3ceet ARINDAM CHAKRABORTY-7NBKP009

advertisement

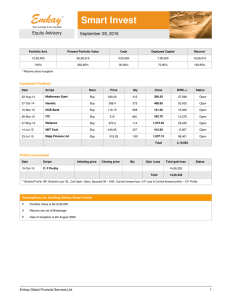

ICFAI NATIONAL COLLEGE 3CEET REPORT ON EMKAY SHARE AND STOCK BROKERS LIMITED PRESENTED BY: ARINDAM CHAKRAABORTY 7NBKP009 ACKNOWLEDGEMENT I would like to thank Ms. Suman Uppal, the respected faculty guide of ICFAI NATIONAL COLLEGE, without the cordial help and cooperation of whom this report would not be successfully completed. I would also like to thank the ICFAI authority for assigning me the task to prepare this report and our company guide Mr. Vikram Mehrotra Assistant Vice President of the company Emkay Share and Stock Brokers Limited for providing us necessary and relevant information for preparing our report in a proper manner maintaining a proper format. CONTENT CHAPTERS Pg INTRODUCTION……………………………………………3 COMPANY PROFILE……………………………………….4 CUSTOMER……………………………………………….....9 COMPETITORS…………………………………………….10 SWOT ANALYSIS………………………………………….15 WHO’S WHO………………………………………………..22 INTRODUCTION Emkay Share & Stock Brokers Limited is one of the leading and professionally managed equity broking companies, offering an entire gamut of financial products and services under one roof; be it trading in Equities, Derivatives, Commodities, Depository, Mutual Funds, E-Broking or IPO’s. YOUR SUCCESS IS OUR SUCCESS is their belief and their endeavour is to maximize customer satisfaction and profits. Financial stability, operational smoothness, personalized services; competitive brokerage and premium research are enjoyed by their highly esteemed clients ranging from Retail Traders, Investors, HNIs, and NRIs to the Institutions and the FII. Value added services are their distinct edge, from Portfolio Management Services (PMS), Private clients Group (PCG) to Debt Advisory. Emkay is known for the quality of its research and has always been rated as one of the top broking houses in Asia. I am glad to be a part of Emkay Share and Stock Brokers Limited as an intern during the 4 months SIP program. I am looking forward to learn lot of things during this program. As a fresher the corporate world is new to me and I have to adopt the corporate cultures in a positive way to gain success in this 4 months program and in my future life. Company Profile Emkay Share and Stock Brokers Limited was founded in 24th January 1995 as Emkay Share and Stock Brokers Private Limited, by two young Chartered Accountants, Mr.Krishnakumar Karwa and Mr. Prakash Kacholia. It was converted into a Public Limited Company in 20th October 2005 and the name was changed to Emkay Share and Stock Brokers Limited. CORPORATE OFFICE: C-6, Ground Floor, Paragon Center, Pandurang Budhkar Marg, Worli, Mumbai – 400 013. Tel No. 66121212, Fax: 66121299; E-mail: marketing@emkayshare.com; MARKETING: PRODUCT PORTFOLIO Trading (Equities/Debt/Derivatives) PMS(Portfolio Management Simplified) Depository Commodity Trading E-Broking IPO Technical Analysis Mutual Funds Insurance Investment Advisory Company Research Internet Trading This Company acquired the membership of: Bombay Stock Exchange 1996 National Stock Exchange 1999 Derivatives Segment – BSE, Trading & Clearing Member 2000 Depository Participant – CDSL 2000 Debt Market – BSE 2001 Derivatives Segment – NSE, Trading & Clearing Member 2001. EMKAY is a full service brokerage house providing comprehensive advisory services to its clients under one umbrella, which would enable managing complete financial planning needs. It has expertise in advisory services in both cash and derivatives sides of the capital markets and are also distributors of savings / investment instruments like Mutual Fund Schemes, Saving Bonds, IPO etc. Emkay also provides commodity trading through its group subsidiaries, and is a member of the MCX and NCDEX. Emkay`s customer base is a mix of institutional, high net worth, and retail investors. This diversified base of customers together with its wide gamut of services provides Emkay with the necessary stability and strength to weather the volatility much better than that of the competitors and also maintain high standards of customer service levels throughout. Emkay meets the support needs of this investor base through execution skills driven by an experienced sales team and research backed advice generated by a team of experienced analysts. Emkay`s advisory services range from investing, trading, research, financial planning and portfolio management, which are offered, to a large number of high net worth individuals and corporate. Most of these services are tailor-made to meet the needs of HNI’s and Corporate in line with their investment objective. Subsidiaries of EmkayEmkay Fincap Limited (EFL): It is a subsidiary Emkay with 85% shares held by Emkay. EFL was formed as a Private Limited Company on 16th May, 2005 for carrying on Share Financing activities and has been converted to Public Limited Company on February 14, 