August 19, 2003

Research Digest

Michael Roessler, 312.630.9880 x. 212

www.zackspro.com

Chordiant Software

155 North Wacker Drive

Chicago, IL 60606

(CHRD-NASDAQ)

Overview

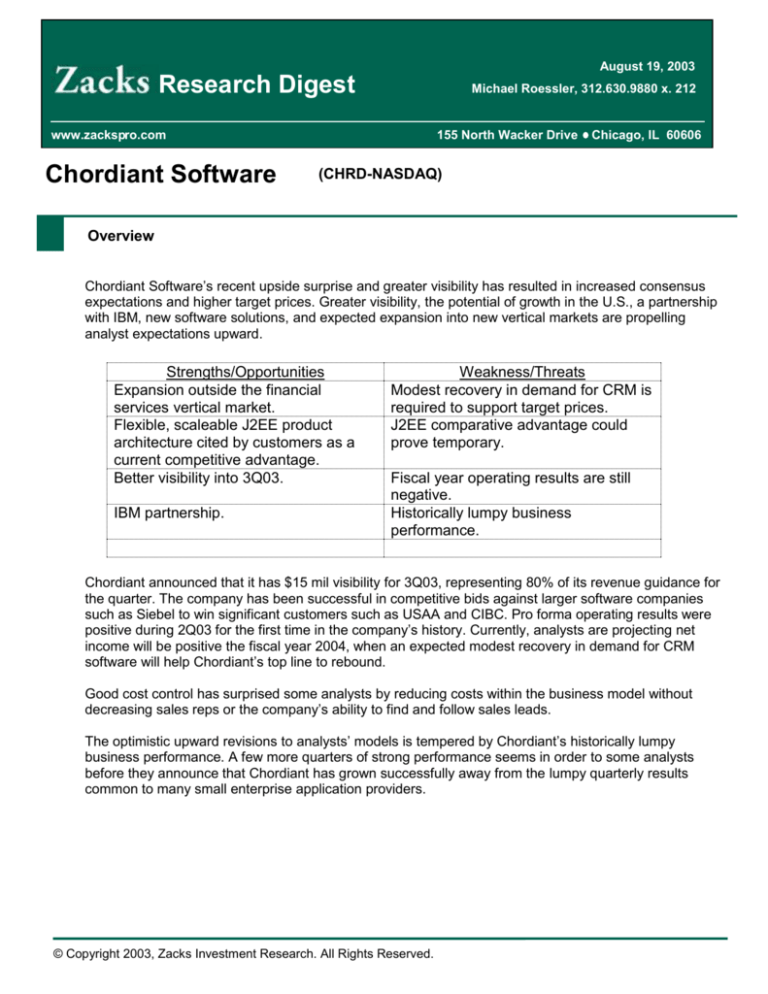

Chordiant Software’s recent upside surprise and greater visibility has resulted in increased consensus

expectations and higher target prices. Greater visibility, the potential of growth in the U.S., a partnership

with IBM, new software solutions, and expected expansion into new vertical markets are propelling

analyst expectations upward.

Strengths/Opportunities

Expansion outside the financial

services vertical market.

Flexible, scaleable J2EE product

architecture cited by customers as a

current competitive advantage.

Better visibility into 3Q03.

IBM partnership.

Weakness/Threats

Modest recovery in demand for CRM is

required to support target prices.

J2EE comparative advantage could

prove temporary.

Fiscal year operating results are still

negative.

Historically lumpy business

performance.

Chordiant announced that it has $15 mil visibility for 3Q03, representing 80% of its revenue guidance for

the quarter. The company has been successful in competitive bids against larger software companies

such as Siebel to win significant customers such as USAA and CIBC. Pro forma operating results were

positive during 2Q03 for the first time in the company’s history. Currently, analysts are projecting net

income will be positive the fiscal year 2004, when an expected modest recovery in demand for CRM

software will help Chordiant’s top line to rebound.

Good cost control has surprised some analysts by reducing costs within the business model without

decreasing sales reps or the company’s ability to find and follow sales leads.

The optimistic upward revisions to analysts’ models is tempered by Chordiant’s historically lumpy

business performance. A few more quarters of strong performance seems in order to some analysts

before they announce that Chordiant has grown successfully away from the lumpy quarterly results

common to many small enterprise application providers.

© Copyright 2003, Zacks Investment Research. All Rights Reserved.

Sales

2Q03 results were better than consensus expectations. License revenue grew 56.7%. Yet the average

analyst forecast is expecting an 10.3% drop in FY03E revenues relative to FY02A. Top-line growth for

the fiscal year in expected to return in FY2004. Variance among analyst models is most significant in

forward sales expectations. One analyst (Pacific Growth) forecasts FY03E revenues to be approximately

7.5% below the average revenue forecast. Notably, this analyst maintains a positive rating on Chordiant.

