LOGO INDUSTRIES CORPORATION (A Development Stage

LOGO INDUSTRIES CORPORATION

(A Development Stage Company)

Notes to Financial Statements

December 31, 2007 and 2006

NOTE 1 - ORGANIZATION AND SIGNIFICANT ACCOUNING POLICIES

Organization and Line of Business

Logo Industries Corporation (the ''Company'') is currently a development stage company under the provisions of Statement of Financial Accounting Standards (''SFAS'') No. 7 and was incorporated under the laws of the State of Nevada on August 27, 2002. The Company has a December 31 year end.

Previously the Company was in the business of designing and developing software for the gaming industry. Currently the Company has no operations. On October 1, 2002, the Company merged with Pro

Roads Systems, Inc. (a Florida corporation), a public shell company traded on the pink sheets. Pro Roads

Systems, Inc. had no operations prior to the merger. The purpose of the merge was to change the

Company's domicile from Florida to Nevada.

Basis of Presentation

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate continuation if the Company as a going concern. However, the Company has no established source of revenue. This matter raises substantial doubt about the Company's ability to continue as a going concern. These financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might be necessary should the company be unable to continue as a going concern.

Management plans to take the following steps that it believes will be sufficient to provide the Company with the ability to continue in existence: Management intends to raise financing through private equity financing or other means and interests that it deems necessary, with a view to moving forward with the development of its software and ultimately selling the software to customers in the gaming industry.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. At December 31, 2007 and

December 31, 2006, the Company used estimates in determining the realization of its customer list and excess cost over fair value of assets acquired. The Company estimates the recoverability of these assets by using undiscovered cash flows based on future operating activities. Actual results could differ from these estimates.

Revenue Recognition

The Company will recognize revenue upon the delivery of its products to customers. Shipping and handling charges are included in gross sales, with the, related costs included in selling, general and administrative expenses. Sales are recorded net of returns, discounts and allowances.

Comprehensive Income

Statement of financial Accounting Standards (“SFAS”) No. 130, “Reporting Comprehensive Income” establishes standards for the reporting and display of comprehensive income and its components in the financial statements. For the years ended December 31, 2007 and 2006, the Company has no items that represent other comprehensive income and, accordingly, has not included a schedule of comprehensive income in the financial statements.

9

LOGO INDUSTRIES CORPORATION

(A Development Stage Company)

Notes to Financial Statements

December 31, 2007 and 2006

NOTE 1 - ORGANIZATION AND SIGNIFICANT ACCOUNING POLICIES (Continued)

Fair Value of Financial Instruments

The estimated fair values of cash, prepaid expenses, accounts payable and accrued expenses and due to stockholder, none of which are held for trading purposes, approximate their carrying value because of the short term maturity of these instruments or the stated interest rates are indicative of market interest rates.

Cash Equivalents

Cash equivalents include all highly liquid debt instruments with original maturities of three months or less which are not securing any corporate obligations.

Concentration of Credit Risk

The Company currently has no bank accounts but in the future its plans to places its cash with high quality financial institutions and at times may exceed the FDIC $100,000 insurance limit. The Company will extend credit based on an evaluation of the customer's financial condition, generally without collateral. Exposure to losses on receivables is principally dependent on each customer's financial condition. The Company will monitor its exposure for credit losses and maintains allowances for anticipated losses, if required.

Advertising Costs

Advertising costs are expensed as incurred. There were no advertising expenses for the years ended

December 31, 2007 and 2006.

Income Taxes

The Company accounts for income taxes under SFAS 109 ''Accounting for Income Taxes.'' Under the asset and liability method of SFAS 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under SFAS 109, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations.

Basic and Diluted Income/(Loss) Per Share:

In accordance with SFAS No. 128, ''Earnings Per sharers the basic income/(loss) per common share is computed by dividing net income/(loss) available to common stockholders by the weighted average number of common shares outstanding. Diluted income per common share is computed similar to basic income per common share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. As of December 31, 2007 and December 31, 2006, the

Company does not have any equity or debt instruments outstanding that can be converted into common stock.

Segment Reporting

Based on the Company's integration and management strategies, the Company operated in a single: business segment. For the years ended December 31, 2007 and 2006, the Company had no revenue.

10

LOGO INDUSTRIES CORPORATION

(A Development Stage Company)

Notes to Financial Statements

December 31, 2007 and 2006

NOTE 1 - ORGANIZATION AND SIGNIFICANT ACCOUNING POLICIES (Continued)

Stock-Based Compensation

The Company accounts for stock-based employee compensation arrangements in accordance with the provisions of Accounting Principles Board Opinion No. 25, ''Accounting for Stock Issued to Employees'' and complies with the disclosure provisions of SFAS 123, ''Accounting for Stock-Based compensation''.

