Financial Accounting

advertisement

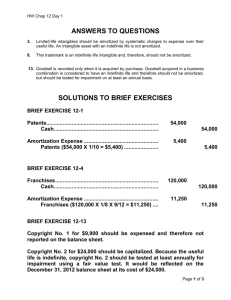

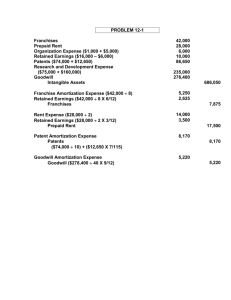

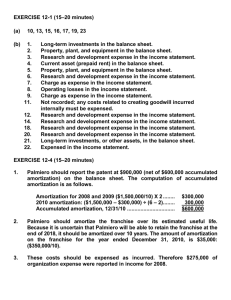

FINANCIAL ACCOUNTING A USER PERSPECTIVE Hoskin • Fizzell • Davidson Second Canadian Edition Capital Assets Chapter Eight Capital Asset Recognition • Capital assets – Used to generate revenue over several periods in the future – Used until replaced with a new asset – Can have residual (or resale) value Capital Asset Valuation • Historical cost – Original cost of the asset – Expensed (amortized) over the period used Capital Asset Valuation • Gain or loss on sale – Recognized only when sold – Difference between proceeds of the sale and the net book value • Net book value (or carrying value) – Original cost less amortization Capital Asset Valuation • Market value – Replacement cost • Amount that would be needed to acquire an equivalent asset – Net realizable value • Amount that could be received by converting the asset to cash Capital Asset Valuation • Canadian practice – Uses historical cost – Amortized over the period of use • Maximum of 40 years – Market value changes generally not recognized Capitalizable Costs • Costs to acquire and prepare the asset for use – Purchase price (less any discounts) – Installation costs – Transportation costs – Legal costs – Direct taxes Basket Purchases • Several assets acquires in one transaction • Price paid is divided between the assets on the basis of their relative fair values at the time of acquisition Basket Purchases Timberland Example Asset Fair market Percentage Purchase price value of fair value allocated Land $ 300,000 25% $ 250,000 900,000 75% 750,000 $1,200,000 100% $1,000,000 Timber Interest Capitalization • Companies often borrow money to finance a capital asset • Interest paid on borrowed money – Capitalized when it is included in the capital asset account rather than being expensed Amortization (or Depreciation) • Method for allocating the cost of capital assets to the periods in which the benefits from the assets are received (the useful life) • Does not refer to the value of the asset • Follows the matching concept Amortization Methods • Straight-line method • Accelerated or diminishing balance method • Decelerated method • Unit of production method Amortization Methods Asset Carrying Value 12 D o l l a r s 10 8 Straight-line Accelerated Decelerated 6 4 2 0 Year 5 Year 10 Year 15 Year 20 Amortization Methods Amortization Expense 0.8 D o l l a r s 0.7 0.6 0.5 Straight-line Accelerated Decelerated 0.4 0.3 0.2 0.1 0 Year 5 Year 10 Year 15 Year 20 Straight-Line Method • Allocates the cost evenly over the life of the asset • Estimates needed for – Useful life – Residual value Straight-Line Method • Assumptions: – Original Cost – Estimated • Residual Value • Useful Life $10,000 $1,000 5 years Straight-Line Method Amortization Expense Original Cost = = = - Residual Value Useful Life $10,000 - $1,000 5 years $1,800 per year Straight-Line Method Amortization Schedule Year Book Value Amortization Beginning Expense 1 $10,000 $ 1,800 2 8,200 1,800 3 6,400 1,800 4 4,600 1,800 5 2,800 1,800 $ 9,000 Accelerated Methods • Amortization – Multiply the carrying value of the asset by a fixed percentage • Carrying value decreases each year • Amortization expenses decreases each year Accelerated Methods • Percentage rates – Lower when asset has longer life • Double declining balance method – Percentage is double the straightline rate – Residual value • Not used for computations • Serves as a constraint Double Declining Balance Method • Assumptions: – Original Cost – Estimated • Residual Value • Useful Life $10,000 $1,000 5 years – 200% Declining Balance Method Double Declining Balance Method • Calculation: DB rate = DB% x SL rate = 200% x 1/n = 200% x 1/5 = 40% Double Declining Balance Method Amortization Schedule Year Balance Accum. Net Book % Amort. in PP&E Amort. Value Expense 1 $10,000 $ 0 $10,000 40 $ 4,000 2 10,000 4,000 6,000 40 2,400 3 10,000 6,400 3,600 40 1,440 4 10,000 7,840 2,160 40 864 5 10,000 8,704 1,296 40 296 $ 9,000 Production Method • Assumptions – Benefits derived are related