Chordiant’s main vertical market is financial services, representing approximately 75% of revenue. The

financial services sector is expected to remain the primary source of revenues going forward, though

Chordiant should gradually diversify its revenue base. Outside its main financial services market, the

company has sold to the telecommunications and travel/leisure industries. Management indicates that

selling to the government sector may develop into an attractive opportunity in the future.

Est. Total Sales ($M)

2003E

$61.3 - 68.4

2004E

$69.3 - $86.4

Est. Growth

13%-26%

Chordiant closed 20 new engagements in 2Q03 versus 12 in the previous quarter. Royal Bank of

Scotland, CIBC, Prudential, and Proximus were major customers.

To date, Chordiant’s largest geographic market is Europe. Chordiant is building a pipeline in the US,

though it remain cautious regarding current US market conditions. Management indicated European

demand is stabilizing with the UK its strongest market – though France remains weak.

Chordiant has begun a partnership with IBM. To date, the company is in approximately 10 deals together

with IBM.

Significantly, management suggested that they have $15 mil in visibility for 3Q03, which is over 80% of

revenue guidance ($17-$18 mil) for the quarter.

Analysts see five major growth drivers:

1. Expanding potential and focus within the U.S.

a. To date, Chordiant generates a majority of its revenue in Europe.

2. Recent partnership with IBM

a. Analysts expect IBM and Chordiant to make joint customer announcements in the near future.

The partnership is expected to target financial services customers.

3. New products

a. Analysts expect new product announcements for provision to Chordiant’s financial services

customers.

4. Expansion of vertical markets

a. Chordiant’s revenue source is mainly within the financial services sector. Chordiant’s success

within this vertical market seems to be based on the flexibility and scalability of its software

architecture, a reason for success that can be transferred to other verticals. Management is

citing the federal government market as an area of key interest.

5. Acquisitions

a. Chordiant has not announced acquisition targets, but has stated that future M&A activity might

be implemented to acquire complimentary J2EE technology.

Zacks Investment Research

Page 2

www.zacks.com

Margin

Gross margins increased to 62.8% sequentially during the second quarter relative to 55.2% in the first

quarter. Average analysts expectations are for FY03E gross margins to drop from an actual 57.7% during

FY2002 to an average expected level of 55.7%.

Within the revenue segments, there is little variance among the gross margins forecasts. Gross margins

for licenses are expected to drop slightly from 95.15% in FY02 to 94.69% in FY03E. Within the service

revenue segment, gross margins are expected to increase somewhat from 59.89% in FY02 to 63.12% in

FY03E.

There is very little variance in expectations for R&D expenditures (around 20% of sales).

Sales & Marketing expenses are forecast to drop from 44% of sales in FY02 to 32% in FY03E.

2003E Margins

Gross Margin

Operating Margin

Net Margin

Low Estimate

58.06%

n/a

n/a

High Estimate

62.01%

n/a

n/a

Earnings Per Share

Chordiant reached pro forma profitability for the first time in its history. Pro forma results exclude noncash compensation, amortization of intangibles, and restructuring expense.

Consensus expectations for FY03E rose following a significant upside earnings surprise in the 2Q03

announcement. Consensus expectations are for $0.04 loss in FY03E. Analysts are forecasting a 340%

jump in year-over-year EPS performance in the 2004 fiscal year to a positive $0.10 in EPS. The variance

in FY2004 expectations is wide. (RBC Cap.) has the highest EPS expectations at $0.19, following its

recent upward model revisions and rating upgrade. Notably, the above-consensus analyst expectations

depend significantly on an expected modest recovery in demand for CRM software. A later than expected

or nonexistent recovery would threaten analyst expectations.

The single analyst with a negative rating on Chordiant (CIBC), has not yet issued quarterly projections for

the 2004 fiscal year, but does project positive results for FY2004.

The improved business backlog has caused substantial upward revisions to analyst FY03 and FY04

expectations, including one analyst’s (Pacific Growth) recent (July) switch from negative to positive

FY2004 expectations.

Management does not provide EPS guidance.

Street Consensus

Company Guidance

Low Estimate

High Estimate

Zacks Investment Research

FY-2003

-$0.04

NF

-$0.06

-$0.01

Page 3

FY-2004

$0.10

NF

$0.05

$0.19

www.zacks.com

Target Price/Valuation

Three of the five sell-side analysts have price target in the $3.00 to $4.00 range. The targets are based

multiples of expected FY2004 EPS estimates, or approximately 2x EV/FY04E Sales. There is one

exception to this range: (RBC Cap.). Recently, (August 6, 2003), (RBC Cap.) raised substantially its

forward FY2004 earnings expectations and placed a 35x multiple on those expectations to obtain a target

price of $6.50 per share. The sudden and large revision is the result of the analyst’s expectation for a

modest recovery in the CRM market generally as well as the increased visibility at Chordiant.

