This Document

advertisement

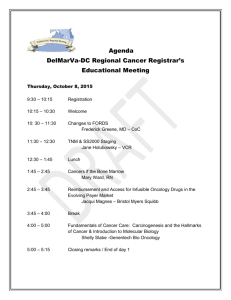

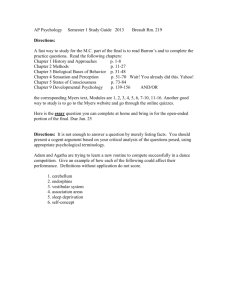

Spring 2012 Term Project FIN 601-51 Pharmaceutical Industry Sean Coyne Table of Contents Table of Contents ............................................................................................................................ 1 Introduction and Company Profiles ................................................................................................ 2 Analysis of Company and Stock Performance ............................................................................... 5 Financial Performance ................................................................................................................ 5 Profitability ............................................................................................................................. 5 Growth .................................................................................................................................... 6 Liquidity.................................................................................................................................. 7 Cash Flows .............................................................................................................................. 7 Earnings and Dividends .......................................................................................................... 7 Financial Risk ......................................................................................................................... 8 Stock performance ...................................................................................................................... 8 Stock Performance During the Last 52 Weeks ....................................................................... 8 ATR, Volatility and Beta ........................................................................................................ 9 Stocks Liquidity ...................................................................................................................... 9 Relative Valuation .................................................................................................................... 10 DuPont Model ............................................................................................................................... 11 EVA, MVA and the Value of Common Stock ............................................................................. 13 Reflections .................................................................................................................................... 17 References ..................................................................................................................................... 18 Attachments .................................................................................................................................. 19 1 Introduction and Company Profiles The pharmaceutical industry is one of great competition, cost and profit. Two well known pharmaceutical corporations will be the focus of this study. Pfizer (PFE) and Bristol Myers Squibb (BMY) both produce similar products, but their financial profiles show they are very different companies. This study will analyze the financial, stock and relative performance of both corporations, as well as use the DuPont Model to calculate the ROE of both companies. Finally this study will place a value on the share price of each corporation and analyze how it differs from the current trading price. While both companies are in the drug industry, Pfizer’s brand awareness is much higher then that of Bristol Myers Squibb. Pfizer currently manufactures 46 products, 14 of which have been blockbuster hits. Products currently manufactured by Pfizer include: Celebrex, Lipitor, Lyrica, Viagra, Xanax and Zoloft (Research and Development at Pfizer). Pfizer also produces over the counter products including; dietary supplements, pain management products, respiratory care products, Caltrat, Advil brands, ThermaCare, and Robitussin. Pfizer also produces personal care products including Chapstick and Preperation-H. In addition to products for humans, Pfizer produces 20 products designed for animals. In 2010 86 percent of Pfizer’s revenues came from products in the biopharmaceutical segment. Pfizer’s research and development department is the industry leader with $8.1 billion invested in 2007 (Research and Development at Pfizer). Pfizer has been accused of scandals ranging from illegal human testing in Nigeria, asbestos allegations, EPA violations and even illegal advertising practices. In 2009 Pfizer paid a fine to the tune of $2.3 billion, the largest fine ever recorded in the United States (Johnson). Pfizer sells its products to wholesalers, distributors, retailers, hospitals, clinics, government agencies, pharmacies, individual provider offices, veterinarians, livestock producers, and grocery stores. Pfizer is a multinational company with over 100,000 employees. In 2011 one of Pfizer’s heavy hitters, Lipitor had a 7 percent decrease in sales due to the loss of patent protection. Due to Lipitor’s brand recognition and widespread use “management announced intentions to sell the drug at lower prices directly to patients, a strategy geared toward fending off a potential exodus to generic competitors” (Pfizer Inc). For the 2012 year Pfizer has three drugs scheduled for FDA action which may help offset the losses due to Lipitor’s patent 2 expiration. Financially Pfizer’s stock has an above-average dividend yield, is rated a 1 in safety and A+ in financial strength. Bristol Myers currently manufactures 42 products, 5 of which have been blockbuster