Performance budgeting reform in China

advertisement

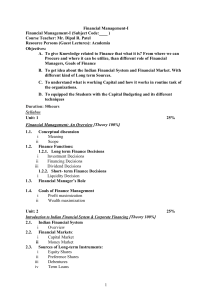

Performance Budgeting Reform in China By Dr. Junsheng Li, Central University of Finance and Economics Abstract During the last two decades, People’s Republic of China (PRC) has tried many budgeting approaches, including line-item budgeting (LIB), zero-based budgeting (ZBB) as a pilot project, and the departmental/ministerial budgeting (D/M B) launched recently, to improve the efficiency of expenditure management. While these reforms have successfully, to a great extent, solved some problems the government faced, the current fiscal system remains weak in transparency, accountability, and predictability. Officially Chinese government hasn’t had performance-based budgeting system ( PBBs) so far, though some pilot projects are taking officially at the central level and some local levels, and some localities are trying to set up local PBBs (say Hainan province). The government officials have realized that the PBBs are necessary for governments to enhance its public finance governance and the effectiveness of the government funds. The core of the PBBs is to set up the aims of performance-based budget and evaluate it by efficiency. Though the PBB and the discussions about PBB have drawn increasing China government attention and some fiscal reforms have been made by the government, it is still very hard to introduce PBBs to all levels of government right now because of government: lacking cost-benefit estimate system; mismatching revenue/expenditure responsibilities of government agencies; and un-overall budgeting (not including all public resources); etc. I. Introduction From 1990s, the Chinese government has tried many budgeting approaches, including line-item budgeting (LIB), zero-based budgeting (ZZB), and recently launched departmental/ministerial budgeting (D/MB), to improve the efficiency of expenditure management. While these reforms have successfully, to a great extent solved the problems the government faced, such as non-regulations on the budget expenditure management, too extensive to evaluate the budget outlay items, etc., the current fiscal system still remains weak in transparency, accountability, and predictability. Officially Chinese government hasn’t had performance-based budgeting system (PBBs) so far, though those reforms are the basic conditions for PBB and some pilot projects are taking officially at the central and some local levels. The Ministry of Finance (MOF) of PRC is positive with the PBB reform and sets this as its mid- to long-term target. MOF convened “PBB Management and Reform International Forum” from 22 to 24 in June of 2004 in Qingdao, Shandong province, the international representatives from World Bank, OECD and some other international organizations and some countries such as Canada, Sweden and -1- Australia were invited to deliver their presentations on their PBB experiences and suggestions to the forum, some domestic governmental officials from MOF and provincial government finance department were involved in the conference. The purpose of this paper is to assess the performance-based budget (PBB) management since 2004 in China and to give suggestions for performance budget reform in PRC. Ⅱ. Background: Performance Budgeting in PRC Since 1978, China took a series of transformation reforms with the fiscal system and the former highly centralized fiscal system was gradually broken. In 1994 China launched a large-scale campaign to further the reform whereby a big leap forward of fiscal system was made. But generally speaking, the reform of the fiscal system in China in the past years has made achievements mainly in the area of government revenue. In expenditure, especially in expenditure budgetary drafting and managing system, however, the reform has remained weak. The budgetary system still adopts the traditional input-oriented method. The input-oriented budgetary system exist many problems, the budget drafting method is unscientific and there are not enough details available, the distribution and application of the budgetary fund is not transparent enough and the legal restricting force on the budget is lowered. Such a budget is not only difficult for the legislative institutions to carry out any budget examination, but it is also harmful to the standardized implementation and legal supervision of the budget. As a result, the present governmental expenditure efficiency is in any case not satisfying. Shortcomings of the current budgetary system include: Cost-benefit estimate system is almost blank; Overstaffed offices, financial profusion, even corruption etc. exist more or less; Can not allocate resources according to priorities and objectives. Can not identify results from expenditure, etc. In the mixed economic system, the existence of the government is essential and the governmental functions are constantly expanding. On one side, low expenditure efficiency aggravates expenditure expansion and furthers the fiscal deficit. On the other side, low budget efficiency will add the taxpayer’s burden as well as the public’s complains. These problems due to budget drafting method and procedure are unable to reflect the overall situation of the use of governmental funds and consequently unable to reflect the situation of the implementation of governmental functions. Moreover, it does not conform to international conventions and trends. The further reform of China's fiscal system will put the emphasis on establishing a framework of public finance suitable to the market economy. While the current budget system is far from the demand of