Document

N

T

I

A

L

L

I

D

E

P

R

E

S

R

S

H

I

P

E

A

D

E

A

S

S

O

C

I

A

T

E

S

Notes, Suggestions, and Other Ideas

Series B

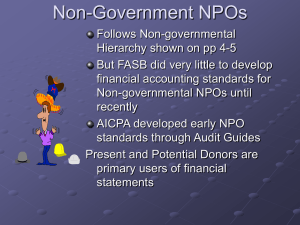

Accounting Standards

Number 2

Non-profit organizations must follow accounting standards guided by the

“Generally Accepted Accounting Principles.” All of the authoritative pronouncements apply unless specifically excluded. In addition, several pronouncements apply to just non-profits and the Statements on Financial Accounting Standards (SFAS) are included below.

SFAS 93 was the first standard established for non-profits. This standard requires the reporting of depreciation on assets. An exception is granted for works of art, historical treasures, and similar assets if the organization can demonstrate the asset is worth maintaining in perpetuity and the organization will protect and preserve it.

SFAS 116 concerns the recognition and reporting of contributions. The contributions are to be reported as revenue at fair market value at the time the promises are made. Donor imposed restrictions affect the classification of the gift. If assets are held by an agent, trustee, or foundation, yet the organization has unconditional rights to receive cash flows, the present value of the expected cash flows are recognized on the organization’s financial statements. For promises to be recorded as revenue, verifiable documentation must be available.

SFAS 117 establishes the proper reporting for financial statements and requires at least a statement of financial position, a statement of activities, a statement of cash flows, and accompanying notes. Donor restrictions will influence the classification of assets as restricted, temporarily restricted, or unrestricted.

SFAS 136 establishes that an organization that holds assets for others will report those assets as liabilities.

SFAS 124 requires that investments in equities and debt securities be reported at fair market value. It also deals with reporting gains and losses. Many investments held by non-profits are endowments established by donors. The non-profit is legally obligated to follow the dictates of the donor. If the donor did not restrict gains on

Accounting Standards, continued

investments, the Uniform Management of Institutional Funds Act (UMIFA) will govern, provided the state has adopted the act. Thus, if the donor is silent about gains and the state has adopted UMIFA, the gains are expendable for the purposes of the endowment gift; and therefore, gains increase unrestricted net assets. However, Pennsylvania has not adopted the UMIFA and thus the gains are permanently restricted

Other statements of financial accounting standards need to be considered when changes are made in college operations. For example, when SFAS 112, accounting for post employment benefits, was introduced it required many colleges to report the contingent liability for future health insurance benefits and thus changed significantly their financial status.

The best reference source this author has found on accounting standards is by

Patrick Delaney, Barry Epstein, Ralph Nash, and Susan Weiss Budak, GAAP 2002:

Interpretation and Application of Generally Accepted Accounting Principles, John Wiley

& Sons Inc., 2001. To keep up with changes in accounting standards, one can reference the web at www.FASB.org

.

William C. Crothers * 810-653-2220 * wmcrothersPLA@AOL.com

2