9.3

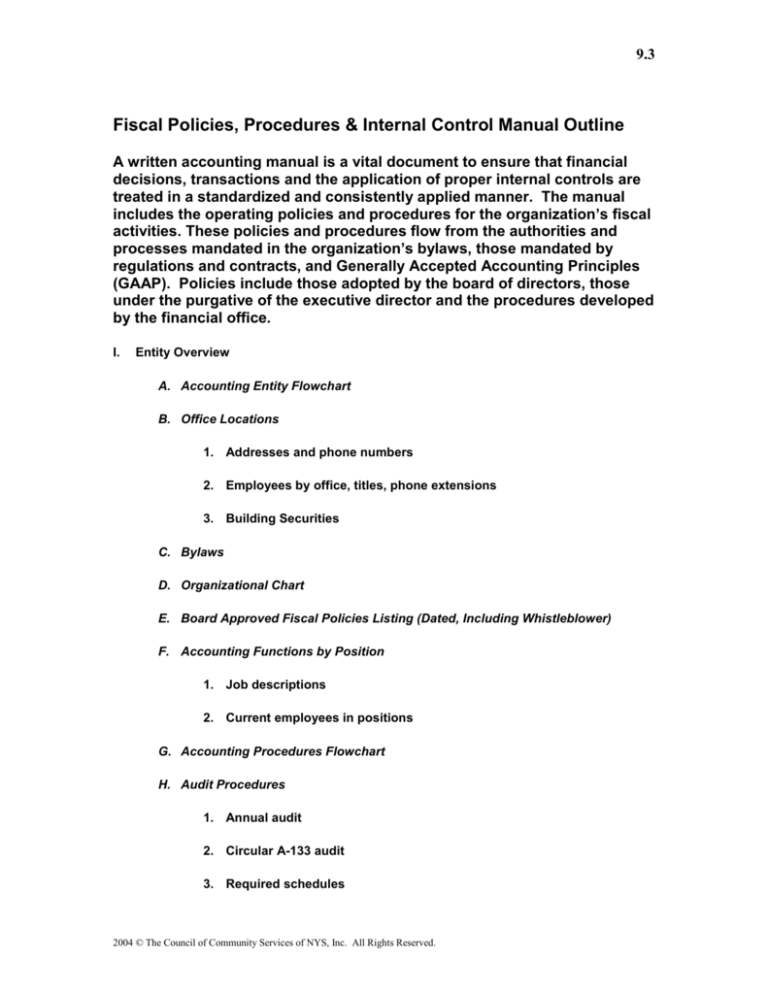

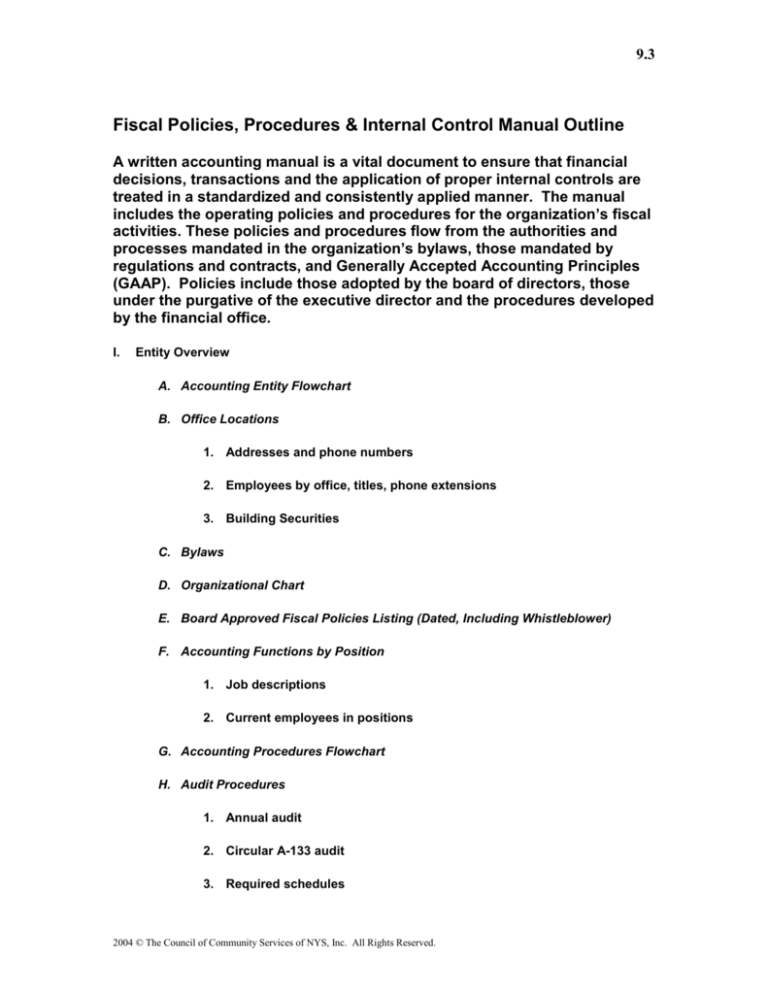

Fiscal Policies, Procedures & Internal Control Manual Outline

A written accounting manual is a vital document to ensure that financial

decisions, transactions and the application of proper internal controls are

treated in a standardized and consistently applied manner. The manual

includes the operating policies and procedures for the organization’s fiscal

activities. These policies and procedures flow from the authorities and

processes mandated in the organization’s bylaws, those mandated by

regulations and contracts, and Generally Accepted Accounting Principles

(GAAP). Policies include those adopted by the board of directors, those

under the purgative of the executive director and the procedures developed

by the financial office.

I.

Entity Overview

A. Accounting Entity Flowchart

B. Office Locations

1. Addresses and phone numbers

2. Employees by office, titles, phone extensions

3. Building Securities

C. Bylaws

D. Organizational Chart

E. Board Approved Fiscal Policies Listing (Dated, Including Whistleblower)

F. Accounting Functions by Position

1. Job descriptions

2. Current employees in positions

G. Accounting Procedures Flowchart

H. Audit Procedures

1. Annual audit

2. Circular A-133 audit

3. Required schedules

2004 © The Council of Community Services of NYS, Inc. All Rights Reserved.

9.3

I.

