Chapter -1

advertisement

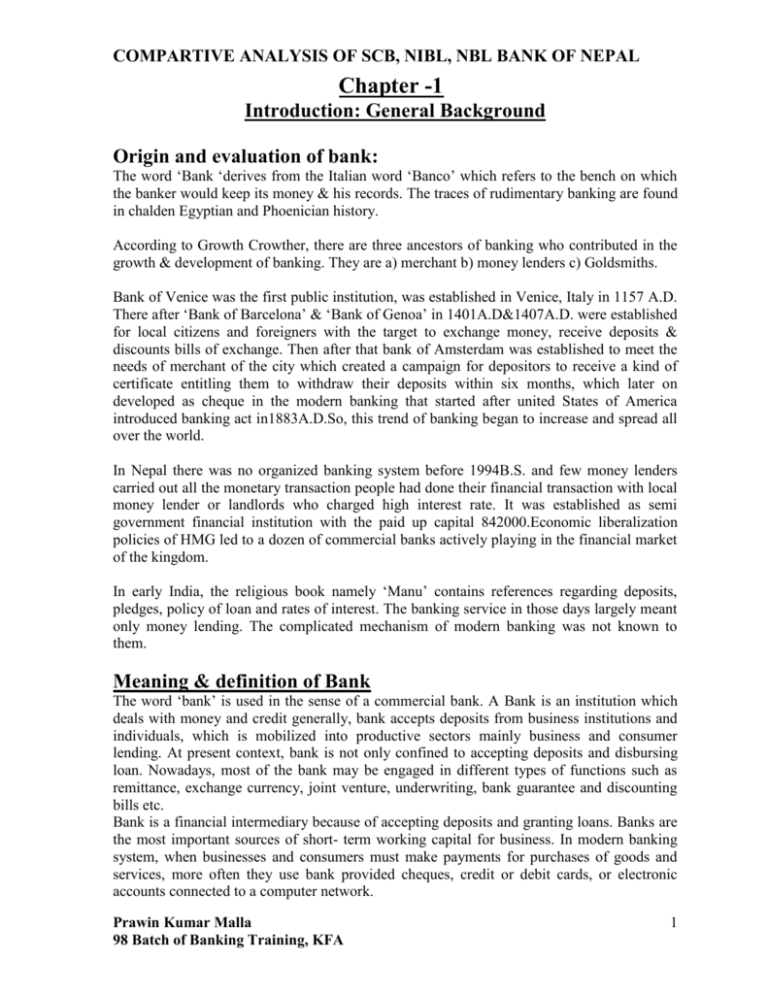

COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Chapter -1 Introduction: General Background Origin and evaluation of bank: The word ‘Bank ‘derives from the Italian word ‘Banco’ which refers to the bench on which the banker would keep its money & his records. The traces of rudimentary banking are found in chalden Egyptian and Phoenician history. According to Growth Crowther, there are three ancestors of banking who contributed in the growth & development of banking. They are a) merchant b) money lenders c) Goldsmiths. Bank of Venice was the first public institution, was established in Venice, Italy in 1157 A.D. There after ‘Bank of Barcelona’ & ‘Bank of Genoa’ in 1401A.D&1407A.D. were established for local citizens and foreigners with the target to exchange money, receive deposits & discounts bills of exchange. Then after that bank of Amsterdam was established to meet the needs of merchant of the city which created a campaign for depositors to receive a kind of certificate entitling them to withdraw their deposits within six months, which later on developed as cheque in the modern banking that started after united States of America introduced banking act in1883A.D.So, this trend of banking began to increase and spread all over the world. In Nepal there was no organized banking system before 1994B.S. and few money lenders carried out all the monetary transaction people had done their financial transaction with local money lender or landlords who charged high interest rate. It was established as semi government financial institution with the paid up capital 842000.Economic liberalization policies of HMG led to a dozen of commercial banks actively playing in the financial market of the kingdom. In early India, the religious book namely ‘Manu’ contains references regarding deposits, pledges, policy of loan and rates of interest. The banking service in those days largely meant only money lending. The complicated mechanism of modern banking was not known to them. Meaning & definition of Bank The word ‘bank’ is used in the sense of a commercial bank. A Bank is an institution which deals with money and credit generally, bank accepts deposits from business institutions and individuals, which is mobilized into productive sectors mainly business and consumer lending. At present context, bank is not only confined to accepting deposits and disbursing loan. Nowadays, most of the bank may be engaged in different types of functions such as remittance, exchange currency, joint venture, underwriting, bank guarantee and discounting bills etc. Bank is a financial intermediary because of accepting deposits and granting loans. Banks are the most important sources of short- term working capital for business. In modern banking system, when businesses and consumers must make payments for purchases of goods and services, more often they use bank provided cheques, credit or debit cards, or electronic accounts connected to a computer network. Prawin Kumar Malla 98 Batch of Banking Training, KFA 1 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL In fact, a modern bank performs such a variety of functions that it is difficult to give a precise and general definition of a bank. Some important definitions for the banks given by different personalities are as follows. As Per Kent –“A bank is an organization whose principle operations are concerned with the accumulation of the temporarily idle money of the general public for the purpose of advancing to other for expenditure.” As per Banking resolution Act of India-“Banking means the accepting for the purpose of lending or investment of deposit of money from the public repayable on demand or otherwise and withdrawable by cheque, draft or otherwise.” As per U.S.Law-“Any institution offering deposits subject to withdrawal on demand and making loans of a commercial or business nature of the bank.” As per Horace white White-“Bank is a manufacture of credit and machine for facilitating exchange.” Banks main purpose is to support the economic growth, agriculture growth, commercial growth of the country. So we can say Bank is a financials institution offering deposits subjects to withdrawal on demand and making loans of a commercial or business nature. According to commercials Bank Act 2031,Acommercial bank means bank which deals in exchanging currency, accepting deposit giving loans and doing commercial transactions.” FINANCIAL SYSTEM Banks are established with different purpose. There are different types of Bank specializing in particular functional areas. Organization a) b) c) d) e) f) Central Bank Commercials Banks Development Banks Finance companies Co-operatives Non- Government organizations No. of Institutions 1 20 28 71 35 25 Origin of Bank in Nepal In the Nepalese the context, it is very difficult to trace the correct chorological history of the traditional Banking systems due to lack of historical records of Banking. In Nepal, crude banking operations were in practice in ancient times between landlords, rich merchants, shopkeepers and other individual money lenders. After Shankadhar introduced Nepal Sambat, a Sudra merchant paid the outstanding debts of country. The historical records show that Guna Kam Dev, king of Kathmandu borrowed money to rebuild his kingdom in 2 Prawin Kumar Malla 98 Batch of Banking Training, KFA COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL 723A.D.Later, during the time of ‘Malla’ money lending business become more popular. The people “Tankadhari” belongs in this class were engaged in money lendingbusiness.After some years Ranadip Singh, a Rana Prime minister of eight year(1877-1885) got interest in the problem and took concrete state by establishing a government financial institution, which helps the public by supplying easy and cheap credit on the security of gold silver ornaments. Tejarath Adda may and regarded as the father of modern banking institution and for quite long time it rendered goods services to the government servants as well as to the general people. ‘The Tejarath Adda’ was replaced by a commercial Bank, Nepal Bank Ltd, which marked the beginning of a new era in the history of the modern banking in Nepal. Nepal Bank has been inaugurated by King Tribhuvan Bir Bikram Shah Dev on 30th Kartik 1994B.S. It was established as a semi government bank with the authorized capital of Rs.10 million and the paid -up capital of Rs. 892 thousand. “ Nepal Bank Ltd, “ however was controlled by the private shareholders till 1951A.D.During that period, HMG share in the total share capital of this bank was not very significant.In1952, HMG had increased its ownership in Nepal Bank Ltd. to 52% in total share capital of this bank in order to hold control over its management. Till the foundation of Nepal Rastra Bank is 1956 A.D. Nepal Bank Ltd. remained the only financial institution of the country. Due to the absence of the central bank, it has to operate the function of central bank. It has managed all the banking transactions of the government along with the entire business of currency exchange on 26th April, 1956. The Nepal Rastra Bank was founded under the Nepal Rastra Bank Act 1955 assuming the entire function of the central bank. Then followed by, in 1963 AD Rastriya Banijya Bank was introduced. The government gradually liberalized and opened up the financial sector, resulting in the rapid entry of the foreign banks which lead to the grand opening of ‘Nabil Bank’ earlier called Nepal Arab Bank in 1984 AD. Other commercial banks started emerging in the private projects due to which opening of finance companies emerged in 1986 AD. At present, the banking sector is more liberalized and there are various types of bank working in modern banking system. This includes central, development and commercial banks. Evolution of the information technology has revolutionized the banking sector in saving lots of time and money by implementing IT. Technology has changed the traditional method of the service of bank. Invention of different software and hardware, which are very essential and available for functioning bank such as Banking software, ATM, E-banking, Mobile Banking and Card like Debit Card, Credit Card, Prepaid Card etc. which helps the customer as well as banks to operate and conduct their activities more efficiently and effectively. This helps bank to generate more customers, goodwill and profit. And today, there are 20 Commercial Bank, 9 Development Banks, 46 Financial Institute and 35 Co-operative Banks. Nepal Banking system is evolving itself as a powerful economic sector. Commercial Bank Commercial bank is the term used for a normal bank to distinguish it form another bank these institutions run to make a profit and owned by a group of individuals, they are primarily concerned with receiving deposits and lending to businesses. It is the major component of the financial system that acts as intermediary between depositors