2006. Emkay Commotrade Limited (ECL): It is another subsidiary of Emkay and Emkay holds 100% shares held of ECL. The Company was formed on 5th January 2006 and proposes to carry on commodity broking business. Emkay proposes to invest in the membership of two commodity exchanges MCX Commodity Exchange NCDEX Commodity Exchange E broking: The term E-Broking stands for Electronic-Broking. It is purchase and sale of shares through the Internet. Traditionally, clients placed orders with your stockbroker either verbally (personally or telephonically) or in a written form (fax). In Online Trading, clients can access their stockbroker's website through their internetenabled PC and place orders through the broker's internet-based trading engine. These orders are routed to the Stock Exchange without manual intervention and executed thereon in a matter of a few seconds. E-Broking Features Instant Loading Live Streaming Quotes Historical & Intraday Charts with Technical tools Multiple Exchanges on a single screen Online Transfer of funds Back Office Access Easy Trade User Friendly with convenient Hot Keys Facility to put orders pre & Post Market DIFFERENT MARKET TRADING: COMPANY ADDRESS CORPORATE OFFICE: Paragon Center, C-06, Ground Floor, Pandurang Budhkar Marg, Worli, Mumbai-400013. Tel:- 91 22 6612 1212 Fax:- 91 22 6612 1299 REGISTERED OFFICE: 4 D, Hamam House, Ambalal Doshi Marg, Fort, Mumbai- 400023. Tel:- 91 22 2265 1576 REGIONAL OFFICE: 4, B.B.D Bag, Stephens House. 4rth Floor, Kolkata-700001. Tel:- 91 33 3058 4460 OPERATION NETWORK Currently Emkay have 17 branches STATE NO. OF OFFICES PUNJAB 2 DELHI 1 KARNATAKA 1 TAMIL NADU 3 KERALA 1 WEST BENGAL 1 MAHARASHTRA 7 GUJARAT 1 TOTAL 17 EXISTING FRANCHISEE STATE NO. OF OFFICES GUJRAT 3 TAMIL NADU 8 RAJASTHAN 3 MAHARASHTRA 7 PUNJAB 2 MADHYA PRADESH 1 HARYANA 1 TOTAL 25 CUSTOMERS HIGH NETWORTH INDIVIDUALS: Our Company’s advisory services ranged from investing, trading, research, financial planning and portfolio management, which are offered, to a large number of high networth individuals and corporate. Most of these services are tailor-made to meet the needs of HNI’s and Corporate in line with their investment objective. High networth individuals are those people whose transactions of shares are carried out in bulk in a day. RETAIL CUSTOMERS: Our Company meets the support needs of this investor base through strong execution skills driven by an experienced sales team and research backed advice generated by a team of experienced analysts. As the retail customers need more research regarding the share transaction because they invest less, could not take losses and want more returns thus customized services are offered to them. INSTITUTIONS: Our Company’s customer base is a rich mix of institutional, high networth, and retail investors. This diversified base of customers together with its wide gamut of services provides us with the necessary stability and strength to weather the volatility much better than its competitors and maintain high customer service levels throughout. COMPETITORS (1)ANGEL BROKING: The angel group has emerged as one of the top three retail broking houses in India. Incorporated in 1857 it has memberships in NSE, BSE and two leading commodity exchanges in India i.e. NCDEX & MCX. Angel is also registered as a depository participant with CDSL. Angel has always believed in offering best services to its customers. Be customized product offering or personalized touch to their services. Angel is the only 100% retail stock broking house offering a gamut of retail centric services they are: E broking Investment Advisory Portfolio Management Services Wealth Management Services Commodities trade INVESTMENT ADVISORY: To derive optimum returns from equity as an asset class requires professional guidance and advice. Professional assistance will always be beneficial in wealth creation. Investment decisions without expert advice would be like treating ailment without the help of a doctor. RESEARCH DEPARTMENT: Strong research has always been their forte. Their investment advisory department is backed by an experience research team. This team comprises of 12 sartorial special analysts and a Research Head. Their vast experience and expertise in spotting great investments opportunities has always been beneficial for their clients. BENEFITS @ ANGEL: Expert Advice: Their expert investment advisors are based at various branches across India to provide assistance in designing and monitoring portfolios. Timely Entry & Exit: Their advisors will regularly monitor clients’ investments and will guide clients to book timely profits. They will also guide clients in adopting switching techniques from one stock to another during various market conditions. De-Risking Portfolio: A diversified portfolio of stocks is always better than concentration in a single stock. Based on their