Under APB 25, compensation cost is recognized over the vesting period based on the excess, if any, on the date of grant of the deemed fair value of the Company's shares over toe employee's exercise price.

When the exercise price of the employee share options is less than the fair value price of the underlying shares on the rapt date, deferred stock compensation is recognized and amortized to expense in accordance with FASB interpretation No. 28 over the vesting period of the individual options.

Accordingly, because the exercise price of the Company's employee options equals or exceeds the market price of the underlying shares on the date of grant, no compensation expense is recognized Options o/ shares awards issued to non-employees are valued using the fair value method and expensed over the period services are provided.

New Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements, which defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. SFAS No. 157 does not require any new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of the information. This statement is effective for us beginning January 1,

2008. The Company is currently assessing the potential impact that adoption of SFAS No. 157 would have on the financial statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and

Financial Liabilities. SFAS No. 159 gives the irrevocable option to carry many financial assets and liabilities at fair values, with changes in fair value recognized in earnings. SFAS No. 159 is effective beginning January 1, 2008, although early adoption is permitted. The Company is currently assessing the potential impact that adoption of SFAS No. 159 will have on the financial statements.

The FASB has revised SFAS No. 141. This revised statement establishes uniform treatment for all acquisitions. It defines the acquiring company. The statement further requires an acquirer to recognize the assets acquired, the liabilities assumed, and any non-controlling interest in the acquired at the acquisition date, measured at their fair market values as of that date. It requires the acquirer in a business combination achieved in stages to recognize the identifiable assets and liabilities, as well as the noncontrolling interest in the acquired, at the full amounts of their fair values. This changes the way that minority interest is recorded and modified as a parent’s interest in a subsidiary changes over time. This statement also makes corresponding significant amendments to other standards that related to business combinations, namely, 109, 142 and various EITF’s. This statement applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. The Company believes the implementation of this standard will have no effect on our financial statements.

11

LOGO INDUSTRIES CORPORATION

(A Development Stage Company)

Notes to Financial Statements

December 31, 2007 and 2006

NOTE 2 – ACQUISITIONS

On November 14 and 15, 2002, the Company purchased all the issued and outstanding shares of the following entities: Paris Holdings LTD; Hawaiian Holdings LTD; Pirate Holdings LTD; Roman

International Holdings LTD; Cyber Capital Company; Atlantis Holdings LTD; Egyptian Holdings LTD; and VGP Holdings LTD. A1l of these entities had business plans that were involved in the gaming industry but prior to the Company's acquisition of each entity, none had commenced operations nor had any assets or liabilities. The Company acquired each entity in its plan to roll-up companies in the gaming industry. See Note 3 for stock issuances relating to these transactions.

NOTE 3 – STOCKHOLDERS’ EQUITY

In September 2007, the Company issued 5,000,000 shares of its common stock, for cash of $100,000

($0.02 per share), in a private placement.

NOTE 4 - INCOME TAXES

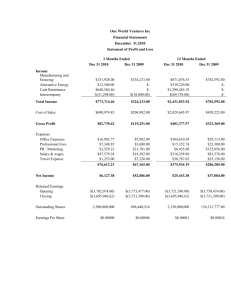

The reconciliation of the effective income tax rate to the federal statutory rate for the year ended

December 31, 2007 and 2006 is as follows:

December 31, 2007 December 31, 2006

Federal Income tax rate 34% 34%

Effect of net operating loss

Effective income tax rate

-34%

0%

-34%

0%

Deferred tax assets and liabilities reflect the net effect of temporary differences between the carrying amount of assets and liabilities for financial reporting purposes and amounts f income tax purposes.

Significant components of the Company's deferred tax used or assets and liabilities at December 31, 2007 and December 31, 2006 are as follows:

December 31, 2007 December 31, 2006

Loss carryforward

Less valuation allowance

Common stock issued for services

$ 6,093

(6,093)

-

$ 87,274

(42,092)

(45,182)

Effective income tax rate $ $ -

At December 31, 2007 and December 31, 2006, the Company has provided a Valuation allowance for the deferred tax asset since management hits not been able to determine that the realization of that asset is more likely than not. Net operating loss carry forwards of approximately $87,274 expire starting in 2017.

NOTE 5 – RELATED PARTY TRANSACTIONS

As of December 31, 2007 and December 31, 2006, stockholders of the Company advanced the Company

$112,305 and $96,982, respectively, to pay for certain professional fees and operating costs. The advances are non interest bearing, unsecured and due upon demand.

12