Solution

advertisement

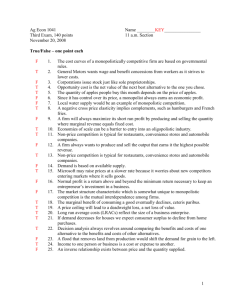

Principles of Microeconomics ECON 101 Exam 2 7-25-06 5 5 5 5 Name:_____________________ Student ID:_________________ 1. Consumer surplus is a. equivalent to value of the good or service in its intended use. b. equivalent to value in exchange. c. the difference between total expenditure and what consumers have to pay per unit. d. the difference between what consumers would be willing to pay and what they have to pay. e. total expenditure divided by price per unit. 2. On a typical supply and demand diagram, consumer surplus is the area a. between the supply and demand curves. b. below the supply curve and below price. c. below the demand curve and above price. d. below the entire demand curve. e. above the entire demand curve. 3. A competitive firm cannot affect it own output price because a. price is determined by consumers, not producers. b. market demand is perfectly elastic. c. it is only one firm among many, so the price is determined in the market as a whole. d. consumer preferences dictate a single price in a competitive market. e. of government regulations, such as price floors and price ceilings. 4. When the production function gets flatter as the quantity of labor increases, (Like in the highlighted portion of the graph to the right.) we know a. that marginal product of labor is rising. b. that marginal product of labor is falling. c. nothing about marginal product of labor. d. that the marginal product of labor is zero. e. that marginal product of labor goes to infinity. TP bLabor g 5 5. Diminishing marginal returns occurs when the a. marginal product of an input is rising. b. marginal product of an input is zero. c. marginal product of an input is falling. d. total product of an input is zero. e. total product of an input is negative. 5 5 6. Marginal cost is a. the extra total cost incurred from increasing output by one unit. b. total cost divided by output. c. variable cost divided by output. d. a cost a firm can write off of its taxes. e. so small it is not important in the firm’s decision-making process. 7. The slope of the total cost curve is called a. diminishing returns. b. total product. c. marginal product. d. marginal benefit. e. marginal cost. Quantity 1 2 3 4 5 5 5 Marginal Cost $7 $6 $9 $12 $15 8. Using the table to the above, determine the profit maximizing output level for the firm if the equilibrium price is $12. (Assuming the firm will stay open and not shut down.) a. 1 b. 2 c. 3 d. 4 e. 5 9. In the long run, firms exit an industry when a. firms in the industry realize economic profit. b. firms in the industry realize economic losses. c. other firms enter the industry. d. economic profits in the industry are zero. e. an increase in productivity lowers the firm’s costs. P S MC ATC AVC pe Df MR AR pe D Q 5 5 5 Q 10. Assume the typical firm has long run cost structure as illustrated in the right most graph in the diagram above; what can we expect to happen in the long run? a. most firms will do nothing and enjoy significant economic profit throughout the long run. b. firms will use the opportunity to reduce production to align with the minimum point on the marginal cost curve. c. economic profits are likely to increase significantly. d. new firms would be likely to enter the industry. e. firms will exit the industry. 11. In long run equilibrium of a competitive market, we expect a. economic profit of the firm to be positive. b. economic profit of the firm to be zero (i.e,, it breaks even). c. economic profit of the firm to be negative (i.e., economic losses). d. approximately half of the firms to have significant economic profit while the other half endure significant economic losses. e. the potential for much greater economic profit than was possible in the short run. 12. Pareto efficiency has been achieved when a. no one feels he has been overcharged for something he just bought. b. the greatest possible good for society has been achieved. c. no individual can be made better off without hurting someone else. d. everyone can be made better off without hurting anyone. e. no one has more than anyone else. $ P MC ATC $40 $35 S $25 AVC $25 $23 Pe D f MR AR D Q 5 100 175 Q 250 Use the diagram above to answer questions 13. 13. The firm will STAY OPEN or SHUT DOWN. (Circle one.) P $ S MC ATC AVC $10 $10 D f MR AR $8 $6 $5 D $2 Q 5 4 Q 100 Use the diagram above to answer questions 14 and 15. 14. In order to maximize profits, the firm will produce a. 100 units. b. 175 units. c. 250 units. d. 15. 175 300 250 300 units. 500 e. 500 units. Calculate the firm’s profit (or loss); be sure to show your work and label your answer as profit, loss, or break even. (Show your work for partial credit.) Profit TR TC $3000 $2400 $600 17. Assume Cy Clone has $10 to spend on pizza, ice cream sundaes, or some 16 combination of the two. Assume the price of a slice of pizza (PP) is $2, and the price of ice cream sundae (PI) is $3. The total utility from consuming various quantities of pizza and ice cream sundaes are in the table. Knowing that Cy is a utility maximizer, fill out the table and use it to predict the quantities of slices of pizza and ice cream sundaes Cy would purchase with $10. Show your work for partial credit. 6 MU P Pizza TU P MU P 0 1 2 3 4 5 0 16 28 36 40 42 XX XX 16 12 8 4 2 8 6 4 2 1 Buy 1st Pizza PP Ice Cream 0 1 2 3 4 5 MU I TU I MU I 0 21 39 48 54 57 XX XX 21 18 9 6 3 7 6 3 2 1 $10 2 $8 3 Buy 1st Ice cream $5 5 Buy 2nd Pizza and 2nd Ice cream $0 8 Cy would buy __2____slice(s) of Pizza, and __2___Ice Cream Sundae(s) PI P Q 17. Consider the market depicted above with the original demand and supply curves labeled D and S above. Now assume a tax on each unit of output is imposed on these producers. 4 4 A. Clearly identify on the graph the deadweight loss resulting from this per unit tax on producers in this market. B. Calculate the deadweight loss. (Show your work here or describe how to calculate it for partial credit: DWL= 1/2 X 3 X 20 = $30 4 C. Briefly explain (or define) deadweight loss below: Deadweight loss is the reduction in consumer and producer surplus resulting from the tax (or other interference in the competitive market).