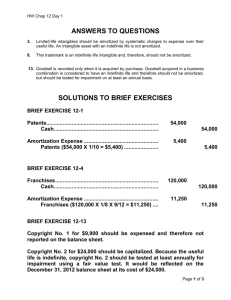

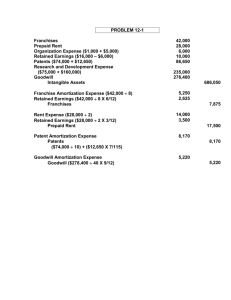

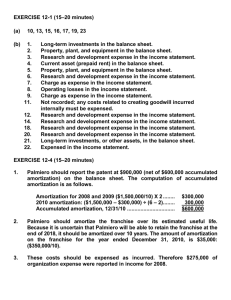

Accounting HW Chapter 10

advertisement

Chapter 10 Day 1: Page 494 – BE10-1 Indicate wheter each of the following assets is property, plant, and equipment (PPE), a natural resource (NR), or an intangible asset (I). If the asset doesn’t fit one of these categories, insert NA (not applicable) in the space provided. a) b) c) d) e) f) Patent Land Building Cash License right Machinery g) Inventory h) Timber tract i) Cut and processed timber j) Trademark k) Franchise l) Investment in common shares m) Oil well n) Coal mine o) Natural gas deposit p) Goodwill Page 495 – E10-1 The following expenditures related to assets were made by Kosinski Company during the first 2 months of 2003: 1. Paid $250 to have the company name and advertising slogan painted on a new delivery truck. 2. Paid a $75 motor vehicle license fee for the new truck. 3. Paid $17,500 for paving the parking lots and driveways on a new plant site. 4. Paid $5,000 of accrued property tax at the time the plant site was acquired. 5. Paid $8,000 for the installation of new factory machinery. 6. Paid $900 for a one-year accident insurance policy on the new delivery truck. 7. Paid $200 for insurance to cover a possible accident ot the new factory machinery while the machinery was in transit. Instructions a) Write a business letter that explains the application of the cost principle in determining the acquisition cost of capital assets. b) List the numbers of the foregoing transactions, and opposite each number indicate the account title from which the expenditure should be debited. Page 495 – E10-2 On March 1, 2003, Chowdhury Company acquired land for which it paid $90,000 cash. It planned to construct a small office building. An old warehouse on the property was torn down at a cost of $6,600. The residual materials were sold for $1,700. Additional costs before construction began included a $1,100 legal fee for work concerning the land purchase, a $7,800 architect’s fee, and $14,000 to put in driveways and a parking lot. Instructions a) Determine the amount to be reported as the cost of the land b) For each cost not used in part a) indicate the account to be debited. Page 498 – P10-1A Kadlec Company was established on January 1. During the first year of operations, the following capital asset expenditures and receipts were recorded: Debits 1. Cost of real estate purchased as a plant site (land fair market value $100,000 and building fair market value $60,000) 2. Accrued property ta paid at time of purchase of real estate 3. Property tax on land paid for the current year 4. Cost of demolishing building to make land suitable for construction of new building 5. Excavation costs for new building 6. Cost of filling and grading the land 7. Architect’s fees for building land 8. Full payment to building contractor 9. Cost of fences around the property 10. Paving of the parking lots and driveways $145,000 2,000 5,000 13,000 20,000 4,000 10,000 600,000 3,000 15,000 $817,000 Credits 11. Proceeds for residual materials of demolished building $2,500 Instructions Analyze the above transactions using the following column headings. Insert the number of each transaction in the Item space. Insert the amounts in the appropriate columns. For amounts entered in the Other Accounts column, indicate the account titles. Item Land Building Other Accounts (specify) Day 2: Page 496 – E10-3 Interprovincial Bus Lines uses the units-of-activity method to amortize its buses. One bus was purchased on January 1, 2002, at a cost of $128,000. Over its four-year useful life, the bus is expected to be driven 100,000 kilometres. Residual value is expected to be $8,000. Instructions a) Calculate the amortizable cost per unit. b) Prepare an amortization schedule assuming that the actual distance driven was 28,000 kilometres in 2002, 30,000 in 2003, 25,000 in 2004, and 17,000 in 2005. Page 496 – E10-4 Stojko Company purchased a new machine on January 1, 2002, at a cost of $89,000. The company estimated that the machine will have a residual value of $12,000. The machine is expected to be used for 10,000 working hours during its six-year life. Stojko Company uses a calendar year end. Instructions a) Calculate the amortization expense under the following methods for each of the years ended December 31, 2002 and 2003: 1) Straight-line, 2) units-of-activity, assuming machine usage was 1,700 hours for 2002 and 1,500 hours for 2003, and 3) declining-balance using double the straight-line rate. b) Which method results in the highest income for the first 2 years? c) Which method results in the highest cash flow for the first 2 years? Page 496 – E10-5 I-Chun Ting, the new controller of Waterloo Company, has reviewed the expected useful lives and residual values of selected amortizable assets at the beginning of 2002. Her findings are as follows: Type of Asset Date Acquired Cost