research, they diversify the portfolio in growth oriented sectors and stocks to minimize the risk and optimize the returns. (2) INDIA INFOLINE: It is a one-stop financial services shop, most respected for quality of its advice, personalized service and cutting-edge technology. VISION: Their vision is to be the most respected company in the financial services space. INDIA INFOLINE GROUP: The India Infoline group, comprising the holding company, India Infoline Limited and its wholly-owned subsidiaries, straddle the entire financial services space with offerings ranging from Equity research, Equities and derivatives trading, Commodities trading, Portfolio Management Services, Mutual Funds, Life Insurance, Fixed deposits and other small savings instruments to loan products and Investment banking. India Infoline also owns and manages the websites www.indiainfoline.com and www.5paisa.com The company has a network of 596 branches spread across 345 cities and towns. It has more than 500,000 customers. INDIA INFOLINE LTD.: India Infoline Limited is listed on both the leading stock exchanges in India, viz. the Stock Exchange, Mumbai (BSE) and the National Stock Exchange (NSE) and is also a member of both the exchanges. It is engaged in the businesses of Equities broking, Wealth Advisory Services and Portfolio Management Services. It offers broking services in the Cash and Derivatives segments of the NSE as well as the Cash segment of the BSE. It is registered with NSDL as well as CDSL as a depository participant, providing a one-stop solution for clients trading in the equities market. It has recently launched its Investment banking and Institutional Broking business. A SEBI authorized Portfolio Manager; it offers Portfolio Management Services to clients. These services are offered to clients as different schemes, which are based on differing investment strategies made to reflect the varied risk-return preferences of clients. Research services The content services represent a strong support that drives the broking, commodities, mutual fund and portfolio management services businesses. Revenue generation is through the sale of content to financial and media houses, Indian as well as global. It undertakes equities research which is acknowledged by none other than Forbes as 'Best of the Web' and '…a must read for investors in Asia'. India Infoline's research is available not just over the internet but also on international wire services like Bloomberg (Code: IILL), Thomson First Call and Internet Securities where India Infoline is amongst the most read Indian brokers. INDIA INFOLINE COMMODITIES LTD.: India Infoline Commodities Pvt Limited is engaged in the business of commodities broking. Their experience in securities broking empowered us with the requisite skills and technologies to allow us offer commodities broking as a contra-cyclical alternative to equities broking. They enjoy memberships with the MCX and NCDEX, two leading Indian commodities exchanges, and recently acquired membership of DGCX. They have a multichannel delivery model, making it among the select few to offer online as well as offline trading facilities. INDIA INFOLINE MARKETING AND SERVICES: India Infoline Marketing and Services Limited is the holding company of India Infoline Insurance Services Limited and India Infoline Insurance Brokers Limited. India Infoline Insurance Services Limited is a registered Corporate Agent with the Insurance Regulatory and Development Authority (IRDA). It is the largest Corporate Agent for ICICI Prudential Life Insurance Co Limited, which is India's largest private Life Insurance Company. India Infoline was the first corporate agent to get licensed by IRDA in early 2001. India Infoline Insurance Brokers Limited India Infoline Insurance Brokers Limited is a newly formed subsidiary which will carry out the business of Insurance broking. They have applied to IRDA for the insurance broking license and the clearance for the same is awaited. Post the grant of license, they propose to also commence the general insurance distribution business. INDIA INFOLINE INVESTMENT SERVICES: Consolidated shareholdings of all the subsidiary companies engaged in loans and financing activities under one subsidiary. Recently, Orient Global, a Singapore-based investment institution invested USD 76.7 million for a 22.5% stake in India Infoline Investment Services. This will help focused expansion and capital rising in the said subsidiaries for various lending businesses like loans against securities, SME financing, distribution of retail loan products, consumer finance business and housing finance business. India Infoline Investment Services Private Limited consists of the following step-down subsidiaries. A. India infoline distribution company B. Money line credit ltd. C. India infoline housing finance ltd. IIFL (Asia) private ltd. IIFL (Asia) Private