the Chinese market economy development and needs to be reformed as soon as possible. -2- Since 1999, a broad package of reforms in budget management has been introduced, covering reforms in budget preparation, budget classification, treasury management, government procurement and installing new information systems (Christine WONG 2005). During the last two decades, PRC has tried many budgeting approaches, including line-item budgeting, zero-based budgeting, and recently launched departmental/ministerial budgeting, to improve the efficiency of expenditure management. While these reforms have successfully solved the problems faced to a great extent, and broken the highly centralized fiscal regime in some aspects, then, the current fiscal system still remains weak in terms of transparency, accountability, and predictability, particularly compared to international standards. The major problems existed now include: Lack of cost-benefit estimate system. Overstaffed offices and mismatched revenue/expenditure responsibilities of government agencies. Misuse or corruption in the allocation and utilization of public financial resources. Under-financed government priorities. Weak monitor/evaluation mechanism over public expenditures. Low transparency, accountability, and predictability of budget formulation. Difficult negotiations between budgeting authority and implementation government agencies due to short of solid information/facts. Discretionary decisions in budget allocation. Loose fiscal discipline in deficit/debt control. Driven by these problems and learning from other countries’ experiences, many fiscal experts are discussing the possibility of introducing the Performance Budget to PRC. These discussions have drawn increasing government attention. In recent years, more and more countries, especially those developing and transition ones, have paid much attention to this budget reform. Also, ADB is strengthening the linkage between country performance and the allocation of scarce ADF resources among recipient countries. To meet this international trend and to solve the existing budgetary problems, the PRC’s government has taken performance budgeting reform into account. Accordingly, a Performance Budgeting Assessment (PBA) should be conducted for the PRC. -3- Ⅲ. Desirability and Feasibility Desirability of Performance Budgeting Reform The reform is of great and profound political, economic and social significance, which includes: Government performance evaluation is an integral part of China’s reform on political system. A democratic political system requires evaluating both efficiency and effectiveness of government’s investment and activities. Government performance evaluation plays an important role in China’s democratic political system development and reform. It’s an important effort to establish a proper framework for public finance, also a major measure to rectify and standardize financial and economic order and constitutes the key to on-going fiscal reform. It has profound implication for budget management: 1).performance needs to be specified and reported in a way which is operational for budget managers; 2).government agencies need greater managerial autonomy and freedom from tight input controls, so they can determine their most efficient delivery of results; 3).changes is required for the range of incentives and sanctions facing departmental managers. Performance budgeting helps to improve government’s performance. The core of modern government management is the improvement of performance. Government performance evaluation helps promote strong performance awareness among the public. Therefore the efforts on improving the performance will go all the way through the government management. Performance evaluation helps government to build up a philosophy of servicing the society as a whole, and build a clean and honest government, thus works to enhance government’s image and reputation. Obviously, an appropriate budget approach will increase transparency and cost-efficiency of fiscal operation, better emphasize on government’s priorities such as education, health care, poverty reduction, and social relief. The PRC Country Strategy and Program 2004-2006 (CSP) identified pro-poor fiscal reform to promoting equitable and inclusive growth and sound governance. To support the CSP exercise, a performance budget reform assessment will be conducted for the PRC①. Feasibilities of Performance Budgeting Reform -4- Significant achievements have been attained in building a democratic government. The ongoing government reform provides a favorable ambience for government performance evaluation. With the government reform moving forward, the public will become more and more performance consciously, which will lead to an enabling social environment for the government performance evaluation. Capitalizing on mature theories and practices regarding government performance evaluation. Some countries have already experienced performance budgeting for 20 years; many countries even stipulated the government performance evaluation system in the law. Modern information, analytical and forecasting technology provides technical support for government performance evaluation. Modern computer technology can meet the demands of government performance evaluation for storing analyzing and querying substantial amount of data within short period of time. IT-based performance evaluation makes the relevant information available for the public and helps various parties to share the information. Currently, governments of all levels, from central government to local government, attach