and lenders. It’s main objective is to collect the idle scattered funds and mobilize them into productive sector for overall Prawin Kumar Malla 98 Batch of Banking Training, KFA 3 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL economic development. Commercial bank is the heart of economic system that holds the deposits of millions of people, government and business sectors. It exchanges money, accepts deposits, grant loan and operates commercial transactions. Basically the functions of commercial bank all over the world are the same. Basic functions are various types of deposit facilities namely current, saving and fixed. Safety of public money, remittance of money, letter of credit, guarantee, loans, lockers facility, foreign exchange, serving as agent of client etc. The commercial Banks of Nepal also do all these functions. Importance of Commercial Bank A commercial bank refers very reliable services to the community by increasing the productive capacity of the country and there by accelerating the pace of economic development. The commercial bank therefore is of utmost important. It can be listed below. a) Legal Entity and Freedom from Exploration A Bank is registered under company act and thus has legal entity. It supports the public from being exploited through money lenders, merchants and Goldsmith who changes high interest rates on lending. b) Financial Intermediaries A bank acts as a financial intermediaries by mobilizing the saving of the society through current account or time deposit account and then providing this money to those who are in need of it by granting loan. c) Transfer of fund Physical transfer of cash involves many risks and costs but transfer of fund from one place to another is the necessity of the day, be it for common people or business people. Banks transfer funds to any corner of the world through their vast network by various expedition modes. d) Boost of Trade Comparative cost and natural endowments have made trade imperative within the country and around the glove. Since the buyers and seller live apart neither the sellers can dispatch the goods without obtaining money nor can buyers remit money without receipt of goods. All these difficulties and apprehensions hovering over the trade are removed by banks by issuing letters of credit and guarantee. These instruments ensure the buyer that he pays only for goods and services as per his need/contract. e) Safety of Valuables A bank offers services by keeping in safe custody of valuables such as negotiable securities, jewellery, documents of title, wills, deed boxes etc. f) Employment Bank fosters agricultural, industrial and commercial activities in the nation. This, in turn, helps to create employment opportunities. Prawin Kumar Malla 98 Batch of Banking Training, KFA 4 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Function Although profit maximization is a mount objective of commercial bank, to achive this objective, commercial bank performs various functions under mandatory rules and regulations and directives of NRB and commercials bank Act,2031(1974). Primary a) Acceptance of Deposits: Current Account Saving Account Fixed Account b) Advancing of Loan Over Draft Cash credit Direct loan with collateral Discounting bill of exchange Loans of money at call and notice General Utility function To issue letters of credit and travelers cheques Collection and payment of cheques, bills, promissory note etc. Remittance of money. Keeping valuable things under safe custody. Collection of trade information and banking statistics. Dealing in foreign exchange. Agency Function Collection of customer’s money from other banks. Receipt and payment of dividend, interest. Security brokerage service. Financial advisory service. To underwrite the government and private securities. Problems of Banking in Nepal After the restoration of multiparty democracy in 2047, B.S.Nepalese economy has been thoroughly overhauled with the policy of liberalized trade and finance. Export business is very important for economic development. Export business is not actually promoted by the banks. Instead banks are promoting more import business by providing enough loans. There are lots of problems in our country are as follows: Prawin Kumar Malla 98 Batch of Banking Training, KFA 5 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL a) Lack of investment in productive sectors: The commercial banks are not providing adequate loan in the productive sector. Most of the investment is centralized in the import business. Such reality shows banks are promoting import business rather than industrialization b) Lack of proper Banking policy: In political environment is not favorable in Nepal. The governmental policies including banking policy are also changed accordingly from time to time. c) Traditional Banking service: In our country most of the people live in rural areas. They have no option but to go to landlords provide traditional banking services. Traditional Bankers (landlords, goldsmiths and rich people) have covered more than 60% of the total banking market in Nepal. d) Lack of research and development: Banks in Nepal are not serious towards research and development. Because of lack of research and development, new profitable sector is not discovered as current requirement. e) Wrong policies of Banks: Most of the banks are to make the profit maximization only. They have the neglected the welfare of customers and nation. In the course of profit maximization, banks are even manipulating the classification of credit and less provision is made. They expand credit beyond the capacity of bank capital. Commercial Banks in Nepal S. NO. Banks 1 Nepal Bank Ltd. 2 Rastriya Banijya Bank 3 Nabil Bank 4 Nepal Investment Bank 5 Standard Chartered Bank Ltd. 6 Himalayan Bank Ltd. 7 Nepal SBI Bank 8 Nepal Bangladesh Bank 9 Everest Bank Ltd. 10 Bank of Kathmandu 11 Nepal Credit and Commerce Bank 12 Nepal Industrial and Commercial Bank 13 Lumbini Bank 14 Machapuchhre Bank 15 Kumari Bank 16 Laxmi Bank 17 Siddhartha Bank 18 Agricultural Bank 19 Global Bank Prawin Kumar Malla 98 Batch of Banking Training, KFA Head Office Kathmandu Kathmandu Kathmandu Kathmandu Kathmandu Kathmandu Kathmandu Kathmandu Kathmandu Kathmandu Bhairawa Biratnagar Narayangrah Phokara Kathmandu Birjung Kathmandu Kathmandu Birgunj Estd. Date (In B.S.) 1994 2022 2041 2042 2043 2049 2050 2050 2051 2051 2053 2055 2055 2057 2057 2058 2059 2064 6 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL 20 Citizen Bank International Ltd. Kathmandu 2064 Objective of Study To know the historical background of the bank. To know the deposit mobilization process, criteria, problems facing by the bank To find out the interest rates charged by the bank in different sectors of loan investment. To analyze the financial strength, weakness. To examine financial performance. To compare the financial position of the same type of business. To provide suggestion to improve based on the finding study. Importance of the Study MANAGEMENT The management also wants to know the financial viability of the bank. This study will be helpful to go deeply into the various matters as to why the performance of their bank is better or worse than other joint Venture Banks. The management will know about their loose areas and gaps, which can be corrected in future. SHAREHOLDERS Shareholders will also be benefited by this study. They want to know how their funds are utilizing and to what extent they are gaining? The study will help them to identify the productivity of their scarce sources. OTHERS Others refer to these all interested group except the management and the shareholders, such as depositors, debtors, investors, competitors, stockbrokers, merchant bankers’ etc. these groups will be interested in the performance of respective banks for their own way such as whether to deposit or not? Invest or not? Finance or not? More, creditors are eager to know the short-term solvency of the bank. The study will be helpful for all types of groups. LIMITATION OF THE STUDY The study is based mainly on secondary data and to some extent on primary data too. The filed work should be completed within a certain period despite of great desire the reporter can't contain all data and information's. Prawin Kumar Malla 98 Batch of Banking Training, KFA 7 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Introduction of Standard Chartered Bank Nepal Limited The Bank earlier known as Grindlays Bank was established under a joint venture agreement between ANZ Grindlays Bank p/c, London and Nepal Bank Limited, on 19th December1985 and was operated since 1987.After the acquisition of the Grinlays Banks operation by standard Chartered Bank on 31 July 2000, it was considered appropriate to change the name of the Bank into Standard Chartered Bank Nepal Ltd. effective from 10 July 2001. Today the Bank is an integral part of Standard Chartered Group who has 75% ownership in the company with 25% shares owned by the