Accumulated Useful Life in Residual Value Amortization Years Jan. 1, 2002 Old Proposed Old Proposed Building Jan 1, 1996 $800,000 $114,000 40 45 $40,000 $70,000 Warehouse July 1, 1999 100,000 9,500 25 20 5,000 3,600 After discussion, management agrees to accept I-Chun’s proposed changes. All assets are amortized by the straight-line method. Waterloo Company uses a calender year in preparing annual financial statements. Instructions a) Calculate the revised annual amortization on each asset in 2002. b) Prepare the entry (or entries) to record amortization on the building and the warehouse in 2002. Page 499 – P10-2A In recent years, Flakeboard Company purchased three machines. Various amortization methods were selected. Information concerning the machines is summarized below: Machine 1 2 3 Acquired Cost Residual Value Jan. 1, 1999 $96,000 $6,000 Jan. 1, 2000 60,000 10,000 Nov. 1, 2001 66,000 6,000 Useful Life in Years 10 8 6 Amortization Method Straight-line Declining-balance Units-of-activity For the declining-balance method, the company uses double the straight-line rate. For the units-ofactivity method, total machine hours are expected to be 24,000. Actual hours of use in the first two years were 1,000 in 2001 and 4,500 in 2002. Instructions a) Calculate the amount of accumulated amortization on each machine at December 31, 2002. Round your answers to the nearest dollar. b) If Machine 2 has been purchased on April 1 instead of January 1, what would the amortization expense be for the machine in 1) 2000, 2) 2001, and 3) 2002? Day 3: Page 497 – E10-8 Presented below are selected transactions of Leger Company for 2002: Jan. 1 June 30 Dec. 31 Retired a piece of machinery that was purchased on January 1, 1992. The machinery cost $62,000 on that date. It had a useful life of 10 years with no residual value. Sold a computer that was purchased on January 1, 2000. The computer cost $5,000. It had a useful life of three years with no residual value. The computer was sold for $500 Discarded a delivery truck that was purchased on January 1, 1998. The truck cost $30,000. It was amortized based on a six-year useful life with a $3,000 residual value. Instructions Journalize all entries required on the above dates. Include entries to update amortization for partial period, where applicable, on the disposal of assets. Leger Company uses straight-line amortization. Page 497 – E10-9 The Rahim Corporation purchased a computer for $10,000. The company planned to keep it for four years, after which it hoped to sell it for $1,000. Instructions a) Calculate the amortization expense for each of the four years under 1) the straight-line method and 2) the double declining-balance method. b) Assume Rahim sold the computer for $1,500 at the end of the third year. Calculate the loss on disposal under each amortization method. c) Determine the impact of each method on net income (total amortization expense plus loss on disposal) related to use of the computer over the three-year period. Page 500 – P10-6A Cuylits Company owned processing equipment that had a cost of $100,000. It had an expected useful life of five years, and an expected residual value of $10,000. Amortization was recorded each December 31. The straight-line method of amortization is used. During its third year of service, the following cash expenditures were made on this equipment: Jan. 7 Completed an overhaul of the equipment at a cost of $14,000. The work included the installation of new computer controls to replace the original controls, which were technologically obsolete. As a result of this work, the estimated useful life of the equipment was increased to a total of seven years. The estimated residual value was increased to $12,000. Feb. 7 Lubricated and adjusted the equipment to maintain optimum performance, at a cost of $1,000. Mar. 19 Replaced a number of belts, hoses, etc., which were showing signs of wear, at a cost of $2,500. Instructions a) Prepare journal entries to record each of the transactions listed above. b) Calculate the amortization expense that should be recorded for this equipment in 1) the second year of its life, 2) the third year of its life (the year in which the above transactions took place), and 3) the fourth year of its life. Page 500-501 – P10-9A Cumby Company incurred the following expenditures in a recent year: Account Title Expenditure Architect fees Cost to demolish an old building that is on a piece of land where Cumby intends to construct a new building Lawyer’s fees associated with a successful patent application Lawyer’s fees associated with an unsuccessful patent application Cost of a grease and oil change on the company’s truck Cost of installing a new roof on the company’s building Cost of painting the president’s office Cost of CD’s and toner for the office computer and printer Payment to a celebrity for endorsement of a product. The celebrity’s endorsement is featured in television advertisements which have been