NEWS : 22.01.2010 TODAYS TOP HEADLINES *** Steel melting

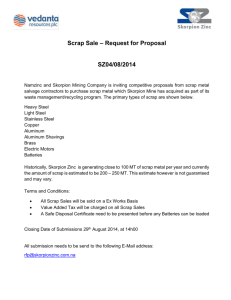

advertisement

NEWS : 22.01.2010 TODAYS TOP HEADLINES *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** Steel melting scrap price shown downfall in major places Magnesium Prices Might Decrease a Bit Ferrosilicon Prices Show Weak Chemical Grade Silicon Metal Price Began to Slide China's NCE to launch scrap futures trading in March Stronger Korean domestic scrap prices continue Scrap offer prices to east Asia are not viable, traders say Ferro-silicon price in Europe rises around €50/tonne Saudi Arabia scrap prices advance on better domestic demand Southern European scrap increases in January Turkish scrap imports hit 14.2m tonnes in eleven months Chinese imported iron ore prices start to fall Chinese EMM, SiMn, FeMn export offer prices rise Chinese FeSi prices slip on slowing demand Posteel to establish scrap venture in Japan Scrap prices in Brazil’s Ceará state at R$400/tonne Chinese manganese prices fall slightly on quiet business Indian Market : Ferro-alloy price trends diverge Chinese ferroalloys - Moly drops out of price rally bandwagon European ferrosilicon prices firming up Buyers: ferrosilicon market to slow down further slightly Ferromanganese market slows down Nickel market remains slow Larsen & Toubro's Shares Plunge After First Sales Decline in Seven Years :: Larsen & Toubro Ltd., India’s biggest engineering company, had its biggest fall in six months after the company reported its first sales decline in seven years and cut its revenue growth target. Steel Production in China Rises 14% to Record as Vehicle, Home Sales Soar :: Crude steel production in China, the largest maker, rose 14 percent to a record in 2009 as the government’s stimulus spending boosted demand from builders and carmakers. Indian Market Report: Ferro-alloy price trends diverge:: The December 2009 quarter could turn out to have been a stellar one for local metal companies, at least in terms of growth numbers. A low base effect, the sharp rally in commodity prices Japanese scrap export price to China crosses JPY 30000 FOB TEX reported that transaction prices of No2 HMS have topped JPY 30,000 per tonne FOB in ferrous scrap exports out of Japan to China, a high level for the first time in five months since August 2009. Japan's ferrous scrap export market for new deals has surged by nearly JPY 3,000 per tonne in a mere one week since the beginning of 2010. Various buyers in China, South Korea and Taiwan face rising prices across the main sources of ferrous scrap imports. As a result, they are under pressure to pay prices close to what sellers quote, a situation where bids are moving up day by day. China's metal scrap dealers made bids last week of around USD 355 per tonne CNF for No2 HMS from Japan. The bids translate into a price level of JPY 30,100 to JPY 30,200 per tonne FOB after a freight rate deduction of USD 27 to USD 28 per tonne at an exchange rate of USD 1 = JPY 92. Therefore, the yen denominated values of the bids go beyond JPY 30,000 per tonne FOB. Japan's ferrous scrap suppliers though have higher price ideas than the Chinese bids. Besides, many of them tend to hold back on new export deals because they give priority to working off shipment backlogs under negotiated export contracts. Accordingly, new contract volumes face slack growth despite an advance in transaction prices. Besides, it is understood that overseas buyers are compelled to raise bids as they are having a tough time securing what they require. As far as South Korea's steelmakers are concerned, companies such as Hyundai Steel Co, Dongkuk Steel Mill Co, Dongbu Steel Co and SeAH Besteel Corporation are in continued inquiries for imports of Japanese ferrous scrap. Their bids rose to a level of JPY 29,000 to JPY 29,500 per tonne FOB for No2 HMS last week. For its part, SeAH Besteel collected offers of Japanese ferrous scrap on January 12th 2010. Also, Hyundai Steel's purchasing manager is visiting Japan for talks on its new procurement of Japanese material. In this connection, Japanese suppliers find it possible to offer what they sell to almost all of South Korea's steelmakers. In Taiwan, meanwhile, China Steel Corp held its import tender January 11th 2010 to take ferrous scrap. Many of market sources expect Japan's ferrous scrap export market for new deals to continue rising in the immediate future at a time when the USA's domestic ferrous scrap market is on the upswing. Still, some market sources point out fears that Japan's ferrous scrap export market may plunge once it peaks out since the current situation looks bubble like. Russia’s scrap export down by 23.8% in last November :: Russia’s