Long-Term Growth

Management has identified its intent to expand Chordian’t exposure beyond its traditional financial

services vertical market, and to give greater attention to the diversification of revenue sources in order to

expand beyond Chordiant’s euro-centric focus, namely by expanding presence in the US. Measuring

Chordiant’s progress toward these goals will be key metrics for forecasting long-term growth potential.

Chordiant’s customers are “singing praise” according to analysts for Chordiant’s scaleable and flexible

software architecture. The scalability and flexibility are due to Chordiant’s usage of J2EE architecture,

placing the client desktops within browsers, thereby eliminating the need for desktop updates and

installations. Siebel, for example, is still transitioning away its client/server architecture. Chordiant’s

usage of J2EE applications enables it to reduce desktop client management requirements producing a

comparative advantage. Monitoring the progress of Chordiant’s competitors in adopting similar

architecture may be significant to Chordiant as the loss of this comparative advantage could negatively

impact the company’s long-term growth potential.

Chordiant’s business performance is historically lumpy. Chordiant, like many small enterprise

applications companies, suffers from a high variance in quarterly results resulting from deals that slip

from one quarter to another. This produced in the past a regular cycle of missing one quarter’s estimates

only to bounce back the following quarter with upside surprises. Chordiant’s ability to grow away from this

trend is significant to turning short-term cyclical gains in the stock into sustainable growth in value.

Individual Analyst Opinions

POSITIVE RATINGS

JMP Securities – Strong Buy ($4.00): JMP Securities believes that Chordiant’s prospects to close new

deals within the next few months is strong enough that the analysts have increased their price target from

$3 to $4 and raised their 2004 pro forma EPS estimate from $0.09 to $0.15. JMP Securities sees little

risk of Chordiant announcing disappointing operating results. The analysts believe that Chordiant has

already achieved sales sufficient to meet both Q3 and Q4 estimates. Potential deals with a European

bank and a UK government agency could improve visibility into 2004 and add further upside to 2004

estimates. Percentage of completion accounting issues, large deals that could fail to close when

expected, and a potential competitive threat from Siebel Systems are cited as possible risks.

Zacks Investment Research

Page 4

www.zacks.com

Needham–Buy ($4.00): Needham’s $4.00 price target calculation is somewhat unusual. Needham starts

by multiplying 25 by both the 2004 and 2005 EPS estimates excluding interest income, then “splits the

difference” between the two values and adds prospective net cash per share of approximately $0.75.

Needham is impressed with Chordiant’s revenue growth, tight expense control, and increase in deferred

revenues. The analysts have increased estimates as a result.

Pacific Growth – Over Weight (N/A): Pacific Growth cites Chordiant’s pro forma operating profit in the

last quarter, reduction in COGS and expenses by $12 mil, and increase in service margins as positives.

Visibility is better considering that management indicates that 80% of its revenue guidance for 3Q03 of

$17 – $18 mil. Reported revenue and EPS for 2Q03 was significant above Needham’s recently raised

estimates. Chordiant reported its first ever pro forma profit. DSO’s excluding receivables related to

deferred revenue decreased to 38 from 62. Chordiant reduced debt by $1 mil (now standing at $1.6 mil in

short-term obligations).

RBC Capital – Outperform ($6.50): RBC Capital’s target price of $6.50 is the highest among the group

and represents a 48% premium to the average target price. This premium is due to the 35x multiple RBC

Capital uses for the future P/E, but more significantly, to the fact that RBC Capital’s projections for

FY2003 and FY2004 are the highest – including a FY2004 pro forma net income projection that is 84%

higher than the average. RBC Capital cites loud customer praise for the flexible architecture of

Chordiant’s system and praise of Chordiant’s strong customer commitment through after-market support.

RBC Capital cites an expectation for modest recovery in demand for CRM software as a significant factor

supporting its investment theses and $6.50 price target. RBC Capital’s analysts seem to be forecasting a

faster and greater recovery within the CRM software sector than other analysts.

NEUTRAL RATINGS

None

NEGATIVE RATINGS

CIBC Capital Markets – Underperformer (N/A): CIBC Capital is only brokerage with a negative rating

on Chordiant. In stark contrast to each of the other brokerage reports, CIBC cites revenue predictability

issues and execution risk as the reasons for its negative rating. Yet the analysts seem to contradict

themselves by calling attention within their report to “better predictability of revenue” due to several large

dollar deals and increasing deferred revenue. We interpret this seeming contradiction to mean that while

Chordiant’s revenue predictability is better than it was in recent quarters, the enhanced visibility has not

existed long enough for the analysts to have much confidence in the improvement. The analysts have

been concerned that Chordiant’s cost-cutting measures would reduce the company’s ability to close

deals. Chordiant surprised the analysts in 2Q03 by increasing sales reps even as it cut expenses –

causing CIBC to retract its concern in the latest report. CIBC Capitals wants to see more quarters

supporting the improving trend before revisiting their negative rating.

Zacks Investment Research

Page 5

www.zacks.com