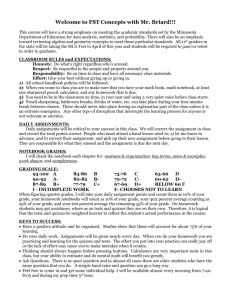

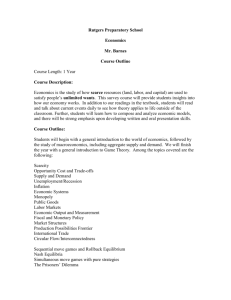

Economics Syllabus – Fall 2002

advertisement

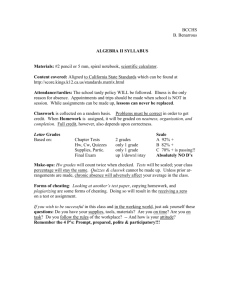

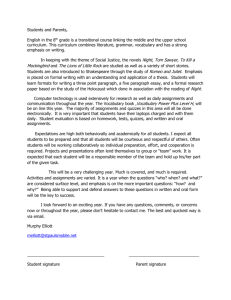

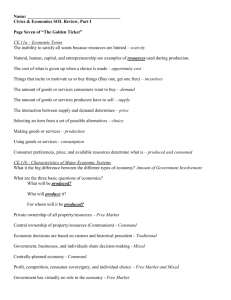

Economics Syllabus Mr. Spaeth sparandy@sd151.k12.id.us Student Name____________________ Parent Signature_________________________ Course Description: This course is an introductory course in economics. We will cover units on basic economic concepts, marginal thinking with supply and demand, market structures and the role of business, banks, money and consumers, the national economy (macroeconomics), and international trade. Students will be evaluated in each unit with class work (book assignments, quizzes and tests) and projects (performance assessments). Grading: You are able to check your grades on-line through Power School. Please do so periodically and if you have any questions about your grade after viewing it on-line, please come talk to me. If you are unsure how to view your grade with Power School check with me. Students will be informed of their grades approximately every two weeks. Once grades are distributed, students will have 48 hours to request a conference with the instructor to talk about their grades and their progress. If you do not request a conference, you are acknowledging the accuracy of the grade and its reflection of your progress. All assignments will be given a point value from 5 – 100. The assignments will fall into one of four categories: class work, projects, quizzes, and tests. The assignments and projects are designed to help prepare you for your tests. The end of course test is worth 10% of your grade. Content: During the course of the semester, students will take approximately 35 quizzes on the learning outcomes listed on this syllabus. These quizzes will not be graded, but will give you feedback as to your progress in the course and it will provide a means for you to demonstrate your level of mastery of the content. Students will answer fact based as well as application level questions over this material. Projects: Students will be required to demonstrate their learning by applying their content knowledge to a variety of situations. These projects may be scored individually, by the class, by the instructor, or a combination there of. Projects, will have specific due dates, usually determined after the assignment is given. Students should understand that having all of the required information completed does not mean you will get full credit. Quality of work and creativity are just two other factors that will be looked at before giving projects a B or an A. If a project is not turned in on time, it will still be accepted for no more than one half credit, depending on when it is turned in. Work that has portions of it copied and pasted off of the Internet or from other sources, will receive an automatic “0.” If you are finding it difficult to keep up, then communicate with your instructor BEFORE the due date. Course Learning Outcomes Unit 1 – Basic Economic Concepts & Our American Economic System 1. Economics is determining how to satisfy unlimited wants with limited resources. 2. Scarcity is the universal problem that forces us to make choices in a world of limited resources and unlimited wants. 3. The essential ingredients needed to produce any product or service referred to as the factors of production. They are land, labor, capital, and entrepreneurship (management). 4. An entrepreneur combines the factors of production in a creative way for a chance to make a profit and they know when to take a risk. 5. Opportunity cost is the most desirable alternative given up as a result of a decision. 6. The basic economic questions are: What should be produced? How should it be produced? How much should be produced? Who should receive it? 7. The four types of economic systems are traditional, command, market, and mixed. 8. Traditional economic systems answer the basic economic questions by doing things the way they have always been done. 9. Command economies answer the basic economic questions through the government. 10. Free market economic systems are where the buyers and sellers answer the basic economic question. 11. The United States economic system is a mixed system. 12. Adam Smith, the father of capitalism, believed society benefited from the pursuit of self-interest and his beliefs influenced the United States and other economic systems. 13. Karl Marx, the father of socialism, believed the group’s needs should be put ahead of individual interest and his beliefs influenced the United States and other economic systems. 14. A public good is a government financed shared good or service for which it would be inefficient to make people pay for, or try to exclude them from. 15. The private sector is represented by individuals, businesses, or non-government entities. 16. An externality is an economic side effect of a good or service that can be positive or negative. 17. Free rider is a person who received public goods but did not pay for the public goods. Unit 2: Marginal Thinking – Demand, Supply, and Markets 18. The law of demand states that at higher prices consumers generally buy smaller quantities, and at lower prices consumers tend to buy larger quantities. 19. Substitute goods and complementary goods both affect markets and the decisions consumers make. 20. Marginal cost is the additional, or extra, expense of producing one more item. 21. The law of diminishing marginal utility helps explain consumer behavior by telling us there comes a point when satisfaction decreases with increased consumption. 22. Supply is the various amounts of a good which producers are willing and able to offer for sale at a given time at all different possible prices. 23. The law of supply tells us businesses produce more when prices are higher and produce less when prices fall. 24. Supply and demand curves can graphically explain market conditions. 25. A surplus is a condition when the price is above the point of equilibrium or market clearing price, such as a price floor (minimum wage). Unit 3: Market Structures & Roles of Business 26. Perfect competition exists in a market when the products are identical and there are many sellers. 