Types of Business Entity

Business Studies Preliminary Course

Topic 1: Nature of Business

Section 1.4 :

Types of Business Entity

Section Overview:

1.4.1 Classification of business

– Legal structure

– Industry

– Size

– Public/private sector

– International, transnational

1.4.2 Relationship of legal structure to particular circumstances

1.4.3 Factors influencing choice of legal structure

– Size, ownership, finance, privatisation

1

Section 1.4 Types of Business Entity

1.4.1

Classification of Business

Legal Structure

Industry

Size

Public/Private Sector

International/Transnational

One of the best ways to understand the differences between businesses is to look at their key features such as ownership, size, industry in which they operate and their legal structure.

A) Public/Private Sector

Business entities can be classified broadly as either government business enterprises

(GBE) (public sector) or private business enterprises.

There are three main types of government business enterprises:

1) Government Statutory Bodies

Government statutory bodies are established under a particular Act of

Parliament to carry out a specialised business function.

For Example:

Agricultural marketing boards.

These boards assist the producers of a particular agricultural product by marketing their products for them.

2) Government Corporations

These businesses function as if they have become INCORPORATED in a similar way to COMPANIES and COOPERATIVES. They function as a business with a structure, management, processes and procedures which combine to deliver a product or service to a clientele.

For Example:

Australia Post and the Australian Broadcasting Corporation (ABC)

2

Section 1.4 i)

Types of Business Entity

3) Semi-Government Authorities

These are organisations that are not directly controlled by governments but often run at a local or regional level with a mix of representatives from local government.

For Example:

Water and gas supply, sportsgrounds, cemeteries & hostels to name a few

PRIVATE BUSINESSES are those which are not owned or operated by governments. Businesses in the private sector can often differ from public sector businesses because they often emphasise financial goals over social goals. Most business activity is undertaken by the private sector.

B) Size

An important way of classifying business entities is according to their size. The

Australian Bureau of Statistics (ABS) classifies Australian businesses as either large, small, or very small. This classification is based on the number of employees in the business.

Large

A manufacturing enterprise with greater than 200 employees, or a nonmanufacturing enterprise with greater than 20 employees. ii) Small

A manufacturing enterprise with fewer than 100 employees, or a nonmanufacturing enterprise with fewer than 20 employees. iii) Very Small

An enterprise with less than 5 employees. Also known as micro businesses

C) Industry

A third way of classifying businesses is according to their industry sector, based on their type of production. An industry consists of businesses which are involved in similar types of production. There are several different types of industry. These include primary, secondary and tertiary industries. Sometimes the classification of tertiary industries is broken down into two further sub-classifications –

quarternary and quinary.

3

Section 1.4 Types of Business Entity

INDUSTRY

Primary Secondary Tertiary

Quarternary Quinary

i) Primary Industry

Those business that provide raw materials for other businesses (iron ore, timber and wheat) or goods directly to the consumer (fresh fruit and vegetables). (i.e. Mining, Forestry, Farming, Fishing) ii) Secondary Industry

Those businesses that use the raw materials provided by primary industry to produce goods. (i.e. all manufacturing businesses) iii) Tertiary Industry

Those businesses that provide services for the economy rather than producing physical goods. (i.e. transport, storage and distribution of goods, leisure and entertainment) iv) Quarternary Industry

Those businesses which focus on the processing of information, and include the information technology, telecommunications, media and financial services industries. v) Quinary Industry

Those industries that focus on providing domestic services, including home cleaning, take away food, child care and nursing homes.

4

Section 1.4 Types of Business Entity

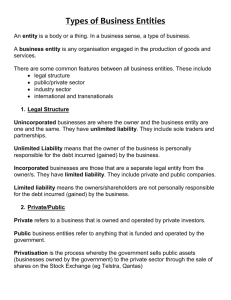

D) Legal Structure

A fourth classification for business is according to the legal structure under which they are established. Private sector businesses are generally divided into two main groups, INCORPORATED and UNINCORPORATED enterprises.

Being incorporated means that a business is officially registered as a company and is subject to the requirements of the Corporations Law. Once a business has been incorporated, it becomes a legal entity in its own right, quite distinct from its owners.

For Example:

Private Companies, Public Companies, Cooperatives and Trusts

In an unincorporated enterprise, there is no legal difference between the owners and the business itself, and therefore the owners have complete legal responsibility for all the actions and debts of the company.