Nepalese public. The Bank enjoys the status the largest international bank currently operating in Nepal. Standard Chartered Group employs 30,000 people in over 500 locations in more than 50 countries in the Asia Pacific Region, South Asia, the Middle East, Africa, the United Kingdom and the Americas. It is one of the world's most international banks, with a management team comprising 79 nationalities. The Bank is trusted across its network for its standard of governance and its commitment to making a difference in the communities in which it operates. An integral part of the only international banking Group currently operating in Nepal, the Bank enjoys an impeccable reputation of a leading financial institution in the country. With 11 points of representation (7 Branches) and 9 ATMs across the Kingdom and with over 300 local staff, Standard Chartered Bank Nepal Ltd. is in a position to service its customers through a large domestic network. In addition to which the global network of Standard Chartered Group gives the Bank the unique opportunity to provide truly international banking in Nepal. Standard Chartered Bank Nepal Limited offers a full range of banking products and services in Wholesale and Consumer banking, catering to a wide range of customers from individuals, to mid-market local corporate to multinationals and large public sector companies, as well as embassies, aid agencies, airlines, hotels and government corporations. The Bank has been the pioneer in introducing 'customer focused' products and services in the country and aspires to continue to be a leader in introducing new products and highest level of service delivery. It is the first Bank in Nepal that has implemented the Anti-Money Laundering policy and applied the 'Know Your Customer' procedure on all the customer accounts. CAPITAL STRUCTURE Capital Structure of SCB Share Capital and ownership of SCB Bank Ltd. Particular Authorized Capital Issued Capital Paid-up Capital Prawin Kumar Malla 98 Batch of Banking Training, KFA Amount (NRs) Rs. 1,000,000,000.00 Rs. 500,000,000.00 Rs. 374,640,400.00 8 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL EQUITY PARTICIPATION Nepalese public Shareholders Standard Chartered Gridley’s Bank Australia Standard Chartered Bank USA Total 25 % 50 % 25 % 100 % PRODUCTS & SERVICES offered by the Bank are as follows: Consumer Bank Current, savings, call and term deposit accounts in Local & Foreign currency Fund Transfer Services - Local & International - Drafts, SWIFT Credit Card Services - Issuance & Acquiring 24 Hour ATM services - SCBNL debit card, VISA and Master Card Safe Deposit lockers Foreign Exchange Services - Issuance/purchase of Travelers Cheques Extra Banking - 365 days banking from Kantipath and Lalitpur Branches Priority Banking; Home Banking Auto Loan Home Loan; Home Advantage Personal Loan SMS Banking Corporate Employee accounts Wholesale Bank Trade Finance - Letters of credit: Issuance and acceptance - Guarantees: Issuance and acceptance Commercial Lending (Working Capital) Term Lending Loan Syndication Forward Exchange Rates Electronic Banking Cash Management - Operating Accounts - Quick Collection Services - Quick Payment Services Cheque writer Corporate Social Responsibility Prawin Kumar Malla 98 Batch of Banking Training, KFA 9 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Standard Chartered Bank Nepal is a socially responsible corporate and recognizes its responsibilities to its staff and to the communities in which it operates. The Bank concentrates on projects that assist children, particularly in the areas of health and education and it has taken up various initiatives to benefit the community. 2 major initiatives in the area of health 'Living with HIV' and 'Seeing is Believing' have been undertaken by the Bank since 2003. Awards & Achievements July 2004 - Award for the Best Presented Accounts in the Financial Institutions Category in Nepal for the Year 2002-2003 and 2002-2001awarded by Institute of Chartered Accountants of Nepal (ICAN). December 2003 - The Best Company, Financial Institutions from Top 10 awards for Business Excellence awarded by 'The BOSS' September 2002 "Bank of the Year 2002 Nepal" by 'The Banker' of the Financial Times. April 2002 - Commercially Important Person (CIP) awarded by His Majesty's Government the Ministry of Finance April 2002- National Excellence Award 2002" for significant achievement in customers satisfaction and relationship" awarded by Federation of Nepalese Chamber of Commerce & Industry (FNCCI) Standard Chartered Nepal - awarded 'Best Commercial Bank' for the 2nd successive Year Specialty Media Pvt. Ltd. the publisher of a leading business magazine 'The boss' awarded the 2nd boss Top 10 Business Excellence Awards for the year 03-04 at a special function hosted in Kathmandu on 11 March 2005. These awards are a tribute to the passion for business excellence and the spirit of entrepreneurship. It is a matter of great pride that Standard Chartered Bank Nepal was adjudged the Best Commercial Bank in Nepal for the second successive year. This is the result of dedicated teamwork, working cohesively as 'One Bank. Hon. Dr Bimal Prasad Koirala, Chief Secretary - Office of the PM and Council of Ministers gave away these prizes to the winners at this large august gathering of distinguished personalities from various walks of life. Share Ownership: Subscription Percentage (%) Holding Foreign ownership Promoters’ Share (General Public) 75 % 25% Capital Structure NRs. Amount Prawin Kumar Malla 98 Batch of Banking Training, KFA 10 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Authorized Capital Issued Capital Paid Up Capital 1,000,000,000.00 500,000,000.00 374,640,400.00 BRANCHES BRANCEHS IN NEPAL 1. NEW BANESHWOR (HEAD OFFICE) 2. LAZIMPAT 3. LALITPUR 4. BIRATNAGAR 5. POKHARA 6. DHARAN 7. BUTWAL 8. HETAUDA 9. BHAIRAHAWA 10.NEPALGUNJ The bank is giving the service of ATM (Automatic Teller Machine) from 10 different place out of which 7 are from inside Kathmandu valley and 3 outside valley. Inside Valley 1. Kathmandu Guest House, Thamel, Kathmandu 2. Bishal Bazar, New Road, kathmandu 3. Kasthamandap, Kamaladi, Kathmandu 4. SCBN, New Baneshwor, Kathmandu 5. SCBN, Lazimpat 6. SCBN, Lalitpur 7. UN Building, Lalitpur Outside Valley 8. Hotel Snowland, Phokhara 9. Mahendra Pool, Phokhara 10. BP Koirala Institute, Dharan Prawin Kumar Malla 98 Batch of Banking Training, KFA 11 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Introduction of Nepal Investment Bank Limited Nepal Investment Bank ltd. (NIBL), previously Nepal Indosuez Bank ltd., was established in 1986 as a joint venture between Nepalese and French partners. the French partner (holding 50% of the capital) was Credit Agricole Indosuez, a subsidiary of one the largest banking groups in the world. With the decision of Credit Agricole Indosuez to divest, a group of companies comprising of bankers, professionals, industrialists and businessmen, in April 2002, acquired 50% of the holdings of Credit Agricole Indosuez in Nepal Indosuez Bank. The name of the bank was changed to Nepal Investment Bank ltd. upon approval of the Bank’s Annual General Meeting, Nepal Rastra Bank and Company Registrar’s office. The shareholding structure comprises of: A group of companies holding 50% of the Capital Rastriya Banijya Bank holding 15% of the Capital. Rastriya Beema Sansthan holding 15% of the Capital. The general public holding 20% of the Capital. Vision Statement: “To be the most preferred provider of Financial Services in Nepal” Mission Statement: To be the leading Nepali bank, delivering world class service through a blend of technology and visionary management in partnership with our committed staff, to achieve sound financial health with sustainable value addition to our stakeholders. We are committed to this mission while ensuring the highest levels of ethical standards, professional integrity, corporate governance and regulatory compliance. Strategic Objectives: To develop a customer oriented service culture with special emphasis on customer care and convenience. To increase our market share by following a disciplined growth strategy. To leverage our technology platform and open scalable systems to achieve costeffective operations, efficient MIS, improved delivery capability and high service standards. To develop innovative products and services that attracts our targeted customers and market segments. 12 Prawin Kumar Malla 98 Batch of Banking Training, KFA COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL To continue to develop products and services that reduces our cost of funds. To maintain a high quality asset portfolio to achieve strong and sustainable returns and to continuously build shareholders’ value. To explore new avenues for growth and profitability. Core values and ethical principles: 1. Customer Focus: At NIBL, their prime focus is to perfect their customer service. Customers are their first priority and driving force. They wish to gain customer confidence and be their trusted partner. 