hits for Bristol Myers and are listed in the top 100 best selling pharmaceuticals. Products currently manufactured by Bristol Myers include: Plavix, Aprovel, Abilify, Pravachol and Erbitux (Products: Bristol-Myers Squibb). Bristol Myer produces only prescription drugs, and does not offer over the counter medication, health and beauty products or products for animals. In 2011 Bristol Myers spent $3.8 billion on research and development. They currently have 12 research facilities in 5 countries. Bristol Myer’s R&D team has helped to bring to market 13 pharmaceuticals for the treatment of cancer, serious mental illness, HIV/AIDS, hepatitis B, rheumatoid arthritis, cardiovascular disease, organ transplant complication and diabetes. Four of these medicines are biologics, which represents a new emergence in the pharmaceutical field. Bristol Myer has been accused of scandals ranging from channel stuffing to collusion. In 2002 Bristol Myer paid a fine of $150 million for allegations of offering excess inventory to customers to create higher sales numbers, while they paid the fine they did not admit guilt (SEC News Digest). Bristol Myers has been building a large cash reserve, “it stood at $6.8 billion at the end of 2011’s first quarter, but probably topped $9.5 billion at yearend” (Bristol-Myers Squibb). Management has made no statement as to how the funds are planned to be spent, or if any new acquisitions are being considered. In 2011 Plavix, one of Bristol Myers’ main products ended its patent protection, resulting in a 22 percent los in sales of Plavic. In 2012 Avapro, which accounted for 18 percent or Bristol Myers’ revenue in 2011, will end its patent protection. New products are in the works, but they are only expected to cover 65 percent of the lost volume by 2016 (Bristol-Myers Squibb). While both Pfizer and Bristol Myers are pharmaceutical companies, their business goals, practices and finances vary greatly. Pfizer is an enormous, diversified company that has thrived on its marketing expertise and memorable brand names. Bristol Myers on the other hand is much smaller both in physical size and financial size, and focuses more on research and development then marketing. 3 Both companies have entered into the bio-pharmaceutical sector, and both forecast growth in this field. In a purely financial comparison Pfizer dominates with $71 billion in sales, $62.7 billion in current assets, and $27.8 billion in liabilities. Bristol Myers on the other hand had $23.3 billion in sales, $14.8 billion in assets and $7.3 billion in liabilities. Pfizer received the following ratings for 2012: Timeliness 3, Safety 1, Technical 4 and a beta of .75 (Pfizer Inc.) Bristol Myers ratings for the same year were Timeliness 3, Safety 1, Technical 3 and a beta of .75 (Bristol Myers Squibb). From an investors standpoint Pfizer’s stock is selling for $24.04 a share with a dividend yield ratio of 4 percent. Bristol Myers stock is selling for $33.59 per share with a dividend yield ratio of 3.9 percent. Both companies have faced significant decreases in stock price since the early 2000s. Pfizer’s market capitalization is almost three times that of Bristol Myers at 164.58 billion, Bristol Myers’s market capitalization is 55.02 billion. 4 Analysis of Company and Stock Performance Financial Performance Profitability ROA ROE Gross Margin Oper. Margin Profit Margin PFE BMY 4.56% 9.78% 77.63% 18.93% 12.96% 16.43% 23.38% 73.65% 32.86% 24.76% Figure 1 Pfizer and Bristol Myers are both profitable companies, but they are not on the same financial level. By looking at the return on assets, return on equity, gross profit margin, operating profit margin and net profit margin the profitability of the two unique companies can be can better compared. The most logical place to start the analysis is with the net profit margin, ratios in Figure 1 will be referenced. The net profit margin is calculated by taking the net income available to stockholders and dividing it by the number of sales. Pfizer’s net profit margin is 12.96 percent while Bristol Myers is 24.76 percent. This shows that for every dollar of sales Bristol Myers had a net income twice as much as Pfizer. This figure on its own is not enough to compare the two companies. The industry average for pharmaceutical companies is 19.5 percent; this places Pfizer below the average and Bristol Myers above, but why? By digging deeper into the financial statements of the two companies a better picture of their true profitability can be formed. The operating profit margin, EBIT divided by sales, shows the company’s performance in operations prior to the affects of interest. Pfizer’s operating profit margin is 18.93 percent while Bristol Myers is 32.86 percent. The relative distance in both net profit margin and operating profit margin shows that Bristol Myers higher net profit margin is not solely due to interest related business practices. In order to get an even better look at the two company’s profitability their gross profit margin must be examined. By analyzing the return on assets and return on equity of both companies a more accurate analysis of their true profitability can performed. Pfizer’s ROA is 4.56 percent, while Bristol Myers is 16.43 percent. Pfizer’s ROE is 9.78 percent while Bristol Myers is 23.38 percent. These 5 results align with the profit margins showing that while Pfizer may have a larger income; Bristol Myers is actually a more profitable company with regards to funding spent. Growth PFE EPS next Y EPS next Q EPS this Y EPS next Y EPS next 5Y Sales Q/Q EPS Q/Q 2.35 0.56 9.08 3.52 2.65 -3.5 -46.13% BMY 1.94 0.64 20.475 -1.52% -0.41% 6.71% 78.06% Figure 2 Profitability is not the only factor to consider when analyzing a