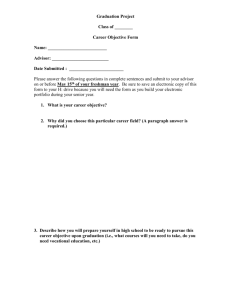

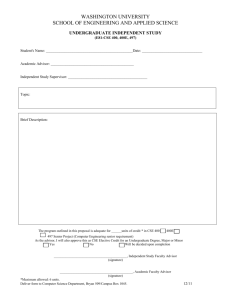

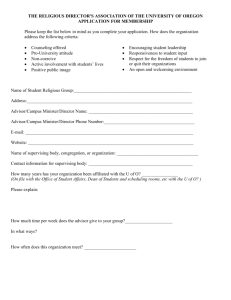

Erin Tamberella CEO - Executive Transformations

advertisement

Erin Tamberella CEO www.executivetransformations.com erin@executivetransformations.com 850-432-6715 3 Easy Steps to a Superior Client Service Model Written by: Erin Tamberella & Rick Wright Updated: 1/12/15 Clients are much more likely to leave their advisor for lack of service than lack of performance. Although we’ve all heard this statistic many times before, it’s easy to lose sight of it when in the midst of a market like we’ve experienced this year. Now may be the time to carefully consider your current client service model and ask yourself, “Are you absolutely certain that you are providing everything your clients need during this difficult period?” We are all quite familiar with the “know your client” rule, but how well do you “know your book?” What follows are three simple, back-to-basics steps to really “knowing your book” and developing a superior client service model based on that knowledge. 1. Segment or Re-segment your book The segmentation of your book should consist of both a quantitative and a qualitative approach. Use the following point system to quantitatively segment your book. The assets and revenue breakpoints may be adjusted upward or downward depending on the nature of your book. However, regardless of where you set your asset and revenue breakpoints, maintain the same number of breakpoints and the same number of points per breakpoint. Simply add up the points for each client and put them in the appropriate client tier—A, B+, B, C, D. Once you’ve completed the quantitative analysis of your book, review each client from a more subjective and qualitative perspective. Although you should adhere to the criteria outlined as closely as possible, there are always exceptions to the rule. It is acceptable to move some “unusual situation” clients upward or downward from their quantitative ranking as you deem necessary. Assets $1 Million and Above $500,000 - $999,999 $100,000 - $499,999 Less than $100,000 Points Assigned 4 3 2 1 Annual Revenue $10,000 and Above $5000 - $9999 $1000 - $4999 Less than $1000 Intangibles Points Assigned 4 3 2 1 Points Assigned Enjoy working with them Takes your advice Gives referrals or advocate Sphere of Influence potential Future revenue potential Currently do some form of residualized business Client Tier A Client B+ Client B Client C Client D Client 1/0 1/0 1/0 1/0 2/1/0 1/0 Points Assigned 12 – 15 9 – 11 7–8 4–6 2-3 2. Develop a Systematized Client Contact Schedule Once you’ve completed the book segmentation process, your next step is to determine an appropriate contact schedule for each tier of client. If you don’t have a structured system for client contact, begin by observing your current behavior patterns. Evaluate how often you typically contact each tier of client and by what methods. List what you’d like to “do more of” and “less of” for each tier. Then develop your own client contact schedule. Always treat your A and B+ clients the same. Whatever you choose to do for As, you do for B+s as well. This is important if your goal is to move B+ clients up to A status. If you have a capable assistant, and unfortunately not every advisor does, the assistant can make the calls as outlined. They’re actually quite simple. In the call the assistant merely asks if the client needs anything at that time. Another possibility is a call to update an item in the client record such as an e-mail address. Plan on sending extras out every week to your higher tier clients. Extras are non-business-related items that you periodically send to a client. It can be a small gift or as simple as an article on a subject the client is interested in. Extras show the client you were thinking about them. It’s these little things that can make a huge difference to people. Include Extras in your client service model. A successful client contact schedule should accomplish two objectives. It should raise the level of service to your existing clients, thereby increasing the probability of referrals. More importantly, it must be something that you will actually do. Use the schedule outlined below as a guide from which to begin. “A” & “B+” Clients: Phone calls: 10 4 check-in calls – assistant if applicable 3 business-related calls – advisor 3 non-business-related calls -- advisor Lunch, dinner, event or outing – 2 Plan/Investment/Market review: 2 – advisor Extras: 3 “B” Clients: Phone calls: 5 2 check-in calls – assistant if applicable 2 business-related calls – advisor 1 non-business-related call – advisor Lunch, dinner, event or outing – 1 Plan/Investment/Market review: 2 – advisor Extras: 2 “C” Clients: Phone calls: 1 – assistant if applicable Market review: 1 – advisor Alternative Option: Use a conference-call format open to all C clients; if they have questions concerning their individual holdings, they can call you or your assistant. “D” Clients: Market review: 1 – advisor Alternative Option: Use a conference-call format open to all C clients; if they have questions concerning their individual holdings, they can call you or your assistant. When talking to clients, do more than just give them an update on the market and their account. Use this as an opportunity to discover what they're really thinking and feeling. Ask them about their fears and concerns. Don't be afraid to go there with clients. They will appreciate that you cared enough to ask. It's your chance to gain tremendous insight into what truly motivates your client. The insight you can gain in these uncertain times will help you to be a better advisor to your client in good times and in bad. In addition to a schedule of phone calls and face-to-face meetings, all clients should be on a longterm drip schedule. This is in addition to their regular client contact schedule. Every client should receive something from you every single month at the same time every single month either via e-mail or hard copy. Take the time to do a little research and see what is available within your firm. J.P. Morgan sends out a weekly market update piece which is an extremely good addition to any long-term drip system. It’s a one-pager, very user friendly to read and it’s free. Just call your J.P. Morgan wholesaler to begin receiving it. 3. Automate The final step is to automate the process in whatever contact management system you use. Whether you use ACT, FACT, Outlook or a proprietary contact management system, this can be done easily by setting recurring activities. Establish your own client contact template for each tier of client. Laminate it and have it on your desk at all times. Make it a point to work through your entire book with a phone call. As you speak to clients each day, use your laminated template to set recurring activities based on their appropriate client tier. All recurring activities are based off of the date of this initial phone call. By setting a client’s recurring activities as you speak to them, client contacts are staggered and are therefore more manageable. The automation step is a critical one. Segmenting your book and establishing your client tier contact schedules are a great beginning but unless you have the process automated, chances are it will be a process that falls by the wayside after a couple of weeks. Automation helps you develop a pattern of consistency and consistency is the foundation of superior client service. Once your client contact schedule is automated, be diligent in keeping up with your task list each day. I recommend that you also establish a clean-up block on either Thursday or Friday to handle all tasks for the week that you were unable to handle previously for whatever reason. Ideally, you want to begin each week with a clear calendar and little or no carryover from the previous week. In the beginning of a market downturn, advisors are usually pretty good about keeping in touch with their clients. However, it’s during this stage of a prolonged market downturn that advisors begin to feel tired. Slowly and insidiously, avoidance behavior begins to creep in. Markets are out of your control but client service is not. So why not focus on what you control? These three steps can easily be accomplished in a weekend. Take the time to develop this system now to safeguard against patterns of avoidance. Just establishing the system will make you feel more proactive and in control. Do it for your clients, do it for yourself. =================== info@executivetransformations.com www.executivetransformations.com Take control of your business. Start living your potential!