scrap export dropped by 23.8 percent to 135,000 tons in November 2009. Turkey was the top export destination at 42,000 tons, up by 20.5 percent compared to same period of previous year. Following was Spain at 37,000 tons, a 29.1 percent rise year-on-year. The country’s export of scrap totaled 1.85 million tons from January to November 2009, down by 68.9 percent year-on-year. Turkey remained the top export destination at 521,000 tons; followings were Spain, Korea and Netherlands at 401,000 tons, 394,000 tons and 81,000 tons respectively. American scrap imports up in November 2009 :: American scrap imports in November of 2009 totaled 1.745 million tons, up by 58.1 percent than the same time of last year and up by 15.4 percent than last month. American scrap import during the first eleven months rose by 1.4 percent to 20.53 million tons from the same time of last year. It is estimated that annual import volume would be 22.4 million tons. Steel melting scrap price shown downfall in major places:: Melting scrap 80:20 HMS Location Change Chennai 0 Hyderabad 0 Kandla 100 Kanpur -267 Kolkata 0 Mandi 185 Mumbai 200 Rudrapur 0 Change is on 20th January as compared to 19th January 2010 Change is in INR per tonne Plate cuttings prices surges :: Product Grade Size Change Plate cuttings Rolling 1" 300 Ship Scrap Melting Mixed 400 Change is on 20th January as compared to 19th January 2010 Change is in INR per tonne Pencil ingot price movement in major places :: Pencil ingot Location Change Ahmedabad 0 Bhiwari 0 Durgapur -92 Ghaziabad 0 Hyderabad -1000 Jaipur 100 Jamshedpur 0 Kanpur -267 Kolkata 0 Mandi 185 Mumbai 400 Muzzafarnagar 0 Nagpur Raigarh 277 Raipur -185 Rourkela -924 Rudrapur 0 Change is on 20th January as compared to 19th January 2010 Change is in INR per tonne Rebar (TMT) price movement in India :: TMT Fe 415 12mm Location Change Ahmedabad -901 Bangalore 0 Chennai -520 Delhi 0 Hyderabad 0 Indore 0 Kanpur -300 Kolkata 0 Mandi 104 Mumbai 450 Raipur -312 Rudrapur 0 Change is on 20th January as compared to 19th January 2010 Change is in INR per tonne Sponge iron price up in major places:: Sponge iron Location Change Bellary 0 Kolkata 0 Raigarh 500 Raipur 200 Rourkela 300 Change is on 20th January as compared to 19th January 2010 Change is in INR per tonne Taiwan scrap imports in October up by 111pct YoY:: It is reported that Taiwan's scrap imports hit 327,000 tonnes in October 2009, up by 111.1% YoY. During January to October 2009 period, Taiwan's scrap imports reached 3.04 million tonnes, down by 42% YoY. In that 10 months, scrap import from 1. US reached 1.6 million tonnes, accounting for 52.7% in total, down by 37.5% YoY 2. Japan 323,000 tonnes, accounting for 10.6%, up by 64.7% YoY 3. Netherlands 130,000 tonnes, accounting for 4.3%, down by 50.4% YoY 4. Australia 104,000 tonnes, accounting for 3.4%, up by 47.1% YoY International Ferro Metals production, stocks rise in December 2009 quarter:: A record production figure was chieved in December, at 21,898 tonnes. Both furnaces, which were suspended in November 2008, are now running at full "Eskom constrained" capacity Chinese ferroalloys - Moly drops out of price rally bandwagon:: Molybdenum has dropped out of the bandwagon of price rallies seen in China’s ferro-alloy markets amid softening domestic demand and a downward western market. The others remain firm although tight U.S. ferro-chrome price rise gathers pace:: Ferro-chrome prices in the United States continue to climb higher as demand starts to gather momentum and a shortage of supply deepens. Stainless steel mills, foundries and service centers have quickly Chinese crude steel output in 2009 up by 27pct YoY:: Chinese National Bureau of Statistics announced that China produced 47.66 million tonnes of crude steel in December, up slightly from 47.26 million tonnes in November but up by 26.6% YoY. For the full year, China produced 567.84 million tonnes of crude steel up by 13.5% YoY from 2008, when the country's output was 500.48 million tonnes. *** European ferrosilicon prices firming up *** European FeMo market still correcting downward *** Profit-takings on European FeV market sends price wide-ranged *** Indian FeV market offers rise on good end-user demand *** Buyers: ferrosilicon market to slow down further slightly *** Brown fused alumina price to keep stable *** Canadian ferromolybdenum market sees price increase *** Ferrovanadium market in the Canada sees increase in demand *** Replacement costs to push US ferromanganese market higher *** South American manganese ore traders still lacking material *** US ferrochrome prices to continue increasing *** Chinese ferromolybdenum market loose stream slightly *** Asian buyers cautious to purchase