business, the growth of the company is very important in predicting future earnings. Using multiple growth forecast formulas (shown above in Figure 2) for revenue, sales and earnings per share, evaluation and comparison of the growth potential for both Pfizer and Bristol Myers can be performed. Pfizer has forecasted earnings per share of + 2.35 for next year, with + .56 for next quarter. The current growth in earnings per share this year has been 9.08 percent, with a forecast growth of 3.52 percent next year. In the long term Pfizer has a forecast growth of 2.65 percent. Pfizer’s quarterly revenue growth has been -3.5 percent while its quarterly earnings growth has been a dismal 46.23 percent. Bristol Myers has forecasted earnings per share of + 1.94 for next year, with + .64 for next quarter. The current growth in earnings per share this year has been 20.475 percent, with a forecast growth of -1.52 percent next year. In the long term Bristol Myers has a forecast growth of -0.41 percent. Bristol Myers quarterly revenue growth has been 6.71 percent while its quarterly earnings growth has been an outstanding 78.06 percent. When comparing only the profitability it appears as if Bristol Myers is the clear choice, yet when evaluating the growth for the short and long term the Pfizer is clearly the more appealing option. 6 Liquidity PFE BMY Quick Ratio 1.78 1.79 Current Ratio 2.06 1.97 Figure 3 Liquidity should not be pushed aside, if a company has all of its assets tied up in long term investments, missing out on a newly created product could become a possibility. In order to analyze the liquidity of Pfizer and Bristol Myers the quick ratio and current ratio will be used. Pfizer’s quick ratio is 1.78 while its current ratio is 2.06. Bristol Myers quick ratio is 1.79 while its current ratio is 1.97. Both companies have very similar ratios, showing that about the same percentage of capital is tied up in inventory, and they have the same amount of liquid assets percentage wise. With no clear difference based on liquidity alone, cash flows from both companies must be analyzed. Cash Flows One way to analyze the cash flow performance of both Pfizer and Bristol Myers is to look at their price to free cash flow ratio. This ratio can be used to estimate the firm’s future financial health. Because the price to free cash flow ratio incorporates cash flow, the effects of depreciation and other non-cash factors are removed which provides a better indication of relative value. Pfizer’s P/FCF ratio is 13.2 and Bristol Myers ratio is much higher at 24.79. Pfizer’s lower ratio shows that they have generated more cash flow unaccounted for in the share price then Bristol Myers. This is a positive sign for Pfizer as it indicates their stock could be a better value. Earnings and Dividends Both Pfizer and Bristol Myers pay annual dividends, and both are traded publically. Pfizer has a current income of $8.7 billion, sales of $64.43 billion, a dividend of $.88 per share and a dividend yield of 4.11 percent. Bristol Myers has an income of 3.7 billion, sales of 21.24 billion, a dividend of $1.36 per share and a dividend yield of $4.17 percent. By examining the income and sales of both companies it is clear that Pfizer is the larger company, and it is bringing in a sizable income. However, the dividend yield of both companies is similar, and Bristol Myers actually paid a higher dividend amount. This is confirmed by looking at the P/E ratio of both 7 companies, Pfizer’s P/E ratio is 19.64, showing the cost per share compared to earnings much higher then Bristol Myers P/E ratio of 2.16. Relative to the earnings, and dividend payout, Bristol Myers is a much more efficient company. Financial Risk When comparing two companies financial risk must not be forgotten. While growth, profitability and earnings are all important factors, if they are based solely on risky projects the company may not be a smart investment. By analyzing the current assets and current liabilities the debt ratio can be calculated. Pfizer’s debt ratio is .14 while Bristol Myers is much higher at .24. The lower debt ratio shows Pfizer has significantly more debt to assets when compared to Bristol Myers. Another ratio useful in comparing financial risk is the debt to equity ratio, which shows the proportion of debt and equity being used to finance assets. Pfizer’s D/E ratio is .4714 and Bristol Myers’s D/E ratio is .3461. Low ratios are to be expected as the pharmaceutical industry is not as capital intensive as say automotive manufacturing. Pfizer’s slightly higher ratio shows it has used more debt to finance its growth. Both Pfizer and Bristol Myers appear financially secure, but in-depth research on their stock performance must be completed before choosing the higher performing company. Stock performance Stock Performance During the Last 52 Weeks During the last 52 weeks both Pfizer and Bristol Myers stocks have varied in price. Using the 52 week range, 52 week high and 52 week low, the two stocks can be analyzed. Pfizer’s 52 week range was 16.3-21.94, while Bristol Myers was 23.9 – 35.10. The current stock price for Pfizer is -2.4 percent below its 52 week high of 21.94, but 31.36 percent above the 52 week low. Bristol Myers has had similar changes with current stock selling at 7.15 percent below the 52 week high and 36.36 percent above the 52 week high. The changes in the past 52 weeks have not been significant enough to set the two businesses apart, as they tended to change in the same manner, possibly driven by market fluctuations. 