entries based on the transactions from pages 189-190, you will fill in the ledger for each related account. Please note the Post Ref here. The post ref on the ledgers should be the Page Number of the journal. On the journal, the post ref is the account number that you moved the information into. Instruction 3 • Prepare an unadjusted trial balance. • Exhibit 10 on page 161. As you complete your ledgers from the information that you get from your journal entries from the daily transactions, be sure to ONLY complete them up to the line that says “Adjusting”. At this point you have not done the Adjustments, so this section of the ledger is not ready to be completed. You will need the subtotal at this point to complete your UNADJUSTED TRIAL BALANCE. HINT: You CANNOT complete the template from top to bottom. You have to jump around within the template depending on the step of the accounting cycle. Once you get the TOTALS in the ledgers from the daily transactions that you recorded from page 189 (you should NOT have information in the ledgers for your adjustments or closing entries at this point), you can then complete the UNADJUSTED TRIAL balance. Remember, this has to balance. Instruction 4 • At the end of June, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). • Part 5 is not optional. • Part 5 is NOT optional, it is a part of your grade. • The worksheet is required. Instruction 5 • This is NOT optional, the worksheet is required. • Enter the unadjusted trial balance on an endof-period spreadsheet (worksheet) and complete the spreadsheet. • Exhibit 11 page 162. Add left to right! After you complete your UNADJUSTED TRIAL BALANCE (HINT: The template TELLS you what the balance of the Unadjusted Trial Balance should be on the worksheet as a way to double check yourself.), you can then begin to fill out your worksheet for the adjustments. The adjustment information is on page 190 in letters a-f. Remember to include the letters a-f on the worksheet for the “Adjustments” columns. HINT: MAKE SURE TO ADD FROM LEFT TO RIGHT! Let’s run through one adjustment on page 161 a. Insurance expired during April is $300. This means we used up $300 of insurance. So let’s see what we had in the prepaid insurance account from the unadjusted trial balance (right above this). We had $1800 in Prepaid Insurance but we used up (time has passed) $300 of this so we need to take it out of the account. Adjusting entry a con’t. Since Prepaid Insurance is an asset it normally has a debit balance. If we want to take away from that account we have to do the opposite or credit the account. So we would debit Insurance Expense and credit Prepaid Insurance. Look at Exhibit 11 on page 162. Do you see the two letter a’s under the adjustments columns? Now go to Exhibit 12. See the JE? Any questions on how to enter the adjusting entries? Remember to read the adjusting information carefully. You now will have the “Adjustments” columns and the “Adjusted Trial Balance” columns completed. So you can then carry over the asset, liability and owner’s equity accounts to the balance sheet columns and the revenue and expense accounts to the income statement columns. You take the figures from the Adjusted Trial Balance columns. Back to the Problem -Instruction 6 • Journalize and post the adjusting entries. • Exhibit 12 page 162 for the adjusting entries. • Exhibit 17 page 166-168 for posting them. Notice we enter the word “adjusting” in the item column on the ledger for the adjusting entries. Right below the worksheet is the area you will use to record the adjustments from the instructions on page 190 (the adjusting entries are labeled a-f). Once you complete them, then you will go back up to your ledgers and NOW you will fill in the rows labeled “Adjusting” and then for these ledgers get new subtotals. The lines in the ledger that say “Closing” are not yet ready to be completed. Once you have all of the adjustments on your ledgers and the new totals on your ledgers through this line, you can then complete the ADJUSTED TRIAL BALANCE. Remember, some accounts will not have a change in their balance from the Unadjusted Trial Balance to the Adjusted Trial Balance because they did not have an adjustment. Instruction 7 • Prepare an adjusted trial balance. • Exhibit 13 page 163. You can now complete the ADJUSTED TRIAL BALANCE based on the new information that you placed in the ledgers and any new totals for the accounts that were adjusted. Some account totals will remain the same and the ones that were adjusted will be different from the totals you had on your UNADJUSTED TRIAL BALANCE. Don’t forget, you will need to complete the ADJUSTED TRIAL BALANCE on your worksheet as well. Instruction 8 • Prepare an income statement, a statement of owner’s equity, and a balance sheet. • Exhibit 14 page 164. • You will complete the financial statements in this order: – Income Statement – Statement of Owner’s Equity – Balance Sheet Where do you get the information to complete the financial statements? The last four columns of the worksheet. Instruction 9 • Prepare and post the closing entries. (Income Summary is account #33 in the chart of accounts.) • Exhibit 15 page 165 and Exhibit 17 pages 166-168 for the posting. • See page 150-153 for instructions on these. When the closing entries are completed, you will once again go up to the ledgers and NOW you will fill in any rows that say “Closing”. These entries should “0” out the revenue, expense and drawing accounts. • You will once again have new totals in your ledgers. The totals will be placed on your Post-Closing Trial Balance. See Exhibit 16 on page 166. Exhibit 15 pg 165 Closing Entries, Kelly Consulting Closing Revenues Closing Expenses Closing Income Summary Closing Drawing 28 Pg 166 NOTE: ONLY ASSETS, LIABILITIES AND CAPITAL SHOULD REMAIN ON THE POSTCLOSING TRIAL BALANCE Objective 6 Explain what is meant by the fiscal year and the natural business year. 30 The annual accounting period adopted by a business is known as its fiscal year. When a business adopts a fiscal year that ends when business activities have reached the lowest point in its annual operation, such a fiscal year is also called the natural year. 31 Questions??? • Textbook Exercises for unit 6 is Problem 4-6A. • Don’t forget to use Problem 4-6B as a reference. • This is not a quick problem, so make sure you begin working on it as soon as possible. • If you finish it early, you can always start on chapter 6.