27. Economies of scale is when larger businesses buy at volume discounts and/or afford equipment smaller businesses cannot afford. 28. Diminishing returns occur when increased inputs do not lead to increased productivity. 29. The majority of businesses can be categorized as forms of proprietorships, partnerships, or corporations. 30. Sole proprietorships are businesses with one owner and benefit from being one’s own boss. 31. Partnerships are businesses with a few owners, usually sharing responsibilities to match their individual strengths. 32. Corporations are businesses that provide limited liability for owners, unlimited life for the firm, and the ability to raise large amounts of monetary capital. 33. Collective bargaining is when labor unions use elected representatives to negotiate with their employers. 34. Companies issue stock to link investors and businesses looking to expand (raise capital). 35. Common stock is a type of investment which gives ownership to the investors and a chance to profit via dividends and capital gains. Unit 4 – Banks, Money, and Consumers 36. The three definitions of the purposes of money are medium of exchange, standard of measure, and store of value. 37. Medium of exchange tells us that money can be used as trade for goods and services. 38. Standard of measure means money provides us with a way of comparing values of goods and services. 39. Store of value explains that money is worth a similar amount later if you choose to save it instead of spending it. 40. The six characteristics of money are durability, portability, divisibility, uniformity, limited supply, and acceptability. 41. Fiat money has value because governments declare it is acceptable to pay debts. 42. Credit Unions are financial institutions that are non-profit and whose customers are members. 43. FDIC is the Federal Deposit Insurance Corporation which insures customers deposits if a bank fails. 44. Rate of return explains what type of profit or loss you are getting on your investment. 45. Budgets are tools to help consumers better manage their resources. 46. The agency consistently providing information to consumers concerning both good and bad business practices by area companies is the Better Business Bureau. 47. The three C’s of credit are collateral, character, and capacity. They are used when determining whether or not you qualify for a loan. 48. Collateral refers to the individual's ability to put property up to secure credit. 49. Character explains whether you pay your bills on time or not, your payment history. 50. Capacity is the earnings and current debt the individual has and his or her ability to take on new debt. Unit 5 – The National Economy 51. GDP is the dollar value of all final goods and services produced in the US in the course of a year. 52. GDP components are consumer spending, business investments, government spending, and net exports. 53. Inflation is a period of rising prices and affects consumers as well as producers. 54. People on fixed incomes can be negatively affected by inflation. 55. Taxes are based on two principles: ability to pay and benefits-received. 56. Ability to pay is a principle that promotes the idea that the rich can afford to pay taxes the poor cannot afford to pay. 57. There are three categories of taxes: progressive, proportional, and regressive. 58. Progressive taxes are characterized by a lower tax rate for lower incomes and a higher tax rate for higher incomes. 59. Proportional taxes are designed to take the same percentage of your income regardless of how much money you make. 60. Income tax provides the majority of revenues for the U.S. government. 61. Withholding taxes are taken from your paycheck. They include federal taxes, state taxes, and FICA. 62. Fiscal policy is a way of managing the nation’s financial affairs through a program of expenditures and taxation. 63. When taxes are reduced it is usually to increase consumer spending and stimulate the economy. 64. In the short term, the government will increase spending if unemployment is high and prices are stable. 65. John Maynard Keynes theories focusing on the whole economy as opposed to the individual and argued demand-side economics is more effective in managing the economy. 66. When commercial banks increase their loans to business and consumers, this usually results in an increase in the nation’s money supply. 67. A budget deficit occurs in a year when expenditures exceed revenues. 68. The sum total of all the money you owe is referred to as debt. 69. The Federal Reserve is the nation's central bank and manages the money supply. 70. The Federal Reserve has the authority to sell government securities and issue paper money. 71. Monetary policy is the Federal Reserve’s way of managing the money supply through changes in interest rates, reserve requirements, or open market operations. 72. Open market operations are a monetary policy tool used by the Federal Reserve where they buy and sell US securities. 73. A recession is two consecutive economic quarters where GDP decreases. 74. A depression is a very severe recession where there are large numbers of people out of work, acute shortages, and excess capacity in manufacturing plants. Unit 6 – International Trade 75. A comparative advantage is when a country can produce something at a lower opportunity cost than another country. 76. An absolute advantage is when it takes a country fewer resources to produce something than another country. 77. NAFTA, EU and the WTO are trade arrangements. 78. Protectionism is a countries use of quotas and tariffs to promote their own industries over foreign competition. 79. Tariffs benefits some groups at the expense of others. 80. A trade deficit is when you import more than you export and a trade surplus is when you export more than you import. 81. Exchange rates determine the value at which foreign currency can be traded. 82. If the US dollar loses its value as compared to foreign currencies, it is likely more nations will buy American goods and services as foreign currency will purchase more.