8 ATR, Volatility and Beta Using the ATR, volatility and beta of the two companies, a better picture of the stock price movement can be formed. The ATR or Average True Range can be used to evaluate a moving average of the stock price in order to understand the amount of change in price that occurs in a set time, usually 14 days. Pfizer’s ATR is .33 while Bristol Myers ATR is .43, this shows that the price of stock for Bristol Myers is more prone to market noise, and the stock price changes from the average more drastically. The volatility of Pfizer’s stock was 1.85 percent for the week and 1.5 percent for the month while Bristol Myers’ was 1.17 percent for the month and 1.23 percent for the week. This shows that Pfizer’s stock has had greater changes in price then Bristol Myers. Bristol Myers ATR suggests Bristol Myers stock has had larger gaps between the previous days close while remaining more stable during trading hours relative to Pfizer. Beta, the market risk, can be used to compare the two stocks and how they react to changes in the market. While both companies’ beta is below 1 showing they are less risky then the market, Pfizer’s beta of .71 shows it is affected more by market changes then by Bristol Myers, who has a beta of .47. By using these three indicators it can be seen that Bristol Myers stock is less affected by outside influences. Stocks Liquidity The liquidity of both stocks is important to understand as converting stock to cash will be important to investors when trying to sell. A stock with a higher liquidity will be easier to convert to cash then one with a lower liquidity. In order to evaluate the liquidity of the stocks the bid-ask-spread must be analyzed. The bid ask spread of Pfizer is much higher at 4.99 when compared to Bristol Myers spread of .2. This shows that the liquidity of Pfizer stock is much lower then Bristol Myers, a negative sign to an investor. 9 Relative Valuation PANEL: A PFE BMY P/E 19.64 2.16 PEG 7.41 -40.34 P/S 2.44 2.59 P/B Book/sh Current Ratio Debt/Eq 1.83 3.45 11.71 9.46 2.06 1.97 42.5 0.34 Figure 4 When comparing Pfizer stock and Bristol Myers stock it is important to use a wide range of factors. While both companies are in the same industry, their financial factors vary greatly. Using the data in Figure 4: the debt to equity ratio, the price to earnings to growth ratio, the P/E ratio, price to book ratio, price to sales ratio, book value per share and current ratio the two companies can be compared. By analyzing the debt to equity ratio it can be seen that Pfizer has significant debt relative to Bristol Myers, making it a less attractive choice. Using the price to earnings to growth ratio Bristol Myers stock is significantly over valued, while Pfizer’s stock is undervalued. Based on the P/E ratios Pfizer is the better choice as the higher P/E (19.64) shows expected growth in the future. Bristol Myers lower P/E ratio of 2.16 shows less growth is expected, and that it may be overvalued. By comparing price to book ratios it can be seen that Pfizer’s stock appears to be undervalued with a P/B of 1.83 while Bristol Myers has a P/B of 3.45, this could also be explained by Pfizer’s higher amount of debt. The price to sales ratio shows that both companies are similar and an investor would be paying for about the same number of sales. The book value per share of each company shows that Pfizer’s stock is a safer investment if the company were to go bankrupt. With a Book/share ratio of 11.71 Pfizer investors would receive more if a bankruptcy were to occur when compared to Bristol Myers Book/share ratio of 9.46. Finally looking at the current ratio it can be seen that both Pfizer and Bristol Myers share a similar level liquidity and both are able to pay short term liabilities. By analyzing the 7 measures above it is obvious that both companies are valuable investments. However, due to better PEG and P/B ratios, coupled with a higher book value and higher book/share ratios Pfizer is more attractively priced. Two areas of comparison where Pfizer 10 was lacking were the D/E ratio and the P/E ratio, both of which can be explained by increased debt from aggressive R&D activity. Pfizer has higher profitability, higher forecast growth and less risk, all factors that cause it to be the more attractive stock. DuPont Model Using the DuPont model the return on equity and return on assets can be evaluated and analyzed for both Pfizer and Bristol Myers. By comparing the: NPM, TAT, ROA. EM and ROE of both companies and by analyzing the underlying causes of the differences and any changes, the ability of the company to generate profits from stockholder equity can be quantified. Company: Pfizer Net Profit Margin (NPM) Total Assets Turnover (TAT) Return on Assets (ROA) Equity Multiplier (EM) Return on Equity (ROE) 2007 16.81% 42.00% 7.07% 1.77 12.53% 2008 2009 16.78% 17.27% 43.45% 23.48% 7.29% 4.05% 1.93 2.37 14.08% 9.59% Figure 5 2010 12.18% 34.77% 4.23% 2.22 9.40% 2011 14.84% 35.86% 5.32% 2.29 12.18% 5-Yr. Avg. 15.58% 35.92% 5.59% 2.12 11.56% Pfizer’s net profit margin average for 2007-2011 was 15.58, as shown in Figure 5. In 2009 Pfizer had a slight increase in net profit margin, followed by a significant decrease. The decrease in NPM in 2010 is due to a combination of factors. The revenue for 2010 was actually higher then 2009, but the stockholder income decreased, causing a larger gap and a lower NPM. The decrease in stockholder income was due to two main factors, Pfizer purchased Wyeth Pharmaceuticals for a combined $68 billion in cash, shares and loans, and Pfizer paid a record breaking fine (Wyeth Transaction). This purchase caused Pfizer’s operating expenses and cost of revenue to increase, yet the returns from the purchase had not yet materialized. In 2009 Pfizer’s TAT decreased by more the 50 percent due to the large increase in assets from the purchase. Assets from 2008 to 2009 more then doubled, yet revenue decreased due to operating costs, and a record breaking fine of $2.3 billion dollars. This increase in assets also caused the decrease in ROA, from 7.29 percent in 2008 to 4.05 percent in 2009. The equity multiplier was also affected by the purchase; it increased from 1.93 in 2008 to 2.37 in 2009, not only due the doubling in assets, but also to a 37 percent increase in equity from the purchase. The affects of the purchase caused the ROE to decrease from 14.08 percent in 2008 to 9.59 in 2009. This decrease can be cited to the purchase of Wyeth using the DuPont Model, and the data in Figure 5. 