NORTH SOUTH UNIVERSITY SCHOOL OF BUSINESS, BBA

NORTH SOUTH UNIVERSITY

SCHOOL OF BUSINESS, BBA Program

Course Title: Introduction to Financial Accounting

Course Code: ACT 201

Semester: Spring 2015

Section: 10 & 11

Class Time: Sec-10: MW 1.00PM – 2.30 PM (NAC-501)

Sec-11: MW 4.20PM – 5.50PM (NAC-414)

Instructor: Nazmun Nahar (NNh)

Office: NAC 776

Office Hours: ST 4.20 PM–5.50 PM, MW 2.30 PM–4.00 PM, THURS 11 AM-1 PM

E-Mail: nazmun87@gmail.com

Website: www.nazmun.weebly.com

Course Description:

This course will familiarize students with the basic accounting terms and concepts. It will give the students the basic information to understand financial statements and its components. This course will introduce the students to financial statements, steps in the accounting cycle, recording purchases, classifying inventory, introduction to internal control, bank reconciliation, importance of cash flow, and introduction to financial statement analysis

Prerequisite(s):

None

Course Objective:

Learn the basic accounting concepts, principles and techniques.

Learn the basic components of financial statement and the source of data used to create them.

Have complete understanding of the accounting cycle.

Understand the importance of accounting in the business environment.

Student Learning Outcomes (SLO)

Be able to develop a record of transactions that have been undertaken by a business assigning values under correct headers.

Be able to set up financial ledgers to identify a summary balance for a period.

Be able to set up financial statements for a period.

Be able to identify errors and develop correcting entries and postings.

Be able to value assets properly and assign proper adjustments for use and deterioration.

Book:

Accounting Principles: Jerry J, Weygandt, Donald E. Kieso and Terry Warfield: 11 th Edition. John Wiley & Sons

Syllabus:

1.

Chapter 1: Accounting in Action a.

What is Accounting b.

Three Activities c.

The Building Blocks of Accounting d.

Who Uses Accounting Data e.

Ethics in Financial Reporting f.

GAAP g.

Measurement Principles

h.

Assumptions i.

The Basic Accounting Equation j.

Assets k.

Liabilities l.

Owner’s Equity m.

Using the Accounting Equation n.

Transaction Analysis o.

Summary of Transactions p.

Financial Statements q.

Income Statement r.

Owner’s Equity Statement s.

Balance Sheet

2.

Chapter 2: The Recording Process a.

The Account b.

Debits and Credits c.

Summary of Debit/Credit Rules d.

Steps in the Recording Process e.

The Journal f.

The Ledger g.

Recording Process h.

The Trial Balance i.

Limitations of Trial Balance j.

Use of Dollar Signs

3.

Chapter 3: Adjusting the Accounts a.

Timing Issues b.

Fiscal and Calendar Years c.

Accrual vs. Cash Basis Accounting d.

Recognizing Revenues and Expenses e.

The Basics of Adjusting Entries f.

Types of Adjusting Entries g.

Adjusting Entries for Deferrals h.

Adjusting Entries for Accruals i.

Summary of Basic Relationships j.

The Adjusted Trial Balance and Financial Statements k.

Preparing Adjusting Trial Balance l.

Preparing Financial Statements from Adjusted Trial Balance

4.

Chapter 4: Completing the Accounting Cycle a.

Using a Worksheet b.

Steps in Preparing a Worksheet c.

Preparing Financial Statements from a Worksheet d.

Preparing Adjusting Entries from a Worksheet e.

Closing the Books f.

Preparing Closing Entries g.

Posting Closing Entries h.

Preparing a Post-Closing Trial Balance i.

Summary of the Accounting Cycle j.

Correcting Entries k.

The Classified Balance Sheet l.

Current Assets m.

Long-Term Investments n.

Property, Plant and Equipment o.

Intangible Assets

p.

Current Liabilities q.

Long-Term Liabilities r.

