Capital Assets

advertisement

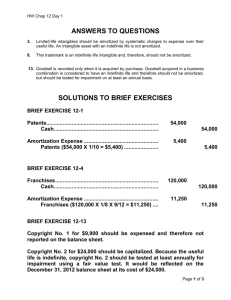

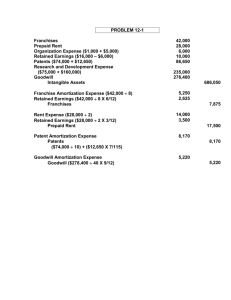

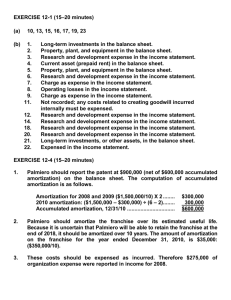

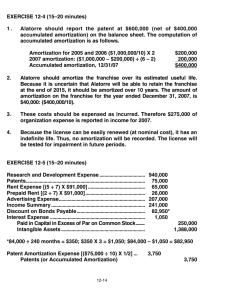

CHAPTER 10 CAPITAL ASSETS Capital assets (fixed assets) are: Long-lived Used in the operations of a business Not intended for sale to customers. Capital assets have two classes: 1. Tangible (can touch it) 2. Intangible (can’t touch it) TANGIBLE CAPITAL ASSETS Tangible capital assets include: property, plant and equipment like: Land + land improvements Buildings + improvements Equipment + freight + installation natural resources such as mineral deposits, oil and gas reserves, and timber INTANGIBLE CAPITAL ASSETS What are they? Patents, copyrights, sports contracts, and trademarks, goodwill Intangible capital assets provide future benefits through the special rights and privileges they possess. © DETERMINING THE COST OF CAPITAL ASSETS Capital assets are recorded at cost (cost principle). Cost consists of all expenditures necessary to 1. 2. Acquire the asset and Make it ready for its intended use. These costs include purchase price, freight costs, and installation costs. So, how do you come up with a cost figure?... MEASUREMENT OF CAPITAL ASSET COST Funny you should ask… Cost is measured by cash paid, or by the cash equivalent price when other assets are used instead. The cash equivalent price is equal to the fair market value of 1. 2. the asset given up or the asset received, whichever is more clearly determinable. LAND The cost of land can include: 1. Purchase price Closing costs such as title and legal fees Accrued property taxes and other liens on the land assumed by the purchaser Land improvements like: 2. 3. 4. 1. 2. 3. 4. Parking lots Fencing Landscaping Lighting BUILDINGS The cost of buildings includes all necessary expenditures relating to purchase or construction. When purchased: When making building ready for its intended use: Purchase price and closing costs. Expenditures for remodelling, replacing or repairing the roof, floors, wiring, and plumbing, etc.. When constructed, cost consists of: Contract price, architects’ fees, building permits, interest payments during construction, and excavation costs. EQUIPMENT The cost of equipment consists of: 1. 2. 3. 4. Cash purchase price, Freight charges, duties or tariffs Insurance against loss during transit, As well as all costs to assemble, install, and test it. WHY AMORTIZATION? (Depreciation - Review) During an asset’s life, its usefulness may decline because of usage or obsolescence. Amortization is the process of allocating to expense the cost of a capital asset over its useful life. Amortization is designed to match expenses with revenues in accordance with the matching principle. Recognition of amortization does not result in the accumulation of cash for the replacement of the asset, nor the use of cash, although an expense is recognized. Land is the only capital asset that is not amortized. AMORTIZATION METHODS Three methods of recognizing amortization are: 1. Straight-line, 2. Declining-balance (includes CCA), and 3. Units of activity. Each method is acceptable under GAAPs. Management selects the method that is appropriate for their company, it should be applied consistently. 1. STRAIGHT-LINE METHOD Historical Cost Salvage Value Annual Rate of Amortization Useful Life (in years) 1. STRAIGHT-LINE METHOD DECLINING-BALANCE METHOD Based on a declining book value (cost less accumulated amortization). The amortization rate remains constant, but the net book value declines each year. Book Value (at beginning of year) Declining balance rate Amortization Expense (for the year) DECLINING-BALANCE (cont.) If you aren’t given a rate for declining balance, use the following formula: NEW! 100% Rate = . Useful Life Example: Business buys $10,000 piece of equipment with a salvage value of $1,000 is expected to last for 10 years. However, management feels that the DECLINING BALANCE METHOD is best for amortizing this asset. 100% 10 years . = 10% DECLINING-BALANCE METHOD UNITS-OF-ACTIVITY METHOD EXAMPLE (assume the following): Mine of 1,000,000 m3 of ore Cost of finding, dropping aValue shaft and Total Cost of Resource – Salvage preparing for use: $50,000,000 This year we harvested 75,000 m3 of ore. Total Units Available Total Amortizable Costs of Mine Total Units available Amortization X Cost per Unit Amortization per unit used Total Amortization Expense Amortization Cost per Unit $ 50,000,000 1,000,000Amortization Units Used $ $ Cost this 50.00 ($50,000,000 Period / 1,000,000) 3,750,000 3 (75,000 m x $50/unit) UNITS-OF-ACTIVITY METHOD REVISING AMORTIZATION Change in Amounts or Speed If annual amortization is inadequate or excessive, a change should be made. When a change is made, 1. 