Limited is wholly owned subsidiary which has been incorporated in Singapore to pursue financial sector activities in other Asian markets. Further to obtaining the necessary regulatory approvals, the company has been initially capitalized at 1 million Singapore dollars. (3) ANAND RATHI: Anand Rathi is a leading full service securities firm providing the entire gamut of financial services. The firm, founded in 1994 by Mr. Anand Rathi, today has a pan India presence as well as an international presence through offices in Dubai and Bangkok. AR provides a breadth of financial and advisory services including wealth management, investment banking, corporate advisory, brokerage & distribution of equities, commodities, mutual funds and insurance, structured products - all of which are supported by powerful research teams. The firm's philosophy is entirely client centric, with a clear focus on providing long term value addition to clients, while maintaining the highest standards of excellence, ethics and professionalism. The entire firm activities are divided across distinct client groups: Individuals, Private Clients, Corporate and Institutions and was recently ranked by Asia Money 2006 poll amongst South Asia's top 5 wealth managers for the ultra-rich. AR Core Strengths Breadth of Services In line with its client-centric philosophy, the firm offers to its clients the entire spectrum of financial services ranging from brokerage services in equities and commodities, distribution of mutual funds, IPOs and insurance products, real estate, investment banking, merger and acquisitions, corporate finance and corporate advisory. Clients deal with a relationship manager who leverages and brings together the product specialists from across the firm to create an optimum solution to the client needs. Management Team AR brings together a highly professional core management team that comprises of individuals with extensive business as well as industry experience. In-Depth Research Their research expertise is at the core of the value proposition that we offer to their clients. Research teams across the firm continuously track various markets and products. The aim is however common - to go far deeper than others, to deliver incisive insights and ideas and be accountable for results. SWOT Analysis for EMKAY Share and Stock Brokers Ltd. SWOT Analysis Is a planning tool used to understand the Strengths, Weaknesses, Opportunities, and Threats involved in a project or in a business. It involves specifying the objective of the business or project and identifying the internal and external factors that are supportive or unfavorable to achieving that objective. SWOT is often used as part of a strategic planning process. SWOT is an acronym for Strengths, Weaknesses, Opportunities and Threats. Strengths: Emkay’s motto “Your success is our success” is always kept in mind their endeavor to provide their clients with best industry practices. It is their ongoing effort to take care of their client’s portfolio and mitigate their clients overall risk to the market. At Emkay they believe in offering solution-oriented structures to all their clients rather than selling generic products. Personalized attention to all the portfolio clients with customization of each portfolio in sync with the investor risk and return profile. Managing over Rs.450 Crores under its Portfolio Management and PCG. High level of transparency with strong service deliverables. One of the few large publicly listed brokerage houses in the country. At Emkay they follow a time-tested and structured Research Process, which has stood the test of time. Using their database they do a thorough analysis of a company This includes analysis of its growth rate, margins, capital efficiency, capacity additions etc. They probe all the published information about the company. This helps them appraise the business dynamics and the company's strategy, its strengths, weaknesses and the challenges faced by it. This also helps them understand its management's capabilities They also hold a dialog with the senior management of the company with set of questionnaires Eventually they are able to comprehend the company's strategy and attempt to perfect future financials They also cross check with competitors, trade associations; company contacts and if necessary changes their model accordingly. Based on their revenue model, they attempt to project the possible price using various ratios such as P/E, P/BV, EV/EBIDTA, EV/Sales, and Discounted Cash Flows etc. They also check technical factors such as liquidity, institutional ownership, management holdings, past share price behavior etc. Finally they award a rating of the stock. Emkay has maintained a steady mix of institutional and retail brokerage revenue. While the institutional segment contributes around 52% of the revenue retail contributes around 