Owner’s Equity

5.

Chapter 5: Accounting for Merchandising Operations a.

Merchandising Operations b.

Recording Purchases of Merchandise (periodic and perpetual) c.

Freight Costs (periodic and perpetual) d.

Purchase Returns and Allowances (periodic and perpetual) e.

Purchase Discounts (periodic and perpetual) f.

Summary of Purchasing Transactions (periodic and perpetual) g.

Recording Sales of Merchandise (periodic and perpetual) h.

Sales Return and Allowances (periodic and perpetual) i.

Sales Discounts (periodic and perpetual) j.

Completing the Accounting Cycle k.

Adjusting entries related to merchandise operation l.

Closing entries related to merchandising operation m.

Multiple step income statement n.

Single step income statement o.

Classified balance sheet

6.

Chapter 6: Inventories a.

Classify Inventory b.

Determine Inventory Quantities c.

Inventory Costing d.

Specific Identification e.

Cost Flow Assumptions (LIFO, FIFO, average cost (both perpetual and periodic)) f.

Financial Statement and Tax Effects of Cost Flow Methods g.

Using Inventory Cost Flow Methods Consistently h.

Lower-of-Cost-or-Market i.

Inventory Errors – Income statement Effects & Balance Sheet Effects

7.

Chapter 8: Fraud Internal Control and Cash a.

Control Features: Use of a Bank b.

Making Bank Deposits c.

Writing Checks d.

Bank Statements e.

Reconciling the Bank Account

8.

Chapter 10: Plant Assets, Natural Resources, and Intangible Assets a.

Plant Assets b.

Determining the Cost of Plant Assets c.

Depreciation d.

Expenditures During Useful Life e.

Plant Asset Disposals (Retirement and Sale) f.

Natural Resources Depletion g.

Intangible Assets h.

Accounting for Intangible Assets i.

Research and Development costs

9.

Chapter 17: Statement of Cash Flows a.

Usefulness of the Statement of Cash Flows b.

Classification of Cash Flows c.

Significant Noncash Activities d.

Format of the Statement of Cash Flows e.

Preparing the Statement of Cash Flows (Indirect method)

Syllabus for Exams:

Exam

Mid-Term 1

Mid-Term 2

Final Exam

Chapters

Ch. 1, 2, 3 & 4

Ch. 5, 6, 8

Ch. 10, 17 & 18

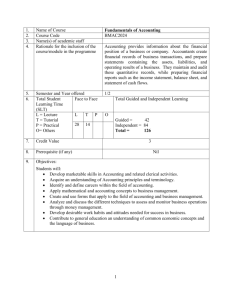

Marks Allocation:

Class Attendance

Assignments

Quiz

Midterm 1

Midterm 2

Final Exam

Total

5%

10%

15%

20%

25%

25%

100%

Assignments:

Assignments play a key role for exam preparation. Students have to submit hand written assignments. Assignments must be submitted in time. Late submission will result in deduction of marks. No assignment would be accepted after three days of due date.

Special Instructions:

Please be self responsible in collection of all the course materials and any updated notice in time from the website

www.nazmun.weebly.com.

Students are required to bring textbook and calculator to every class. Most importantly, it is not allowed to share anything during the exams/quizzes.

Daily attendance is mandatory. Late attendance will cost you class attendance points. Students missing more than

2 classes will not be given the class attendance points.

Cell phones must be switched off during classes and exams.

There will be NO make-up exam or comprehensive exam in this course, under any circumstances.

NSU rules will be applied regarding using unfair and unethical means (including cheating, plagiarism) during exams/quizzes. Any academic misconduct will result in F grade for the course.

Incomplete (I) will not be given in any circumstances.

Please email me for the appointment of additional office hours.

Please consult and comply with the NSU code of conduct and guidelines offered by the BBA program office.

Important Note:

This course outline is tentative and the instructor has the right to modify it depending on the performance of the class.