Tax Filings Required

J. Investment Policy

K. Bank Accounts

L. Insurance Carriers

M. Tenants

N. Supply Order Procedures

O. Computer Security

1. Description of measures in place

2. Back up procedures

P. Equipment Maintenance

Q. Web Service

R. Accounting Software

1. Password protections

2. Chart of accounts

3. Record Retention Policy

II. ________ Main Division

A. Annual Budget

1. Process

2. Cost allocations

3. Funding sources

4. Program listing

B. Quarterly Inter-company Reconciliation’s

C. Monthly Reporting

D. Daily General Ledger Duties

2004 © The Council of Community Services of NYS, Inc. All Rights Reserved.

9.3

1. Accounts payable

2. Accounts receivable

3. Cash receipts

4. Cash disbursements

5. Journal entries

E. Bank Reconciliation’s

F. Payroll

G. Vacation, Sick and Personal Time Tracking

H. Fixed Assets

I.

Line of Credit

J. Petty Cash

K. Credit Card

L. Document Destruction & Retention Policies

M. Whistleblower Policies

N. Gift Acceptance & Donor Privacy

O. Filing System

III. ________ Grant Division

A. Grants

1. Fiscal year

2. Subcontractors

3. Reporting requirements

B. Voucher Preparation

C. General Ledger Duties

1. Cash Receipts

2004 © The Council of Community Services of NYS, Inc. All Rights Reserved.

9.3

2. Cash Disbursements

3. Transfers

4. Journal Entries

5. Bank Reconciliation’s

2004 © The Council of Community Services of NYS, Inc. All Rights Reserved.