34% and with the remaining contributed by the Private Client Group (PCG). As a result the stock is a play on growth in both the segments of the market. Rating Model: They also have their stock-rating model for PMS. Through this model they rate every stock they buy on a few broad parameters. This gives them an objective view of all decisions they make. Capital structure From Year To Year (Rs crore) Class Of Share Authorized Capital Issued Capital Paid Up Shares (Nos) Paid Up Face Value Paid Up Capital 2006 2007 Equity Share 25.00 24.27 24265750 10 24.27 2005 2006 Equity Share 25.00 17.90 17900000 10 17.90 2004 2005 Equity Share 4.00 3.50 3500000 10 3.50 In the given capital structure it is indeed noteworthy that the no. of paid up shares and amount of paid up capital is increasing rapidly year after year. This thing is also indicator of good performance and smooth functioning of the company deals with the financial instruments. Share holding Share holding pattern as on : Face value 31/12/2007 10.00 30/09/2007 10.00 No. Of Shares % Holding No. Of Shares 30/06/2007 10.00 % Holding No. Of Shares % Holding Promoter's holding Indian Promoters Sub total 17497500 72.11 17497500 17497500 72.11 72.11 17497500 17498000 72.11 72.11 17498000 72.11 Non promoter's holding Institutional investors FII's 2309811 Sub total 9.52 2889728 1665604 11.91 6.86 2025604 1564379 8.35 6.45 1564379 6.45 Other investors Private Corporate Bodies 494575 2.04 768884 3.17 797350 3.29 NRI's/OCB's/Foreign Others 69330 0.29 52800 0.22 51147 0.21 Others 22029 0.09 163508 0.67 32668 0.13 Sub total General public Grand total 585934 3292588 24265750 2.41 13.57 100.00 985192 3757454 24265750 4.06 15.48 100.00 881165 4322206 3.63 17.81 24265750 100.00 Ratios Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Per share ratios Adjusted EPS (Rs) 3.86 8.63 18.87 11.61 Adjusted cash EPS (Rs) 5.03 9.05 20.04 12.09 Reported EPS (Rs) 3.83 8.63 18.82 11.58 Reported cash EPS (Rs) 5.00 9.05 19.99 12.06 Dividend per share 1.25 1.00 2.00 1.50 Operating profit per share (Rs) 5.08 13.03 28.67 15.82 Book value (excl rev res) per share (Rs) Book value (incl rev res) per share (Rs.) Net operating income per share (Rs) Free reserves per share (Rs) 46.86 46.86 22.84 20.39 20.39 25.97 64.65 64.65 64.68 48.49 48.49 37.43 36.86 10.39 54.65 -0.01 Operating margin (%) 22.21 50.15 44.32 42.25 Gross profit margin (%) 17.10 48.55 42.52 40.97 Net profit margin (%) 15.28 32.51 27.85 28.59 Adjusted cash margin (%) 20.08 34.07 29.66 29.83 Adjusted return on net worth (%) 8.23 42.33 29.18 23.93 Reported return on net worth (%) 8.16 42.33 29.10 23.88 Return on long term funds (%) 13.01 64.61 46.97 37.96 Long term debt / Equity - - - - Total debt/equity - - 0.16 - Owners fund as % of total source 99.96 99.85 85.65 100.00 Fixed assets turnover ratio 4.34 11.40 8.06 3.11 Current ratio 2.32 1.62 1.86 2.24 Current ratio (inc. st loans) 2.32 1.62 1.62 2.24 Profitability ratios Leverage ratios Liquidity ratios Quick ratio 2.31 1.61 1.79 2.22 Inventory turnover ratio - - 11.68 86.77 Dividend payout ratio (net profit) 38.21 17.81 12.01 14.60 Dividend payout ratio (cash profit) 29.27 16.99 11.31 14.02 Earning retention ratio 62.12 82.19 88.02 85.43 Cash earnings retention ratio 70.92 83.01 88.72 86.01 Adjusted cash flow time total debt - - 0.54 - Financial charges coverage ratio 34.01 127.78 78.80 93.78 Fin. charges cov.ratio (post tax) 24.37 85.95 50.94 60.88 Material cost component (% earnings) - - - - Selling cost Component 20.57 14.34 13.76 - Exports as percent of total sales 0.15 - - - Import comp. in raw mat. consumed - - - - Long term assets / total Assets 0.22 0.04 0.03 0.12 Bonus component in equity capital (%) 57.69 78.21 - - Payout ratios Coverage ratios Component ratios Comments: The current ratio of the firm is 2.32 in the year 2007 and it has increased in compare to the last two years. As compared to the standard current ratio 2:1, this is perfect. Each rupee of current liability can be backed by current assets of Rs.2.32.So the firm appears to be facing no financial crisis. The quick ratio/acid test ratio indicates that the firm’s instant debt paying capacity is quite satisfactory as the ratio is above the standard ratio 1:1. The debt equity ratio of 2007 indicates there is no dependence on outsiders’ capital. Dividend payout ratio is also getting increased. In 2007 it has come to 38.21.The market value of the share is increasing. Weaknesses: Emkay has come into the market in 1995 but the online services facility is not up to the mark. It should look after its brokerage per share; it is 30 paise per share but in case of other stock broking firm in most of the cases it is 20 paise. It has a very weak sales force. Less customer database. Fewer branches in eastern region. Emkay continues to carry a huge business risk of a single line business entity. The company is heavily