11 Competitor: Bristol Myers Net Profit Margin (NPM) Total Assets Turnover (TAT) Return on Assets (ROA) Equity Multiplier (EM) Return on Equity (ROE) 2007 11.19% 73.93% 8.27% 2.48 20.50% 2008 25.47% 69.70% 17.76% 2.41 42.86% Figure 6 2009 56.42% 60.66% 34.22% 2.09 71.49% 2010 15.92% 62.70% 9.98% 1.98 19.74% 2011 17.46% 64.43% 11.25% 2.07 23.25% 5-Yr. Avg. 25.29% 66.28% 16.30% 2.21 35.57% Similar to Pfizer, Bristol Myers also experienced a significant change in ROE during the last five years. Bristol Myers’ net profit margin average for 2007-2011 was 25.29, as shown in Figure 6. In 2009 Bristol Myers had a significant increase in net profit margin, followed by a significant decrease. The decrease in NPM in 2010 was due to a combination of factors. The revenue for 2010 decreased from 2009, but the stockholder income more then doubled, causing a smaller gap and a higher NPM. The increase in stockholder income is due to two main factors: Bristol Myers purchased Mederax for $2.4 billion and the spinoff of Mead Johnson Nutrition (Pierson). This purchase caused Bristol Myers profit margin to double, mostly due to significant increases in net income from discontinuing operations and net income from continuing operation. The net income from discontinuous operations was mainly due to the split from Mead Johnson Nutrition after an IPO of $562.5 million which left Bristol-Myers with 90% ownership of the firm (Wahba). This can be seen by the NPM of 2011 returning to a closer to average rate. The quality and sustainability of both Pfizer’s and Bristol Myers’ ROE is difficult to compare. Pfizer’s strength lies in its large size, and stability of ROE. Bristol Myers has a higher ROE on average, but much of it is due to the spinoff of Mead Johnson Nutrition. Looking at Bristol Myers NPM for 2007, 2010 and 2011, their performance is very similar to Pfizer’s. However Bristol Myers 5 year average TAT performance of 66.28 percent is significantly better the Pfizer 13.09 percent. Bristol Myers high TAT is due to its low total assets, mainly its low inventory and low non current assets when compared to Pfizer. The cause of this low asset approach may be due to Bristol Myers’ commitment to research, while Pfizer heavily markets its own products. While both Pfizer and Bristol Myers perform well when compared using the DuPont model, Bristol Myers 5 year performance, specifically with regards to the TAT make it the superior choice. Pfizer’s performance in 2009 and 2010 can be attributed to short term projects, while Bristol Myers maintained a higher ROE, equivalent EM, higher ROA significantly higher TAT and higher NPM overall, even during Pfizer’s stronger years. 12 EVA, MVA and the Value of Common Stock By using multiple corporate valuation formulas it can be determined if each company is showing signs of stability or growth. By analyzing multiple formulas including the NOPAT, FCF, ROIC, EVA and MVA a more accurate value of both companies can be formed. By using the NOPAT formula, the use of financial leverage can be accounted for when evaluating the companies operating efficiency. Pfizer’s NOPAT did not experience any significant changes, although it did decrease steadily from 2008 to 2010, with an overall decrease of 19 percent. This steady decline in NOPAT can be attributed to increased operating expenses in 2009 and 2010, and increased sales expenses and research and development costs in 2010. In addition Pfizer experienced a reduction of inventory in 2010 of approximately 30 percent. The decrease in NOPAT might normally signify a lack of growth, but the increased expenses are most likely due to the purchase of Wyeth in 2009. Bristol Myer’s NOPAT experienced no significant changes for the years 2008-2010. This lack of change is a result of a steady EBIT and steady revenue stream. While Pfizer’s purchase led to its decrease in NOPAT, Bristol Myers was able to maintain a steady NOPAT partially due to its heavy focus on research and development. By looking at the FCF for the years 2008-2010 the affect of depreciation can be accounted for. Pfizer’s FCF experienced a significant change in the year 2010. In 2009 Pfizer’s FCF was $8.7 billion it dropped to $5.3 billion in 2010. The drop in FCF coincides with the purchase of Wyeth, and can be traced to a $3 billion increase in depreciation, and the previously mentioned decrease in NOPAT. Bristol Myer’s FCF experienced a steady growth from $2.6 billion in 2008 to $4.1 billion in 2010. Their increase in FCF is not attributed to changes in depreciation, but a reflection of their NOPAT’s stability and overall decrease in net investment in operating capital. This decrease in net investment in operating capital is due the purchase of Mederax in 2009, which caused the net investment in operating capital to spike, before returning to a stabile amount in 2010. In addition to the FCF, the ROIC can be used to further analyze a corporations true worth. Pfizer’s ROIC experienced a significant decrease of almost 50 percent in 2009. This decrease was due to a large increase in total operating capital, mainly long term assets. The