2. Quality: They believe a quality service experience is paramount to their customers and they are strongly committed in fulfilling this ideal. 3. Honesty and Integrity: They ensure the highest level of integrity to their customer, creating an ongoing relationship of trust and confidence. They treat their customers with honesty, fairness and respect. 4. Belief in our people: They recognize that employees are their most valuable asset and their competitive strength. They respect the worth and dignity of individual employees who devote their careers for the progress of the Bank. 5. Teamwork: They are a firm believer in teamwork and feel that loyal and motivated teams can produce extraordinary results. They are drive by a performance culture where recognition and rewards are based on individual merit and demonstrated track record. 6. Good Corporate Governance: Effective Corporate Governance procedures are essential to achieve and maintain public trust and confidence in any company, more so in a banking company. At NIBL, they are committed in following best practices resulting in good corporate governance. 7. Corporate Social Responsibility: As a responsible corporate citizen, they consider it important to act in a responsible manner towards the environment and society. Their commitment has always been to behave ethically and contribute towards the improvement of quality of life of their people, the community and greatly the society, of which they are an integral part. Board of Directors: Mr. Prithivi Bahadur Pandey Mr.Prajanya Rajbhandari Mr. Deepak Man Serchan Prawin Kumar Malla 98 Batch of Banking Training, KFA Chairman/Chief Executive Director Director Director Group "A Group "A Group "A 13 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Mr. Sanjeev Manandhar Mr. Om Nidhi Tiwari Mr. Surendra Bdr. Singh Mr.Damodar Prasad Sharma Pandey Director Director Director Expert Director Rastriya Banijya Bank Rastriya Beema Sansthan General Public Under BFIA Service Offered: Deposits Ezee Saving EBanking Premier Banking ATM NTC Mobile Bill Payment Loans and Advances Vehicle Loans Debit/Credit Card Safe Deposit Locker 365 Days Service TRADE FINANCE REMITTANCES EXPORT CREDIT BILLS PURCHASE TELEBANKING SERVICE ANY BRANCH BANKING FUNDS TRANSFER BANK GUARANTEES CLEARING/COLLECTION Management Team S.N. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. Name of Management Team Prithivi Bahadur Pandéy Jitendra Basnyat Jyoti Prakash Pandey Maheshwor Prakash Shrestha Rajan Amatya Bijay Pant Anuj Timilsina Bijendra Suwal Shobha Shrestha Deepak Shrestha Deepak K Shrestha Rabin Sijapati Sujan Subedi Barun Shrestha Sujan Pradhan Bikash Thapa Bandana Thapa Suyog Shrestha Sachin Tibrewal Prabir SJB Rana Tul Jung Pandey Bikendra Thapa Prawin Kumar Malla 98 Batch of Banking Training, KFA Position Chairman/Chief Executive Director Senior General Manager/Company Secretary General Manager Deputy General Manager Assistant General Manager, Putalisadak Branch Assistant General Manager, Credit Quality Control Head, Corporate Banking Head, Information Technology Head, Retail Banking Head, Legal Head, Trade & Finance Head, Internal Audit Head, Loan Administration Head, Accounts & Budgets Head, Cash & Remittance Head, Cards & Remittance Head, Treasury & Foreign Exchange Head, Credit Administration Head, Office of CED Head, Human Resource Head, Reconciliation Acting Head, Research & Development 14 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. Pradeep Basnyat Jhalak P. Khanal Shreechandra Bhatta Manju Basnet Uttam B. K.C Ajay K. Kafle Dhiraj Thapa Prakash Dungana Pramod Uprety Bishal Thapa Kumar Thapa Ashok Kumar Khadka Gokarna P. Duwadi Mantri Lal Gupta Head, General Service Branch Manager, Pulchowk Branch Branch Manager, Birjung Branch Branch Manager, Newroad Branch Branch Manager, Seepadole Branch Branch Manager, Butwal Branch Branch Incharge, Pokhara Branch Branch Incharge, Narayangarh Branch Incharge, Jeetpur Branch Branch Incharge, Biratnagar Branch Branch Incharge, Banepa Branch Branch Manager, Janakpur Branch Branch Manager, Bhairahawa Branch Branch Incharge, Nepalgunj Branch Branch Network: KATHMANDU HEAD OFFICE Durbar Marg, P.O. Box 3412 Tel: 4228229, 4242530 (DISA) Fax: 977-1-4226349, 4228927 Swift: NIBL NP KT Telex: 2435, 2328 NIBL NP PULCHOWK BRANCH Pulchowk, Lalitpur Tel: 5520346, 5547858 Fax: 977-1-5520342 BIRGUNJ BRANCH Adarshanagar, P.O. Box 101 Tel (051) 523327, 525277 Fax: (051) 525297 SEEPADOLE BRANCH Arniko Highway Suryabinayak, Bhaktapur Tel: 6615617, 6612832 Fax: 6616617 BANEPA BRANCH Banepa, Kavre Tel: (011) 664315,662401 Fax: (011) 662402 JEETPUR BRANCH Jeetpur, Bara Tel: (053) 520297 Fax: (053) 520877 NEWROAD BRANCH Newroad, Kathmandu Tel: 4242858, 4230374 Fax: 977-1-4227050 BIRATNAGAR BRANCH Golcha Chowk, Biratnagar Tel: (021) 534523, 534524, 534525 Fax: (021) 534526 BUTWAL BRANCH Traffic Chowk, Butwal Tel: (071) 549991, 549992, 549993 Fax: (071) 549888 BHAIRAHAWA BRANCH Maitri Road, Bhairahawa Tel: (071) 526991, 526992 Fax: (071) 526990 PUTALISADAK BRANCH Putalisadak, Kathmandu Tel: 4445302, 4445303 Fax: 977-1-4445304 POKHARA BRANCH Chiple Dunga,Pokhara Tel: (061) 538919, 539276 Fax: (061) 538920 NARAYANGARH BRANCH Pulchowk, Narayangarh Tel: (056) 532921,532922 Fax: (056) 532925 JANAKPUR BRANCH Mills Area, Janakpur Tel: (041) 527331 Fax: (041) 527332 NEPALGUNJ BRANCH Dhamboji, Nepalgunj Tel: (081) 525978,525682 Fax: (081) 521664 Prawin Kumar Malla 98 Batch of Banking Training, KFA 15 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Introduction of Nabil Bank Limited: Since1984, Nabil Bank (also called Arab bank) is in a unique position in the banking industry in Nepal, as the nation’s first joint venture bank it has an unmatched 22 years of operational experience, giving it unparalleled insight into the market, risks, opportunities and customer needs. It provides a full range of commercial banking services through its 19 Branches of representation across the kingdom and over 170 reputed correspondent banks across the world. In conjunction to this, the Bank today Surges Ahead in meeting its Mission to be the “Bank of 1st Choice” for all its stakeholders; Customers, Shareholders, Regulators, Communities we work in and Staff. Nabil’s values are Customer Focused, Result oriented, Innovative, Synergistic, Professional or C.R.I.S.P., Everyday in everything we do. Nabil’s statement of commitment to always be ‘Your Bank at Your Service’ which is a clear reflection that the Bank’s stakeholders are at the core of everything it does. As we all know, an economy of Nepal has not been performing well for the last few years due to prevalence of political instability in the nation. Even Nabil maintained its performance; that is why in the fiscal year 2005/06 deposits increased by 32.64% to reach Rs. 19.35 billion, retail lending by 56.90% to reach Rs. 2.81 billion and corporate lending by 14.35% to reach Rs.10.47 billion. Nabil truly humbled and proud of the continued confidence and support of its customers, which is a prime source for its constant commitment to provide even higher levels of service delivery and financial solutions in the year ahead. Shareholders form its next group of stakeholders and Nabil is pleased that in addition to the 85% dividend the market price of its shares has also done consistently well. Nabil is fully equipped with modern technology which includes ATMs, credit cards, state-of-art, world-renowned software from InfoSys Technologies System, Bangalore, India, Internet banking system and Telebanking system etc services. The entire Nabil Team embraces a set of Values that acronym is referred to as ‘C.R.I.S.P.’ representing the fact that they consistently strive to be Customer Focused, Result Oriented, Innovative, Synergistic and Professional. By living these values, individually as professionals and collectively as a Team, Nabil Bank is committed to Surge Ahead to be the Bank of 1st Choice in Nepal. Focus: Nabil Bank has focused on customer satisfaction by providing highly acclaimed services. It is concerned to be "The Bank of the first choice" through its values of always being customer focused, result oriented, innovative, synergetic and professional. Awards and Recognition: Prawin Kumar Malla 98 Batch of Banking Training, KFA 16 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL The bank operations where highly satisfactory even in the prevailing hard times in the country. The bank received the "Bank of the year 2004", presented by the banker, a publication of the financial times, London. It has completed its 2 decades of banking sector. After 2 decades of operation the bank has maintained its image as good as loyal bank which makes its customer even more loyal towards the bank and its services. Values: Customer focused Result oriented Innovative Synergistic Professional Promise: To always be "you're Bank at your service" Products and services: Working capital Loan