2. There is no correction of previously recorded amortization expense, and Amortization expense for current and future years is revised using the normal formulas. When asset is bought/sold part way through a year, that year’s amortization must be prorated. REVISING AMORTIZATION Change in Method If you decide to change the amortization method, a prior period adjustment must be made When you change any accounting policy you: Do NOT revise prior years’ financial stmts 2. Calculate the total change for all prior years and charge it directly to the Capital account 3. Record this year’s amortization using the new method. Why would it be done this way? 1. C.C.A. Capital Cost Allowance CCA is the government’s method of calculating amortization for tax purposes. CCA is exactly like the Declining Balance method. However, CCA only allows you to recognize ½ a year’s amortization in the year of disposal AND purchase. CCA rates are specific, and are the maximum allowable rates for a year. See page 472 for a schedule of CCA rates for asset classes. C.C.A. and Income Taxes Must report using GAAPs Most firms use straight-line (it’s easy) But taxes are determined using tax law (CCA). This creates a discrepancy. Observe CCA vs. Straight Line CCA Straight Line Year 1 Year 2 Year 3 Year 4 C.C.A. and Income Taxes The discrepancy is charged to an account called Deferred Income Tax Most people (especially politicians) think that this account represents legitimate tax that corporations have somehow evaded paying. Not the case. It arises from the discrepancy between CCA for tax purposes, and amortization using GAAPs. Date April 30 Particulars Income Tax Expense Deferred Income Taxes Cash Debit Credit 25,000 5,000 20,000 EXPENDITURES DURING USEFUL LIFE Ordinary repairs are expenditures to maintain the operating efficiency and expected productive life of the capital asset. Expenditures are usually immaterial in amount and occur infrequently. They are operating expenses and are debited to Repairs Expense. Additions and improvements are costs incurred to increase operating efficiency, productive capacity, or expected useful life of the capital asset. They increase a company’s investment in productive facilities, so They are capital expenditures and are debited to the capital asset. CAPITAL ASSET DISPOSALS (Example: equipment costing $5,000 with $1,100 of amortization was sold for $4,000 on September 30th) 1 Amortization for the fraction of the year to the date of disposal must be recorded Date Sept 30 Particulars Debit Amortization Expense 100 Accumulated Amortization (assumed) To record 9 months of depreciation on disposed asset. Credit 100 CAPITAL ASSET DISPOSALS 2 Remove the value of all accounts associated with that asset, and record receipt of cash. Date Sept 30 Particulars Debit Cash Accumulated amortization Equipment Gain on sale of equipment Credit 4000 1200 5000 200 To record gain on the sale of buffing equipment. Gain or loss equals = Selling Price – Book Value $200 = ($4,000 - $3,800) $1,200) = $3,800 Historical($5,000 Cost ––Accumulated Amortization CAPITAL ASSET DISPOSALS (cont.) Alternatively, you can combine all three steps into one journal entry. The only difference here is that Accumulated Amortization will not include the value of the last write-off (step 1). Date Sept 30 Particulars Cash Amortization expense Accumulated amortization Equipment Gain on sale of equipment Debit 4000 100 1100 Credit $1,200 5000 200 NATURAL RESOURCES Natural resources (wasting assets), consist of standing timber and underground deposits of oil, gas, and minerals. They have two distinguishing characteristics: 1. They are physically extracted in operations. 