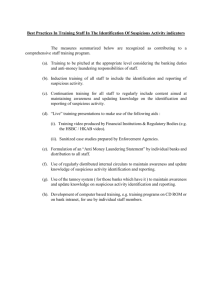

A Guideline for the Turkish Banking System on Significance of Fight

advertisement