Fixed Capital Loan Import Loan Bills discounting facility under Suppliers Credit Export Loan Hire Purchase Cards & ATMs: E-Banking Clean Bills Project Finance Consortium/Syndication Loan U.S. Visa Fee Safe Deposit Locker Balance Certificate Advance Payment Certificate Mortgage Loan Remittance Trade Finance Deposit Board of Directors of Nabil Bank Chairman Mr. Satyandra Pyara Shrestha Ex-Governor Nepal Rastra Bank Directors Mr. Mukunda Nath Dhungel General Manager Nepal Stock Exchange Ltd. Prawin Kumar Malla 98 Batch of Banking Training, KFA Mr. Mohiuddin Ahmed Ex-Ambassador of Bangladesh To the kingdom of Nepal 17 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Mr. Supriya Gupta Mr. Abdul Awal Mintoo Ex-Chairman & Managing Director President UTI Bank Ltd. India Federation of Bangladesh Chamber of Commerce & Industry Mr. Shambhu Prasad Poudyal Mr. Dayaram Gopal Agrawal “Pappu” Ex-Executive Chairman Rastriya Beema Sansthan Businessman Lazimpat, Kathmandu Share ownership Local ownership Financial Institution Organized Institution General Public Foreign ownership Total 50% 10% 10% 30% 50% 100% Capital Structure: Authorized Capital: Issued Capital: Paid up Capital: Note: 491654400 shares of Rs 100 each paid up NPR 500000000 NPR 491654400 NPR 491654400 Branches: 1. Kantipath Branch 2. New road Branch 3., Lalitpur Branch 4. Jorpati Branch 5. Maharajgunj Branch 6. Birjung Branch 7. Pokhara 8. Bhairahawa Prawin Kumar Malla 98 Batch of Banking Training, KFA 10.Power House Chowk Branch 11.Biratnagar Branch 12.Itahari Branch 13.Sunsari 14.Butwal 15.Bhalwadi 16.Nepaljung 17.Lakeside 18 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL 9. Dharan 18.Exchange Counter Airport Chapter -2 Data Presentation & Analysis The financial performances of the selected commercial banks have been carried in terms of CAMEL approach C - Capital Adequacy A - Assets Quality M - Management E - Earnings L - Liquidity Capital Adequacy Ration (CAR): The capital accounts of a commercial bank play several vital roles in supporting its daily operations and ensuring its long-run viability. In the first place, capital provides a cushion against the risk of failure by absorbing financial and operating losses until management can address the bank's problems and restore the institution's profitability. Second, capital provides the funds needed to bet the bank chartered, organized and operating before deposits come flowing in. A new bank needs starting up funding to acquire land, build a new structure or lease space, equip its facilities, and hire offers and staff even before opening day. Third, capital promotes public confidence in a bank and reassures its creditors (including the depositors) of the bank's financial strength. Capital also must be strong enough to reassure borrowers that the bank will be able to meet their credit needs even if the economy turns down. Fourth, capital provides funds for the organization's growth and the development of new services, programs, and facilities. When a bank grows, it needs additional capital to support that growth and to accept the risks that come with offering new services and building new facilities. Most banks eventually outgrow the facilities they start with. An infusion of additional capital will permit a bank to expand into larger quarters or building additional branch offices in order to keep pace with its expanding market area and follow its customers with convenient service offerings. Prawin Kumar Malla 98 Batch of Banking Training, KFA 19 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Capital adequacy ultimately determines how well financial institutions can cope with shocks to their balance sheets. Thus, it is useful to track capital-adequacy ratios that take into account the most important financial risks—foreign exchange, credit, and interest rate risks—by assigning risk weightings to the institution's assets. The Basel capital adequacy ratio was adopted in 1988 by the Basel Committee on Banking Supervision as a benchmark to evaluate whether banks operating in the G-10 countries have sufficient capital to survive likely economic shocks. The ratio calls for minimum levels of capital to (i) provide a cushion against losses due to default arising from both on- and off-balance-sheet exposures; (ii) demonstrate that bank owners are willing to put their own funds at risk; (iii) provide quickly available resources free of transactions and liquidation costs; (iv) provide for normal expansion and business finance; (v) level the playing field by requiring universal application of the standard to internationally active banks; and (vi) encourage less risky lending. The original Basel capital ratio, along with subsequent amendments, requires international banks to have a specific measure of capital greater than or equal to 8 percent of a specific measure of assets weighted by their estimated risk. The ratio is an analytical construct with complex definitions of the numerator (capital) and the denominator (risk-weighted assets) that cannot be derived directly from standard financial statements. The formula states that a banking enterprise must have capital on a worldwide consolidated basis equal to 8 percent or more of its risk-weighted assets, which includes off-balance-sheet positions. Where: Capital = (tier 1 Capital - Goodwill) + (tier 2 Capital) + (tier 3 Capital) Adjustments. Tier 1 capital, or "core capital," consists of equity capital and disclosed reserves that are considered freely available to meet claims against the bank. Tier 2 capital consists of financial instruments and reserves that are available to absorb losses, but which might lack permanency, have uncertain values, might entail costs if sold, or otherwise lack the full loss-absorption capacity of tier 1 capital items. Tier 3 capital consists of subordinated debt with an original maturity of at least two years for use, if needed, against market risk exposures associated with fluctuations in the market value of assets held. According to NRB directives, commercial bank should maintain their CAR 11%, core capital 5.5% supplementary capital 5.5%. CAR = Total Capital Fund Total Risk Weighted Assets X 100 Table 1 Name of Banks 2003/2004 NIBL 11.18% NABIL 13.56% Prawin Kumar Malla 98 Batch of Banking Training, KFA 2004/2005 11.58% 12.44% 2005/2006 11.97% 12.31% 20 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL SCB 15.57% 16.06% 14.91% Percentage Capital Adequacy Ratio 18.00% 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% NIBL NABIL SCB 2003/2004 2004/2005 2005/2006 Years Figure 1.1 Core Capital: Table 2 Name of Banks NIBL NABIL SCB 2003/2004 7.22% 12.12% 13.76% 2004/2005 8.52% 11.35% 13.99% 2005/2006 7.97% 10.78% 12.99% Core Capital Percentage 16.00% 14.00% 12.00% 10.00% 8.00% NIBL 6.00% 4.00% SCB NABIL 2.00% 0.00% 2003/2004 2004/2005 2005/2006 Years Figure 2.1 Prawin Kumar Malla 98 Batch of Banking Training, KFA 21 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Supplementary Capital: Table 3 Name of Banks NIBL NABIL SCB 2003/2004 3.96% 1.44% 1.81% 2004/2005 3.06% 1.09% 2.07% 2005/2006 4.01% 1.52% 1.92% Percentage Supplementary Capital 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% NIBL NABIL SCB 2003/2004 2004/2005 2005/2006 Years Figure 3.1 Data Interpretation From the above bar chart here we can see that all the banks, either it is SCB, NIBL or NABIL all has capital adequacy ratio as per NRB rules and regulations. As well as the core capital is also as per NRB rules. From three banks SCB has higher capital adequacy ratio. But the remaining two banks have also sufficient ratio. From the table we can interpret that the people who deposits their amount in these banks are in safe position. From the lending side it shows that banks are not good in lending. Specially SCB which has highest among three shows that this bank is good for depositors but it is unable to lend its money. So it also affects their interest income. While NIBL shows that it is efficiently lending its money to the people. Also we can calculate Activity ratio of these three banks: Activity ratio= Total Lending x 100 Total Deposit Prawin Kumar Malla 98 Batch of Banking Training, KFA 22 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Here we include only local currency deposit and local currency lending. Table 4 Name of Banks NIBL NABIL SCB 2003/2004 63.68 60.55 31.63 2004/2005 73.33 75.05 43.55 2005/2006 69.63 68.63 39.92 Activity ratio Percentage 80 70 60 50 40 NIBL 30 20 SCB NABIL 10 0 2003/2004 2004/2005 2005/2006 years Figure 4.1 Data Interpretation From the chart we can assume that NIBL and NABIL are lending more money which means their cash are not remaining idle in the bank but depositors are in safe position also as we see from capital adequacy ratio. From this we can say that either there are getting higher interest income or loosing it. Also they are taking more risk by lending that much higher i.e. risk of loan loss provision. Here SCB has less lending that means their