IB&FS - PESIT South Campus

advertisement

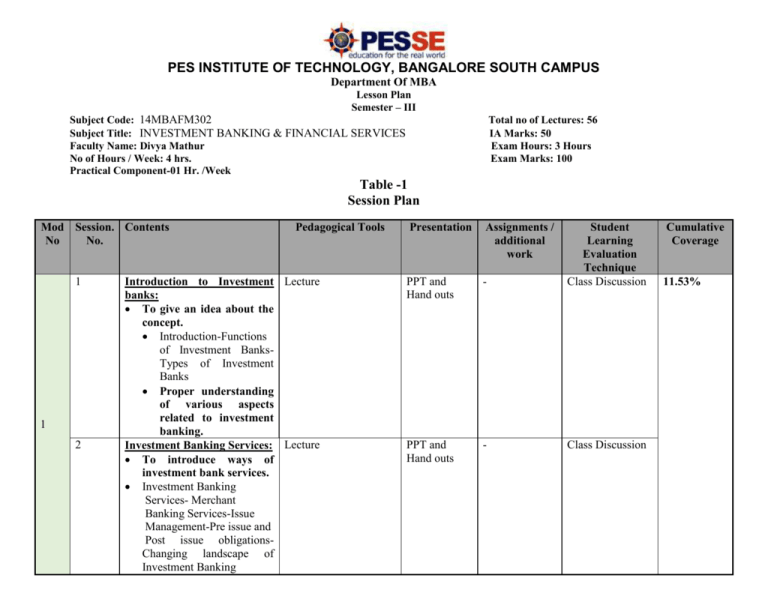

PES INSTITUTE OF TECHNOLOGY, BANGALORE SOUTH CAMPUS Department Of MBA Lesson Plan Semester – III Subject Code: 14MBAFM302 Subject Title: INVESTMENT BANKING & FINANCIAL SERVICES Faculty Name: Divya Mathur No of Hours / Week: 4 hrs. Practical Component-01 Hr. /Week Total no of Lectures: 56 IA Marks: 50 Exam Hours: 3 Hours Exam Marks: 100 Table -1 Session Plan Mod Session. Contents No No. 1 1 2 Pedagogical Tools Introduction to Investment Lecture banks: To give an idea about the concept. Introduction-Functions of Investment BanksTypes of Investment Banks Proper understanding of various aspects related to investment banking. Investment Banking Services: Lecture To introduce ways of investment bank services. Investment Banking Services- Merchant Banking Services-Issue Management-Pre issue and Post issue obligationsChanging landscape of Investment Banking Presentation Assignments / additional work PPT and Hand outs - Student Learning Evaluation Technique Class Discussion PPT and Hand outs - Class Discussion Cumulative Coverage 11.53% Understanding of various modes of investment banking. 3 4 1 LAB-I 5 6 2 Regulation of the Capital Market The aim is to understand the components and functioning of secondary market. SEBI regulations for merchant bankers, brokers and sub brokers, intermediaries and portfolio managers -The student should understand the system of capital market. Regulation of the Capital Market SEBI issue and Listing of Debt securities Regulation 2008. The student should understand the system of capital market. The Art Of Budgeting Depository System: Objectives, activities, interacting systems, role of depositories and their Services To understand various aspects of depository system. To understand the role of NSDL and CDSL Advantages of depository system -NSDL and CDSL portfolio, The student should be Refer – Table 3 Class Discussion Assignments Lecture - Class Discussion Lecture Refer – Table 3 Class Discussion Case presentation Lecture - Class Discussion Case presentation Assignments Lecture PPT and Hand outs 26.92% able effectively explain the system of depository. 7 Lecture Depository Participants The process of clearing and settlement through Depositories, Depository Participants. The candidate should be able to understand the process. Refer – Table 3 Class Discussion Test Assignments 8 Regulations relating to Lecture Depositories -SEBI (Depositories and Participants) Regulations 1996 Registration of depository and participant- Rights and Obligations of depositories and participantsRecent amendments Custodial services- The Stock Holding Corporation of India Limited Process of buying a home lecture Housing Finance To understand the concept of house loan Role, Types of housing loans, Institutions and banks offering Housing Finance lecture Housing Finance To bring an idea about system of loan Procedure and Interest rates. - Class Discussion Case presentation Assignments - Class Discussion Assignments Refer – Table 3 Class Discussions Assignments 2 LAB-II 9 3 10 26.92% 11 12 LABIII 13 4 14 15 16 LABIV 5 17 18 Income Tax Implication. Reverse mortgage loan The student should be able Non-Banking Finance lecture Companies Types, Growth, Functions, RBI Guidelines, Prudential Norms. Lecture Factoring: Origin, Types, Factoring mechanism, advantages System of credit disbursement factoring charges, International factoring, Factoring in India Forfeiting: Origin, characteristics, benefits, Forfeiting: Difference between factoring and forfeiting, Growth of forfeiting in India. Lecture Lecture Lecture Lecture Identify a Leasing company in Bangalore and evaluate their process and outcomes.(Please mention the name of the products they considered for leasing & Brief history of the company) 2. Identify a Hire purchase company in Bangalore and evaluate their process and outcomes.(Please mention the name of the products they considered for leasing & Brief history of the company). Underwriting: Lecture Concept – Devolvement - Business model Underwriting in fixed price offers Lecture and book built offers. - Class Discussions Case presentation Assignments PPT and Hand outs PPT and Hand outs PPT and Hand outs PPT and Hand outs Class Discussions Refer – Table 3 PPT and Hand outs Class Discussion Assignment PPT and Hand outs Class Discussion Assignment PPT and Hand outs Class Discussion 38.46% Venture Capital: Concept, features, Origin and the current Indian Scenario. Private equity Investment banking perspectives in private equity ,Concept of bond and int. rate determination What are all the parameters in Credit rating used in ICRA explain its silent features Microfinance: The paradigm NGOs and SHGs lecture & solving problems PPT and Hand Refer – Table outs 3 Class Discussion lecture & solving problems PPT and Hand outs Class Discussion Case presentation Assignments lecture & solving problems PPT and Hand outs 21 Microfinance delivery mechanisms – Future of micro finance lecture & solving problems PPT and Hand Refer – Table outs 3 Class Discussions Test Assignments Class Discussions Test Assignments 22 lecture & solving problems Lecture PPT and Hand outs PPT and Hand outs Lecture PPT and Hand outs 25 Leasing: Concept, Steps in Leasing Transactions, Types of Lease Legal frameworks, Advantages and disadvantages of Leasing, Explain Venture Capital. Select a suitable company of your choice in Bangalore and identify their financial stages used for the growth of it and explain its current status. Contents of a Lease Agreement, Matters on Depreciation and Tax, Problems in leasing Problems in leasing 26 lecture & solving problems lecture & solving problems PPT and Hand outs PPT and Hand Refer – Table outs 3 27 Factors influencing Buy or Borrow or Lease Decision Briefly explain the current credit rating system prevailing in India and explain its impact on Indian lecture & solving problems PPT and Hand outs 19 20 LABV 4 20 23 LABVI 24 5 LABVI Problems in leasing Class Discussion Assignments Class Discussion Assignment 50% 61.53% Class Discussion Class Discussion Case presentation Assignments Class Discussion Assignments 76.92% 28 lecture & solving problems PPT and Hand outs Class Discussion Assignments Class Discussion Test Case presentation Assignments Class Discussion Presentations Assignments 29 Comparison of Hire Purchase with Credit sale, Instalment sale and Leasing lecture & solving problems PPT and Hand Refer – Table outs 3 30 Banks and Hire Purchase. Problems related to outright purchase, Hire purchase and Leasing. Lecture PPT and Hand outs 31 Problems related to outright purchase Lecture PPT and Hand outs Class Discussion Case presentation LABVIII 32 Case Study On Credit Rating Of ICICI Credit rating: Definition and meaning, Process of credit rating of financial instruments Rating methodology, Rating agencies, Rating symbols of different companies. Rating agencies for SMEs Lecture PPT and Hand Refer – Table outs 3 Class Discussion Case presentation Lecture PPT and Hand outs Class Discussion Case presentation Lecture PPT and Hand outs PPT and Hand outs Class Discussion Case presentation Class Discussion Case presentation Lecture PPT and Hand Refer – Table outs 3 Class Discussion Case presentation Lecture PPT and Hand outs PPT and Hand outs Refer – Table 7 33 34 35 8 Economy for Future Generation Group. Hire Purchasing: Concepts and features, Hire Purchase Agreement Lecture 37 Securitization of debt: Meaning, Features, Special Purpose Vehicle Case Study On Housing Finance Case On NHB Types of securitisable assets, Benefits of Securitization, Issues in Securitization. REVISION 38 Lecture 39 REVISION LABIX 36 REVISION Class Discussion Case presentation 88.46% 100% 3 LABX 40 41 42 43 Venture capital financing stages and growth REVISION REVISION REVISION Review of previous year question papers LABXI Case Study - Make Or Buy Decision For Leasing Vishal Engineering Enterprises For Leasing & Hire Purchase Review of previous year question papers Review of previous year question papers Review of previous year question papers Credit rating companies in India with its symbols 44 45 46 LABXII Class Discussion Case presentation Table – 2 Presentation Topics Sl.No. 1 2 3 4 5 6 7 8 Presentation Topic Pre issue and Post issue obligations SEBI (Depositories and Participants) Regulations 1996 International factoring difference between factoring and forfeiting Investment banking perspectives in private equity Future of micro finance Advantages and disadvantages of Leasing Rating symbols of different companies Table – 3 Assignments & Additional Work Mod No 1 2 3 4 5 6 7 8 1-8 S.No. Assignment Topics Questions from module 1 Questions from module 2 Questions from module 3 Questions from module 4 Questions from module 5 Questions from module 6 Questions from module 7 Questions from module 8 Each student have to submit three questions from question bank 1 question for 3 marks 1 question for 7 marks 1 question for 10 marks Table – 4 Case Study Topics Case study will be given to the students for presentation based on previous year question papers problems S.No. Particulars I – VIII Question Paper, VTU, December 2010 ” Question Paper, VTU, July 2010 ” Question Paper, VTU, December 2009 ” Question Paper, VTU, July 2009 ” Question Paper, VTU, December 2008 ” Question Paper, VTU, July 2008 ” Question Paper, VTU, December 2007 ” Question Paper, VTU, July 2007 ” Question Paper, VTU, December 2006 ” Question Paper, VTU, June / July 2006 ” Question Paper, VTU, December 2004 Mod No Table – 5 References & Additional Readings S.No. 1 2 3 4 Particulars Investment Analysis and Portfolio management – Prasanna Chandra, 3/e,TMH, 2010 Security Analysis & Portfolio Management – Punithavathy Pandian, 2/e, Vikas, 2005. Investments – ZviBodie, Kane, Marcus & Mohanty, 8/e, TMH, 2010. Security Analysis & Portfolio Management – Fisher and Jordan, 6/e, Pearson, 2011. Table – 6 (IA Pattern) Test Marks Presentations Assignments 60% 20% 20% For Internal Evaluation T1 marks and the best out of remaining two will be considered. 1st Test is mandatory.