great importance to performance evaluation. Achievements have been made in the development of theory and practice in regard of performance evaluation. Performance evaluation has been implemented in certain areas and departments. Experiences have been accumulated along the way. The role of CNAO (China National Audit Office) has been the growing prominence, whose annual reports have kept up criticism of the MOF and other government bodies at the central and local levels. Beginning in 1999, the Auditor-General has appeared each year at the NPC Standing Committee Meetings in June to present the Administration’s report on the audit of the previous year’s budget. In recent years, this has become a popular annual event that attracts a great deal of media attention and follow-up investigations by the press. This has generated continuing pressure to improve public-sector management and provided support for budget reform through the NPC. More importantly, the new “scientific development” paradigm adopted under Hu Jintao and Wen Jiabao, which calls for a more balanced, inclusive and people-centered approach, should translate into support from the top leadership for continuing reforms in public expenditure management and budgeting. During the past years, some projects are selected as pilot performance budgeting -5- projects in cost estimate and result evaluation. Some local governments have partly introduced Performance Budgeting approach. The MOF is also positive with the Performance Budgeting reform and sets this reform as its mid- and long-term target. Divisions and Localities with Pilot or Experimental Projects Central government To strengthen the budget management, MOF has carried out some experiment unit work of project expenditures along with the reform of departmental budgeting. Some project expenditures of government in 2003 are required to be assessed its performance, and the results of performance assessment will be referred in the resources allocation in 2004. At the same time, some inner bureaus of ministry of finance, such as bureau of education, technology and culture, have enacted some management rules for project performance assessment. Fujian Government performance evaluation has been systematically carried out in Fujian Province. What Fujian government has been done is comprehensive and instructive. Fujian government has issued two government instructions to carry out performance evaluation in 2004 and 2005. Fujian government’s performance evaluation is to base the promotion, salary and other motivational measures on the outcome of performance evaluation. Putian municipal government and Xiamen municipal government serve as the demonstration sites. Gansu Gansu is the place where the first government performance evaluation has been carried out. The third party evaluation of government performance is so called “Lanzhou experiment”, which is instructive for China’s government performance evaluation as a whole. Gansu provincial government entrusted the third party—Chinese Local government performance evaluation center of Lanzhou University to evaluate its performance. The performance evaluation center is a non-government institution. The center came up with a report entitled “Gansu non public-owned enterprises’ evaluation of government performance. Xuhui District, Shanghai Xuhui district has put in place evaluation measures for government financial projects in 2003. The first government performance evaluation system has been built up and implemented in some government departments. But no significant results have been achieved. -6- Shenzhen Shenzhen government’s performance evaluation is effective and comprehensive. It can serve as the role model for government performance auditing. Shenzhen government has put in place Shenzhen Special Economic District Auditing Regulations as early as 2001. In 2004, it expanded the scope of performance evaluation and issued regulations on auditing government investment projects. In recent years, annual reports of government performance evaluation have been made to the public. Qingdao Qingdao municipal government introduced corporate management methodologies and third party evaluation. For the first time in China, object evaluation personnel have been trained in Qingdao. In addition, government performance evaluation has also been carried out in Beijing in recent years. Ⅳ. Issues to Consider Regarding China’s Government Performance Budget Evaluation In the PRC, The current program of budget reform towards performance budgeting system comprises a large, complex and ambitious package of measures that are long overdue, and they will be crucial in moving China toward a modern budgeting system and a well-functioning public sector. However, these reforms are only just beginning, and it’s not easy to set up performance budgeting system in short term because: There is no mature and systematic experience previously, also, there are no systematic theories to guide the evaluation; Correlative reforms such as accrual accounting haven’t been established; Relevant skills and human resources are often in short supply. Government is pursuing diverse goals, which are conflicting to each other, so government has to trade off among conflicting interests and values; Most evaluations are self-motivated and regulated, there are no regulation or law in place to support and guide the evaluation; Most of evaluations are sponsored by government. In most cases a certain level of government evaluates its subordinate’s performance. It’s rarely seen that the public evaluate the government or government’s internal evaluation. Although the prerequisites