purchase of Wyeth caused Pfizer’s long term assets to increase due to the additional property, 13 equipment and other long term capital assets. The drop in ROIC does not necessarily indicate poor investment choices, but instead indicates that the large amount of capital acquired in 2009 has not yet generated significant revenue. Bristol Myers acquired a company in 2009, and yet their ROIC actually increased from 2009 to 2010. The increase in ROIC is due to an increase in EBIT, which can be mainly attributed to the spinoff of Mead Johnson Nutrition. Due to the spinoff, Bristol Myers’ decreased their cost of revenue, operating expenses and sales expenses in 2009 when compared to 2008. In addition to ROIC, the EVA of both companies must be analyzed. Pfizer’s EVA experienced a significant decrease from $4.2 billion in 2008 to $1.8 billion in 2009. The EVA is calculated based on the NOPAT, which decreased by $1 billion on 2009, and the total operating capital multiplied by the WACC. The WACC for Pfizer was chosen due to evaluation from Wikiwealth, and industry wide evaluation from Valueline. Valueline gave the drug industry as a whole a WACC of 8.22 percent, this shows Wikiwealth’s 8 percent WACC for Pfizer falls close to the industry average. The $2.4 billion decrease in EVA was caused not only by the NOPAT, but also by a significant increase in total operating capital, due to the purchase of Wyeth. Again, while this statistic on its own might indicate a decrease in firm effectiveness the acquisition of Wyeth is the root cause of the sudden changes, and not poor business practices. Bristol Myers experienced a significant increase in EVA, which was $1.9 billion in 2008 and grew to $3.2 billion on 2009. The WACC for Bristol Myers was taken from wikiwealth which estimated it at 7.4 percent, close to the industry average of 8.22 percent. Similar to their RIOC, Bristol Myer’s increase in EVA is due to their carve-out of Mead Johnson Nutrition. This spinoff not only caused a significant increase in the EBIT, but also lowered operating costs. Bristol Myers’ higher NOPAT and steady total operating capital caused their EVA to almost double. Similar to Pfizer this increase should not be over emphasized as it is a result of a single action. Bristol Myers’ EVA did increase slightly from 2009 to 2010, a strong sign that the company is effectively utilizing its acquisition of Mederax while benefiting from the spinoff of Mead Johnson Nutrition. A corporate valuation would not be complete without analyzing the MVA. The MVA shows how much the corporation has increased the value of the capital contributed by investors. Pfizer’s MVA skyrocketed to $122 billion in 2009 from $53 billion in 2008. Pfizer’s market and book value both doubled from 2008 to 2009. In 2010 after the acquisition was complete, the 14 MVA decreased to a more stable $107 billion as the gap between the market value and the book value shrank. This stabilization on MVA may be due to investor excitement in 2009, which settled in 2010. Bristol Myers’ MVA experienced change in 2009 due to their spinoff and acquisition, but not to the same degree as Pfizer. Bristol Myers’ MVA decreased slowly from 2008 to 2010, yet the book value increased each year. The decrease in MVA is most likely due to lack of investor excitement, as the market value and book value grew closer together. The reduction of the MVA is not a negative sign as the MVA itself still remained positive, it simply shows that investors of Bristol Myers value the stock at a price more similar to its actual book value. The final step in placing a value on a corporation is to analyze the current market price per share when compared to the calculated value per share. The future expectation of the company must be considered in addition to the current figures. Pfizer’s value per share was calculated based on a growth forecast of 5 percent per year. The 5 percent growth rate was the most conservative estimate available, and was obtained from historical data. Bristol Myer’s value per share was calculated based on a growth rate of 3 percent, obtained from historical data as well. Both growth rates were closely aligned with the estimated growth rates found on Morningstar’s and Wikiwealth’s websites. Estimating Value Per Share g = Expected Growth of FCF (%) (see comments in section 4 above) FCF2011 = FCF2010 (1+g) Vop = FCF2011/ (WACC-g) Value of Non-operating Assets: cash & short term investments Total Value of the Company Non-op. liabilities: Short-term debt + Non-current liabilities Value of Common Stock = Total Value of the Company minus Non-operating liabilities. Number of Common Shares Outstanding Value Per Share ($) = Value of Comm. Stk/ # of Shares Current Market Price Per Share ($) Figure 7 5% $ 5,652.50 188416.536 $ 54,289.00 $ 242,705.54 $ 84,215.00 158490.536 8012 $ $ 19.78 24.41 Pfizer’s share price was valued at $19.78 based on calculations found in Figure 7. Pfizer is currently trading at $24.21, $4.68 above book value. The higher trading price can be attributed 15 to investor’s expectation of growth being higher then calculated, as well as investor faith in the companies’ stability. Pfizer’s diverse product line and large number of best selling pharmaceuticals make it an attractive investment; however the upcoming expiration of patents has kept it stock prices from becoming inflated. Pfizer is expected to undertake a radical distribution process in order to keep its name brand drugs competitive with lower cost generics. This coupled with the expected growth and upcoming products make Pfizer’s future outlook a positive one. By comparing the current market price to the calculated value and considering future expectation of performance