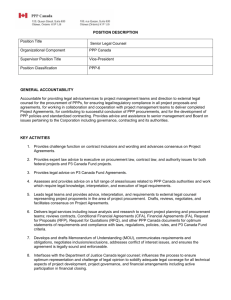

Guidelines for the Provision of Infrastructure and Capital Investment

advertisement