ferrosilicon *** Buyers in Asia watching brown fused alumina market *** Quite quiet demand in graphite electrode market *** Demand for green silicon carbide powder keeps good in Japan *** Brown fused alumina market stable *** Silicon carbide grain sands price hits a new high level *** Coke-made black silicon carbide prices increase *** Chinese chrome ore market in stalemate *** Smelters raise spot offers of silicomanganese *** Ferromanganese market slows down *** Ferrotungsten price difficult to go higher in China *** Asian traders show little interest in buying magnesia *** Heavy snow affects magnesia transportation by sea in North China *** Bauxite market stable in Asia *** Ukainian Doneckstal Ltd to increase purchasing volumes of ferroalloy *** Ferrosilicon export price rises in Russia *** Nickel market remains slow *** European ferrosilicon prices firming up *** European FeMo market still correcting downward *** Profit-takings on European FeV market sends price wide-ranged *** Indian FeV market offers rise on good end-user demand *** Buyers: ferrosilicon market to slow down further slightly *** Brown fused alumina price to keep stable *** Canadian ferromolybdenum market sees price increase *** Ferrovanadium market in the Canada sees increase in demand *** Canadian cobalt prices remain firm despite low demand *** Enquiries of titanium sponge getting a little bit more but concluded prices stable *** Replacement costs to push US ferromanganese market higher *** South American manganese ore traders still lacking material *** US ferrochrome prices to continue increasing *** Chinese ferromolybdenum market loose stream slightly *** Antimony ingot market still experiencing appreciation *** Trading slows down in zinc ingot market *** Asian buyers cautious to purchase ferrosilicon *** Mingtai Aluminum cuts down production *** Participants watching lead ingot market *** Chinese alumina output up by 4.4% year-on-year in 2009 *** Aluminum powder producers cut down production in Henan *** Buyers in Asia watching brown fused alumina market *** Fused zirconia prices unchanged *** Shandong Aluminum’s output at 1.4 million tons in 2009 *** Quite quiet demand in graphite electrode market *** Demand for green silicon carbide powder keeps good in Japan *** Brown fused alumina market stable *** Silicon carbide grain sands price hits a new high level *** Aluminum scraps price keeps high *** Some aluminum alloy ingot producers to halt production *** Lateritic nickel ore market goes flatly *** Cobalt oxalate price going up further *** Shangyi Nonferrous’ aluminum alloy project to come on stream in May *** Coke-made black silicon carbide prices increase *** Cobalt oxide price keeps going up *** Cadmium market holds low in India *** Participants believe tin price to retreat further *** Cobalt powder price keeps firm *** Alumina fused zirconia market steady *** Antimony trioxide prices jumping *** Magnesium ingot price decline decelerates in Shaanxi *** Selenium powder suppliers reluctant to sell *** Little room for copper prices to rise before the Spring Festival *** Lithium hydroxide price holds firm *** Manganese flake price decreases a bit *** Jinhong Industry to suspend copper rod production *** Panlong Arsenic to start trial production in May *** Chinese chrome ore market in stalemate *** Smelters raise spot offers of silicomanganese Japanese copper smelters settle TC/RC agreement with BHP Billiton :: It is reported that some Japanese copper smelters have entered to an agreement with BHP Billiton that 2010 TC/RC will be cut by 38 percent. The agreement prices were US$46.5/ton. The processing costs of the new fiscal year are less than US$75 which set in 2009’s contract. Japanese crude steel production in 2009 falls to 40 year low:: It is reported that Japan's crude steel production in 2009 dropped by 26.3% YoY from the previous year to 87.53 million tonnes, the lowest level since 1969 and a fall for the second consecutive year amid the recession. MMTC says export tax on iron ore causes no effect on exporting :: India's largest international trading company, MMTC has indicated that the recent increased export tax on iron ore has not have a negative impact on iron ore exports. The president of MMTC Sanjiv Batra has told the press that China and India do not hold a long term agreement together; spot prices agreement should not bring any problems. If the Chinese importers are taking extra cost because of the increased export tax in India, new prices could be discussed. Batra also predicts that iron ore spot price will be up. Aluminum shipments in US and Canada dip in December The Metals Activity Report from the Metals Service Center Institute shows that inventories