cash is remaining idle or they are taking less risk. Either this bank is getting less interest income compare to other two banks or this bank i.e. SCB has low loan loss provision. We can see more from assets and liquidity. Assets Quality: Assets quality refers to the degree of financial strength and risks in a bank’s assets, loan and advances, investment cash etc. are the focus of assets kept by the banks. Asset is the most critical factor in determining the strength of any bank. Asset quality ratio is also known as activity ratio and also called as turnover ratio because it indicates the speed with which assets are being converted or turnover. Primary factors that can be considered are the quality of loan risk associated with assets and credit administration system. Prawin Kumar Malla 98 Batch of Banking Training, KFA 23 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Through loan and advances bank guarantee a profit which is a significant part of its income. Lending activities are highly risky activities. It is very important for the bank that most of the loans perform well. These are basically two types of loans. They are performing loan and non performing loan. Non-performing loans decrease the net profit of the bank. Performing loan to total loan Non-performing loan to total loan Total provision to total loan Classification of loan and its provision Classification of loan Performing Non-performing loan a) Category Good i) Sub-standard ii) Doubtful debt iii) Bad debt Durations Loan loss provision 1 to 3 months 1% 3 to 6 months 25% 6 months to1 Yr 50% 1 Yr or above 100% Performing Loan Ratio Loans which are recovered quickly and will be recovering within 9odays fall under this category. This ratio shows how much the bank is successful in utilizing their assets for the purpose of profit generation. Higher ratio indicates efficiency in utilizing the good loans. Performing Loan to total loan= Performing loan Total loan Table below shows performing Loan to Total Ratio of SCBN, Nabil and NIBL in % Table 5 Name of the Bank SCBN NABIL NIBL 2003/04 2004/05 2005/06 96.23 % 96.12 % 97.53 % 97.31 % 98.68 % 97.93 % 97.87 % 98.63 % 97.31% Prawin Kumar Malla 98 Batch of Banking Training, KFA 24 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Performing Loan to Total Loan Ratio 99.00% 98.50% Percentage 98.00% 97.50% SCBN NABIL NIBL 97.00% 96.50% 96.00% 95.50% 95.00% 2003/04 2004/05 2005/06 FiscalYear Figure 5.1 Data Interpretation: From the above bar diagram, it is clear that the ratio of performing loan is increasing. It is 96.23 % in Year 2003/04 and has been increased to 97.87 % in Year 2005/06. It is very good performance and will be hard for other bank to catch them because of their high net profit. This bank leads the way in terms of performing loan ratio. In year 2003/04, it is 96.65% but in Year 2005/06, it is 98.63%, which makes able to register huge profits and increase their market share. NIBL is also performing well in performing loan ratio. Its ratio is above 97 % over three year’s period and has good market share. b) Non-Performing Loan Ratio (NPL) Loan is said to be non-performing with the due date of 3 months to 6 months and 6 to 12 months and more than 1 year. Non-performing loan consists of substandard loan, doubtful loans and bad loans. Higher ratio indicates the higher risk associated with the total loan and vice-versa. NPL Ratio = Non-performing loan X 100 Total Loan Table shows the classification of loans and required provisions: Table 6 Classification of Loans Substandard (3-6 Months) Doubtful (6 months – 1 Year) Bad Loans (more than 1 Year) Prawin Kumar Malla 98 Batch of Banking Training, KFA Provisions Required 25 % 50 % 100 % 25 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Table below shows a Non-performing Loan to Total Loan Ration of SCBN, Nabil and NIBL in %. Table 7 Name of the Bank SCBN NABIL NIBL 2003/04 2004/05 2005/06 3.77% 3.88% 2.47% 2.69% 1.32% 2.07% 2.13% 1.37% 2.69% Non-Performing Loan to Total Loan Ratio 4.00% 3.50% 3.00% 2.50% SCBN NABIL NIBL 2.00% 1.50% 1.00% 0.50% 0.00% 2003/04 2004/05 2005/06 Fiscal Year Figure 7.1 Data Interpretation The above bar diagram shows that bank has the decreasing trend. In Year 2003/04, the ratio is 3.77 % and in Year 2005/06, it has decreased to 2.13 % which help the bank to make good position in the market. This bank has the lowest NPL in the Year 2004/05 and 2005/06. Nabil has been doing very well and their financial performance proves that it is one of best bank in Nepalese Bank. NIBL has average performance among the three banks. The ratio has been lowest in Year 2003/04, medium in Year 2004/05 and highest in Year 2005/06. It indicates that it has not been able to improve its non-performing ratio. But overall ratio is below 3 % which is not bad. Prawin Kumar Malla 98 Batch of Banking Training, KFA 26 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL c) Total Loan Loss Provision Under this category, Banks has to keep certain amount of capital as provision form Loan Loss. Not all loans which banks provide are recoverable, so to compensate for the loss, capital kept as provision will be used. Banks always look to maintain a lower Loan Loss Provision ratio for high profitability. Loan Loss Pr ovision to Total Loan Total loans loss provision Total loan Table below shows Loan Loss Provision to Total Loan Ratio of SCBN, Nabil and NIBL in % Table 8: Name of the Bank 2003/04 SCBN NABIL NIBL 2004/05 2005/06 4.24 % 4.19 % 3.30 % 3.29 % 2.94 % 2.68 % 2.84 % 3.13 % 3.05 % Total Loan Loss Provision 4.50% 4.00% Percentage 3.50% 3.00% SCBN 2.50% NABIL NIBL 2.00% 1.50% 1.00% 0.50% 0.00% 2003/04 2004/05 2005/06 FiscalYear Figure 8.1 Data Interpretation From the above bar diagram, we can see that the ratios of SCBN are at a decreasing trend. This shows that SCBN has written off their Loans. Like SCBN, the ratio of NABIL is also at decreasing trend. This also shows that NABIL has written off their Loans. The ratio of NIBL is lowest among the banks for two first years but in Year 2005/06, it is highest. It is also in increasing trend. Prawin Kumar Malla 98 Batch of Banking Training, KFA 27 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Management: MANAGEMENT ANALYSIS. There is a saying, ‘good mgmt can make and poor can break an organization.’ Banks are no exception to this universal phenomenon. An institution can take a desire momentum only when the mgmt is capable enough. The success of any bank heavily relies upon the efficiency of its management to derive the bank to earn good profit. Therefore the management of the bank must made careful focus in its objective and dedicate its efforts to reach that objective. There are different types of risk associated with banks operation and can be addressed only by adopting comprehensive management system. Management is a process of managing the institution by making suitable plans and policies and implementing them to achieve the objectives of the institution. And the efficiency of management is evaluated by considering the following factors The overall structure of bank Quality of human resource Technological adaptation Management information system Internal control system Working environment Decision making process All the above factors are equally important for the evaluation of management efficiency. For the effective management there should be perfect structure of institution, qualitative human resource, superior technology, good mgmt information system, and good relation with its customer. Similarly there should be fair decision-making and appropriate working condition. To support our project work we personally visit the respective banks as their customer and we have categorized them as per the information derived from there Here we have rated the banks on a scale of 0-5 as 0 - poor 1 - below average 2 - average 3 - good 4 - very good 5 -excellent Table 9: Criteria of analysis SCB NIBL NABIL Location 5 5 5 Customer service 4 4 4.5 Prawin Kumar Malla 98 Batch of Banking Training, KFA 28 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Security 5 5 5 Space for consumer 5 5 5 Inquiry facility 4.5 4 4 Internal control system 4.5 4.5 4.5 Interior 5 4 4 Availability of parking space 5 4 4 The efficiency of banks can be analyzed by analyzing staff efficiency ratio by applying following formulaStaff efficiency ratio (SER) = Net profit after tax No of staff Table 10: Banks SCB NABIl NIBL 2003/4 2.05 1.39 0.47 2004/5 1.77 1.22 0.66 Rs. in million 2005/6 1.91 1.44 0.90 Staff efficiency Ratio 2.5 Banks 2 SCB 1.5 NABIl 1 NIBL 0.5 0 2003/4 2004/5 2005/6 Years Figure 10.1 Interpretation In above table we can see that SCB has higher efficiency ratio than that of NIB and NABIL. The quality of mgmt is also evaluated by considering the corporate governance factor. To achieve the objective of the bank, there must be a clear line between mgmt and shareholders or BOD in terms of authority, responsibility and accountability levels. Good corporate governance