For Example:

Sole Traders, Partnerships

The Main Legal Classifications of Private Sector Businesses

Unincorporated enterprises

Sole trader

Private sector business enterprises

Partnership Private company

Incorporated enterprises

Trust &

Co-op

Public company

5

Section 1.4 Types of Business Entity

E) International/Transnational

Many businesses have operations that span more than one country. Theoretically, these businesses can be structured as any of the types of business entities already mentioned, but in practice most international businesses are public companies. i) An international business: is a legal entity where ownership and production are based in one country, but which exports goods or services to other countries. ii) A multinational business: has ownership which is restricted to a single country, however, operations occur in more than one company. Most commonly, multinational businesses use overseas production facilities. iii) A transnational business: has international ownership and operations.

This means that it is likely to be registered in many countries with each country or region’s operations acting with a fair degree of independence.

Type of

Business

Ownership

Structure

Production Consumption

International

Multinational

Transnational

Single country

Single country

International

Single country

International

International

International

International

International

1.4.2

Relationship of Legal Structure to Particular Circumstances

Unincorporated Enterprises

A) Sole Traders

As the name suggests, the SOLE TRADER business is owned and operated by a single person. The success of the business generally relies on the skills and effort of the owner. This type of business is usually small because of the limited amount of finance that can be raised by one person.

6

Section 1.4 Types of Business Entity

Advantages:

Owner is his/her own boss.

Owner is responsible for all the decisions made which concern the business.

All profits belong to the owner.

Owner may offset business losses against other income.

It is an inexpensive business structure to establish and maintain, with less responsibility to the government.

Disadvantages:

Owner must bear all the losses of the business.

Owner needs to wear many hats.

Owner is personally liable for debts (UNLIMITED LIABILITY), which means personal assets may be at risk.

Owner is responsible for the business and therefore might not be able to take a holiday because no one else has the expertise.

B) Partnerships

A PARTNERSHIP exists where more than one person carries on a business together, sharing the profits. Partnerships are in many respects similar to sole traders in terms of their legal responsibilities. The partners are responsible for any of the debts of the business and are fully responsible for any of the activities of the business. Nevertheless, there are several advantages of a partnership arrangement:

Advantages

The responsibility for running the business is shared.

Establishment costs are low compared with setting up a company.

Taxation obligations may be minimised.

Each partner is able to specialize in one area of the business.

The ability to raise finance for the business is enhanced, by the business being able to take on more partners.

Disadvantages

The partners have unlimited liability.

The availability of capital is restricted.

No one person has complete control.

7

Section 1.4

Profits are shared amongst more individuals.

Types of Business Entity

If one partner incurs any debts or dies, the other partners are left with the liabilities.

C) Limited Partnerships

A limited partnership is a variation on the standard partnership arrangement. This allows a person to invest capital into a business venture, without being responsible for the debts of the business or any of its actions. In other words, with a limited partnership the only risk for an investor is that they may lose their investment funds

– there are no other legal liabilities.

Limited partnerships are becoming increasingly popular in the areas of real estate developments, mining projects, arts, theatrical and film undertakings, and agricultural schemes. Limited partners do not take any part in the management or decisionmaking activities of the business.

Incorporated Enterprises

D) Companies

Companies are the preferred structure for most businesses other than very small operations. A COMPANY is an incorporated business for which the owners have limited liability. They are separate legal entities from their owners which means that unless the directors break the law in running the business, they cannot be held liable for any of the acts or debts of the business. The fact that businesses can operate at arms length from individuals is a major reason why even small business owners often form companies.

Other ways in which companies differ from unincorporated businesses include:

Companies are subject to company tax. (i.e. 30 cents in every dollar of profit)

Companies raise most of their required funds through equity financing.

Companies can continue trading when the original owner dies or retires.

Management in a company is not tied to ownership.

Companies fall into two broad types – PROPRIETARY COMPANIES (i.e. Private companies) and PUBLIC COMPANIES. There are also some slight variations on these two which are companies limited by guarantee and no-liability companies.

8

Section 1.4 i) Proprietary Limited Company

Types of Business Entity

The most common form of company structure in Australia is the Proprietary

Limited Company. It has the words ‘Pty Ltd’ after its name, indicating that it is private and the shareholders have limited liability.