mentioned above are not ready yet. However, The MOF has promoted to implement some kind of performance budget in 2005. Therefore, it’s time for making a further research on the feasibility and the prospect of performance budgeting in the PRC nowadays. -7- Ⅴ. Towards Performance Budget Reform in China: Some Suggestions Defining a Framework for Performance Measurement Performance budgeting assessment is a necessary step to deepen the reform of department budget. The essence of department budgeting reform is to establish a perfect performance budgeting management system to improve the performance of government management and the efficiency of public finance expenditure. The reform of performance budgeting won’t be accomplished in an action. In the reform of performance budgeting assessment, we must definitude the principles of reform and the steps of reform according to the process of China’s department budget reform, introducing the concept of performance budgeting to China’s public finance expenditure management gradually. Principles of Performance Budgeting Reform in PRC While it is undeniable that performance measurement is a key tool in the process of improving the delivery of public services, this should not be viewed as an end in itself, but part of a wider reform process. Performance is a deceptively simple idea: simple because it is easy to express key concepts and objectives; deceptive because it is hard to apply these ideas in government②. We must stick to some basic principles to guarantee the process of reform. Aim for clarity in purpose First, it is necessary to be sure about who will use the performance information, how they will use it, and why they will use it. There are many potential users of performance information, ranging from the program manager, the central evaluator in the ministry of finance, the member of a legislative watchdog committee, and the final consumer of the government service. Each of these potential users has different objectives: for example, making better resource allocation decisions, improving services, increasing accountability, etc. Measures should only be chosen when users are identified and their objectives properly defined. The ultimate aim should be to help the user reach more informed conclusions and to make better decisions about service performance. Focus on core information Second, once the purpose has been clarified there should be a conscious effort to prioritize between different performances measures to avoid information overload. It is usually recommended that in the first instance the focus should be on the priorities of the entity, i.e., its core objectives and service areas. Often it takes sufficient time and effort to establish success criteria for these priorities and objectives without widening the scope of performance measurement. Align with practical needs of the agency Third, it is necessary to make performance information as relevant as possible to the -8- agency. To do so requires performance measurement to be aligned with the objective, setting procedures and the performance review process of the agency. In this way, those collecting and processing the data can appreciate what these are being used for and relate their use to the agency’s procedures. Of course, this does not mean ignoring the multiple uses of performance information. There should be links between the performance measures used at an operational level, those used by agency’s management, and those used by higher level government officials, say in the ministry of finance. Balance the perspective on performance. Fourth, it is necessary to recognize that different activities create different needs for performance measurement. Narrow program activities perhaps can be covered by very few measures, but complex program activities may need a wide range of performance measures balanced over the different aspects of the services. Often it is felt desirable to have an appropriate mix of internally generated and external measures. Obviously, meeting this need may involve trade-offs with other criteria such as focus and alignment. Review the performance measures Fifth, there should be a consistent effort to upgrade performance measurement. This reflects the fact that the previously chosen criteria are subject to change over time. Agency objectives change, priorities between objectives change, different users emerge, and hence the required balance of performance information is necessarily changed. Selected performance measures, therefore, should be regularly reviewed and updated to reflect such changes in priorities and shifts in the focus of public policy. A performance measurement system that is static is not likely to be fulfilling its function as part of a performance management system. Ensure robustness of basic information Lastly, but perhaps more importantly, performance measures should be based on reliable and timely data. The basic raw data should be robust, in the sense of being derived in a way that is verifiable, free from bias, and preferably comparable over time and between different organizations. Data should also be capable of being derived in a time frame compatible with the needs of decision-makers. Concrete Steps and Measures to Performance Budgeting Performance budget is an innovation of concept rather than only a technique tool in the government performance management. It will renovate the patterns of government management thoroughly. Therefore, we must make concrete steps and measures towards performance budgeting. Establish a uniform and normative performance budgeting assessment law to -9- define the