requires policies, procedures and operating manuals to be supreme in any bank, whereby only professional considerations should play a role in strategic decision-making. Earning: Prawin Kumar Malla 98 Batch of Banking Training, KFA 29 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Profit is oriented through the different operations by bank and its final goal is to achieve the profit is earning. High level of shows the successfulness of any business. Therefore, an analysis of the ratio helps the management, shareholders and its customer to evaluate those performances of the bank sustainability of earnings and to forecast growth of banks. Chronically unprofitable financial institutions risk insolvency. Compared with most other indicators, trends in profitability can be more difficult to interpret-for instance, unusually high profitability can reflect excessive risk taking. The following rations can be used to analyze the earning capacity of banks: i) EPS ii) ROA iii) ROE iv) P/E Ratio Earning Per Share (EPS): Earning Per Share indicates after tax earnings for equity shareholders on a per share basis. It reflects the earning power of the bank. High EPS shows sound profitability. EPS= Total Earning of a Company No. of Outstanding Shares Table below shows Earnings per Shares of SCBN, NIBL and NABIL in Rs. Earning per Share (EPS) Table 11 Name of Bank SCB NIBL NABIL 2003/04 rs143.55 Rs. 51.70 Rs. 92.61 2004/05 Rs. 143.93 Rs. 39.50 Rs. 105.79 2005/06 Rs. 175.84 Rs. 59.35 Rs. 129.21 Earning Per Share 200 Rupees 150 SCB 100 NIBL NABIL 50 0 2003/04 2004/05 2005/06 Years Figure 11.1 Data Interpretation: Prawin Kumar Malla 98 Batch of Banking Training, KFA 30 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL When Net Profit of Bank is high the EPS of the bank will also be high which shows the bank is in good conditions. The above data shows SCB has the highest EPS and is increasing. Nabil is in increasing order but NIBL’s EPS has decreased in the FY 2004/05 and goes up in FY 2005/06.After comparing these three banks SCB has the highest profitability position, then Nabil and NIBL respectively. Return On Assets (ROA): This ratio depicts how efficiently a bank is utilizing and mobilizing its assets to generate profit. Higher the ration the better it is as it shows high turnover of assts. ROA = Net Profit after Tax Total Assets The Table below shows ROA of SCB, NIBL, and Nabil in % Table 12 Name of Bank SCB NIBL NABIL 2003/04 2.27% 1.13% 2.72% 2004/05 2.46% 1.40% 1.40% 2005/06 2.56% 1.16% 2.85% ROA 3.00% Percent 2.50% 2.00% SCB 1.50% NIBL 1.00% NABIL 0.50% 0.00% 2003/04 2004/05 2005/06 Years Figure 12.1 Data Interpretation: From the comparative table, we can find that there is a competition between SCB, NIBL and Nabil. Nabil demonstrate the highest ROA in FY 2003/04 but decreases in FY 2004/05 but again rises up in FY 2005/06. Each bank shows an increasing order. Among the three Nabil’s ROA is more than the rest of the two banks. The NIBL has the least ROA among the three banks. However, it is worthy to note that the purchase of assets by the bank could affect this ratio in the immediately year could result in a higher ROA ratio. Return on Equity (ROE): It indicates the profit earned on total shareholders fund. Higher the ratio in the better it is for the bank, as it indicates better utilization of capital fund and total assets. Prawin Kumar Malla 98 Batch of Banking Training, KFA 31 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL ROE= Net Profit after tax Shareholder’s Equity Table below shows ROE of SBN, NIBL and Nabil Table 13 Name of Bank 2003/04 35.96% 14.70% 28.29% SCB NIBL NABIL 2004/05 32.22% 19.09% 29.45% 2005/06 35.72% 18.15% 30.41% ROE 40.00% 35.00% Percent 30.00% 25.00% SCB 20.00% NIBL 15.00% NABIL 10.00% 5.00% 0.00% 2003/04 2004/05 2005/06 Years Figure 13.1 Data Interpretation: The above graph shows that SCB has been successfully mobilizing its shareholder’s fund and generating high profits. While comparing individually in three different fiscal years NIBL has the lowest ROE.SCB has a decreasing trend in ROE in the FY 2004/05 and increase in the FY 2005/06. Price Earnings Ratio (P/E Ratio): Price Earning Ratio is widely used to evaluate the bank’s performance as expected by investor. It represents the investor’s judgment or expatiators about growth in the banks earnings. In other words, it measures how the net is responding towards the earning performance of the particular bank. Higher P/E ratio indicates greater confidence in the bank’s future. Lower P/E ratio lids MPS to decline. P/E Ratio = MPS EPS Prawin Kumar Malla 98 Batch of Banking Training, KFA 32 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Table below shows P/E Ratio of SBN, NIBL and Nabil Table 14: Name of Bank 2003/04 SCB NIBL NABIL 2004/05 16.29 20.25 14.27 12.16 18.18 10.80 2005/06 21.46 21.23 17.34 P/E Ratio 25 Ratio 20 SCB 15 NIBL 10 NABIL 5 0 2003/04 2004/05 2005/06 Years Figure 14.1 Data Interpretation: The above table shows the increment of P/E Ratio of SCB, NIBL and Nabil banks respectively. It increases the confidence of the shareholders and the credibility of the bank. Higher the P/E ration better for the shareholders that is used to assess a bank’s performance as expected. Liquidity Liquidity of the bank shows the ability to solve one's payment. It also shows the overall financial position of the bank. The liquidity in term can be used as an ability to invest in a sensitive sector like government securities, money at call etc. The limited portion of the deposit received through the depositor can be easily converted into cash. Liquidity helps to reduce the liquidity risk, which directly leads to bankruptcy. Liquidity is a bank ability to generate cash quickly at a reasonable cost. The ratio is calculated by dividing current assets by current liabilities, which test the short-term solvency of the firms. Liquidity can be measured in three ways: 1. Cash Reserve Ratio .2. Cash & Bank Balances to Total Deposit Ratio .3. Government Securities to total deposit Ratio Prawin Kumar Malla 98 Batch of Banking Training, KFA 33 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Cash Reserve Ratio: The bank has required a certain percent of the total liquid able balance i.e. cash and bank balance for quick accessibility. Therefore, Nepal Rastriya Bank has set a fixed CRR for all the Commercial banks which bank has to comply. According to the directives of NRB all Commercial bank should have CRR of 5%. Mathematically, Cash Reserve Ratio = Cash Balance / Total Deposit The following table shows the Price earning ratio provided by the three commercial banks. Cash Reserve Ratio Table no: 15 Year SCBNL NABIL NIBL 2003/04 2004/05 2005/06 9.46 8.77 6.86 6.87 3.83 3.26 9.19 9.78 13.61 Cash Reserve Ratio 14 12 10 8 SCBNL 6 NABIL NIBL 4 2 0 2003/04 2004/05 2005/06 Figure 15.1 Interpretation: This ratio is one of the credit ratios that show the credibility of any bank. In the above table, NIBL has the highest ratios where as NABIL has the lowest ratios. This shows that NIBL maintains a high cash balance with respect to the deposits and NABIL maintains the low cash balance compared to its total deposit. The above table also shows that the liquidity of the NIBL is also high due to its holding of cash with respects to its total deposits. SCBNL and NIBL has maintained NRB standard for CRR whereas NABIL has not done so. Cash and Bank Balance to Total Deposit Mathematically, Cash and Bank Balance to Total Deposit Prawin Kumar Malla 98 Batch of Banking Training, KFA Cash and Bank Balance Total Deposit 34 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Cash and Bank Balance to Total Deposit Table 16 Year SCBNL NIBL NABIL 2003/04 2004/05 2005/06 9.56 5.25 4.46 10.56 9.40 12.34 6.87 3.83 2.87 Cash and Bank balance to total Deposit 14 12 Percent 10 SCB 8 NIBL 6 NABIL 4 2 0 2003/04 2004/05 2005/06 Years Figure 16.1 Interpretation: This ratio is one of the credit ratios that show the credibility of any Bank. Looking at the above table, NIBL has the highest ratio where as NABIL has the lowest ratios. This shows that NIBL maintains a high cash balance with respect to its deposits and NABIL maintains a low cash balance compare to its total deposits. It is better for the bank having adequate balance so that bank can provide the cash easily to the depositors at any time. Investment in Government Securities to Total Deposits The bank can invest the amount from the total deposit in government securities such as treasury bills and bond. The ratio can be calculated total Government investment dividend from total deposits. This ratio shows us how much the bank has invested in government securities. Investment in government securities is the safest investment sector and can be liquidated at any time. Mathematically, GSTTD Investment in Government Securitie s Total Deposits Investment in Government Securities to Total Deposits Table 17: Prawin Kumar Malla 98 Batch of Banking Training, KFA 35 