The Norwegian Boom Bust Cycle Revisited

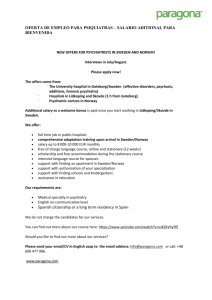

advertisement