of aluminum products at metals service centers in the United States and Canada rose slightly in December as shipments of those products declined seasonally. December shipments of aluminum products from US service centers totaled 79,100 tons, 16.5% lower than December 2008 shipments. Total US service center aluminum shipments of 1.04 million tons were 38.4% below 2008 volume. Aluminum inventories at the end of the year of 279,000 tons were 21.7% lower than a year ago and, at current shipping rates, equal to a 3.5-month supply. In Canada, aluminum shipments from metals service centers totaled 7,700 tons in December, or 20.1% below year-ago volume. Canadian service centers shipped 125,500 tons of aluminum in 2009, a decline of 24.2% from 2008 shipments. The year-end inventory of aluminum products in Canada was 29,200 tons, 13.1% below a year ago and, at current shipping rates, equal to a 3.8-month supply. The Metals Activity Report, based on data from metals service centers in the United States and Canada, is produced by the Metals Service Center Institute and a third-party econometrics and strategy firm, McCoy, Scott & Co. Founded in 1909, the Metals Service Center Institute has more than 375 members operating from about 1,200 locations in the U.S., Canada, Mexico, and elsewhere in the world. Together, MSCI members constitute the largest single group of metals purchasers in North America, amounting each year to more than 55 million tons of steel, aluminum, and other metals, with about 300,000 manufacturers and fabricators as customers. MSCI’s membership also includes almost all ferrous and non-ferrous industrial metals producers in North America. Metals service centers inventory and distribute metals and provide first-stage fabrication services. Chinese coal supply gap is huge despite the high production According to the previous report, China current coal supply gap was nearly 30%, resulting in the insufficient supply despite China annual production of 3 billion tonnes. If the current situation continued, it is estimated that the coal will be excavated out in Shandong Province 20 years later. An insider of the industry told that the coal is still not enough, even if the coal price was CNY 10,000 per tonne in the future. He believed that to change the coal shortage should alter the extensive economic development mode fundamentally. Although the Shanxi coal output was only 620 million tonnes down 20 million tonnes over previous year, coal output broke CNY 3 billion in 2009 up by 12%YoY. It is obviously erroneous that heavy snow led the coal shortage in the circumstance of the rising of the coal production, because the coal shortage presented in the same period last year. In view of this, the elimination of the medium and small coal mines can help control, but it is unfavorable for the domestic coal supply. China's coal supply is so huge that only large coal mines can't guarantee the domestic normal demand, so China should relax the restriction to the medium and small mines with strict management to relieve the coal pressure. Ukraine ferroalloys output in 2009 falls by 25pct YoY According to the Association of Ukrainian Ferroalloy Producers, in 2009 Ukraine registered a decrease of 25.2%YoY in its ferroalloys production to 1.036 million tonnes. 1. 2. 3. 4. Silicomanganese output decreased by 15.6%YoY to 741,900 tonnes Ferromanganese production went down by 64% YoY to 129,400 tonnes Ferrosilicon output increased by 7.4% YoY to 150,300 tonnes Metallic manganese production went up by 75.6% YoY to 15,100 tonnes Chinese coke price stand at USD 420 per tonne FOB Latest CCCMC Reference Prices for Coke Exports as on January 19th 2010, based on the average reference prices for coke export transactions concluded in the previous week stood USD 410 per tonne to USD 420 per tonne on FOB basis. The CCCMC reference prices are average prices for coke export transactions concluded the week prior to issuance date of such reference prices. The China Chamber of Commerce of Metals, Minera ls and Chemicals Importers and Exporters (CCCMC for short) is the largest trading association in China. Issuance Date High Price Low Price 2010.01.19 420 410 2010.01.12 420 410 2009.12.29 410 400 2009.12.22 410 400 In USD per tonne On FOB china basis The China Chamber of Commerce of Metals, Minerals and Chemicals Importers and Exporters is the largest trading association in China. The CCCMC reference prices are average prices for coke export transactions concluded the week prior to issuance date of such reference prices.

![You`re invited to celebrate [child`s name]`s birthday at SCRAP! What](http://s3.studylib.net/store/data/007177272_1-c15601fb9e11b26854f13f1982e634e8-300x300.png)