Pfizer’s current stock price valued on par, to slightly under value. Estimating Value Per Share g = Expected Growth of FCF (%) (see comments in section 4 above) FCF2011 = FCF2010 (1+g) Vop = FCF2011/ (WACC-g) Value of Non-operating Assets: cash & short term investments Total Value of the Company Non-op. liabilities: Short-term debt + Non-current liabilities Value of Common Stock = Total Value of the Company minus Non-operating liabilities. Number of Common Shares Outstanding Value Per Share ($) = Value of Comm. Stk/ # of Shares Current Market Price Per Share ($) Figure 8 3% $ 4,309.63 97946.14114 9569 107515.1411 8741 98774.14114 1699 $ $ 58.14 32.59 Bristol Myers share price was valued at $58.14 based on calculations found in Figure 8. Bristol Myers is currently trading at $32.59, $25.55 below book value. The lower trading price can be attributed to investor’s uncertainty in upcoming products, as well as unrealized gains form the 2009 activities. Bristol Myers’ small product line and lack of best selling pharmaceuticals cause its stock to sell at a lower price. Similar to Pfizer, Bristol Myers has patents set to expire in the near future, making its future uncertain. Bristol Myers focus on research and development has helped it to maintain a stable future by reducing risk, but has also reduced the probability of large gains for investors. By comparing the current market price to the calculated value and considering future expectation of performance, Bristol Myers’ stability and solid past earnings the current stock price is under valued. Its stability may have pushed investors to riskier corporations where higher gains are available. 16 Reflections During the process of performing the analysis I found myself often referencing the textbook and similar reference materials in order to fully understand the real world meaning of terms and ratios. It is easy to say “the price to earnings ratio is the market value divided by the earnings per share” but fully understanding what that means, and how it helps to value the companies performance is task in itself. I found this project helpful in integrating the information learned in the classroom and previous classrooms with real world usage. Concepts discussed in financial based classes became relevant during multiple portions of this project. Applying the information learned in the classroom to a real world company helped me to better understand the reasoning behind the evaluation steps, in addition to how to perform them. The combination of calculating the ratios and figures in Excel coupled with explaining what the figures indicated helped to build a connection between the objective valuation of a company, and the subjective valuation based on the figures calculated. The connection between the financial figures and predicting the future of a company was only part of the knowledge gained from this project. By retrieving date from multiple sources such as Valuline, Morningstar, Yahoo Finance, Wikiwealth and Reuters, the uncertainty of almost all evaluation calculations can be seen. For most ratios and figures that required incite into the future, the various sources disagreed. Often times, textbooks state predictions as fact for the sake of calculation, but this project showed that this is never the case. Overall this project showed that corporate finance is as much of a science as an art. Relying solely on calculations without considering the environment of the industry or the future actions of the company will not give a true representation of a corporation’s performance. In order to better analyze a company one must take into account the underlying causes of the ratios and figures being evaluated. 17 References "Bristol-Myers Squibb" Value Line Publishing. N.p., 13 JAn 2012. Web. 13 Apr 2012. Johnson, Carrie. "Drugmaker Pfizer to Pay Record Penalty In Improper-Marketing Case." Washington Post 03 SEP 2009. Pierson, Ransdell . "Bristol-Myers to buy Medarex for $2.4 billion." Reuters. 22 JUL 2009: n. page. Print. <http://www.reuters.com/article/2009/07/23/us-bristolmyersidUSTRE56M07120090723>. "Pfizer Inc.." Value Line Publishing. 13 JAn 2012. Web. 13 Apr 2012. "Products." Bristol-Myers Squibb. FEB 2012. Web. 13 Apr 2012. <http://www.bms.com/products/Pages/home.asp&xgt>. "Research and Development at Pfizer." Pfizer Inc. 13 Apr 2012. "SEC News Digest." U.S. Securities and Exchange Commission. 09 AUG 2007. Web. 13 Apr 2012. <http://www.sec.gov/news/digest/dig080904.txt>. Wahba, Phil. "RPT-IPO VIEW-Mead Johnson IPO to build up Bristol Myers cash." Reuters. 08 FEB 2009, 13 Apr. 2012. <http://uk.reuters.com/article/2009/02/08/markets-stocks-ipoidUKN0849350220090208>. "Wyeth Transaction." Pfizer Shareholder Services. Web. 13 Apr 2012. <http://www.pfizer.com/investors/shareholder_services/wyeth_transaction.jsp>. 18 Attachments PANEL: A Index Market Cap Income Sales Book/sh Cash/sh Dividend Dividend % Employees Optionable Shortable Recom PANEL: B EPS (ttm) EPS next Y EPS next Q EPS this Y EPS next Y EPS next 5Y EPS past 5Y Sales past 5Y Sales Q/Q EPS Q/Q Earnings SMA50 Table 1: Data for Analysis of Company and Stock Performance PFE BMY PFE BMY DJIA S&P 500 S&P 500 P/E 19.64 2.16 164.58B 55.02B Forward P/E 9.11 16.8 8.7B 3.70B PEG 7.41 -40.34 67.43B 21.24B P/S 2.44 2.59 11.71 9.46 P/B 1.83 3.45 3.77 9.12 5.17 P/C 6.3 13.2 0.88 1.36 P/FCF 24.79 1.78 4.11% 4.17% Quick Ratio 1.79 110600 27000 Current Ratio 2.06 1.97 42.5 Yes Yes Debt/Eq 0.34 47.39 Yes Yes LT Debt/Eq 0.34 1.9 2.3 SMA20 1.07% 1.04% PFE BMY 1.09 2.35 0.56 9.08 3.52 2.65 -6.12 6.87 -3.5 -46.13% Jan 31 BMO 0.225 2.16 1.94 0.64 20.475 -1.52% -0.41% 28.37% 5.56% 6.71% 78.06% Jan 26 BMO -1.69% PFE Insider Own Insider Trans Inst Own Inst Trans ROA ROE ROI