airing for the past three months and will continue to be televised for another six months after year end. Cost of four new tires for the company delivery van Cost of rebuild the engine on the company delivery van Cost of pave the company parking lot Cost of painting the corporate logo on the sides of the company delivery van Instructions For each of the above expenditures, indicate the account title under which the expenditure should be recorded (debited). Day 4: Page 497 – E10-10 On July 1, 2002, Phillips Inc. invested $480,000 in a mine estimated to have 800,000 tonnes of ore. At the end of production at the mine, the company estimates it will have to spend $150,000 to restore the site to an environmentally acceptable condition. The property will then be sold for $90,000. During the last six months of 2002, 100,000 tonnes of ore were mined and sold. Instructions a) Prepare the journal entry to record the amortization expense. b) Assume that 100,000 tonnes of ore were mined but only 80,000 were sold. How much amortization expense is recorded in 2002? How are the costs applied to the 20,000 unsold tonnes? Day 5: Page 497 – E10-11 The following are selected transactions of Arseneault Corporation during 2002: Jan. 1 May 1 Paid $150,000 to develop a trademark. The trademark has an estimated useful life of five years. Purchased a patent with an estimated useful life of five years and a legal life of 20 years for $45,000 Instructions Prepare all adjusting entries at December 31 to record the amortization required by the events above. Page 497 – E10-12 Doucette Company, established in 2002, has the following transactions related to intangible assets: Jan 2 Apr. 1 July 1 Sept. 1 Sept. 30 Purchased a patent (7-year life) for $420,000 Goodwill purchased (indefinite life) for $360,000 A 10-year franchise which expires on July 1, 2012 is purchased for $450,000 Research costs of $185,000 are incurred. Development costs of $50,000 are incurred. (No marketable products have yet been identified.) Instructions a) Prepare the necessary entries to record these intangibles. All costs incurred were for cash. b) Make the entries as at December 31, 2002, recording any necessary amortization. There was no impairment of goodwill. Day 6: Page 498 – E10-13 Northwest Sports Enterprises, owner of the Vancouver Canucks National Hockey League team, reported the following selected information as at June 30, 2000: Accumulated amortization-leasehold improvements Accumulated amortization-equipment Accumulated amortization-hockey franchise and rights to players Amortization expense Equipment Investments Hockey franchise and rights to players Leasehold improvements $230,697 860,074 1,693,850 220,171 1,081,364 13,700,434 7,528,235 1,124,248 Instructions a) Identify which financial statement (i.e., balance sheet or income statement) and which section (e.g., current assets, capital assets, etc.) each of the above items should be reported in. b) Prepare the capital assets section of the balance sheet, as at June30, 2000. Page 498 – E10-14 Imax Corporation of Mississauga makes and leases projection and sound systems for 210 giant-screen IMAX theatres in 26 countries. During a recent year, it reported total revenue (assume equal to net sales) of US$208,569,000, net income of US$23,219,000, and average total assets of US$525,710,500. Instructions a) Calculate the asset turnover and return on assets ratios for Imax Corporation. b) The asset turnover for Imax’s industry is 0.5 times. The return on assets for the industry is 5.7%. Comment on how Imax’s management of its assets compares to that of its industry. Page 501 – P10-11A The intangible assets reported by Tar Company at Decmber 31, 2002, are presented below: Patent ($70,000 cost less $7,000 amortization) Copyright ($48,000 cost less $19,200 amortization) Total $63,000 28,800 $91,800 The patent was acquired in January 2002 and has an estimated useful life of 10 years. The copyright was acquired in January 1999 and also has an estimated useful life of 10 years. The following cash transactions may have affected intangible assets during the year 2003: Jan 2. June 30 Sept. 1 Oct. 1 Paid $12,000 of legal costs to successfully defend the patent against infringement by another company. Developed a new product, incurring $125,000 in development costs, which were paid in cash. A patent was granted for the product July 1. Its expected usefully life is equal to its legal life. Paid $80,000 to an Olympic gold medalist to appear in commercials advertising the company’s products. The commercials were air in September and October. Acquired a copyright for $120,000 cash. The copyright has an expected useful life of 6 years. Instructions a) Prepare journal entries to record the above transactions. b) Prepare journal entries to record the 2003 amortization expense for intangible assets. Round your answers to the nearest dollar c) Prepare the capital assets section of the balance sheet at December 31, 2003.