Advantages

Shareholders’ liability is limited to the amount of shares that they own.

Shares can be sold without disrupting the operations of the company.

It is easier to increase ownership of the company.

Perpetual succession means that the business does not need to be wound up in the event of the death or replacement of the directors.

Disadvantages

Shares can not be offered to the public.

The company must lodge a return with ASIC for each financial year.

Establishment costs are high in comparison with sole traders.

Lenders will often seek personal guarantees from directors before making a loan to the company. ii) Public Company

A public company is one which is listed on the stock exchange. In order to list on the stock exchange, a business must go through a complex process of offering shares to the public by issuing a prospectus which has been approved by the Australian Securities and Investments Commission. A public company has the word ‘Limited’ (Ltd) after its name, indicating that shareholders have limited liability. For Example: Woolworths Limited.

Other characteristics of public companies include:

The general public are able to purchase and sell shares easily on the stock exchange.

The minimum number of shareholders is one and there is no maximum limit.

The company may borrow additional funds from the public.

The company is required to make its financial reports available to the public.

There is a large management structure.

9

Section 1.4 iii) Companies Limited by Guarantee

Types of Business Entity

These companies have members rather than shareholders. They run in order to provide a service to a specific group of people and are not set up to make a profit for their members. Companies limited by guarantee raise their capital through subscription fees, an annual levy or a joining fee. This ensures that the organisation has adequate funds to enable it to operate.

Examples include: Professional associations, charitable organisations and sporting clubs. iv) No Liability Companies

A no liability company (NL) is a form of public company that was introduced in order to attract shareholders to invest in high-risk ventures such as the mining industry or oil exploration.

E) Cooperatives

Cooperatives are incorporated organisations, owned and controlled by their members, which have been set up to provide certain common benefits for those members.

For Example:

By pooling their resources, fruit growers in a particular area can set up a common fruit processing and marketing cooperative, with the aim of providing a guaranteed market for growers’ output and increasing profits.

F) Trusts

A TRUST is a type of business where the assets are managed on behalf of beneficiaries. The assets of the trust are usually divided into portions or shares known as units. Most trusts are set up to help people to manage their investments and often minimise tax payments. Some of the most popular types of investment trusts include cash management trusts, mortgage trusts, property trusts, and

share trusts.

Trusts have two major financial benefits: i) Managed trusts pay no tax on behalf of the individual investors. ii) Liability for any losses made by a unit trust is generally born by the unit holders, with the loss being reflected by a decline in the value of each unit holding.

10

Section 1.4 Types of Business Entity

1.4.3

Factors Influencing Choice of Legal Structure

Size, Ownership, Finance, Privatisation

When a business is first established, the business owner must decide what type of legal structure to adopt. Having considered the various types of legal structures, it is now appropriate to consider the factors that influence the choice of legal structure: size,

ownership, finance, and privatisation.

A) Size

One of the most important factors in determining what legal structure a business should adopt is the size of the business. In their earliest stages, businesses often start out with an unincorporated structure: sole tradership or a partnership. This is the

easiest and cheapest way to get established. As the business expands and more money is at risk, many owners opt to establish a company. This gives them the important benefit of limited liability and, sometimes, greater access to finance.

B) Ownership

Businesses whose main aim is to cater to specific community needs, such as a local sports club, may choose a structure that will make it easier for people to move in

and out of business ownership, such as through a membership structure rather than through shareholdings.

Business owners also place a high priority on the freedom of being self-employed, having substantial (if not complete) control over their working life and not having to report to someone else. The prospect of having this freedom weakened through a partnership or an incorporated structure where there are other business owners can be unattractive.

Often major disputes can arise between partners or between the owners of a small business. Because of the threat of this conflict, some people choose to work on their own for themselves, even if it means that the business does not become as large or as profitable as it could.

C) Finance

Most businesses begin with very limited access to investment capital, normally relying on the personal resources of the business owner or owners. As the business develops and its need for finance grows, a company structure may become more appropriate. This is suitable if there are several owners in the business and this structure can maximize access to capital by attracting shareholders to the company as part-owners.

11

Section 1.4

D)

Types of Business Entity

If a business has plans for significant expansion, and needs access to millions of dollars, its best option is to become a public company. Becoming a public company offers major financial advantages, but it also has a downside. It is an expensive option, involving significant legal and accounting fees and possibly resulting in the original owner losing control over the business to other investors.