Gross Margin Oper. Margin Profit Margin Payout SMA200 BMY 0.03% -1.28% 70.73% -2.39% 4.56 9.78 5.37 77.63% 18.93 12.96% 71.23 9.55% PANEL: C PFE BMY PFE Shs Outstand 7.69B 1.69B Perf Week 1.09% Shs Float 7.69B 1.69B Perf Month 0.47% Short Float 0.72% 1.60% Perf Quarter 7.80% Short Ratio 1.34 2.48 Perf Half Y 15.11% Target Price 24.15 33.73 Perf Year 12.86% 52W Range 16.3-21.94 23.9-35.10 Perf YTD -0.05% 52W High -2.40% -7.15% Beta 0.71 52W Low 31.36% 36.36% ATR 0.33 RSI (14) 52.96 49.22 Volatility 1.85%-1.5% Rel Volume 0.59 0.6 Prev Close 21.49 Avg Volume 41.53M 10.87M Price 21.41 Volume 24,376,510 6,553,126 Change -0.37% (Source: http://www.finviz.com/ and http://www.finance.yahoo.com/ and http://reuters.com/finance) 19 0.07% 75.93% 68.54% -0.39% 16.43% 23.38% 21.17% 73.65% 32.86% 24.76% 61.48% 7.23% BMY -0.03% 0.49% 0.59% 11.76% 30.26% -6.62% 0.47 0.43 1.17% 1.23% 32.64 32.59 -0.15 Table 2: Data for ROA and ROE Analysis - DuPont Model 2007 2008 2009 2010 2011 Company: Pfizer Net Profit Margin (NPM) 16.81% 16.78% 17.27% 12.18% 14.84% Total Assets Turnover (TAT) 42.00% 43.45% 23.48% 34.77% 35.86% Return on Assets (ROA) 7.07% 7.29% 4.05% 4.23% 5.32% Equity Multiplier (EM) 1.77 1.93 2.37 2.22 2.29 Return on Equity (ROE) 12.53% 14.08% 9.59% 9.40% 12.18% 2007 2008 2009 2010 2011 Competitor: Bristol Myers Net Profit Margin (NPM) 11.19% 25.47% 56.42% 15.92% 17.46% Total Assets Turnover (TAT) 73.93% 69.70% 60.66% 62.70% 64.43% Return on Assets (ROA) 8.27% 17.76% 34.22% 9.98% 11.25% Equity Multiplier (EM) 2.48 2.41 2.09 1.98 2.07 Return on Equity (ROE) 20.50% 42.86% 71.49% 19.74% 23.25% (Source: http://www.morningstar.com --- Key Ratios) 20 5-Yr. Avg. 15.58% 35.92% 5.59% 2.12 11.56% 5-Yr. Avg. 25.29% 66.28% 16.30% 2.21 35.57% Table 3: Corporate Valuation (Source: http://www.morningstar.com --- Financials) USD in Million except per share data Company: Pfizer FY2008 FY2009 FY2010 Cash $ 23,731.00 $ 25,969.00 $ 28,012.00 Accounts Receivable $ 8,958.00 $ 14,645.00 $ 14,612.00 Inventory $ 4,381.00 $ 12,403.00 $ 8,405.00 Accounts Payable $ 1,751.00 $ 4,370.00 $ 4,026.00 Accruals $ 1,667.00 $ 2,424.00 $ 2,108.00 Net Operation Working Capital (NOWC) $ 33,652.00 $ 46,223.00 $ 44,895.00 Operating Long-term Assets (LOA) $ 13,287.00 $ 22,780.00 $ 19,123.00 Total Operating Capital = NOWC + OLA $ 46,939.00 $ 69,003.00 $ 64,018.00 Earnings Before Interest and Taxes (EBIT) $ 11,726.00 $ 10,827.00 $ 9,422.00 Tax Rate 31.52% 31.52% 31.52% NOPAT = EBIT (1-T) $ 8,029.96 $ 7,414.33 $ 6,452.19 Depreciation $ 11,841.00 $ 11,144.00 $ 13,175.00 Operating Cash Flow = NOPAT + Depreciation $ 19,870.96 $ 18,558.33 $ 19,627.19 Net Investment in Operating Capital $ (904.61) $ (1,312.64) $ 1,068.86 FCF = NOPAT - Net Investment in Operating Capital $ 8,934.58 $ 8,726.96 $ 5,383.33 ROIC % = (NOPAT / Total Operating Capital)*100 17.11% 10.74% 10.08% WACC % (see comments in section 4 above) 8.0% 8.0% 8.0% EVA = NOPAT - (Total Operating Capital x WACC) $ 4,274.84 $ 1,894.09 $ 1,330.75 Market Value of Common Equity $ 111,148.00 $ 212,949.00 $ 195,014.00 Book Value of Common Equity $ 57,510.00 $ 89,964.00 $ 87,764.00 MVA = Market Value - Book Value 53,638.00 122,985.00 107,250.00 Estimating Value Per Share (use FY2010 data as base) g = Expected Growth of FCF (%) (see comments in section 4 above) FCF2011 = FCF2010 (1+g) Vop = FCF2011/ (WACC-g) Value of Non-operating Assets: cash & short term investments Total Value of the Company Non-op. liabilities: Short-term debt + Non-current liabilities Value of Common Stock = Total Value of the Company minus Non-operating liabilities. Number of Common Shares Outstanding Value Per Share ($) = Value of Comm. Stk/ # of Shares Current Market Price Per Share ($) 21 5% $ 5,652.50 188416.536 $ 54,289.00 $ 242,705.54 $ 84,215.00 158490.536 8012 $ $ 19.78 24.41 USD in Million except per share data Company: Bristol Myers FY2008 FY2009 Cash $ 8,265.00 $ 8,514.00 Accounts Receivable $ 3,710.00 $ 3,164.00 Inventory $ 1,765.00 $ 1,413.00 Accounts Payable $ 1,535.00 $ 1,711.00 Accruals $ 2,974.00 $ 3,407.00 Net Operation Working Capital (NOWC) $ 9,231.00 $ 7,973.00 Operating Long-term Assets (LOA) $ 5,405.00 $ 5,055.00 Total Operating Capital = NOWC + OLA $ 14,636.00 $ 13,028.00 Earnings Before Interest and Taxes (EBIT) $ 3,991.00 $ 5,602.00 Tax Rate 24.65% 24.65% NOPAT = EBIT (1-T) $ 3,007.22 $ 4,221.11 Depreciation $ 816.00 $ 707.00 Operating Cash Flow = NOPAT + Depreciation $ 3,823.22 $ 4,928.11 Net Investment in Operating Capital $ 378.36 $ 1,104.89 FCF = NOPAT - Net Investment in Operating Capital $ 2,628.86 $ 3,116.22 ROIC % = (NOPAT / Total Operating Capital)*100 20.55% 32.40% WACC % (see comments in section 4 above) 7.4% 7.4% EVA = NOPAT - (Total Operating Capital x WACC) $ 1,924.15 $ 3,257.04 Market Value of Common Equity $ 29,552.00 $ 31,008.00 Book Value of Common Equity $ 12,246.00 $ 14,835.00 MVA = Market Value - Book Value 17,306.00 16,173.00 Estimating Value Per Share (use FY2010 data as base) g = Expected Growth of FCF (%) (see comments in section 4 above) FCF2011 = FCF2010 (1+g) Vop = FCF2011/ (WACC-g) Value of Non-operating Assets: cash & short term investments Total Value of the Company Non-op. liabilities: Short-term debt + Non-current liabilities Value of Common Stock = Total Value of the Company minus Non-operating liabilities. Number of Common Shares Outstanding Value Per Share ($) = Value of Comm. Stk/ # of Shares Current Market Price Per Share ($) 22 $ 3% 4,309.63 97946.14114 9569 107515.1411 8741 98774.14114 1699 $ $ 58.14 32.59 FY2010 $ 7,301.00 $ 3,480.00 $ 1,204.00 $ 1,983.00 $ 3,597.00 $ $ 6,405.00 4,664.00 $ 11,069.00 $ $ $ 5,562.00 24.65% 4,190.97 744.00 $ $ 4,934.97 6.86 $ 4,184.11 37.86% 7.4% $ 3,371.86 $ 31,076.00 $ 15,708.00 15,368.00