PERSONAL FINANCE COURSE OUTLINE

advertisement

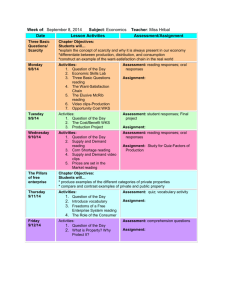

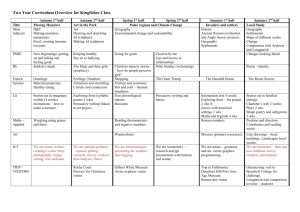

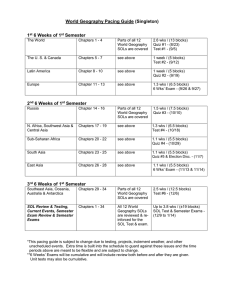

PERSONAL FINANCE Teacher – Roger Jones Contact information – 615-822-2375 E-mail – Roger.Jones@JP2hs.org Textbook – Personal Finance Jack R. Kapoor, Les R. Dlabay, Robert j. Hughes ISBN- 978-0-07-895839-7 Course Overview This Personal Finance course will cover real life issues that face every person no matter the occupation, nationality, or economic background. The course will expose students to every aspect of Personal Finance from getting that first job and filling out a W-4 form, to the breakdown of withholdings on the first paycheck, to filling out a 1040ez tax form, all the way to setting up that last financial plan, estate planning. The class will give students tools that they can take from the class and put to use as soon as they leave the classroom. This is a must take class for anyone that wants to get a head start on their financial future. Below is a course outline, which gives a description of each topic that will be covered and what will be taught. Each section will have homework or class work assignments and a test. For some sections there will be a guest speaker that will come and talk with the class about the section at hand. For each section with a speaker there will be an essay due from notes taken from the lecture. The sections with the asterisk in front of them will have the speakers. If assignments for each section are not turned in by the time the test is given for that section, the student will receive no credit for that assignment. Semester 1: 1) 2) 3) 4) 5) 6) Career Planning Financial Decisions and Goals Personal Financial Records Taxes * Banking * Credit Mid-Term Review / Exam 1-2 wks 1-2 wks 1-2 wks 1-2 wks 1-2 wks 1-2 wks 1wk Semester2: 7) Investing * 8) Consumer Purchasing 9) Housing 10) Home / Auto Insurance 11) Life / Health Insurance * 12) Retirement / Estate Planning * Final Review / Exam 1-2 wks 1-2 wks 1-2 wks 1-2 wks 1-2 wks 1-2 wks 1 wk Type Description Homework Daily preparation for class that involves reading and doing section assessments, in class assignments and bringing outside documents Chapter Assessments: Answer questions about chapter content and filling out various forms and documents Outside Speaker Presentation on various topics covered in class Students prepare an essay based on the information that they receive from the speaker, text and outside sources. Fill in the blank / Multiple Choice The ability to use learned knowledge to answer the fill in the blank questions is a good demonstration of the knowledge acquired during the class Essay Tests Assessment Form Weight 100 points (40%) Outside Documents: May include job applications, tax return forms and tables, check stubs, deposit slips (checking and savings) etc. 100 points (10%) Content is graded with the use of rubric identical to the one used to assess Great Book Essays 100 points (50%) Each test will include a very small percentage of multiple choice questions and the remainder will be fill in the blank Exams Mid-Term / Final The mid-term and final are similar to the course tests in that they are fill in the blank with some multiple choice Also the exams are cumulative; the mid-term will cover the first semester information and the final will cover the second semester information 100 points (20%) of semester grade