Privatisation

Privatisation is the process whereby governments sell off government business to private enterprise. Towards the end of the 1980’s, economic rationalists argued that government corporations would become more efficient and profitable if they were shifted out of government ownership and were made accountable to shareholders through the normal structures of a public company. It would also allow governments to reduce their debt levels by selling off these enterprises. Notable examples include the sale of QANTAS, Commonwealth Bank, and more recently the partial sale of Telstra.

12

Section 1.4

DEFINITIONS:

Company

Types of Business Entity

An incorporated business for which the owners have limited liability.

Cooperative A limited liability business owned and controlled for the benefit of its members.

Incorporated Business A business which has become a company by complying with the rules of the Australian Securities and Investments

Commission

Limited Liability The liability of the owners of an incorporated business; it is limited to the funds they have invested in the company.

Multinational Corporation A business that has expanded beyond its home country into host countries by developing subsidiaries.

Partnership

Public Company

An unincorporated business usually operated by 2–20 people.

A company that invites members of the public to buy its shares.

Private Business

Privatisation

One which is neither owned nor operated by governments.

The process whereby governments sell off government business to private enterprise.

Proprietary Company (Private Company) This type of incorporated business is not listed on the stock exchange because it does not seek public funds. It must have at least 2 – 50 members and have the word ‘proprietary’ or ‘Pty’ in the name.

Sole Trader

Trust

An unincorporated business operated by a single person.

A type of business where the assets are managed on behalf of beneficiaries.

Unincorporated Business A business which is not a company, that is a sole trader or partnership. The owner(s) are personally liable for the debts of the business.

Unlimited Liability Refers to the liability of owners of unincorporated businesses who can be personally liable for business debts.

13

Section 1.4

HOMEWORK ACTIVITIES:

Types of Business Entity

Activity 1: Write down arguments for and against the following propositions:

Proposition 1: The government should be the monopoly owner of

Proposition 2: effective if they were privately owned.

Activity 2: What is meant by the term industry sector? By using examples, identify and explain the differences between the various sectors.

Activity 3: Identify the industry sector that each of the following is from:

Nannies

Sugar Grower

Jewellery Store industries such as telecommunications because they are essential to the nation’s security and survival.

Government business would be more efficient and

CD Store

TAFE lecturer

Restaurant

Photographer

Bell Shakespeare Company

Fridge Manufacturer

Dogwasher Builder Truck Company

Activity 4: Complete the Activity on P.48 of Longman Text.

Activity 5: Complete the Activity on P.52 of Longman Text.

Activity 6: Complete the Activity on P.45 of Longman Text.

Activity 7: View the website: http//:www.asic.gov.au

Task: List the responsibilities of incorporated companies.

Activity 8: Answer the following questions: i) Explain the difference between limited liability and unlimited liability. ii) Explain the difference between a partnership and a company? iii) What are the ways in which businesses can raise funds? iv) What are the advantages and disadvantages of a partnership?

14

Section 1.4 Types of Business Entity

Activity 9: A group of people approach you for advice. They want to establish a courier business in the city, based on motor-cycle deliveries. What business structure would you advise them to use? Why? Explain how they could end the arrangement.

Activity 10: Vocabulary Exercise and Chapter Review

_____________ _____________ means that the owners of a business may be personally liable for the debts of a business. __________________ businesses, such as ________ ___________ and ________________, have unlimited liability. Partnerships usually have a size of 2 to ______ partners.

The ______________ ______________ and _______________

______________ controls the activities of companies. Companies must lodge their ________________ with ASIC. When a company is registered,

ASIC issues a _______________ ______ _________________ and allocates a nine-digit ______________ _____________ __________.

Companies have ___________ _____________ and, once

______________, they become a separate legal _________. This means the company can sue and be sued, own __________ and continue to

_________ after the original owners die. This is known as _____________

______________. A __________ company can have its shares listed on the

______________ _________ ____________. public, partnerships, constitution, Australian Securities, Investments

Commission, Australian Stock Exchange, Australian Companies

Number, Certificate of Incorporation, Unlimited liability, incorporated, unincorporated, sole traders, entity, assets, exist, 20, perpetual succession

15