Philip D. Ameen John J. Perrell - Financial Executives International

advertisement

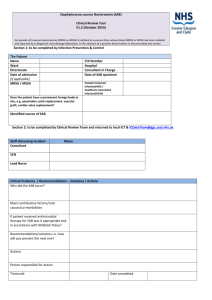

March 2, 2000 Mr. Lynn Turner Chief Accountant Securities and Exchange Commission 450 Fifth Street, NW, Washington, DC 20549 Dear Lynn: The Committee on Corporate Reporting of the Financial Executives Institute ("FEI") and the Financial Reporting Committee of the Institute of Management Accountants (“IMA”) have jointly prepared this letter regarding Staff Accounting Bulletin No. 101, “Revenue Recognition in Financial Statements.” This Staff Accounting Bulletin covers fundamental revenue recognition topics. Its scope is pervasive and will affect essentially all of our members. The critical issue for us is determining the most efficient and effective means to identify elements of the SAB that alter existing revenue recognition practices. As our staffs have studied it, we have been unable to conclude, or to advise our management, clients and Boards of Directors/Audit Committees, on the likely effects of the SAB in certain areas, which are discussed below. More questions continue to be raised as members become more fully aware of potential interpretations of the SAB. At this point, it seems clear that, whatever the outcome of various questions and interpretations, it is in the best interests of our members, the capital markets, and the SEC that these uncertainties be resolved and applied widely and uniformly in an orderly fashion, as soon as possible. To accomplish this, we believe it is necessary and desirable to delay the effective date until at least the fourth quarter of 2000. The extent to which the SAB changes practice for companies, practices that had been viewed as acceptable and reasonable prior to the issuance of the SAB, makes this change more like an accounting change rather than a clarification. Accordingly, additional time for planning for its implementation and identifying cumulative accounting adjustments is justified. As an indication of the nature of concerns that have been raised thus far, our members and clients have arrived at widely differing interpretations about the following: What constitutes customer acceptance? What are acceptable methods for recognition of revenue from licensing arrangements? How should multi-element sales transactions be accounted for? How should installation, including costs of installation of sold product be accounted for? What is the proper accounting for deferred acquisition costs? When is it appropriate to use probability to recognize revenue for contingent features of sales arrangements? Each of these topics is complex, and we shall not discuss them in detail in this letter. However, we note that, had these matters been addressed through issuance of a new FASB standard or interpretation, the nature and complexity of many of these issues would have required an extended transition period to ensure proper application. It is clear that many of our members are not yet knowledgeable on these issues. Moreover, even among those that are knowledgeable on the SAB, many will not be in a position to adequately assess the impact of these issues on their operations and to quantify the effects of adoption by the first quarter 2000 effective date. We further note that this Staff Accounting Bulletin was issued in December 1999, shortly after the issuance of the SAB on restructuring. Although both Staff Accounting Bulletins were covered in an FEIsponsored conference call on December 20, 1999, the primary focus of the discussion was on restructuring and very little time was spent on revenue recognition. Another complicating factor is the fact that a majority of our members have calendar fiscal year-ends, leaving them extremely limited opportunities to perform a detailed review of the Staff Accounting Bulletin’s requirements. We are concerned that the pervasive nature of the issues and complexities of interpretation will give rise to waves of transition effects being communicated to the financial markets: Companies that are aware of these issues may be in a position to disclose the effects (at least to the extent interpretation is clear) by the time of 1st quarter earnings releases; A second wave of disclosures would likely occur in the second quarter for companies that either misunderstood the Staff Accounting Bulletin’s intent or were not aware of later developments; Final “waves” of changes will likely occur in each quarter throughout the year as Staff positions are made known through cases or speeches. The FEI and the IMA believe it is essential that we work together with the Office of the Chief Accountant and other interested parties to agree upon and implement a process related to this new Staff Accounting Bulletin. That process should comprise four activities: (1) Identify the population of questions and areas that appear contradictory or unclear in the Staff Accounting Bulletin. (2) Develop clear answers to those questions. (3) Educate companies, auditors and other interested parties; and (4) Analyze and gather data regarding the effects of adoption. This approach will ensure that subsequent interpretation and/or clarification of the Staff Accounting Bulletin’s requirements are communicated quickly and effectively to all affected parties and that its adoption will be uniform. We appreciate the willingness you expressed, during the February 22nd meeting between you and certain of our members, to review specific examples of transactions where we are encountering difficulty and we plan to provide such examples shortly. We ask that the Chief Accountant’s Office give immediate consideration to our request to delay the effective date of SAB 101. We recognize that a great deal of research and technical work went into preparing the SAB over the past year. We would like to ensure that the implementation phase of the SAB receives the same level of attention. We welcome the opportunity to discuss our proposal further at your convenience and will be pleased to make available technical experts from our committees to assist your office in resolving these issues as expeditiously as possible. Sincerely, Philip D. Ameen John J. Perrell Philip D. Ameen Chair, Committee on Corporate Reporting Financial Executives Institute John J. Perrell Chair, Financial Reporting Committee Institute of Management Accountants