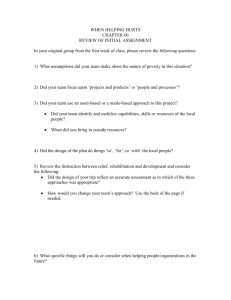

Health and Welfare

advertisement