scope, target and content of performance assessment To assure the normal development of performance assessment, we should establish a uniform and normative performance budgeting assessment law to solve the problem of system limitation and guarantee the advance of performance assessment. We should not only assess the performance of single public expenditure item, but also widen the scope of performance including all the expenditures of government such as constant expenditure and public engineering expenditure. The content of performance should include the operational assessment and the financial assessment. We should not only assess the process of budget and the management of funds, but also assess the rationality of performance target and the outcome of project target. Performance measurement is not to be more than simply an add-on to the traditional budget process, it is an essential part of the process of performance budgeting. In turn, performance budgeting must be viewed as an integrated method of allocating resources. The central idea is to link resource allocation explicitly to outputs or outcome—performance— and this should be recognized as involving more than just budgeting. Rather it encompasses the entire budget management process in supporting and demanding better performance: budget planning, budget execution, reporting, and auditing. In this way, performance measurement requires to be fully integrated into a performance management system. To support the latter, in turn, entails establishing a performance information system. Establish a basic information database concerning the performance indicators First of all, performance assessment should establish an integrated performance indicators and basic information data-base, so that we can measure the performance target of project. Therefore, on the principle of combining qualitative analysis with quantitative analysis, uniform indicator and professional indicator, we should establish a system of performance assessment indicators and a basic information data-base gradually. Second, we must definitude the content of performance budgeting assessment of public finance expenditure. According to the basic condition and the requirement of reform target, we may differentiate constant expenditure performance assessment and project expenditure performance assessment. The objective of constant expenditure performance assessment is to assess the total performance of one department. The basic start of designing constant expenditures performance assessment is according to the function of government, which regulates the basic services what the department should provide. At the same time, the objective of project expenditure performance assessment is to assess the performance of concrete performance of one project. Through project performance assessment, we can not only assess the security, validity and normality of project, but also allocate financial resources efficiently by comparing - 10 - similar projects in one field. Establish the outcome quality dimension in the system of performance indicators Output is the products and services that departments provide, while outcome is the social effect of government project. Output puts more emphasis on efficiency and is based on short- and medium-term time horizon, while outcome put almost equal emphasis on social effect and efficiency and is based on very long-term time horizon. There is no doubt that outcome is better than output on the performance assessment of government. But it is more difficult to use the concept of outcome to assess the social effect of government project. Thus there need a process to divert output to outcome gradually. Furthermore, there is an important consideration for the efficiency of service provision, where efficiency as measured by the ratio of outputs to inputs can be improved by reducing quality of the output. Thus we must establish the quality dimension of outcome to avoid above problems. Furthermore, different service of government perhaps needs different qualitative characteristics. Since there are many dimensions to quality, who decides what qualitative characteristics are important for a particular service. Identify the executor of performance budgeting assessment Which department should be the executor of performance budgeting assessment is an arguing question since performance budgeting assessment is introduced to China. One point is that Ministry of finance should be responsible for performance assessment of government. The other point is that Ministry of audit is the executor of performance assessment. As far as this report is concerned, we think ministry of finance is the executor of performance budgeting assessment because it is the department of public finance expenditure management. Ministry of finance is responsible for the establishment of performance assessment system and the correlative policy constituting. Furthermore, ministry of finance is also the organizer of performance budgeting assessment. Advance the reform of accrual accounting and budgeting process in government management to completely reflect the performance of government There may be limitations in the accounting system, especially if cash based, that may not be able to record the full costs of capital since depreciation is not included. The accrual accounting system can reflect the information of some long-term projects and potential debts in government. Furthermore, it is also helpful to improve the integrality, reliability and transparency of budget, reinforcing the cost-benefit analysis and assessment of government performance. At present, Australia, New