2. They are replaceable only by an act of nature. NATURAL RESOURCES Acquisition Cost The acquisition cost of a natural resource is the cash or cash equivalent price necessary to acquire the resource and prepare it for its intended use. If the resource is already discovered, cost is the price paid for the property. NATURAL RESOURCES Amortization The units-of-activity method is generally used to calculate amortization ILLUSTRATION 10-24 STATEMENT PRESENTATION OF AMORTIZATION Accumulated Amortization, a contra asset account, is deducted from the cost of the natural resource in the balance sheet as follows: Lane Coal Company Balance Sheet (partial) December 31, 2003 Assets Capital assets Coal mine Less: Accumulated amortization Net book value $ 5,000,000 384,000 4,616,000 INTANGIBLE ASSETS Intangible assets cannot be touched. They are rights, privileges, and competitive advantages that result from the ownership of long-lived assets that do not possess physical substance. Do Problems: P10-2A, and 7A TYPES OF INTANGIBLE ASSETS Patents Copyrights Trademarks and Trade Names Franchises and Licenses Goodwill Research and Development Costs COPYRIGHTS Copyrights are granted by the federal government giving the owner the exclusive right to reproduce and sell artistic or published work Copyrights extend for the life of the creator plus 50 years TRADE MARKS/NAMES Word, phrase, jingle or symbol that distinguishes or identifies a particular enterprise or product If indefinite life, do not amortize. Test for impairment PATENTS Exclusive right to manufacture, sell or control granted for 20 years Legal costs of protecting a patent in an infringement suit are added to the Patent account and amortized over the remaining life of the patent FRANCHISES Contractual agreement under which the franchiser grants the franchisee the right To sell certain products To render specific services or to use certain trademarks or trade names, usually within a designated geographic area Annual fees are not capitalized, but are expensed. LICENSES Operating rights permit the enterprise to use public property in performing its service (i.e. the use of airwaves for radio or TV broadcasting) Annual fees are NOT capitalized, but expensed. GOODWILL Goodwill represents favourable attributes that relate to a business enterprise Recorded only in an exchange transaction that involves the purchase of an entire business Goodwill = (Price paid – Equity in Business) Goodwill is not written off as it has an unlimited useful life. It must be tested regularly for impairment. Impairment is when fair market value for an assets drops below the book value. GOODWILL -75,000 100,000 cash Equity acquired = 25,000 goodwill 100,000 How does goodwill arise? Firm A Firm B Firm AB Cash 100,000 50,000 50,000 Other Assets 300,000 100,000 400,000 25,000 How? Goodwill 400,000 150,000 475,000 Liabilities 200,000 75,000 275,000 Equity 200,000 75,000 400,000 150,000 275,000 How? 200,000 475,000 -100,000 cash + 25,000 goodwill = 200,000 GOODWILL Two steps: ONE: If FMV > Book Value = no impairment TWO: If not, then Goodwill is impaired. Things to consider in determining FMV: Significant adverse change in legal or business climate Adverse action by a regulator Unanticipated competition Loss of a key personnel More-likely-than-not expectation that a significant portion of a reporting unit will be sold or disposed of Impairment of a significant asset group within a reporting unit Recognition of a goodwill impairment loss by a subsidiary RESEARCH AND DEVELOPMENT COSTS Research costs–record as an expense when incurred Development costs–capitalize if associated with an identifiable, feasible product. Otherwise, expense What does identifiable and feasible mean? ACCOUNTING FOR INTANGIBLE ASSETS In general, accounting for intangible assets is the same as for capital assets. Intangible assets are: 1. 2. 3. Recorded at cost; Written off over useful life in a rational and systematic manner; At disposal, book value is eliminated and gain or loss, if any, is recorded. AMORTIZATION Amortizable intangible assets: Have defined lives Allocate cost to expense over the shorter of Useful (economic) life, or Legal life Straight-line method of amortization is used Unamortizable Intangible assets: Have indefinite useful lives, Do not amortize, and Must be tested for impairment (when fair market value for an assets drops below the net book value). FINANCIAL STATEMENT PRESENTATION Capital Assets are often combined on the Balance Sheet. If so, there should be full disclosure in the notes to the financial statements, which means disclose: Balances in each major asset class, Accumulated amortization of each major class, (or of assets in total), Amortization methods used should be described, and Amount of amortization expense for the period disclosed as well. ASSET TURNOVER RATIO The ratio that shows how efficiently a company uses its assets to generate sales is the asset turnover ratio. Net Sales Average Total Assets = Assets Turnover RETURN ON ASSETS The ratio that shows the profitability of assets used in the earnings process is the return on assets. Net Income Average Total Assets = Return on Assets