dependent on the growth of capital market volumes, which are cyclical in nature. Most of its peers have over the past 23 years diversified their revenue streams to reduce this business risk. Opportunities: Emkay can expand their business all across the country with the help of the opinion of educated professionals. Emkay is having its knowledgeable customer’s base on the basis of which they take decision to provide customer driven services. The company is going to import the software called “FANKIN” by which anyone can open a D-Mat account within 120 minutes. Threats: Intensive competition Price war in brokerage charges Infrastructure bottlenecks Fluctuating markets WHO’S WHO BOARD OF DIRECTORS: Mr. G.P. Gupta, Chairman, has 35 years experience in development Banking. He was formerly the Chairman and Managing Director of Industrial Development Bank of India and Chairman of Unit Trust of India. Besides, being a past Director of Bharat Heavy Electrical Limited, National Aluminum Co. Limited, Hindustan Aeronautics Ltd. Mr. Krishna Kumar Karwa, Managing Director, is a Chartered Accountant and has 17 years experience in the stock market across research, dealing and execution with special focus on the ‘cash’ segment of the capital markets. He also directs the wealth management services business, which is aimed at providing portfolio advisory and risk management. Mr. Prakash Kacholia, Managing Director is a Chartered Accountant and has 15 years experience in Share Broking Activities. He leads our Company’s derivatives business, generating trading strategies and identifying market opportunities. He has served the BSE in the capacity of a governing board member and on the derivatives committee of SEBI at the time of the launch of derivatives in the Indian market. He is currently on the Board of Bank Of India Share Holdings Ltd. Mr. S.K. Saboo, Director, has over 40 years of experience in the Management field. He is the Group Executive President and Business Head of Aditya Birla Group, the premier business group in India and responsible for independently managing the units. Mr. R.K. Krishnamurthy Director is a Solicitor and Senior Partner with Mulla & Mulla Craigie Blunt & Caroe, a reputed firm of Advocates, Solicitors and Notaries. He is a solicitor in the Mumbai High Court and Supreme Court of England. Mr. G.C. Vasudeo, Director, is a member of Institute of Chartered Accountant, Institute of Company Secretaries, Institute of Cost and Works Accountant and Law Graduate. He has wide industrial experience of 25 years. He is presently Director- Finance of Schenectady Herdilla Limited in charge of Corporate Finance, Accounts, Material Sourcing and Information Technology. He has been instrumental in the restructuring of the Herdilla Group and also in Mergers and Acquisition within the Group. Key Managerial Personnel: Anish Damania, having 13 years of experience in the finance/ capital market. He is responsible for the business with institutions/ Mutual funds. He also looks after the research department of our Company which is backbone of share broking activities. Akhilesh K Singh, having over 13 years of industry experience has been the Head of Sales & Distribution with Prebon Yamane (I) Ltd, Business Head - PMS & Private Banking with Darashaw and CEO with Birla Capital among others. At Emkay he heads the Portfolio Management Services (PMS), Mutual Fund Advisory and distribution of third party products. Chirayush Bakshi, having 18 years of experience in the field of Marketing and business development. He is responsible for brand Building, franchisee and branch network expansion all across India and also organizing and managing Events for our Company. V.H. Bhaskaran, having 25 years experience in capital market. He is responsible for the development of business and establishing new branches/franchisee network in South India. He is looking after the development of activities in the southern part of India. Samir Rachh, having 16 years of experience in the capital market. He is responsible for optimizing the returns to the PMS investors of the Company. He was earlier in charge of research function of the Company. Vijay Saraf, having 20 years of experience of managing the operations and business development in Capital Markets. Prior to joining with us, he has worked with Centrum Capital Limited. Manish Jain, having 6 years experience in secretarial and Compliances in Capital Markets. He is the company Secretary of our Company. Prior to joining us he was employed with Asit C. Mehta Investment Intermediates Limited as Assistant Manager Compliance. He was instrumental in setting-up the Depository Participant during his tenure with M. P. Stock Exchange. Saket Agarwal, having 15 years experience as a sub –broker and partner in Chartered Accountant Firm. Prior to joining us, he was working with M/s. S.S. Jhunjhunwala & Co. as a Partner.