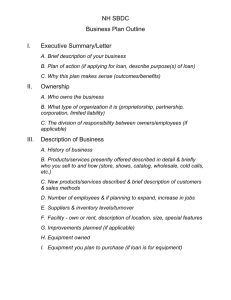

Financial Examination Guide

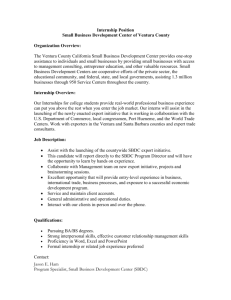

advertisement