to the output or use of an asset • Requires that the useful life can be expressed as units of output Production Method • Assumptions: – Original Cost $10,000 – Estimated Residual Value $1,000 – Estimated Usage Year 1 Year 2 Year 3 Year 4 Year 5 5,000 units 4,500 units 5,500 units 3,000 units 2,000 units 20,000 units Production Method Amortization Expense per Unit - Cost = = = Residual Value Estimated Total Units of Output $10,000 - $1,000 20,000 units $0.45 per unit Production Methods Amortization Schedule Year Cost per Units Expense Unit Used 1 $ 0.45 5,000 $ 2,250 2 0.45 4,500 2,025 3 0.45 5,500 2,475 4 0.45 3,000 1,350 5 0.45 2,000 900 $ 9,000 Recording Amortization Expense • All amortization methods: SE-Amortization expense XX XA-Accumulated amortization XX Corporate Income Taxes • Revenue Canada – Amortization expense is allowed to be deducted to calculate accounting income – Capital cost allowance (CCA) instead must be used to calculate taxable income Corporate Income Taxes • May result in a temporary difference between Accounting income and taxable income • Result is a future tax asset or liability (formerly referred to as deferred tax) Capital Cost Allowance (CCA) • Capital assets are grouped into classes and assigned a maximum rate – Vehicles: Class 10: rate 30% – Equipment: Class 8: rate 20% Capital Cost Allowance (CCA) • Companies may deduct any part of the undepreciated capital costs (UCC) in the class up to the stated maximum • Exception: – Year of acquisition: 50% of normal amount Capital Cost Allowance (CCA) • Central Corp. purchases new equipment (Class 8) at a cost of $20,000 • CCA Year 1: 50% x $20,000 x 20% = $2,000 Year 2: 20% x ($20,000-$2,000)= $3,600 Year 3: 20% x ($20,000-$2,000-$3,600) = $2,880 Capital Cost Allowance (CCA) • Journal entry: SE-Tax expense 11,460 A-Future tax asset* 90 L-Income taxes payable 11,550 *(Future tax liability if a credit balance) Changes in Amortization Estimates and Methods • Estimates of useful life and residual value may change over time • Amortization may change as a result Changes in Amortization Estimates and Methods • Straight-Line Method Assumptions – Original Cost – Residual Value – Useful Life $10,000 $1,000 5 years • Changes in Year 4 (Estimations) • Remaining Useful Life • Residual Value 3 years $ 400 Changes in Amortization Estimates and Methods Amortization Expense = = = Remaining Book Value - Residual Value Useful Life $4,600 - $400 3 years $1,400 per year Changes in Amortization Estimates and Methods Amortization Schedule Year Book Value Amortization Beginning Expense 1 $10,000 $ 1,800 2 8,200 1,800 3 6,400 1,800 4 4,600 1,400 5 3,200 1,400 6 1,800 1,400 $ 9,600 Sale of Capital Assets • Original cost and accumulated amortization removed from accounts • Gain or loss: difference between cash received and book value A-Cash 1,200 XA-Accumulated amortization 9,000 A-Property, plant and equipment 10,000 SE-Gain on sale of PP&E 200 Disposal of Capital Assets • If assets are disposed of and no cash is received XA-Accumulated amortization 9,000 SE-Loss on disposal of PP&E 1,000 A-Property, plant and equipment 10,000 Writedown of Capital Assets • If future recoverable amount of a capital asset declines below its carrying value SE-Loss due to damage to asset 1,000 XA-Accumulated amortization 1,000 Natural Resources • Capitalizing the costs implies that they have future value • Example: oil exploration • Exploration costs choices – Full costing method – Successful efforts method Intangible Assets • Intangible assets have probable future value but no physical form • Guidelines: – If developed internally, expense as incurred – If purchased, can be capitalized Intangible Assets • Estimate useful life and residual value (if any) • Use straight-line method to amortize SE-Amortization expense A-Patents XX XX Intangible Assets • Advertising – Generally expensed as incurred • Patents, Trademarks, Copyrights – Legal life is the maximum for amortizing • Goodwill – Capitalize and amortize if purchased Return on Assets ROA = Net income before interest Average total assets Net income + [Interest expense x (1-Tax rate)] = Average total assets