PROBLEM 12-1 Franchises 42,000 Prepaid Rent 28,000

advertisement

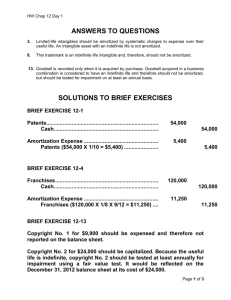

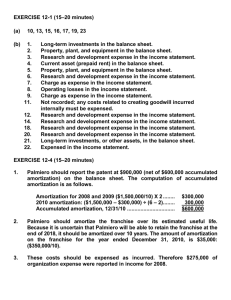

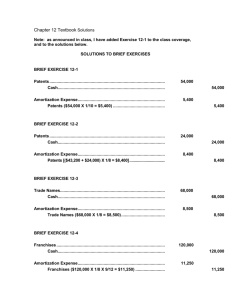

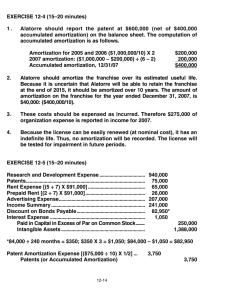

PROBLEM 12-1 Franchises Prepaid Rent Organization Expense ($1,000 + $5,000) Retained Earnings ($16,000 – $6,000) Patents ($74,000 + $12,650) Research and Development Expense ($75,000 + $160,000) Goodwill Intangible Assets Franchise Amortization Expense ($42,000 8) Retained Earnings ($42,000 8 X 6/12) Franchises Rent Expense ($28,000 2) Retained Earnings ($28,000 2 X 3/12) Prepaid Rent 42,000 28,000 6,000 10,000 86,650 235,000 278,400 686,050 5,250 2,625 7,875 14,000 3,500 17,500 Patent Amortization Expense Patents ($74,000 10) + ($12,650 X 7/115) 8,170 Goodwill Amortization Expense Goodwill ($278,400 40 X 9/12) 5,220 8,170 5,220 PROBLEM 12-7 Yuka Sato Corporation Year Ended December 31, 2001 Adjusting Journal Entries (Not required) -1Machinery 34,700 Patents (To transfer cost of improving machinery to the plant asset account) -2Cost of Goods Sold Accumulated Amortization of Patents [To record 2001 patent amortization (1/20 X $93,500)] 34,700 4,675 4,675 -3Licensing Agreement No. 2 4,000 Unearned Revenue (To classify revenue received in advance on licensing agreement as unearned revenue) -4Prior Period Adjustment—Licensing Agreement No. 1 42,450 Licensing Agreement No. 1 (To write off the permanent 70 percent reduction in the expected revenue-producing value of licensing agreement No. 1 caused by the late December 2000 explosion and the amortization of licensing agreement No. 1 for 2000) Schedule 1 Licensing agreement No. 1 amortization Book value of licensing agreement No. 1 destroyed prior to adjustment 4,000 42,450 $60,000 40 = $ 1,500 $58,500 X 70% = 40,950 $42,450 PROBLEM 12-7 (Continued) -5Cost of Goods Sold 6,450 Accumulated Amortization of Licensing Agreements ($450 + $6,000) To record 2001 amortization of licensing agreements No. 1 ([$60,000 – $42,450] 39) and No. 2 (10% X $60,000) -6Retained Earnings 30,000 Goodwill (To transfer cost of incorporation improperly charged to Goodwill) -7Equipment 15,000 Accounts Receivable 6,100 Leasehold Improvements (To charge the equipment account with movable equipment and to record a receivable from the landlord for the real estate taxes erroneously paid by Sato) 6,450 30,000 21,100 -8Cost of Goods Sold 1,500 Prior Period Adjustment—Amortization of Leasehold Improvements 1,500 Accumulated Amortization of Leasehold Improvements (To record 2000 and 2001 amortization of leasehold improvements based on 10 year life of lease (2 X 10% X $15,000) NOTE: Spreadsheets could not be saved 3,000