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Year SCBNL NABIL NIBL 2003/04 2004/05 2005/06 37.56 37.25 37.49 26.01 16.51 11.81 17.36 13.67 13.33 Investment in Govt. Securities to Total Deposit 40 35 30 25 SCBNL 20 NABIL 15 NIBL 10 5 0 2003/04 2004/05 2005/06 Figure No: 17.1 Interpretation: SCBNL has invested 37.56% of its total deposit during the F/Y 2003/2004, which is the highest among these three banks. Government securities are considered safe zone but this reduces their earning, as the government securities generally have low rate of return. And NIBL has invested low amount of deposits in government. It indicates that SCBNL has high liquidity and NIBL has lowest Liquidity position among these banks. Prawin Kumar Malla 98 Batch of Banking Training, KFA 36 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL CHAPTER 3 Summary, conclusion and Recommendations: Summary All the three banks have maintained CAR as per Nepal Rastra Bank rules and regulation. In the data analysis SCB has greater CAR compare to other two banks. It shows that it has higher equity capital. Activity ratio of SCB is lowest compare to NABIL and NIBL. Where as NABIL has higher activity ratio. Performing loan of NABIL is higher compare to SCB and NIBL. But in the table SCB has able to increase its performing loan while NABIL shows little decrease in 2005/2006 and same as NIBL. Regarding Non-performing loan SCB is able to decrease its NPL. The trend shows decreasing pattern. Whereas NABIL has low Non-performing loan but in the year 2005/2006 the figure shows slight increase in its NPL. Among the three banks NIBL has highest NPL but it is acceptable. Overall total loan loss provision of NIBL is greater. Where as SCB and NABIL are able to decrease its TLL but NIBL TLLP has been increased in 2004/2005 compare to 2003/2004. From the question asked to the banks people and through observation management of SCB and NABIL are good. But comparing these two banks the management of SCB is good in overall. But the attitude of SCB employee is not good as compare to NIBL. From the diagram staff efficiency ratio 0f SCB is very good which also shows overall good management in the bank. Employees of SCB are hard working and productive. EPS of SCB is greater compare to two banks. The EPS of SCB has been increasing year to year whereas EPS of NIBL shows downward trend 2004/2005. Here NABIL is also able to increase its EPS but not goods as SCB. SCB is able to earn high profit. Prawin Kumar Malla 98 Batch of Banking Training, KFA 37 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL The trend of SCB shows increasing trend in ROA whereas, other banks’ ROA is fluctuating. It means SCB is able to get higher profit every year. ROA of SCB has increased in 2003/04, 2004/05 and 2005/06 respectively. ROE of SCB is also greater compare other banks. The figure of SCB in 2003/2004 is 35.96%, in 2004/2005 it was 32.22% and in 2005/2006 it is 35.72%. Where as NIBL has lowest ROE it is 18.15% only in year 2005/2006. Regarding price earning ratio again SCB has higher ratio. It is 21.46% in 2005/2006 where as NIBL has 21.23%, here NABIL has lowest price earning ratio. CRR of SCB is 6.86, but NABIL has 3.26 in 2005/2006. AS per NRB CRR should be 5% and it should not exceed that. In this case NABIL has good CRR while NIBL has highest CRR. Total Cash and Bank balance to total deposit ratio of SCB is 9.56, 5.25, and 4.46. NIBL has 10.56, 9.40, and 12.34. Whereas NABIL has 6.87, 3.83 and 2.87. SCB and NABIL are able to decrease whereas NIBL shows inefficient. Investment in Government securities to total deposit of SCB is 37.56, 37.25 and 37.49. Nabil has 26.01, 16.51 and 11.81. Whereas NIBL has 17.36, 13.57 and 13.33. NABIL has lowest percentage investment. Prawin Kumar Malla 98 Batch of Banking Training, KFA 38 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL Conclusion and Recommendation: Capital adequacy and availability ultimately determine the robustness of financial institutions to shocks to their balance sheet. Aggregate risk-based capital ratios (the ratio of regulatory capital to risk weighted assets) are the most common indicators of capital adequacy, based on the methodology agreed to by the Basel Committee on Banking Supervision in 1988. Simple ratios of capital to assets without differential risk weights often complement this measure. An adverse trend in these ratios may signal increased risk exposure and possible capital adequacy problem. In addition to the amount of capital quality. In may countries, bank capital consists of different elements that have varying availability and capability to absorb losses, even within the broad categories of tier 1, tier 2, and tier 3 capital. If these capital elements can be reported separately, they can serve as more reliable indicators of the ability of banks to withstand losses, and help to put overall capital ratios. The Basel Committee's minimum standards for risk-weighted capital adequacy were originally intended to apply only to internationally active banks, but are now used in most countries industrial, emerging and developing and for most banks. Recent proposals have been put forward by the Basel Committee to update this standard to account for the rapid development of new risk-management techniques and financial innovation. These proposals introduce greater refinement into the existing system of risk weighting, to relate its categories more accurately to the economic risks faced by banks-- including as measured by banks' own internal ratings systems, or less elaborately, based on ratings from external rating agencies. However, improved risk measurement comes at the expense of comparability. Under the new proposal, each bank's way of estimating credit risk can differ, which being reflected in different risk-weighted assets and capital ratios, would make aggregation of individual bank ratios problematic. This issue has not so far been tackled explicitly in the Basel proposal. Well designed loan classification and provisioning rules are key to obtaining a meaningful capital ratio. Loan classification rules determine the level or provisioning, which affects capital both indirectly (by reducing income) and directly (through inclusion of general provisions, to some extent in regulatory capital. Moreover in most Group of Ten (G10) countries, banks are required to deduct specific provisions (or loan-loss reserves) from loans that is, credit is calculated on a net basis which reduces the value of total assets and hence of capital . Simple gearing ratios the ratios of capital to assets, without differential risk weights are also meaningful indicators and are often used Prawin Kumar Malla 98 Batch of Banking Training, KFA 39 COMPARTIVE ANALYSIS OF SCB, NIBL, NBL BANK OF NEPAL To assess leveraged positions in off balance-sheet transactions resulting from a derivative contract, the basic derivative instruments forwards and options can be replicated by holding (and in the case of options, constantly adjusting) positions in the spot market of the underlying security, and by borrowing or lending in the money market. This replication of the contract maps the individual components into own-funds equivalent (equity) and borrowed-funds equivalents (debt), which can be used to measure that leverage contained in long and short forward positions and option contracts. This on-balance-sheet asset equivalent of the exposure is also called the current notional amount. Overall leverage ratios, defined as on balance-sheet asset plus off-balance-sheet exposures (gross or net), can be obtained following this method. Indicators covered in this section suggest that two main measures are important for tracking capital adequacy: the ratios of regulatory capital to risk weighted assets (the Basel capital adequacy ratio), and The ratio of capital to assets (the gearing ratios). In countries where bank derivatives trading is considered of systemic importance, it is also advisable, when monitoring capital ratios, to adjust for off-balance-sheet items. From the analysis SCB and NABIL shows great performance compare to NIBL in all department. NIBL need to issue more debentures to increase its CAR. Non performing loan has to be decreased by SCB and NIBL. For this they have to do credit appraisal of customer more strictly. NIBL should be able to mobilize their asset. They have high liquidity they have to lend more cash in effective way to the prominent customer. Besides SCB other two banks have to try to invest in government securities. Because it is more safe. NRB has imposed 0% risk in theses types of investment. So other bank should able to invest which will generate high profit and it is also safe for them because risk is not attached with it. NIBL should able to increase its staff efficiency. They should provide good incentives, opportunities and good working environment for the staff. As well as infrastructure should be good, attractive. Prawin Kumar Malla 98 Batch of Banking Training, KFA 40