Zealand, England, Sweden and America have moving from cash to accrual accounting in the government accounting. To reflect the real cost and performance of government activities, we should moving to accrual accounting gradually in the coming reform of government accounting system. - 11 - Develop a performance management system It is as well to recognize that it will take time to introduce a comprehensive system of performance management. The ultimate objective is to put in place a system to match costs with activities, to measure performance of these activities, to develop standards of performance, and compare costs and performance levels with agreed standards. The challenge of this approach is to link performance information to the budget process and the allocation of resources. International experience has shown that until this connection occurs performance, is seen merely as a regular reporting requirement, but not directly relevant to day-to-day management and budgeting. Therefore, it is of great importance to development a performance management system in the coming years. Assess the performance of the budget system These steps toward a performance management system are directed to setting up a clear accountability framework for budget managers that lies at the heart of the new performance budgeting model. This reformulated accountability arrangement represents a fundamental change toward a more devolved system of budget management whose effects are quite far reaching. How to judge whether a PEM system is robust enough to accommodate the previously discussed changes required by performance-oriented budget management is a new question. In turn this requires an assessment of the overall performance of the PEM system. REFERENCES: Bowsher , C.(1985), “Governmental Financial Management at the Crossroads: The Choice is Between Reactive and Proactive Financial Management,” Public Budgeting and Finance, 5(I): 9-22. General Accounting Office (1997a), Performance Budgeting: Past Initiatives Offer Insights for GPRA Implementation, Washington, DC: Author. Governmental Accounting Standards Board (1990), Service Efforts and Accomplishments Reporting: Its Time Has Come: An Overview: Norwalk, CT: Authou. Jack Diamond (2001),PERFORMANCE BUDGETING: MANAGING THE REFORM PROCESS, available at www.imf.org Jack Diamond (2002) , Performance Budgeting: Is accrual accounting required? IMF Working Paper Jack Diamond (2003) , From program to Performance Budgeting: The Challenge for Emerging Market Economics. IMF Working Paper Jack Diamond (2005) , Establishing a Performance Management Framework for Government. - 12 - IMF Working Paper Marc Robinson and Jim Brumby(2005), Does Performance Budgeting Work?: An Analytical Review of the Empirical Literature. IMF Working paper Key, V.(1940, December), “The Lack of a Budgetary Theory”, The American Political Science Review, 34: 1137-1144. Lewis, V.(1952).”Toward a Theory of Budgeting,” Public Administration Review, 12(I): 42-52. Mikesell, J.L. (1995), Fiscal Administration: Analysis and Application for the Public Sector, 4th ed. Belmont, CA: Wadsworth. OECD/World Bank Budget Practices and Procedures Database, available at www.oecd.org/gov/budget. Xiang Huaicheng and Lou Jiwei (2004), Editors, Five Years of Budget Reform in China, 1998-2003 (in Chinese), Beijing, China Financial Economics Press. Christine WONG (2005) , PUBLIC SECTOR BUDGET MANAGEMENT ISSUES IN CHINA available at www.oecd.org/gov/budget. ① The other case should be noted here: in November 2003, the Sixteenth National Congress of the Communist Party of China celebrated China’s remarkable economic achievements over some 25 years of transition to a market economy, but also called for some significant corrections. One clearly identified strand of correction aims to renew the Party’s commitment to a more balanced growth that benefits all regions and sectors and stem the alarming growth in inequalities that has marred the achievements of the recent years. This was spelled out in more specific terms in Premier Wen Jiabao’s Report to the National People’s Congress (NPC) on 5 March 2004, when he called for: Reorienting China’s development strategy to one that emphasizes balanced, sustainable and “people-centered” growth; Strengthening social protection; Solving fiscal problems of the rural sector; Curbing corruption and government abuse; Putting China on a timetable to achieve a “xiaokang society” (a well-off society). What is notable about this call for a xiaokang society is that, for the first time, the government is explicitly focusing on targeting the outcomes of economic growth, shifting away from the traditional emphasis on the quantitative targets such as rates of growth and income levels. This new emphasis on outcomes will bring more scrutiny onto government performance, since the public sector is the primary provider of many of the services that are critical to achieving a “people-centered” growth. To achieve the goals set out will require improving public expenditure management and ensuring that government spending is more tightly linked to priorities, improving budget processes and execution, and holding government accountable for improving its performance. Indeed, in a speech during 2002, then-Vice Premier Li Lanqing called improving public expenditure management “an important guarantor for the achievement of ‘Xiaokang society”(Xiang and Lou, 2004). In sum, the pressure is on to improve public expenditure management.—writer note. ② Jón R. Blöndal, Deputy Head of Division, Budgeting and Management Division.Performance Management in OECD Member countries. - 13 -