The Accounting System

advertisement

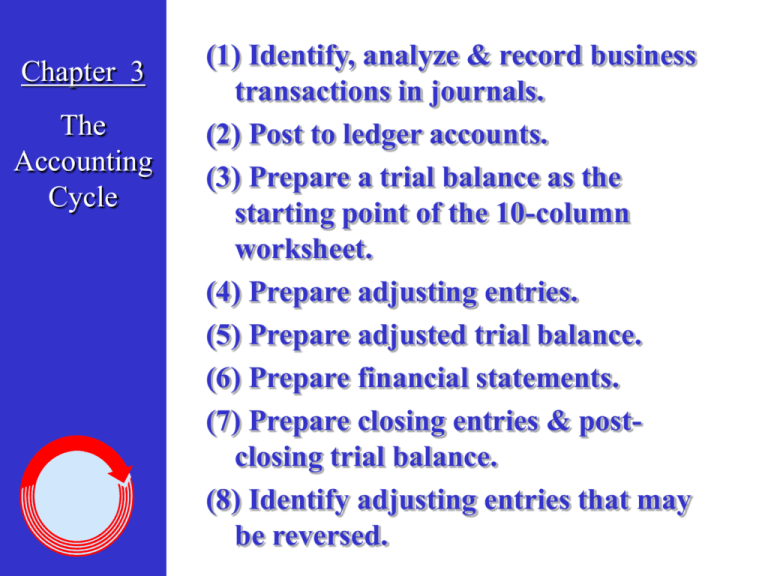

Chapter 3 The Accounting Cycle (1) Identify, analyze & record business transactions in journals. (2) Post to ledger accounts. (3) Prepare a trial balance as the starting point of the 10-column worksheet. (4) Prepare adjusting entries. (5) Prepare adjusted trial balance. (6) Prepare financial statements. (7) Prepare closing entries & postclosing trial balance. (8) Identify adjusting entries that may be reversed. The Accounting Cycle: Step 1 • Event: A happening of consequence. May be external or internal. Generally triggers a change in assets, liabilities or equity. Identify, analyze & record business transactions in journals. • Transaction: An external event involving a transfer or exchange between two or more entities. • Journal: The book of original entry. Transactions are recorded in journal entry form in their entirety. • Account: An account represents an area of similar economic interest. The Accounting Cycle: Step 1 Identify, analyze & record business transactions in journals. Double Entry System of Accounting. A logical method for recording transactions. It recognizes that there are at least two events or changes for each transaction. Debit (or sum of the debits) will always equal the credit (or the sum of the credits). Account Name A Debit enters an amount on the left-hand side of an account. It does not mean A Credit enters an amount on the right-hand side of an account. It does not mean increase or decrease. increase or decrease. Balance Sheet Equation: Assets = Liabilities + Owner Equity Assets will always equal the sources of those assets. That is, assets belong to either the creditors or the owners. The Assets Accounting debit credit Cycle: Step 1 + - Liabilities debit Owners Equity credit debit - + Identify, analyze & record business transactions in journals. credit - + Expense debit +- Revenue credit debit credit - + A Journal Entry: Double Entry Debit & Credit Rules Date Dr. Account name XX Dr. Account name XX Cr. Account name Explanation XX The Accounting Cycle: Step 2 Post to ledger accounts. – Posting: The carrying of the essential facts from the journal to the ledger. • Ledger: The book (manual or computer) of “T” accounts. – General ledger (GL) is the book of control or general accounts. – Subsidiary ledger contains the detail of a specific control or general account (e.g., Accounts Receivable). The Accounting Cycle: Step 2 Post to ledger accounts. Types of accounts Real Accounts exits from one period to the next and are not closed. Real accounts are the balance sheet accounts including asset, liability and equity accounts (except dividends). Nominal Accounts exist in name only. At the end of each period, they are closed. Nominal accounting are the income statement accounts--Revenue and expense as well as the dividends account. The Accounting Cycle: Step 3 Prepare a trial balance as the starting point of the 10-column worksheet. • Trial Balance: A list of all open accounts in the GL (Assets, Liabilities, Owners’ Equity, Revenues, Expenses … in order) and their balances. Done to prove the equality of debits and credits. – Unadjusted--taken after routine entries are posted. – Adjusted--taken after adjusting entries are posted. – Post-closing--taken after closing entries are posted. This will not detect omissions or errors where debits = credits. It only determines, after adjusting, if total debits = credits. The Accounting Cycle : Step 4 Prepare Adjusting Entries 4 General Types Of Adjusting Entries Adjusting Journal Entries (AJE’s) are prepared to bring the books up to date as of the close of the accounting period. Dr. Expense Cr. Asset (such as “prepaid ...” or “accumulated depr”) Defer (or apportion) an expense and reduce an asset Dr. Unearned Revenue (to reduce the liability) Cr.Revenue Defer (or apportion) unearned revenue and reduce a liability Dr. Expense Cr. Liability Accrue an unrecorded expense Dr. Receivable Cr. Revenue Accrue an unrecorded revenue The Accounting Cycle: Step 6 • Financial Statements: The primary reporting vehicles for accounting information. They are the result of the collection, tabulation and summation of accounting data. The following four statements comprise a complete set of financial statements (“taken as a whole”): – Balance sheet--Financial condition Prepare Financial Statements (position) of an enterprise at the end of the period. … real accounts – Income statement--Shows the results of operations for the period. … nominal accounts – Statement of cash flows--Reports cash activity for the period by operating, investing and financing flows. – Statement of retained earnings--Reconciles the beginning and ending balances in the owner equity account. The Accounting Cycle: Step 7 Prepare Closing Entries & the PostClosing Trial Balance Prepare Closing Entries: – to empty the nominal (I/S, dividends) accounts in preparation for use in the next period. – to update the inventory account if the merchandiser uses a periodic inventory procedure. – to formally calculate net income or loss. – to update retained earnings. The Accounting Cycle: Step 8 Closing A Merchandise Cycle: Inventory Methods Inventory Methods: • Periodic: – Use of the purchases and contra accounts, Freight-in. – Adjust inventory at end of period within the context of closing. – Cost of Goods Sold (COGS) is a calculated figure – Closing involves purchases, sales, contras, Freight-in. • Perpetual: – Inventory is kept up-to-date--Debited when bought, credited when sold-Returns & Allowances, discounts flow through the inventory account. – Cost of Goods Sold is a known figure. – No purchase contras to close. The Accounting Cycle: Step 8 Prepare Reversing Entries Reversing entries are optional and are used to ease the preparation of journal entries throughout the accounting period without regard to the accounting period.